Answered step by step

Verified Expert Solution

Question

1 Approved Answer

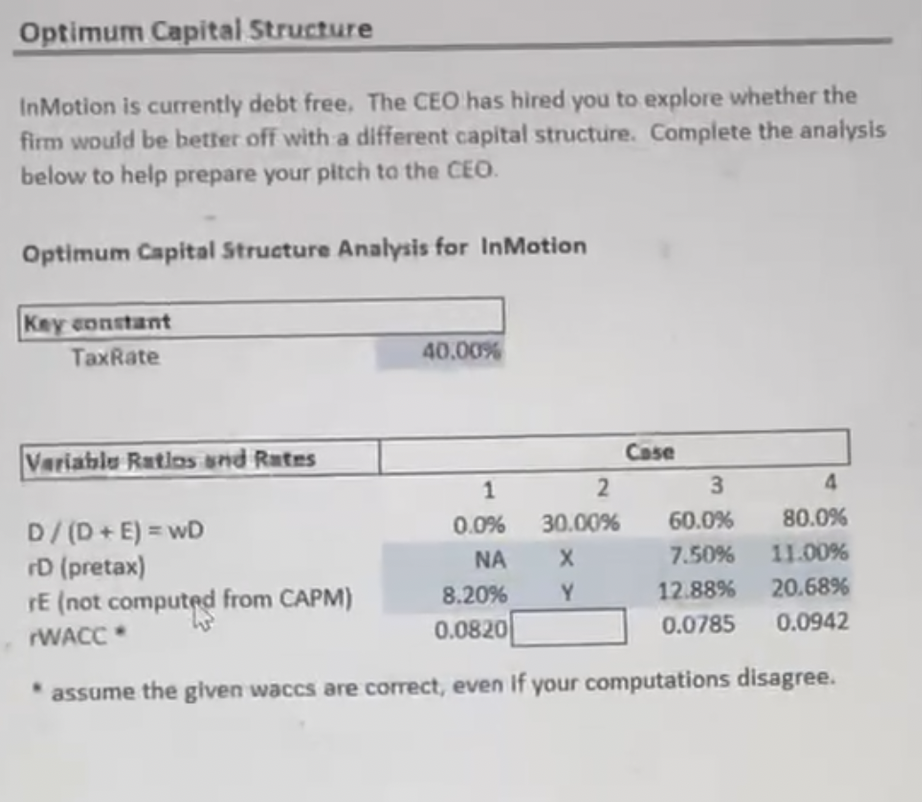

1. A colleague in your firm believes that 0.0776 is the rWACC for Case 2. Assuming she is correct, what is the optimum D/(D+E) ratio

1. A colleague in your firm believes that 0.0776 is the rWACC for Case 2. Assuming she is correct, what is the optimum D/(D+E) ratio for the firm?

2. If X= 5.56% and Y=9.39%, what is the rWACC for Case 2?

Optimum Capital Structure In Motion is currently debt free. The CEO has hired you to explore whether the firm would be better off with a different capital structure. Complete the analysis below to help prepare your pitch to the CEO. Optimum Capital Structure Analysis for In Motion Key constant TaxRate 40.00% Variable Ratlos and Rates 4 D/(D+E) = WD rD (pretax) TE (not computed from CAPM) WACC 1 0.0% NA 8.20% 0.0820 Case 2 3 30.00% 60.0% 7.50% Y 12.88% 0.0785 80.0% 11.00% 20.68% 0.0942 * assume the given waccs are correct, even if your computations disagreeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started