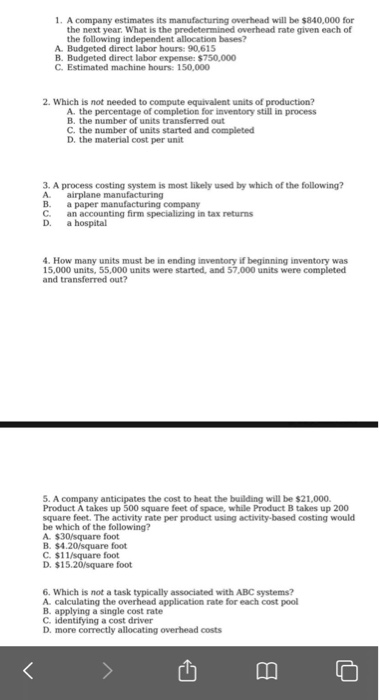

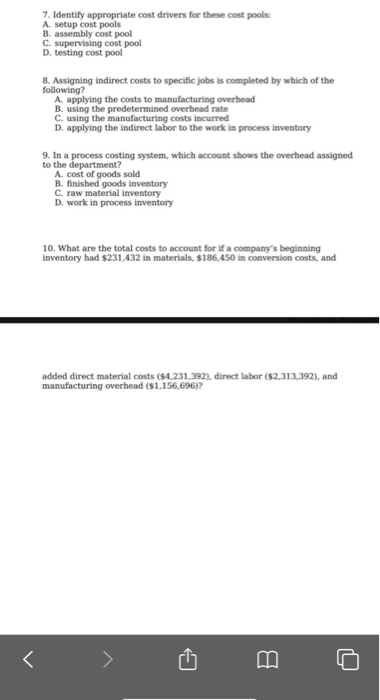

1. A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following independent allocation bases? A Budgeted direct labor hours: 90 615 B. Budgeted direct labor expense: $750,000 C. Estimated machine hours: 150.000 2. Which is not needed to compute equivalent units of production? A the percentage of completion for inventory still in process B. the number of units transferred out C. the number of units started and completed D. the material cost per unit 3. A process costing system is most likely used by which of the following? A airplane manufacturing a paper manufacturing company a n accounting firm specializing in tax returns a hospital c D 4. How many units must be in ending inventory if beginning inventory was 15,000 units, 55,000 units were started, and 57.000 units were completed and transferred out? 5. A company anticipates the cost to heat the building will be $21,000 Product A takes up 500 square feet of space, while Product B takes up 200 square feet. The activity rate per product using activity-based costing would be which of the following? A $30square foot B $4.20/square foot C. $11/square foot D. $15.26/square foot 6. Which is not a task typically associated with ABC systems? A calculating the overhead application rate for each cost pool B. applying a single cost rate C identifying a cost driver D. more correctly allocating overhead costs 7. Identify appropriate cost drivers for these cost pools: A setup cost pools B. assembly cost pool Csupervising cost pool D. testing cost pool 8. Assigning indirect costs to specific jobs is completed by which of the following? A applying the costs to manufacturing overhead B using the predetermined overhead rate C using the manufacturing costs incurred D. applying the indirect labor to the work in process inventory 9. In a process costing system, which account shows the overhead assigned to the department? A cost of goods sold B. finished goods inventory C. raw material inventory D. work in process inventory 10. What are the total costs to account for if a company's beginning inventory had $231.432 in materials, $186,450 in conversion costs, and added direct material costs ($4.231,392), direct labor ($2,313,392), and manufacturing overhead ($1.156,696)