Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please can you use the learning outcomes to answer, your help is highly appreciated. Use the information below to analyse and report on the performance

Please can you use the learning outcomes to answer, your help is highly appreciated.

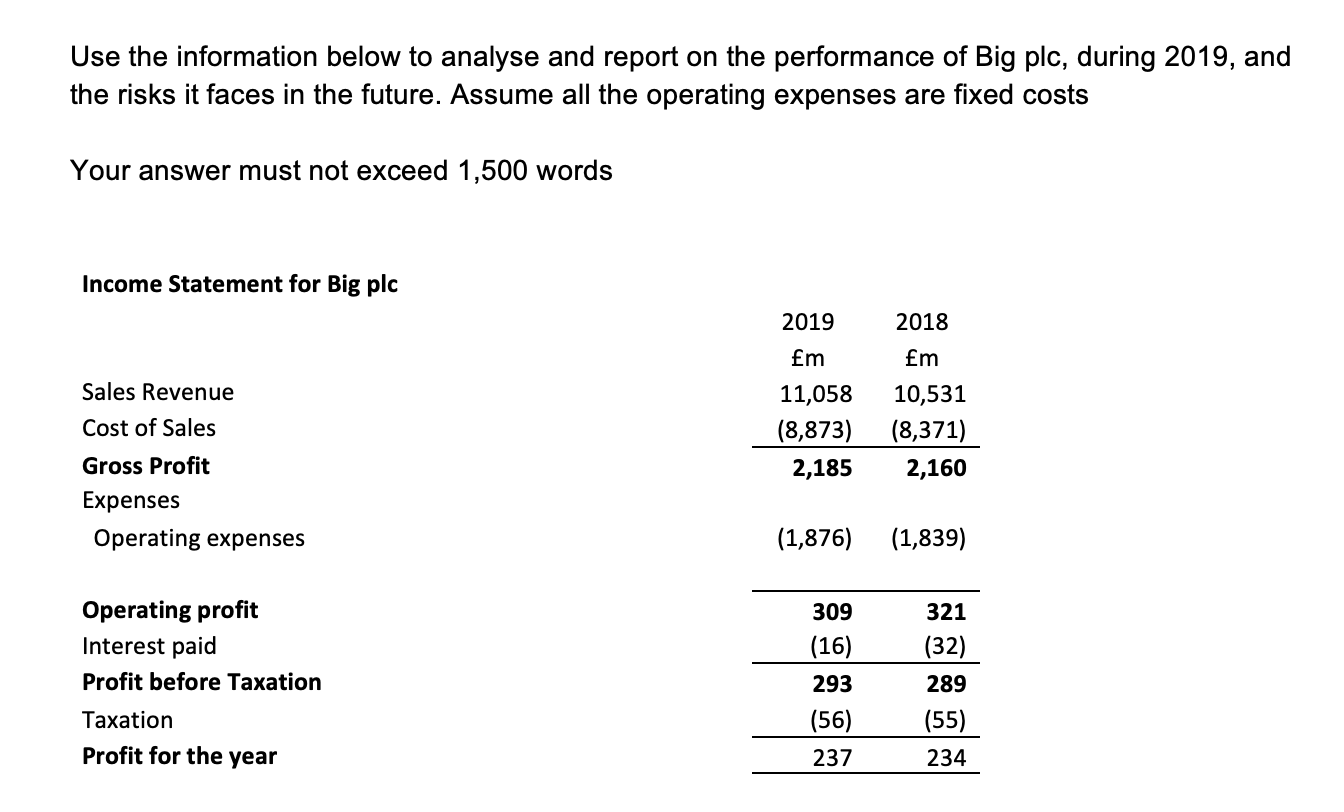

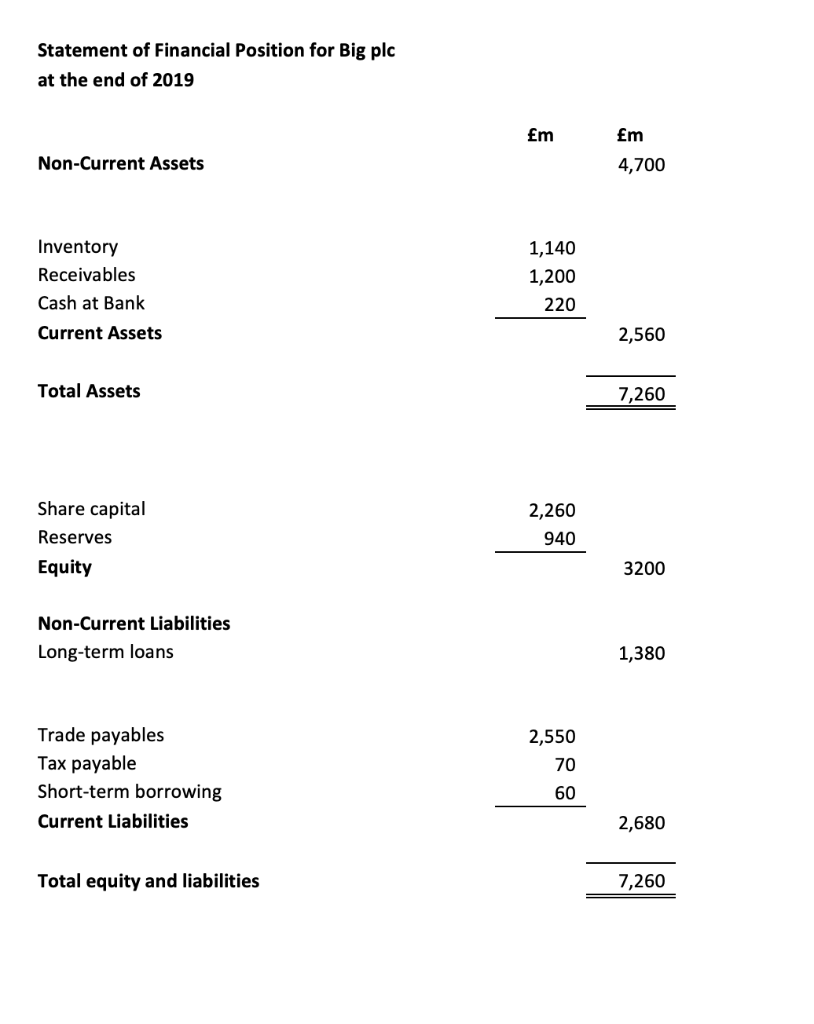

Use the information below to analyse and report on the performance of Big plc, during 2019, and the risks it faces in the future. Assume all the operating expenses are fixed costs Your answer must not exceed 1,500 words Income Statement for Big plc 2019 2018 Em fm Sales Revenue Cost of Sales 11,058 (8,873) 2,185 10,531 (8,371) 2,160 Gross Profit Expenses Operating expenses (1,876) (1,839) Operating profit Interest paid Profit before Taxation 309 (16) 293 (56) 321 (32) 289 (55) 234 Taxation Profit for the year 237 Statement of Financial Position for Big plc at the end of 2019 Em m Non-Current Assets 4,700 Inventory Receivables Cash at Bank Current Assets 1,140 1,200 220 2,560 Total Assets 7,260 Share capital Reserves Equity 2,260 940 3200 Non-Current Liabilities Long-term loans 1,380 Trade payables Tax payable Short-term borrowing Current Liabilities 2,550 70 60 2,680 Total equity and liabilities 7,260 Learning Outcomes . The following learning outcomes are assessed in this paper: O Interpret and analyse a company income statement, statement of financial position and statement of cash flows. Perform simple cost-volume-profit analysis. OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started