Question

1. A company is considering a $12,000 investment in a project with the following predicted cash flows in the subsequent four years: $5,300; $4,000; $3,800.

1. A company is considering a $12,000 investment in a project with the following predicted cash flows in the subsequent four years: $5,300; $4,000; $3,800. It requires a 15% return. What is the profitability index for this investment, and what does it suggest?

2. When a firm anticipates a poor market, lacks qualified managers, or experiences other concerns, the firm may institute ______ in order to limit investments.

3. A firm expects to spend $15,000 on project A. In year 1, it forecasts a cash flow of $7,000; in year 2, $4,000, in year 3, $3,000; and in year 4, $2,000. what is the internal rate of return for this project?

4. _____ is when a firm has a maximum amount of money it is willing to spend on new investments.

5. Suppose a firm has identified potential capital projects that fit its investment strategy. What is the next step in the capital budgeting process?

6. A company considers the three options presented in the

table below. Under which circumstance would the company be most inclined to select project A?

7.

8.

9.

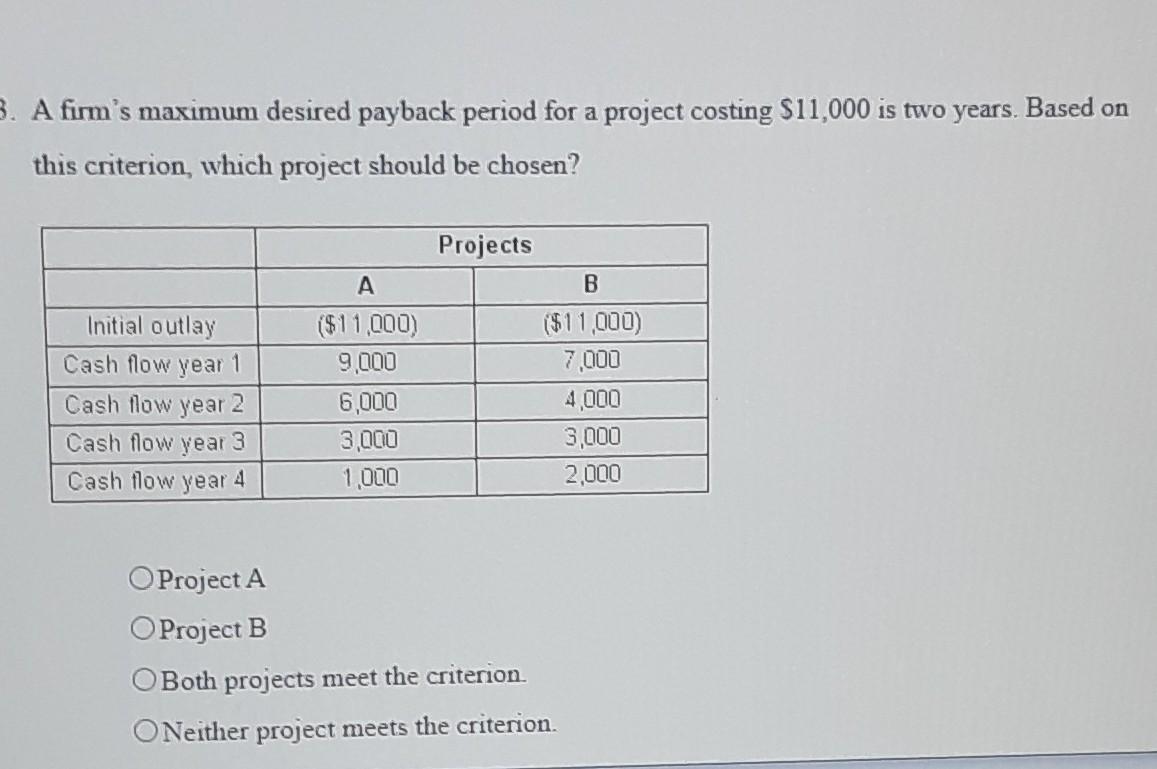

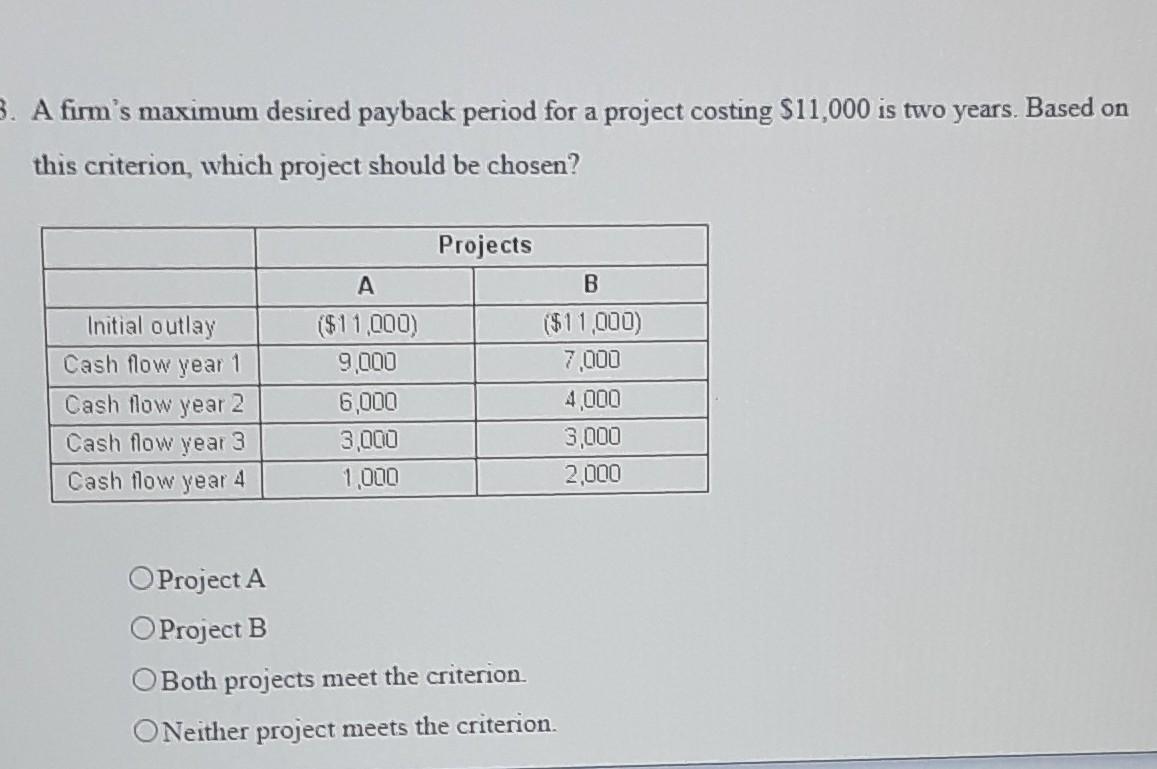

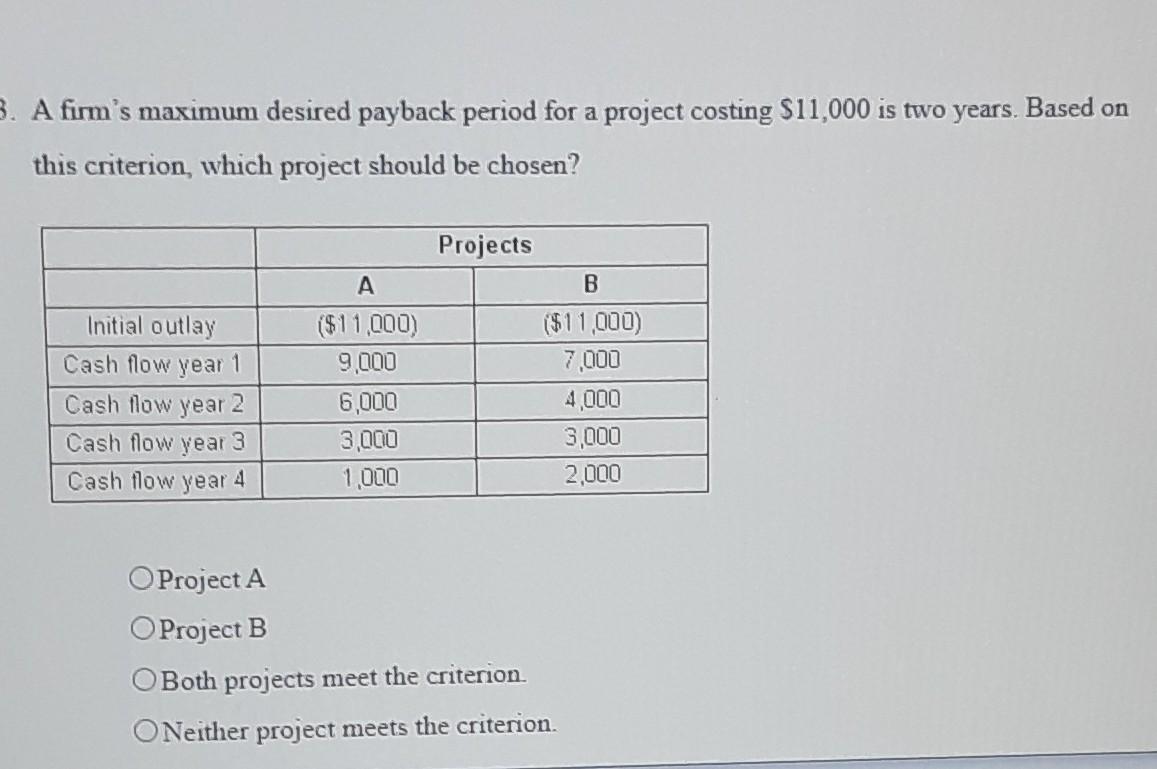

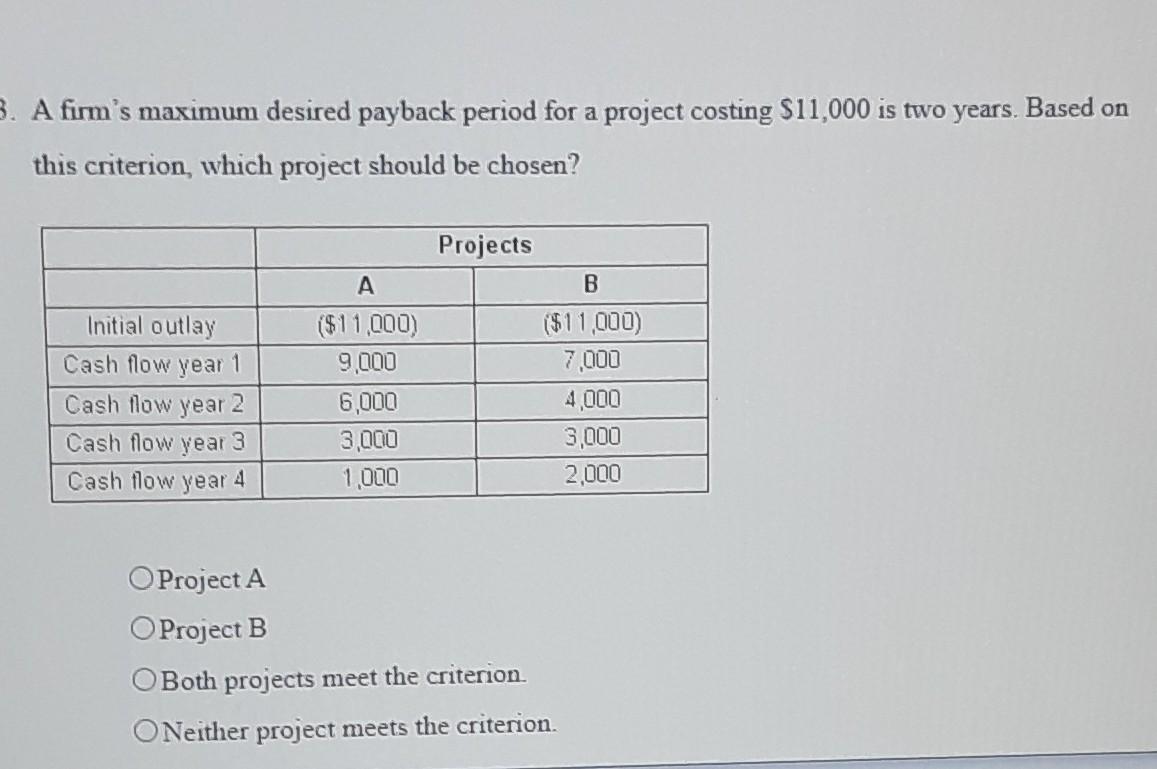

3. A firm's maximum desired payback period for a project costing $11,000 is two years. Based on this criterion, which project should be chosen? Projects A B ($11,000) ($11,000) Initial outlay Cash flow year 1 9,000 7,000 Cash flow year 2 6,000 4,000 Cash flow year 3 3,000 3,000 Cash flow year 4 1,000 2,000 O Project A O Project B Both projects meet the criterion. ONeither project meets the criterion. 3. A firm's maximum desired payback period for a project costing $11,000 is two years. Based on this criterion, which project should be chosen? Projects A B ($11,000) ($11,000) Initial outlay Cash flow year 1 9,000 7,000 Cash flow year 2 6,000 4,000 Cash flow year 3 3,000 3,000 Cash flow year 4 1,000 2,000 O Project A O Project B Both projects meet the criterion. ONeither project meets the criterion. 3. A firm's maximum desired payback period for a project costing $11,000 is two years. Based on this criterion, which project should be chosen? Projects A B ($11,000) ($11,000) Initial outlay Cash flow year 1 9,000 7,000 Cash flow year 2 6,000 4,000 Cash flow year 3 3,000 3,000 Cash flow year 4 1,000 2,000 O Project A O Project B Both projects meet the criterion. ONeither project meets the criterion. 3. A firm's maximum desired payback period for a project costing $11,000 is two years. Based on this criterion, which project should be chosen? Projects A B ($11,000) ($11,000) Initial outlay Cash flow year 1 9,000 7,000 Cash flow year 2 6,000 4,000 Cash flow year 3 3,000 3,000 Cash flow year 4 1,000 2,000 O Project A O Project B Both projects meet the criterion. ONeither project meets the criterion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started