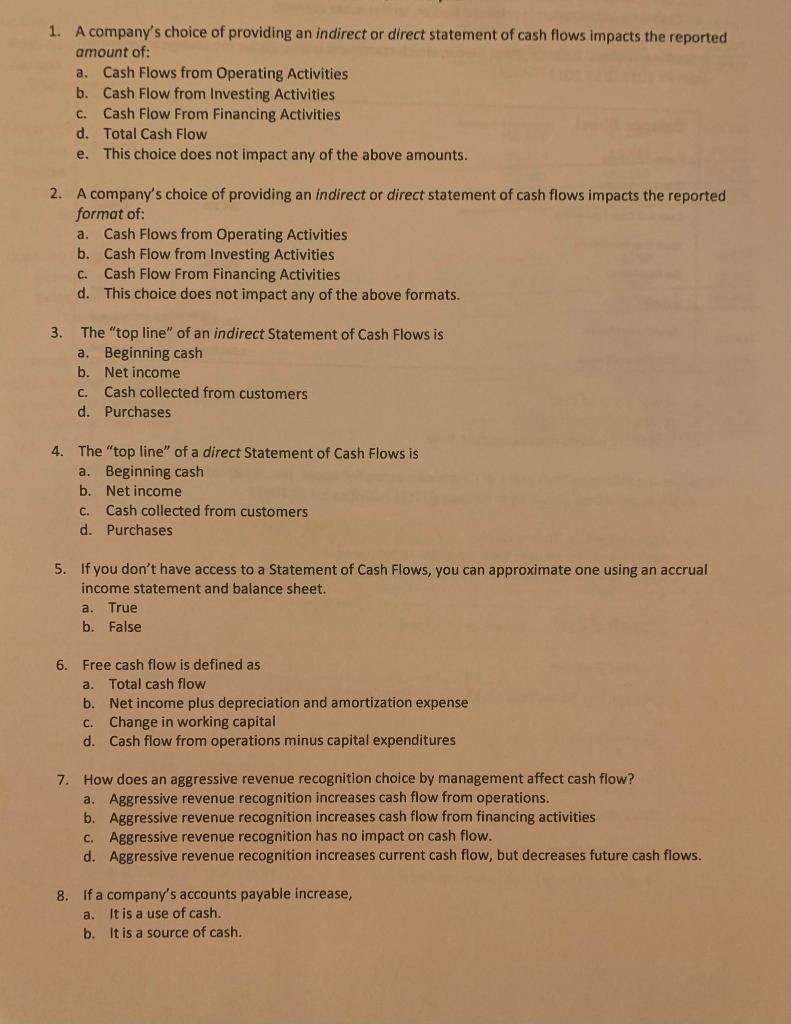

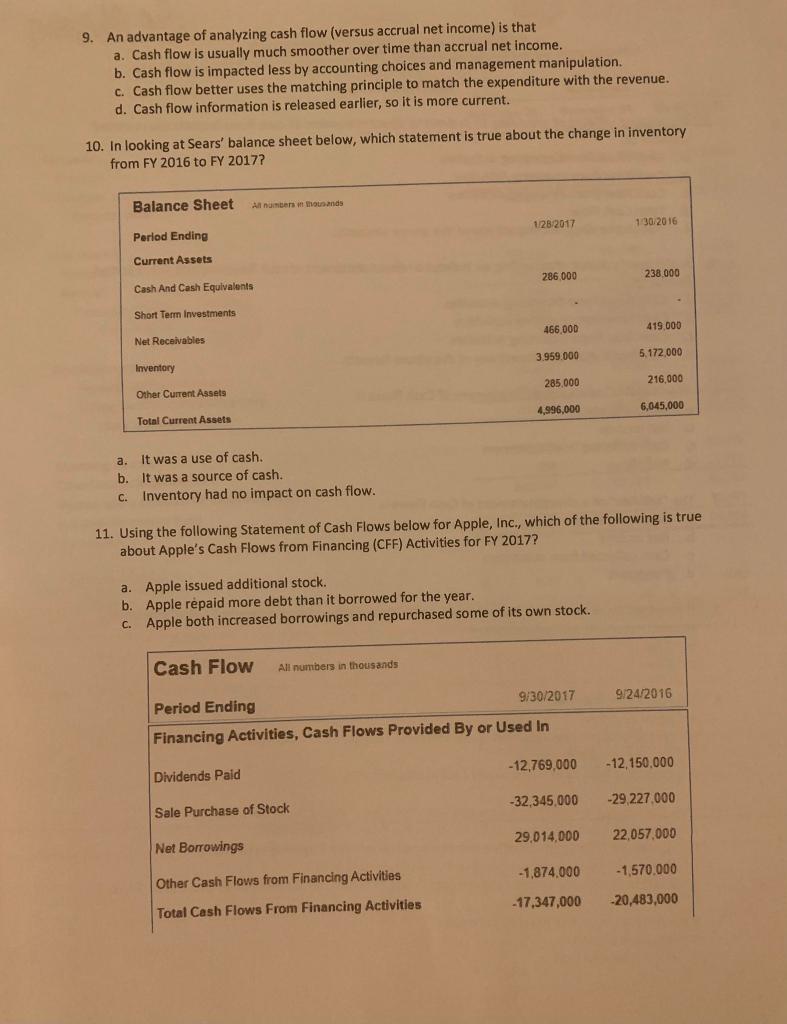

1. A company's choice of providing an indirect or direct statement of cash flows impacts the reported amount of: a. Cash Flows from Operating Activities b. Cash Flow from Investing Activities C. Cash Flow From Financing Activities d. Total Cash Flow This choice does not impact any of the above amounts. e. 2. A company's choice of providing an indirect or direct statement of cash flows impacts the reported format of: a. Cash Flows from Operating Activities b. Cash Flow from Investing Activities C. Cash Flow From Financing Activities d. This choice does not impact any of the above formats. 3. The "top line" of an indirect Statement of Cash Flows is a. Beginning cash b. Net income C. Cash collected from customers d. Purchases 4. The "top line" of a direct Statement of Cash Flows is a. Beginning cash b. Net income c. Cash collected from customers d. Purchases 5. If you don't have access to a Statement of Cash Flows, you can approximate one using an accrual income statement and balance sheet. True b. False a. 6. Free cash flow is defined as a. Total cash flow b. Net income plus depreciation and amortization expense C. Change in working capital d. Cash flow from operations minus capital expenditures 7. How does an aggressive revenue recognition choice by management affect cash flow? a. Aggressive revenue recognition increases cash flow from operations. b. Aggressive revenue recognition increases cash flow from financing activities C. Aggressive revenue recognition has no impact on cash flow. d. Aggressive revenue recognition increases current cash flow, but decreases future cash flows. 8. If a company's accounts payable increase, a. It is a use of cash. b. It is a source of cash. 9. An advantage of analyzing cash flow (versus accrual net income) is that a. Cash flow is usually much smoother over time than accrual net income. b. Cash flow is impacted less by accounting choices and management manipulation. c. Cash flow better uses the matching principle to match the expenditure with the revenue. d. Cash flow information is released earlier, so it is more current. 10. In looking at Sears' balance sheet below, which statement is true about the change in inventory from FY 2016 to FY 2017? Balance Sheet All numbers ousands 128-2017 130/2016 Period Ending Current Assets 286 000 238.000 Cash And Cash Equivalents Short Term Investments 466,000 419 000 Net Receivables 3.959.000 5.172.000 Inventory Other Current Assets 285.000 216,000 4,996.000 6,045,000 Total Current Assets a. b. It was a use of cash. It was a source of cash. Inventory had no impact on cash flow. C. 11. Using the following Statement of Cash Flows below for Apple, Inc., which of the following is true about Apple's Cash Flows from Financing (CFF) Activities for FY 2017? a. Apple issued additional stock. b. Apple repaid more debt than it borrowed for the year. c. Apple both increased borrowings and repurchased some of its own stock. Cash Flow All numbers in thousands 9/30/2017 9/24/2016 Period Ending Financing Activities, Cash Flows Provided By or Used In - 12,769,000 -12,150,000 Dividends Paid -32,345,000 -29.227.000 Sale Purchase of Stock 29.014,000 22.057.000 Net Borrowings -1,874,000 -1,570.000 Other Cash Flows from Financing Activities -17,347,000 -20,483,000 Total Cash Flows From Financing Activities