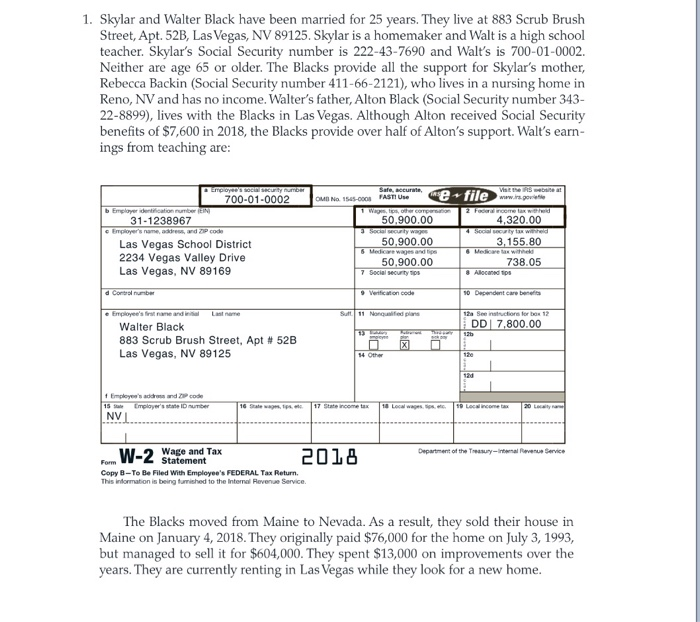

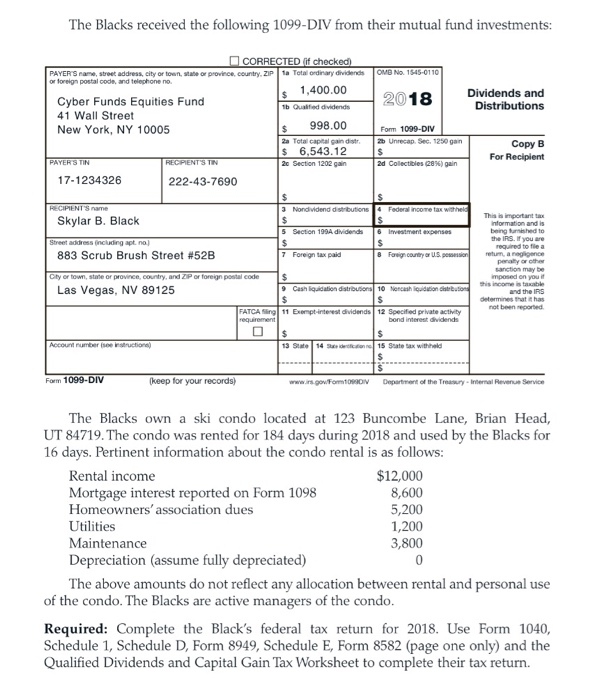

1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a homemaker and Walt is a high school teacher. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age 65 or older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343- 22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of $7,600 in 2018, the Blacks provide over half of Alton's support. Walt's earn- ings from teaching are: 700-01-0002 No. 1545-00 AS e file 50,900.00 50,900.00 50,900.00 4,320.00 3,155.80 738.05 31-1238967 Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 DDI 7.800.00 Walter Black 883 Scrub Brush Street, Apt # 52B Las Vegas, NV 89125 4 Othar Employes's addr and code NV Wage and Tax 201 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This dormation is being turished to the Internal Revene Servce. The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2018. They originally paid $76,000 for the home on July 3, 1993, but managed to sell it for $604,000. T years. They are currently renting in Las Vegas while they look for a new home hey spent $13,000 on improvements over the The Blacks received the following 1099-DIV from their mutual fund investments: PAE e troet address, city or toen, state or proviece, country,2P 1a Tetal ondinary divisends oM NO. 1545-0110 or foreign postal oode, and telephone no. 1,400.00 998.00 6,543.12 2018Dividends and Distributions Cyber Funds Equities Fund 41 Wall Street New York, NY 10005 Form 1099-DIV 2a Total capital gain distr2b Unrecap. Sec. 1250 gain Copy B For Recipient RECPENTS TIN 2c Section 1202 gain 2d Colectbes 28%) gain 17-1234326 222-43-7690 RECIPIENT Skylar B. Black 883 Scrub Brush Street #52B Las Vegas, NV 89125 nformation and is being turmished to 199A dividends Street address including apt no Foreign tax paid City or town, state or province, country, and ZP or foreign postal codeS mposed en you it this income in taxable 10 Noncash luidution not been eported ATCA ing 11 Exempt-interest dividends 12 Specifed private actvity dvidends Form 1099-DIV (keep for your records www.irs.gov FormtoiDN Dpartment of the Treasury-Inenal Revenue Service The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 184 days during 2018 and used by the Blacks for 16 days. Pertinent information about the condo rental is as follows: Rental income Mortgage interest reported on Form 1098 Homeowners association dues Utilities Maintenance Depreciation (assume fully depreciated) $12,000 8,600 5,200 1,200 3,800 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo Required: Complete the Black's federa tax return for 2018. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E, Form 8582 (page one only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return