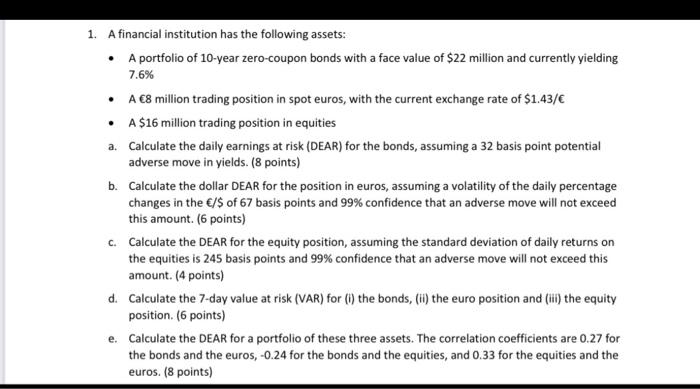

1. A financial institution has the following assets: A portfolio of 10-year zero-coupon bonds with a face value of $22 million and currently yielding 7.6% A 8 million trading position in spot euros, with the current exchange rate of $1.43/ A $16 million trading position in equities a. Calculate the daily earnings at risk (DEAR) for the bonds, assuming a 32 basis point potential adverse move in yields. (8 points) b. Calculate the dollar DEAR for the position in euros, assuming a volatility of the daily percentage changes in the /$ of 67 basis points and 99% confidence that an adverse move will not exceed this amount. (6 points) C. Calculate the DEAR for the equity position, assuming the standard deviation of daily returns on the equities is 245 basis points and 99% confidence that an adverse move will not exceed this amount. (4 points) d. Calculate the 7-day value at risk (VAR) for() the bonds, (ii) the euro position and (iii) the equity position. (6 points) e. Calculate the DEAR for a portfolio of these three assets. The correlation coefficients are 0.27 for the bonds and the euros, -0.24 for the bonds and the equities, and 0.33 for the equities and the euros. (8 points) 1. A financial institution has the following assets: A portfolio of 10-year zero-coupon bonds with a face value of $22 million and currently yielding 7.6% A 8 million trading position in spot euros, with the current exchange rate of $1.43/ A $16 million trading position in equities a. Calculate the daily earnings at risk (DEAR) for the bonds, assuming a 32 basis point potential adverse move in yields. (8 points) b. Calculate the dollar DEAR for the position in euros, assuming a volatility of the daily percentage changes in the /$ of 67 basis points and 99% confidence that an adverse move will not exceed this amount. (6 points) C. Calculate the DEAR for the equity position, assuming the standard deviation of daily returns on the equities is 245 basis points and 99% confidence that an adverse move will not exceed this amount. (4 points) d. Calculate the 7-day value at risk (VAR) for() the bonds, (ii) the euro position and (iii) the equity position. (6 points) e. Calculate the DEAR for a portfolio of these three assets. The correlation coefficients are 0.27 for the bonds and the euros, -0.24 for the bonds and the equities, and 0.33 for the equities and the euros. (8 points)