Question

1. A firm's bank reconciliation statement shows a book balance of $32,840, a non-interest note collected by the bank of4,100, outstanding checks of $1,400, and

1. A firm's bank reconciliation statement shows a book balance of $32,840, a non-interest note collected by the bank of4,100, outstanding checks of $1,400, and a service charge of $100. Its adjusted book balance is?

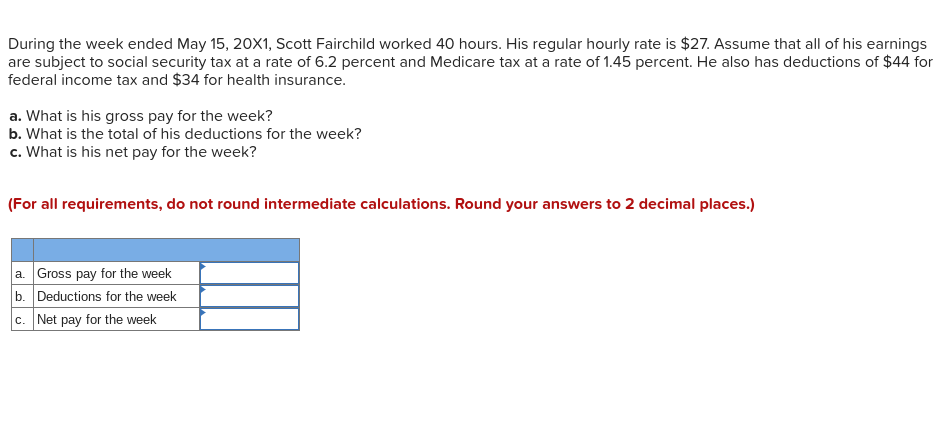

2. An employee whose regular hourly rate is $13 and whose overtime rate is 1.50 times the regular rate worked 43 hours in one week. In the payroll register, the employer should record an overtime premium of ?

3. Roy DeSoto earns a regular hourly salary of $20.00. He is paid time-and-a-half for all hours in excess of 40 in the week. For the week ended March 8, 20X1, he worked a total of 55 hours. His gross wages year to date, prior to his March 8, paycheck, are $12,140. Social Security Tax is 6.2% on a maximum of $132,900 of gross wages per year, Medicare Tax is 1.45%, federal unemployment tax is 0.6% and state unemployment tax is 4.2%, both on a maximum of $7,000 of gross wages per year. What is the employer's payroll tax expense for Roy for the week ended March 8, 20X1?

4. The beginning capital balance shown on a statement of owner's equity is $85,000. Net income for the period is $35,000. The owner withdrew $43,000 cash from the business and made no additional investments during the period. The owner's capital balance at the end of the period is

5. The beginning capital balance shown on a statement of owner's equity is $54,000. Net loss for the period is $16,000 and the owner withdrew $20,000 cash from the business and made no additional investments during the period. The owner's capital balance at the end of the period is

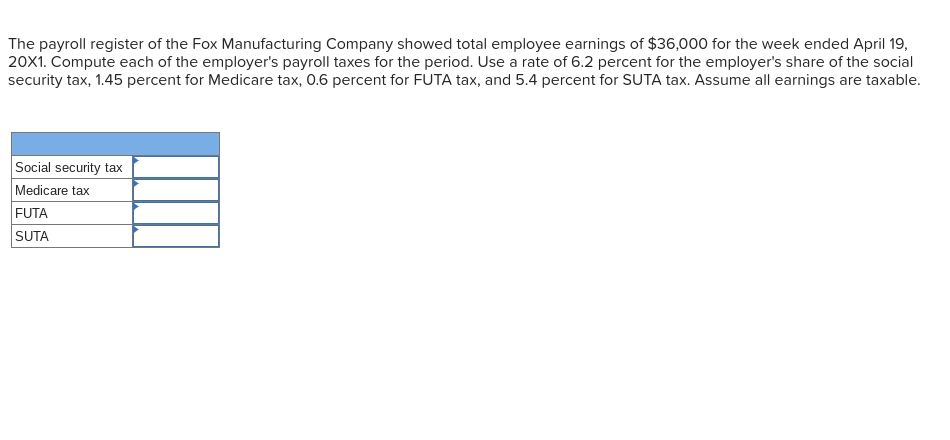

6.

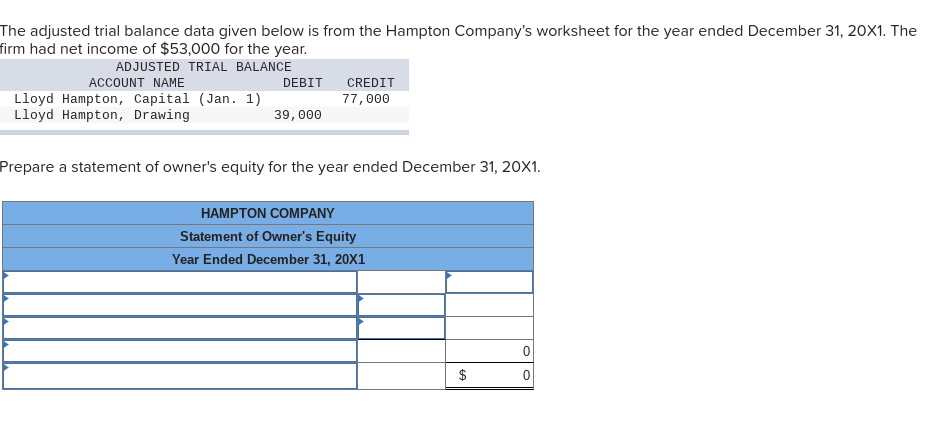

The adjusted trial balance data given below is from the Hampton Company's worksheet for the year ended December 31, 20X1. The firm had net income of $53,000 for the year. ADJUSTED TRIAL BALANCE ACCOUNT NAME DEBIT Lloyd Hampton, Capital (Jan. 1) CREDIT 77,000 Lloyd Hampton, Drawing 39,000 Prepare a statement of owner's equity for the year ended December 31, 20X1. HAMPTON COMPANY Statement of Owner's Equity Year Ended December 31, 20X1 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started