Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1: a) golden parachutes b) poison pills c) arbitrage d) white knights 2: risk arbitrage OR pure arbitrage Firms facing hostile takeovers often take actions

1: a) golden parachutes b) poison pills c) arbitrage d) white knights

2: risk arbitrage OR pure arbitrage

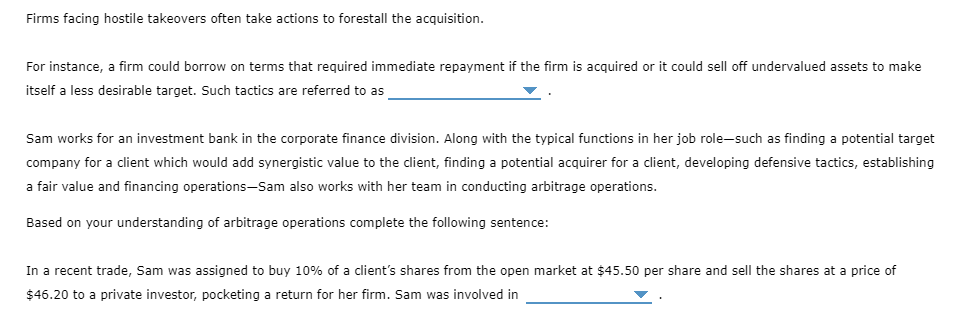

Firms facing hostile takeovers often take actions to forestall the acquisition. For instance, a firm could borrow on terms that required immediate repayment if the firm is acquired or it could sell off undervalued assets to make itself a less desirable target. Such tactics are referred to as Sam works for an investment bank in the corporate finance division. Along with the typical functions in her job role-such as finding a potential target company for a client which would add synergistic value to the client, finding a potential acquirer for a client, developing defensive tactics, establishing a fair value and financing operations-Sam also works with her team in conducting arbitrage operations. Based on your understanding of arbitrage operations complete the following sentence: In a recent trade, Sam was assigned to buy 10% of a client's shares from the open market at $45.50 per share and sell the shares at a price of $46.20 to a private investor, pocketing a return for her firm. Sam was involved inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started