Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. a) If the price of a bond with face value $100 is $90, and the price of a bond with face value C$100

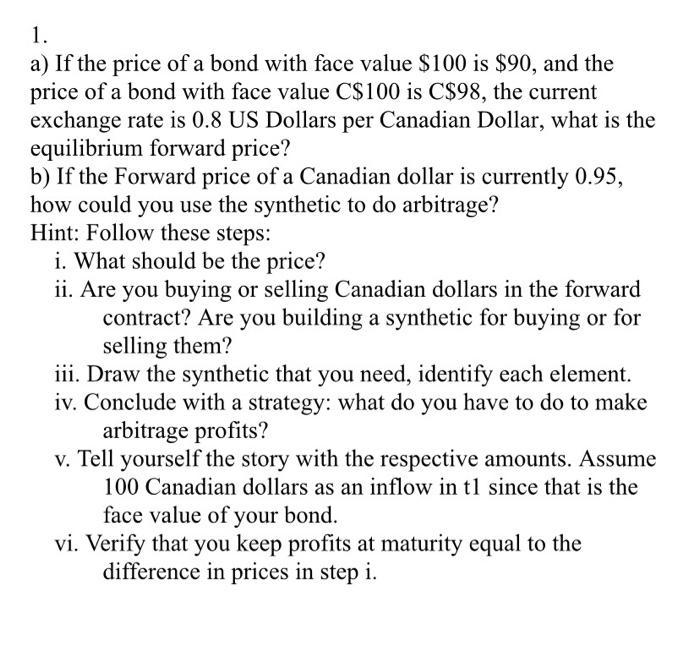

1. a) If the price of a bond with face value $100 is $90, and the price of a bond with face value C$100 is C$98, the current exchange rate is 0.8 US Dollars per Canadian Dollar, what is the equilibrium forward price? b) If the Forward price of a Canadian dollar is currently 0.95, how could you use the synthetic to do arbitrage? Hint: Follow these steps: i. What should be the price? ii. Are you buying or selling Canadian dollars in the forward contract? Are you building a synthetic for buying or for selling them? iii. Draw the synthetic that you need, identify each element. iv. Conclude with a strategy: what do you have to do to make arbitrage profits? v. Tell yourself the story with the respective amounts. Assume 100 Canadian dollars as an inflow in t1 since that is the face value of your bond. vi. Verify that you keep profits at maturity equal to the difference in prices in step i.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Interest Rate in US Face ValuePrice of US BondPrice of US Bond 1009090 01111 In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started