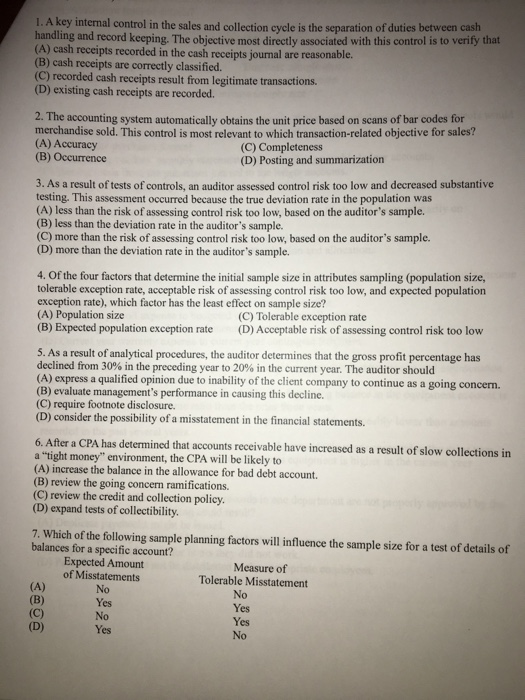

1. A key internal control in the sales and collection cycle is the separation of duties between cash handling and record keeping. The objective most directly associated with this control is to verify that (A) cash receipts recorded in the cash receipts journal are reasonable. (B) cash receipts are correctly classified. (C) recorded cash receipts result from legitimate transactions. (D) existing cash receipts are recorded. 2. The accounting system automatically obtains the unit price based on scans of bar codes for merchandise sold. This control is most relevant to which transaction-related objective for sales? (A) Accuracy (B) Occurrence (C) Completeness (D) Posting and summarization 3. As a result of tests of controls, an auditor assessed control risk too low and decreased substantive testing. This assessment occurred because the true deviation rate in the population was (A) less than the risk of assessing control risk too low, based on the auditor's sample. (B) less than the deviation rate in the auditor's sample. (C) more than the risk of assessing control risk too low, based on the auditor's sample. (D) more than the deviation rate in the auditor's sample 4. Of the four factors that determine the initial sample size in attributes sampling (population size, tolerable exception rate, acceptable risk of assessing control risk too low, and expected population exception rate), which factor has the least effect on sample size? (A) Population size (B) Expected population exception rate (D)Acceptable risk of assessing control risk too low (C) Tolerable exception rate 5. As a result of analytical procedures, the auditor determines that the gross profit percentage has declined from 30% in the preceding year to 20% in the current year. The auditor should (A) express a qualified opinion due to inability of the client company to continue as a going concern. (B) evaluate management's performance in causing this decline. (C) require footnote disclosure. (D) consider the possibility of a misstatement in the financial statements %. After a CPA has deternined that asounts receivable have increased as a result of slow collections in a "tight money" environment, the CPA will be likely to (A) increase the balance in the allowance for bad debt account. (B) review the going concern ramifications. (C) review the credit and collection policy (D) expand tests of collectibility. 7. Which of the following sample planning factors will influence the sample size for a test of details of balances for a specific account? Expected Amount of Misstatements No es No es Measure of Tolerable Misstatement (A) oFMis No es Yes No