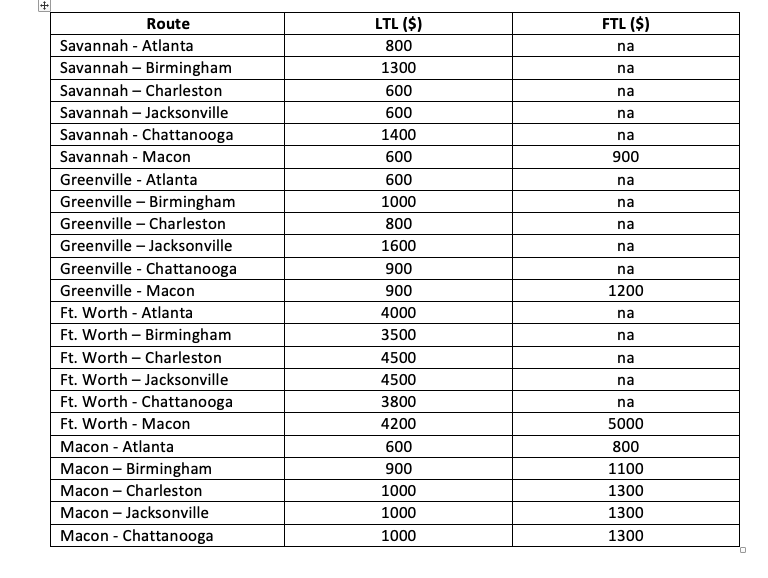

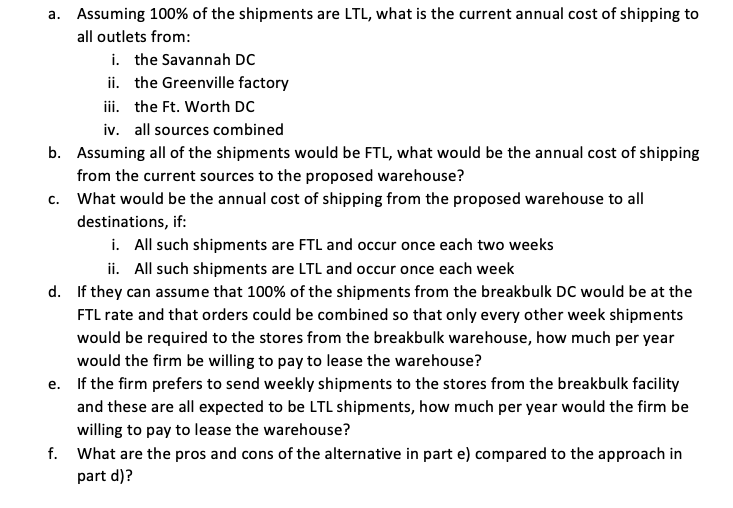

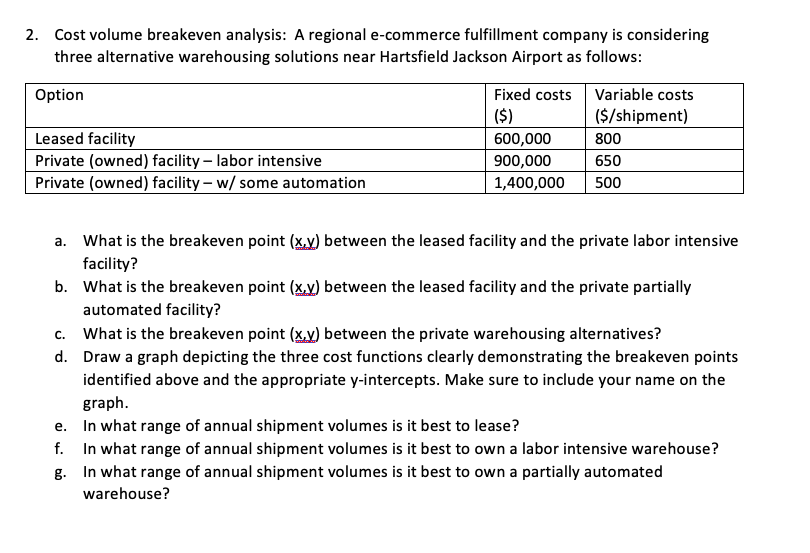

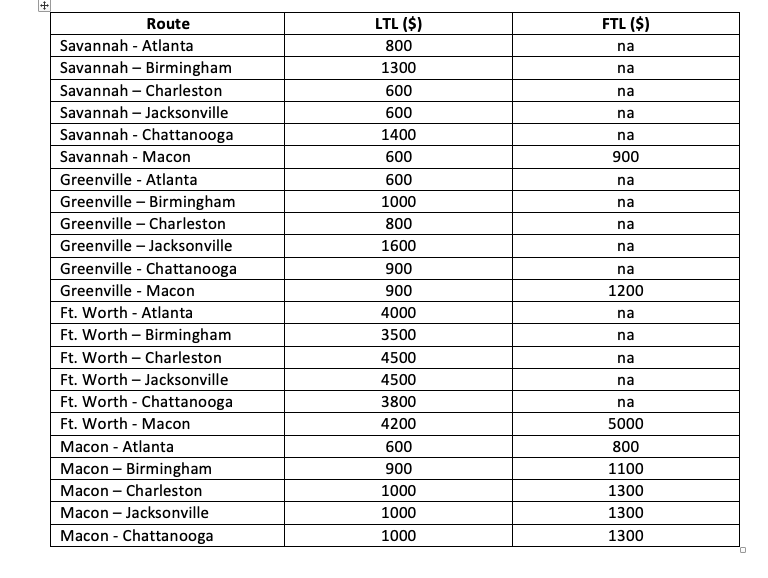

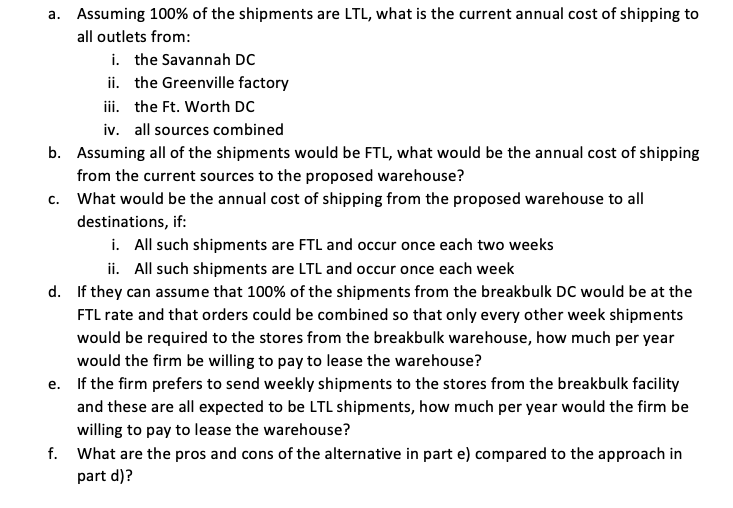

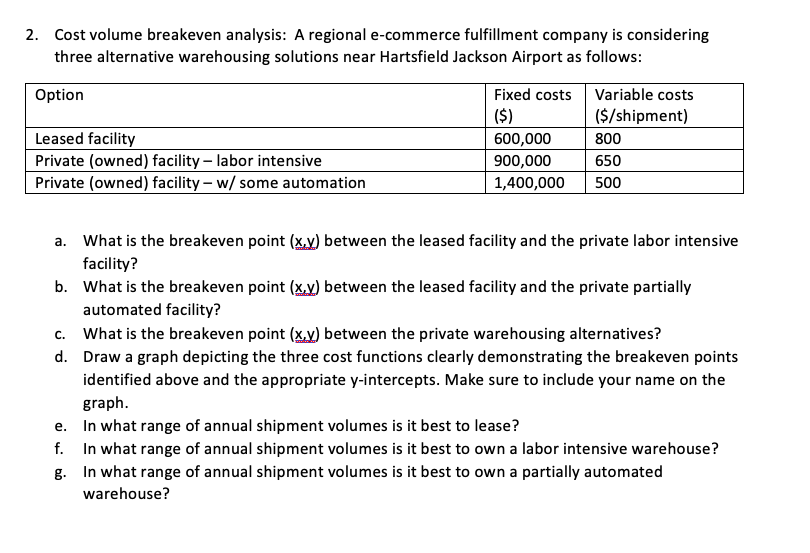

1. A regional home goods store has outlets in Atlanta, Birmingham, Charleston, and Jacksonville, and Chattanooga. Products are sent to these facilities in weekly LTL shipments to fulfil their orders from a DC in Savannah (sends total volume of 80 FTL of European import goods), a DC in Fort Worth (200 FTL Asian and Central American Import Goods), and a manufacturing facility in Greenville, SC (that sends 180 FTL of fabrics and carpet). Management has located a facility in Macon, Georgia that is well suited to breakbulk operations for their products. It could be leased for $50,000 per month and would have $750,000 in annual operating costs (including triple net costs of tax, maintenance and insurance). The current and estimated shipping costs are provided in a table below. FTL ($) na LTL ($) 800 1300 600 na na 600 na na 900 na na na na na Route Savannah - Atlanta Savannah - Birmingham Savannah - Charleston Savannah - Jacksonville Savannah - Chattanooga Savannah - Macon Greenville - Atlanta Greenville - Birmingham Greenville - Charleston Greenville - Jacksonville Greenville - Chattanooga Greenville - Macon Ft. Worth - Atlanta Ft. Worth - Birmingham Ft. Worth - Charleston Ft. Worth - Jacksonville Ft. Worth - Chattanooga Ft. Worth - Macon Macon - Atlanta Macon - Birmingham Macon - Charleston Macon - Jacksonville Macon - Chattanooga 1200 na 1400 600 600 1000 800 1600 900 900 4000 3500 4500 4500 3800 4200 600 900 1000 1000 1000 na na na na 5000 800 1100 1300 1300 1300 c. a. Assuming 100% of the shipments are LTL, what is the current annual cost of shipping to all outlets from: i. the Savannah DC ii. the Greenville factory iii. the Ft. Worth DC iv. all sources combined b. Assuming all of the shipments would be FTL, what would be the annual cost of shipping from the current sources to the proposed warehouse? What would be the annual cost of shipping from the proposed warehouse to all destinations, if: i. All such shipments are FTL and occur once each two weeks ii. All such shipments are LTL and occur once each week d. If they can assume that 100% of the shipments from the breakbulk DC would be at the FTL rate and that orders could be combined so that only every other week shipments would be required to the stores from the breakbulk warehouse, how much per year would the firm be willing to pay to lease the warehouse? e. If the firm prefers to send weekly shipments to the stores from the breakbulk facility and these are all expected to be LTL shipments, how much per year would the firm be willing to pay to lease the warehouse? f. What are the pros and cons of the alternative in part e) compared to the approach in part d)? 2. Cost volume breakeven analysis: A regional e-commerce fulfillment company is considering three alternative warehousing solutions near Hartsfield Jackson Airport as follows: Option Leased facility Private (owned) facility - labor intensive Private (owned) facility - w/ some automation Fixed costs Variable costs ($) ($/shipment) 600,000 800 900,000 650 1,400,000 500 a. What is the breakeven point (x,y) between the leased facility and the private labor intensive facility? b. What is the breakeven point (x,y) between the leased facility and the private partially automated facility? c. What is the breakeven point (x,y) between the private warehousing alternatives? d. Draw a graph depicting the three cost functions clearly demonstrating the breakeven points identified above and the appropriate y-intercepts. Make sure to include your name on the graph. e. In what range of annual shipment volumes is it best to lease? f. In what range of annual shipment volumes is it best to own a labor intensive warehouse? g. In what range of annual shipment volumes is it best to own a partially automated warehouse