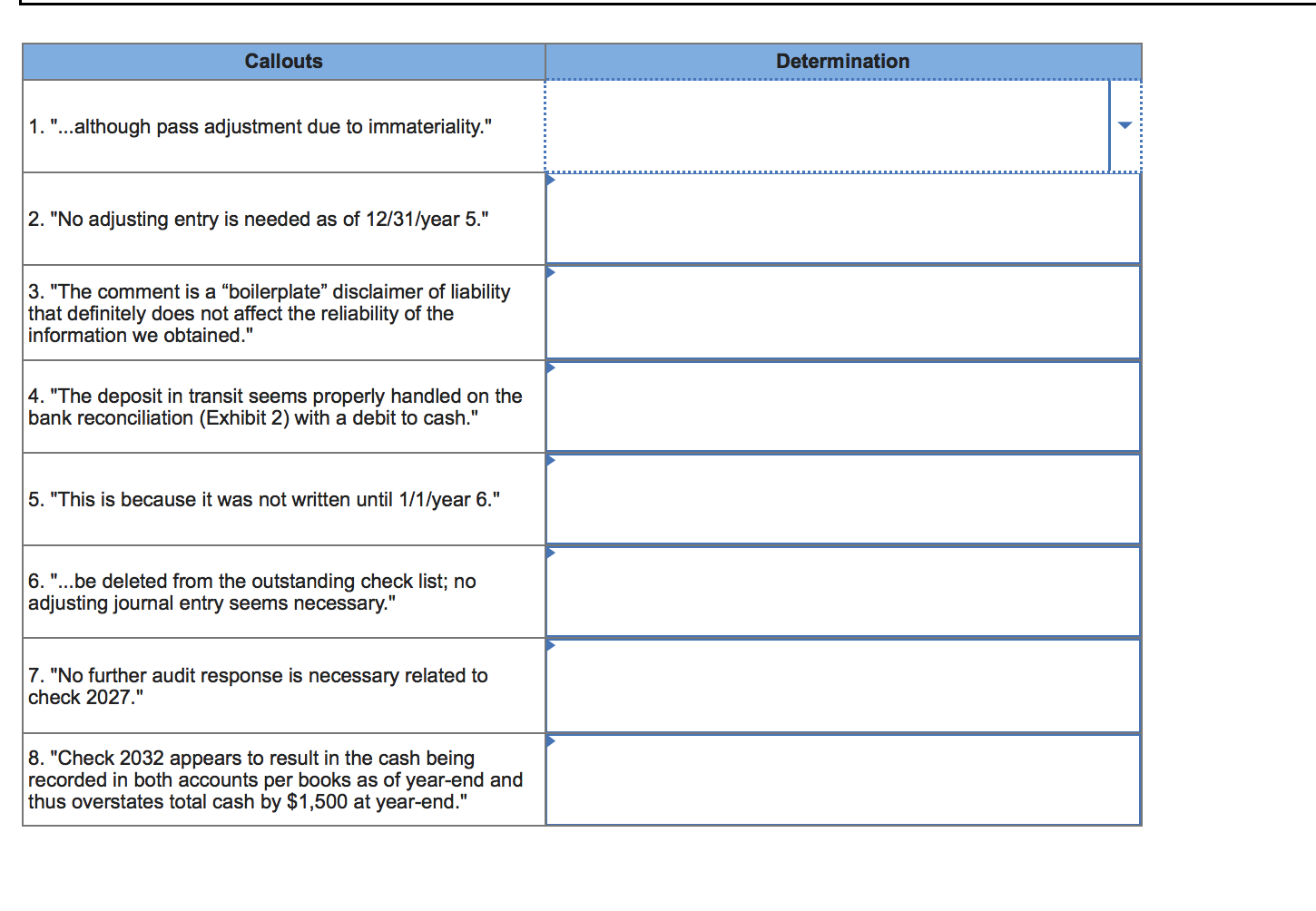

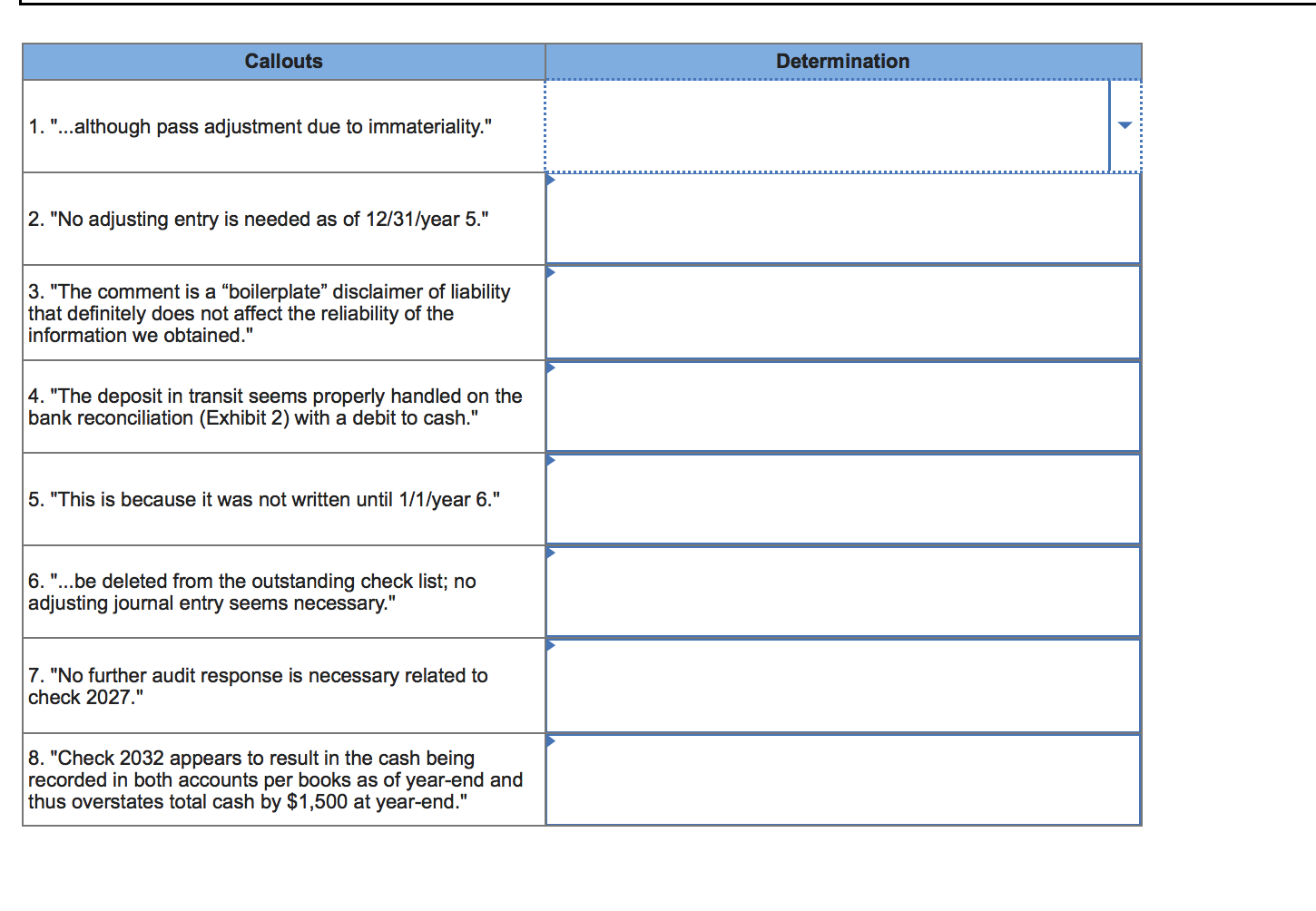

1. A. Retain the original text. B. Replace with as, whenever petty cash is spent, a related journal entry debiting the expense and crediting petty

1. A. Retain the original text.

1. A. Retain the original text.

B. Replace with as, whenever petty cash is spent, a related journal entry debiting the expense and crediting petty cash should be recorded when an imprest account is used; accordingly, we should propose an adjusting entry.

C. Replace with and indicates we need to perform additional procedures as this imprest account is not being properly used.

D. Replace with and indicates likely fraudulent financial reporting.

E. Replace with and indicates likely misappropriation of assets.

2. A. Retain the original text.

B. Delete entire point 2.

C. Replace with "We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting accounts receivable for $6,000."

D. Replace with "We should propose an adjusting entry as of 12/31/year 5 debiting cash and crediting miscellaneous revenues as net income is understated as of 12/31/year 5."

E. Replace with "We should increase our assessed level of fraud risk due to this situation and propose no adjusting entry as of 12/31/year 5."

3. A. Retain the original text.

B. Delete entire point 3.

C. Replace with Because the bank representative added a disclaimer to the confirmation, we must discard this confirmation and use other auditing procedures to establish the balances.

D. Replace with Because the bank representative added a disclaimer to the confirmation, we are required by the professional standards to consider this a fraud risk factor and to consider the need for additional fraud-related procedures.

E. Replace with Therefore, we are required to reconfirm the account electronically in this circumstance.

F. Replace with This comment (disclaimer) on the confirmation may cast doubt about the completeness and accuracy of the information contained in the response and, accordingly, we should obtain further audit evidence.

4. A. Retain the original text.

B. Delete entire point 4.

C. Replace with The deposit in transit is likely to be an interbank transfer between the general account and the special account.

D. Replace with The deposit in transit should be included on the bank transfer schedule.

E. Replace with The deposit in transit seems to have taken too long to reach the bank; we should investigate this further.

5. A. Retain the original text.

B. Delete entire point 5.

C. Replace with This is because it was written in year 4.

D. Replace with But since the bank transfer schedule shows that it was received on 12/31/year 5 in the special account, we should investigate this transaction further.

E. Replace with This represents a proper deposit in transit for the special account as of 12/31/year 5.

6. A. Retain the original text.

B. Delete entire point 6.

C. Replace with be deleted from the check list, with a possible adjusting journal entry proposed debiting cash and crediting a miscellaneous revenue type account.

D. Replace with be deleted from the check list, with a debit to bad debt expense and a credit to cash.

E. Replace with remain on the list of outstanding checks until cashed to keep the account in balance.

F. Replace with is required to be reissued to a satisfactory charity for disbursement.

7. A. Retain the original text.

B. Delete entire point 7.

C. Replace with We should perform further procedures to determine why the account reconciliation excludes this item, which should be listed as a deposit in transit as of year-end.

D. Replace with We should perform further procedures to determine why the account reconciliation excludes this item, which should be listed as an outstanding check as of year-end.

E. Replace with We should propose an adjusting entry recording the disbursement in December.

8. A. Retain the original text.

B. Delete entire point 8.

C. Replace with The transaction related to Check 2032 is either a deposit or a withdrawal; it cant be both.

D. Replace with Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $3,000 at year-end.

E. Replace with Check 2032 is recorded in the general account per bank in year 6; thus it understates total cash by $1,500 at year-end.

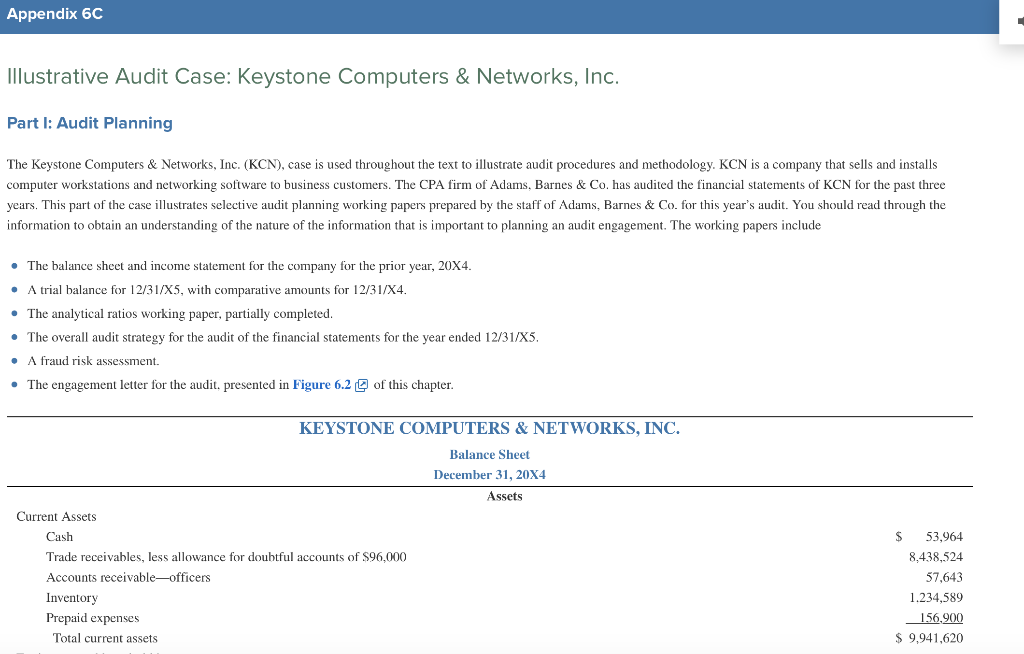

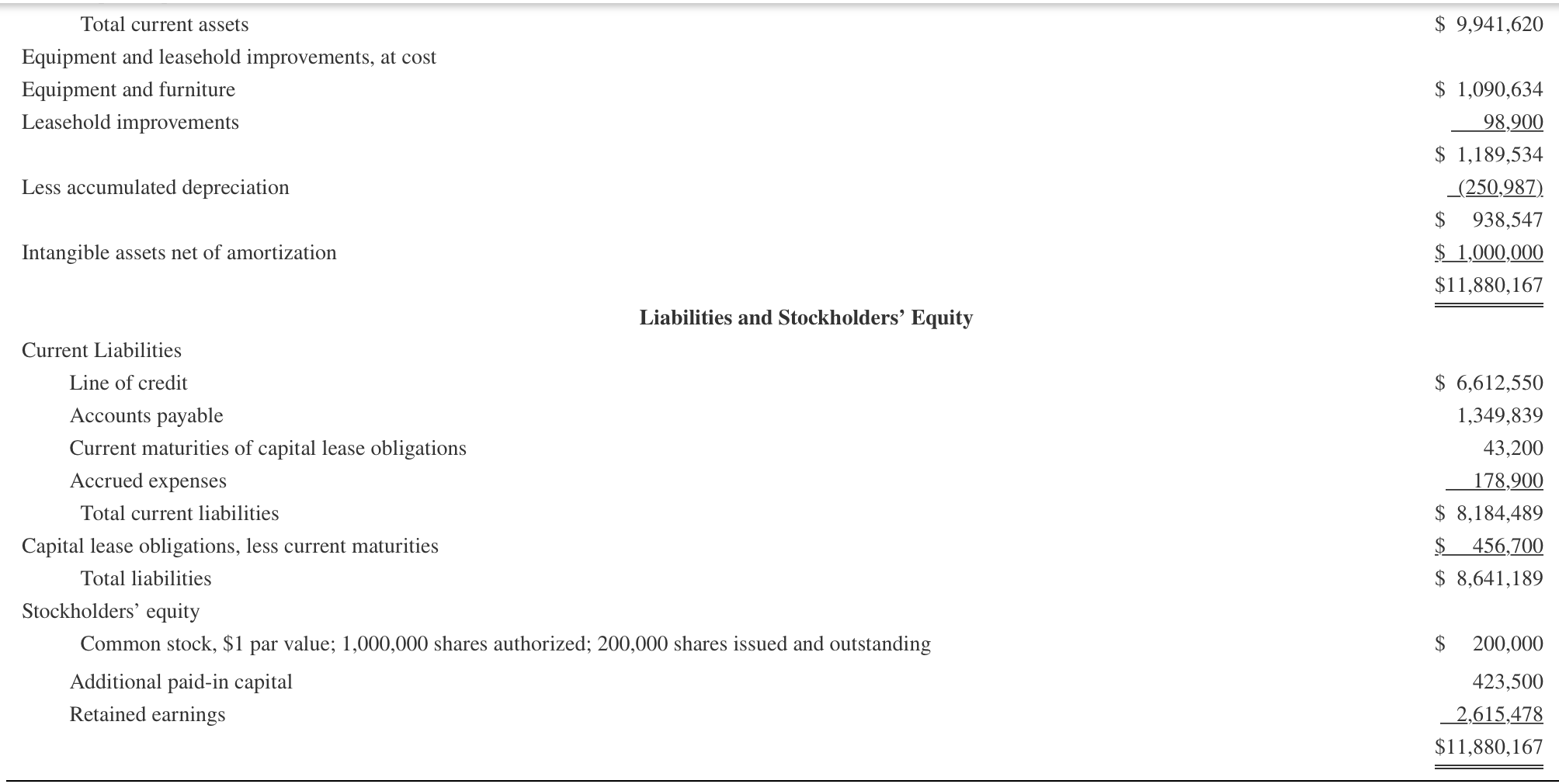

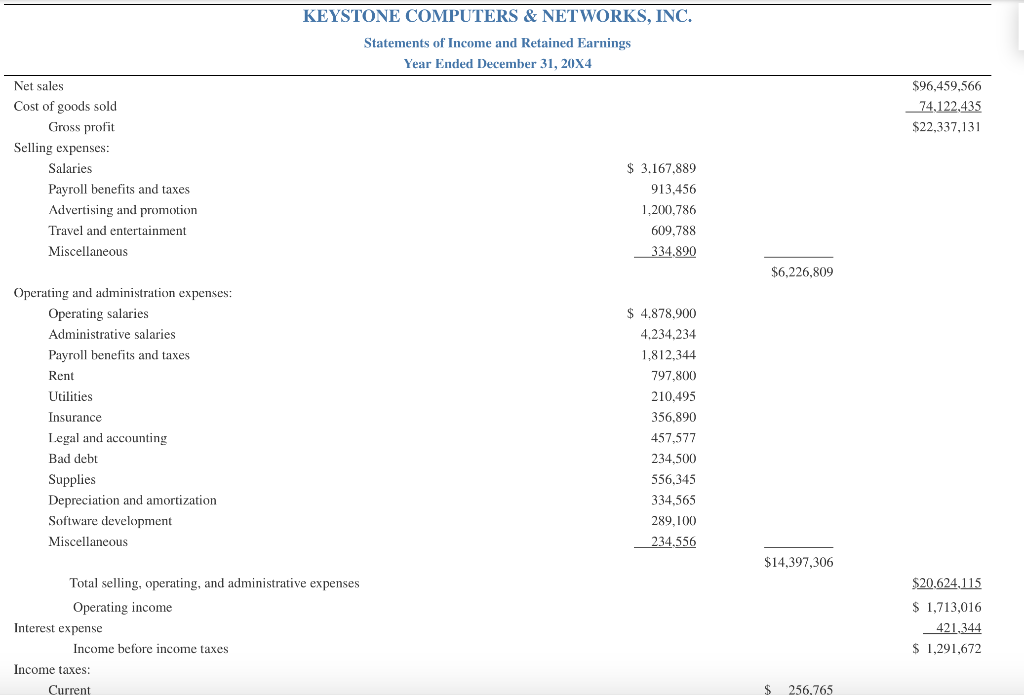

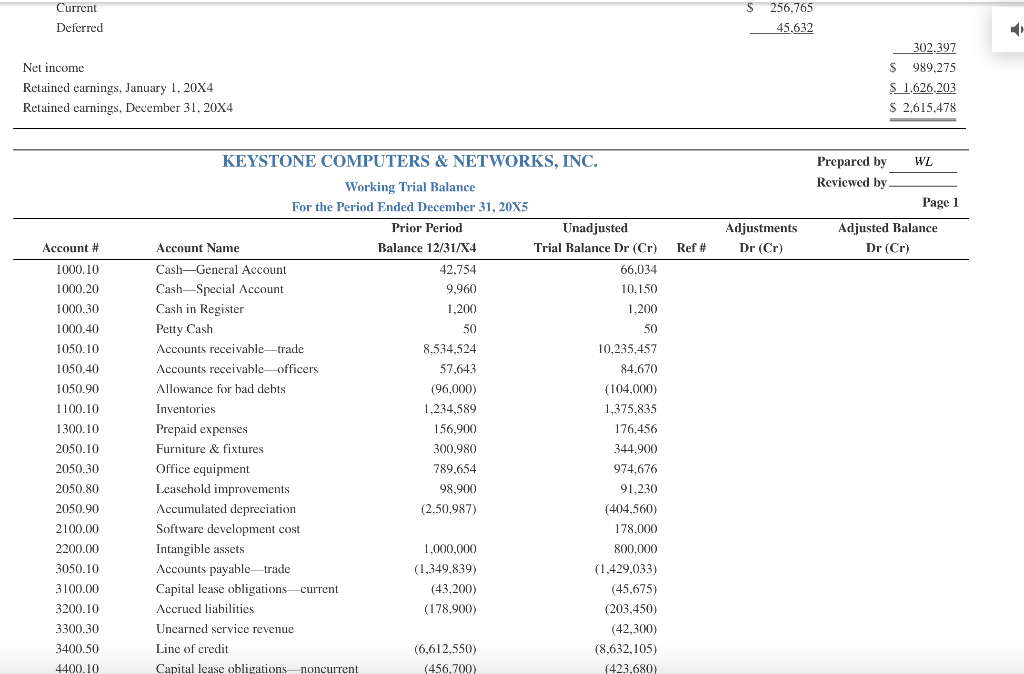

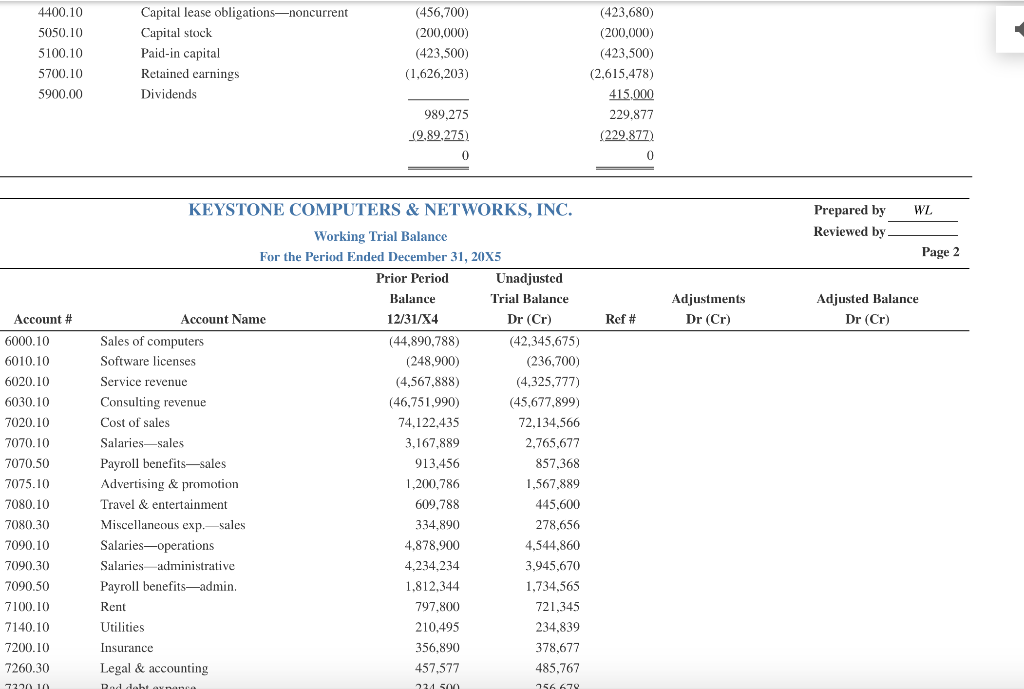

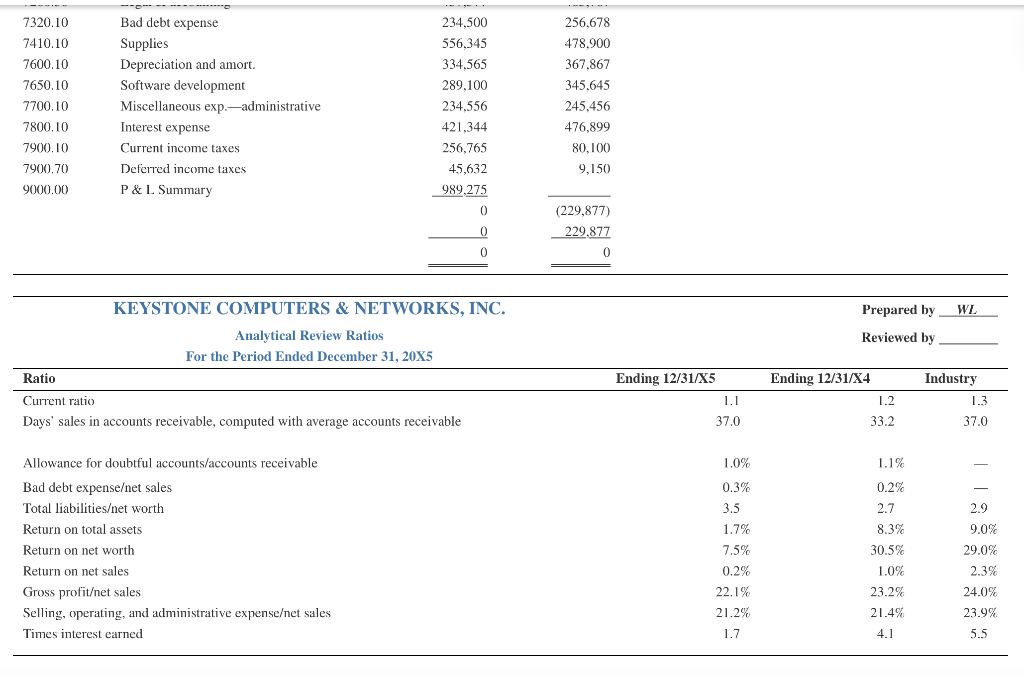

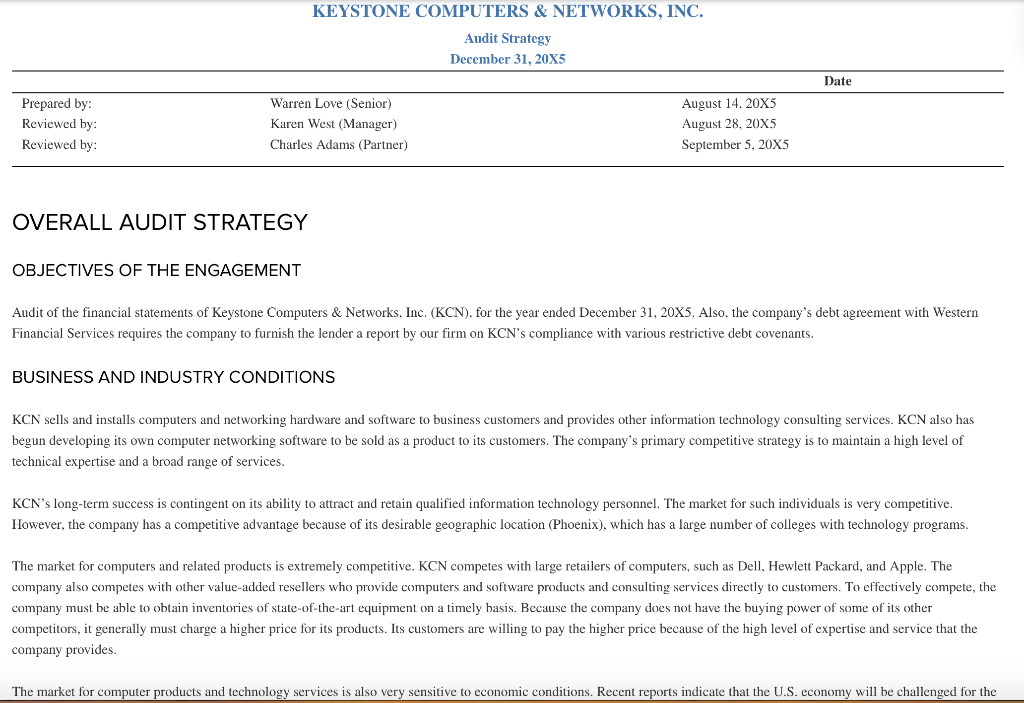

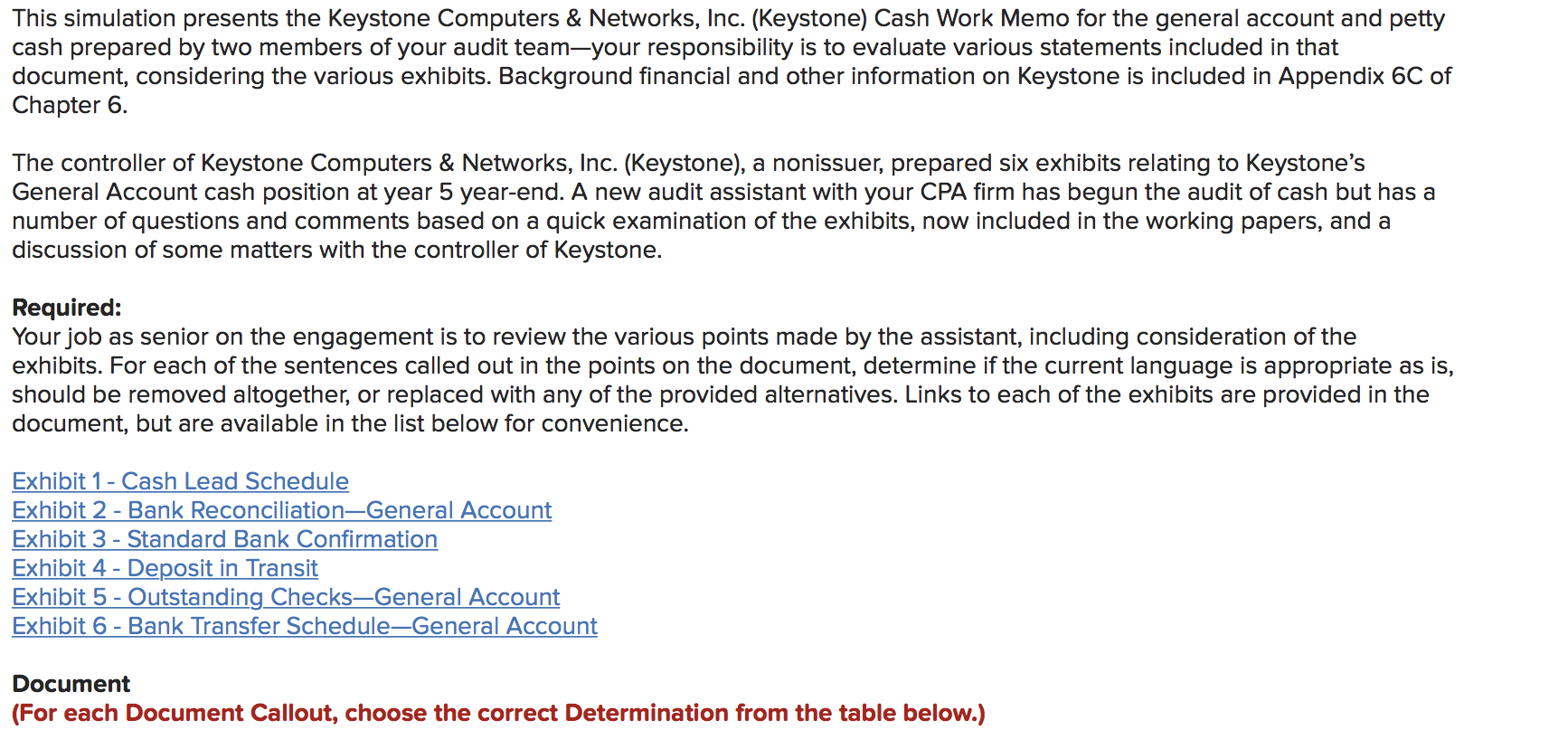

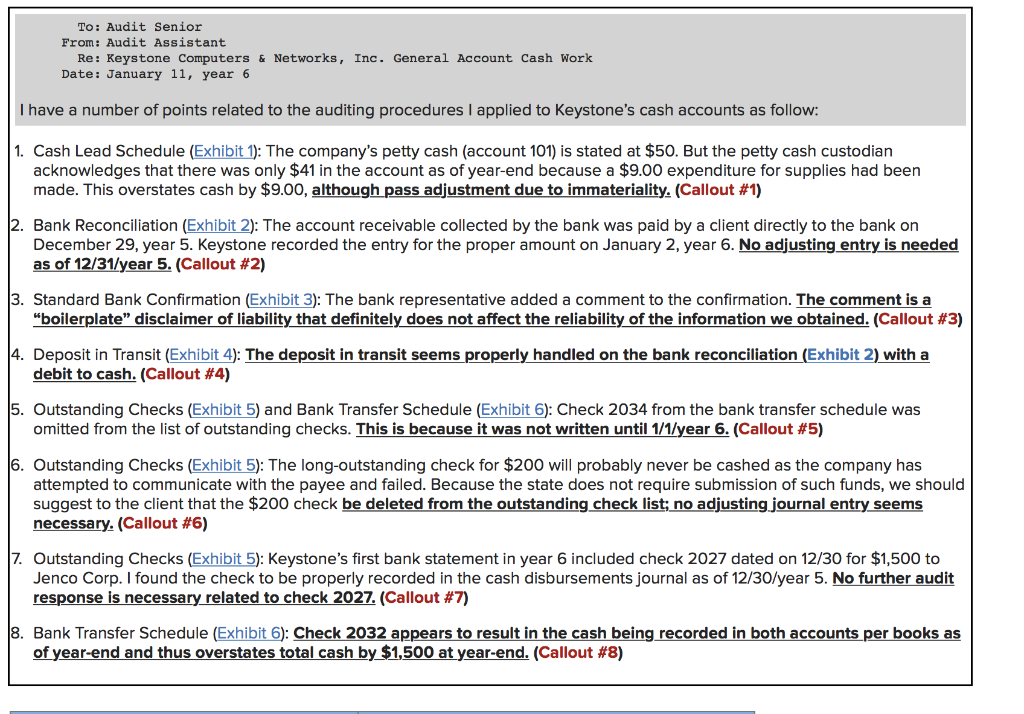

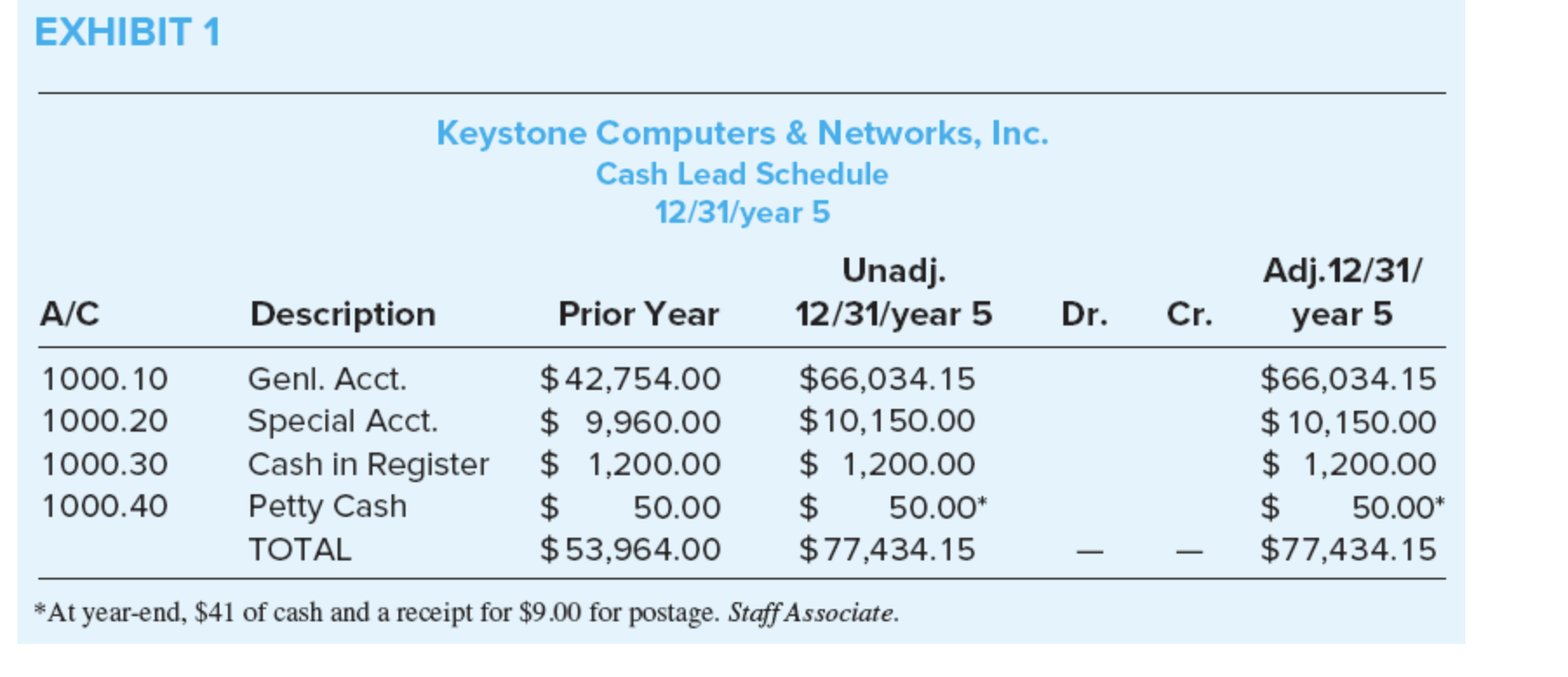

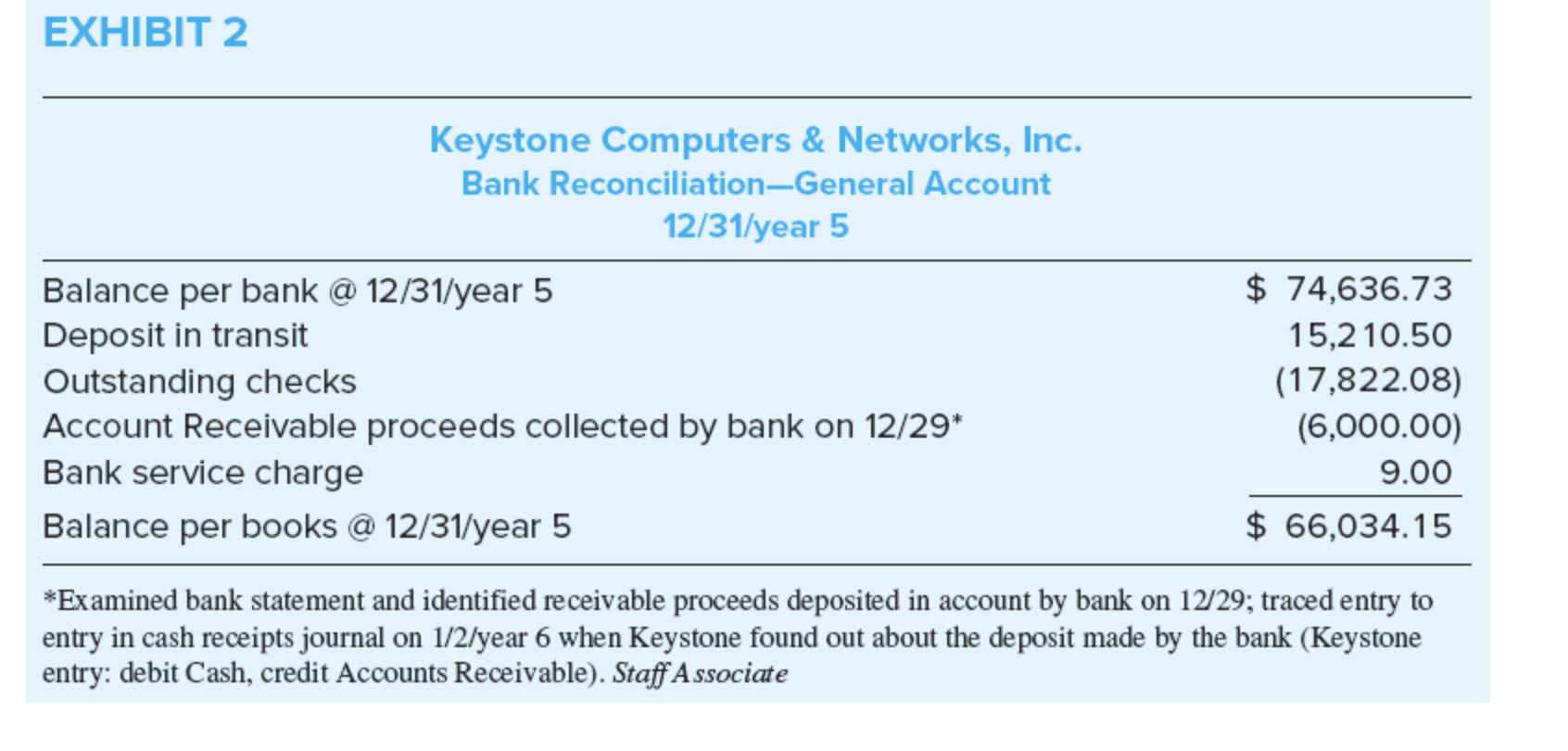

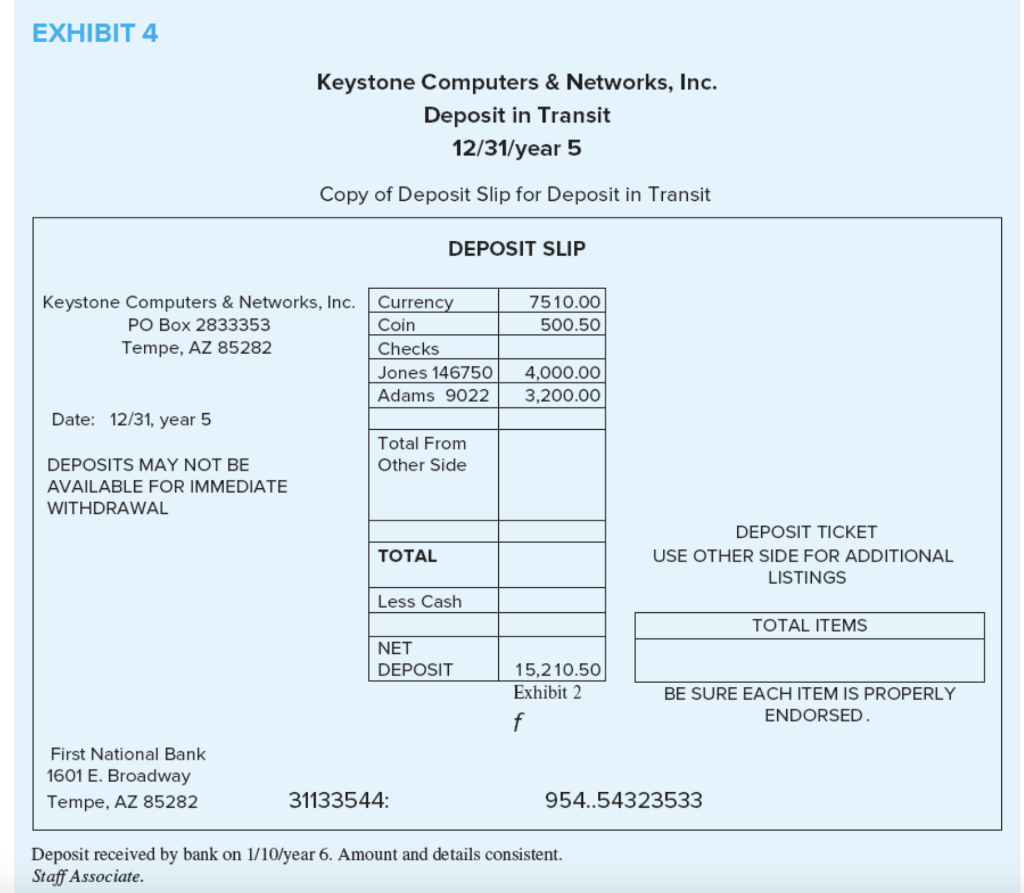

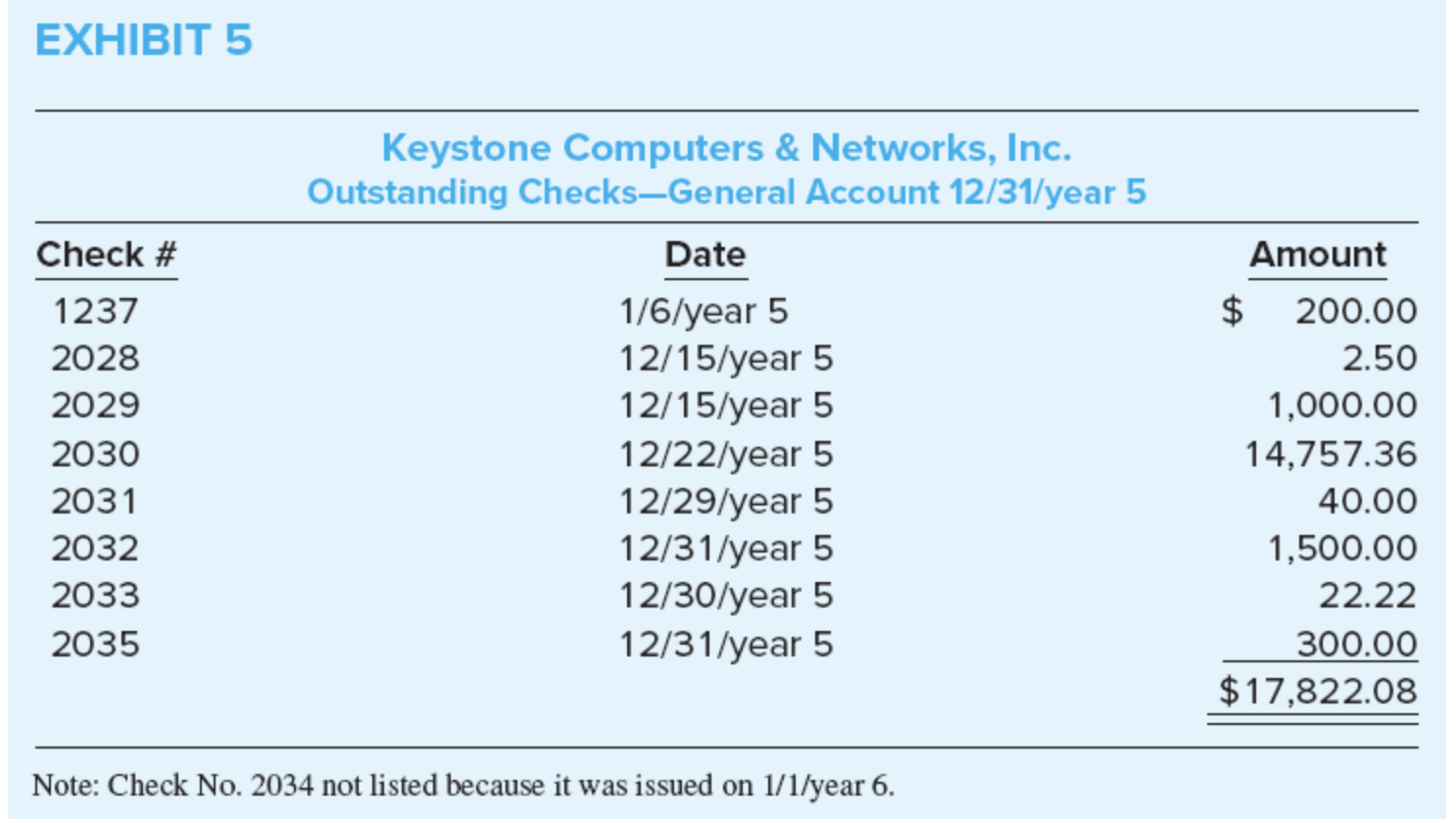

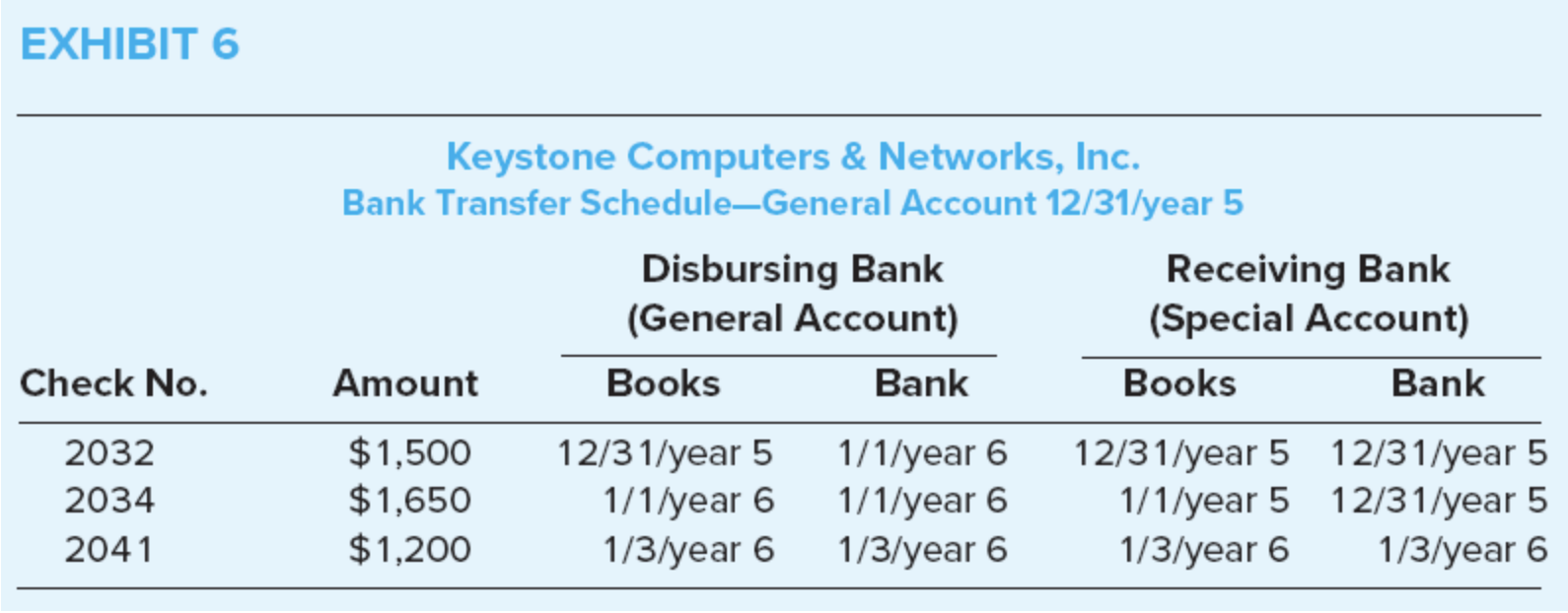

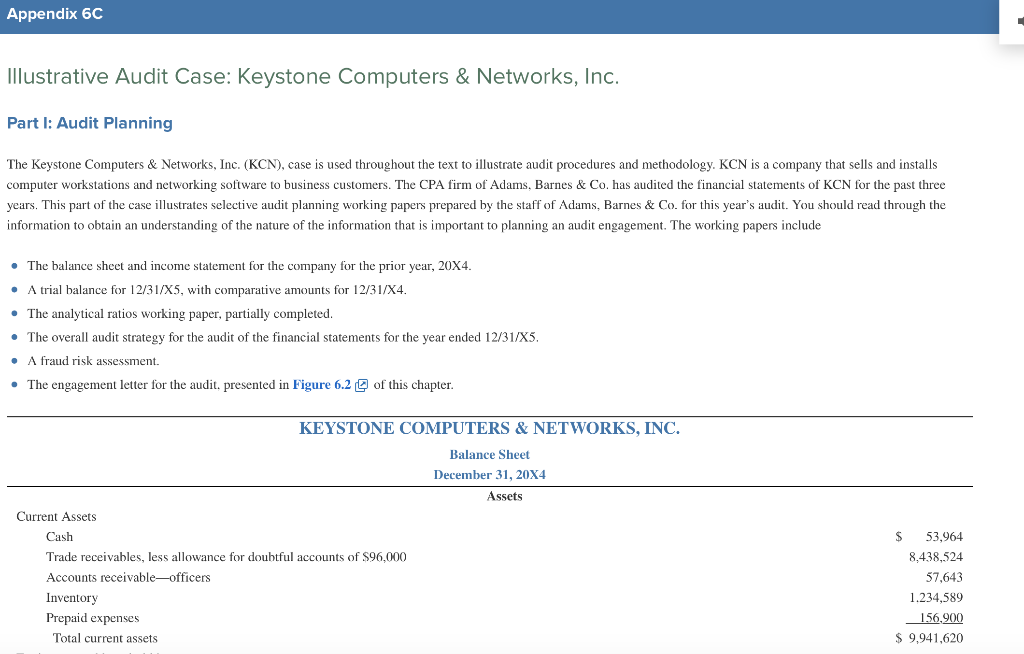

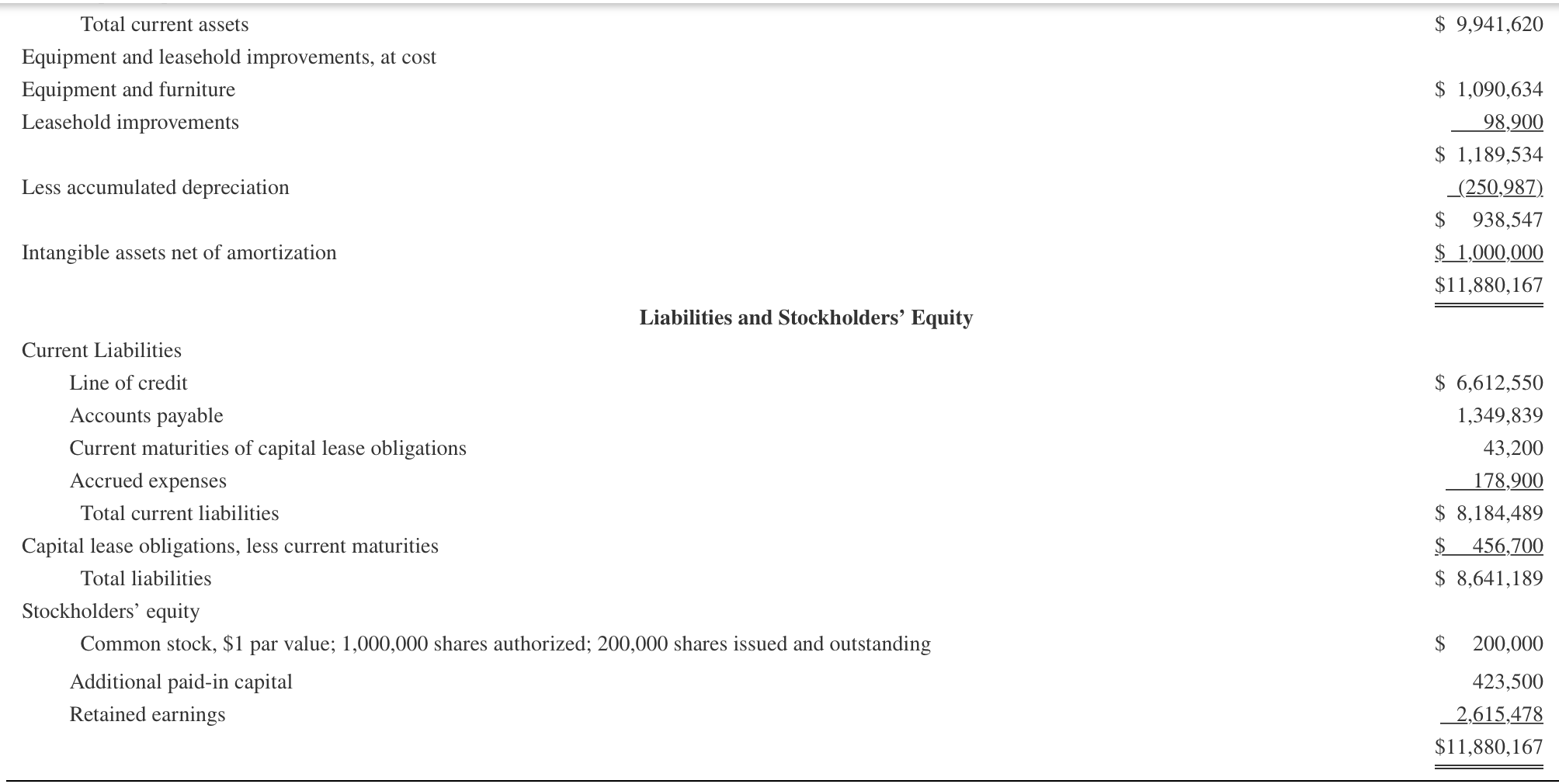

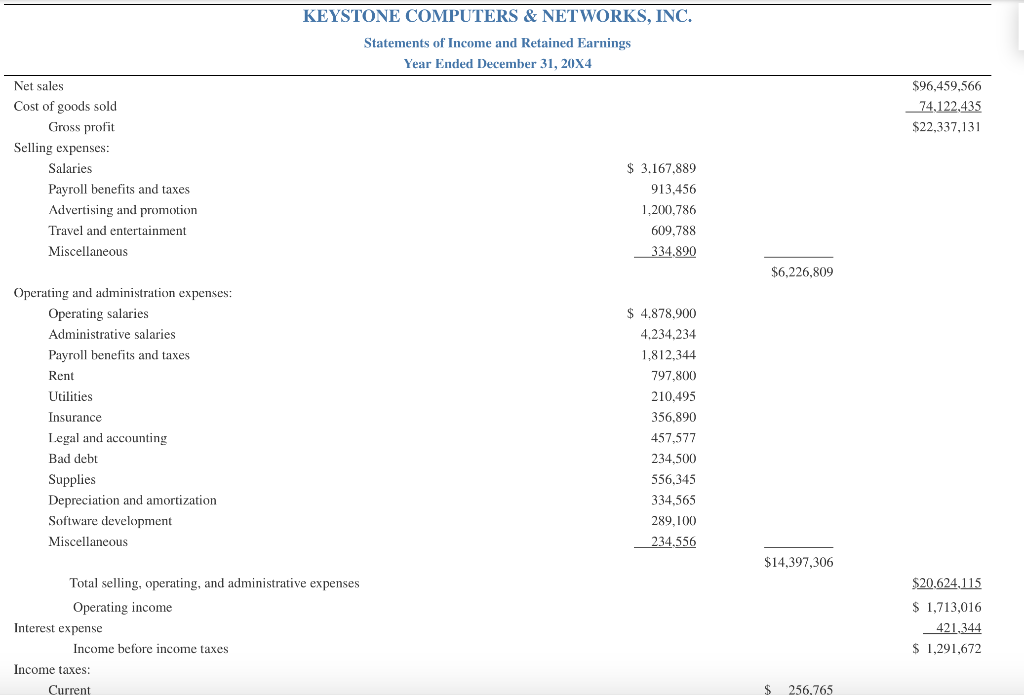

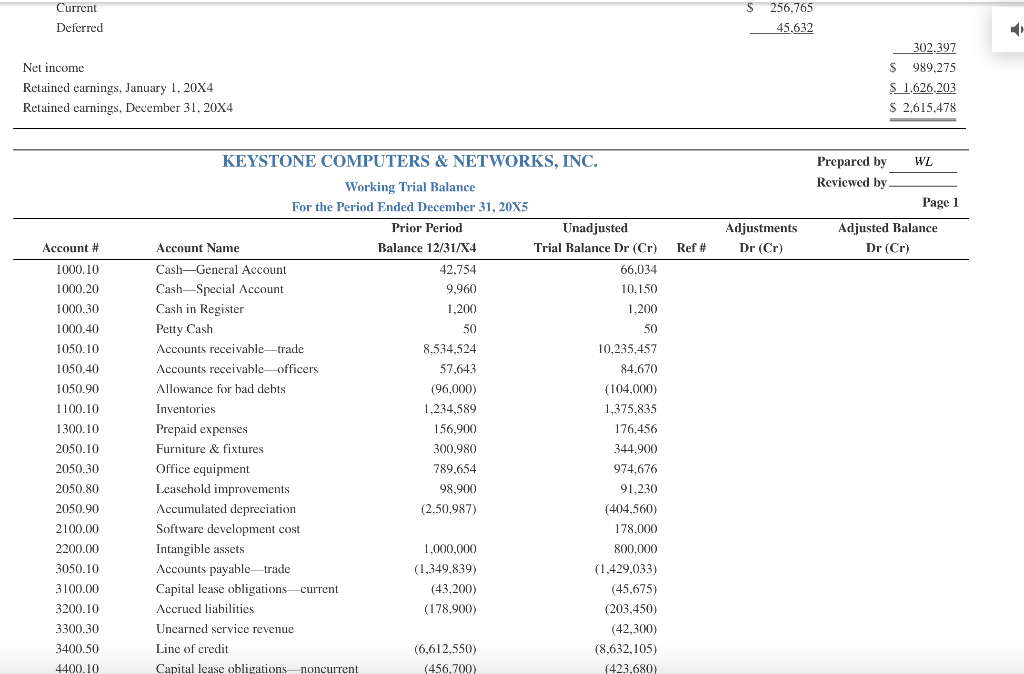

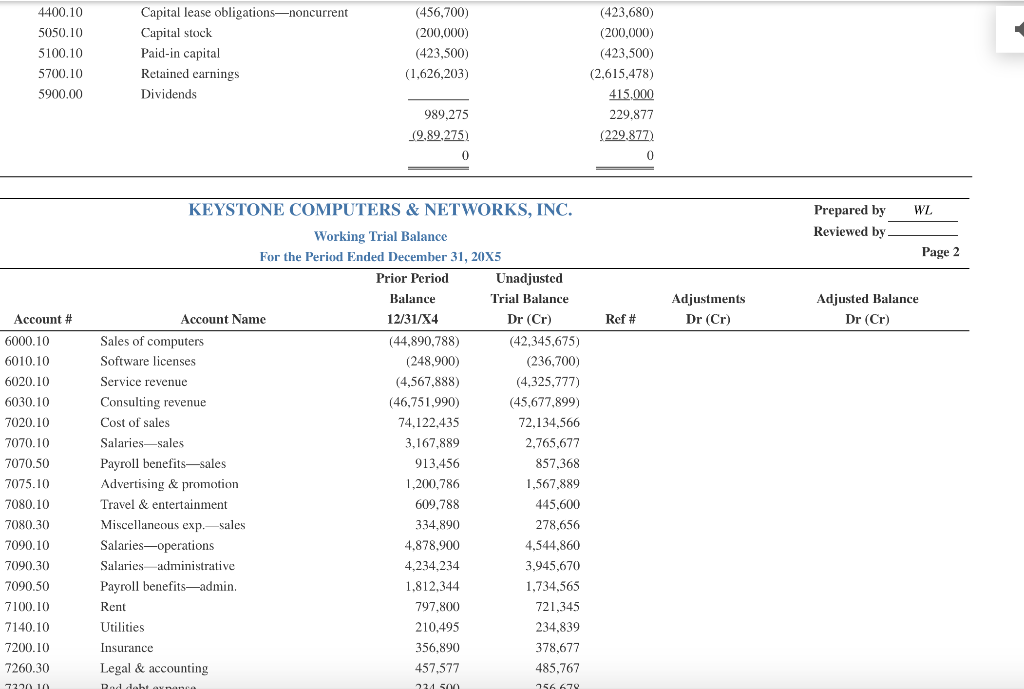

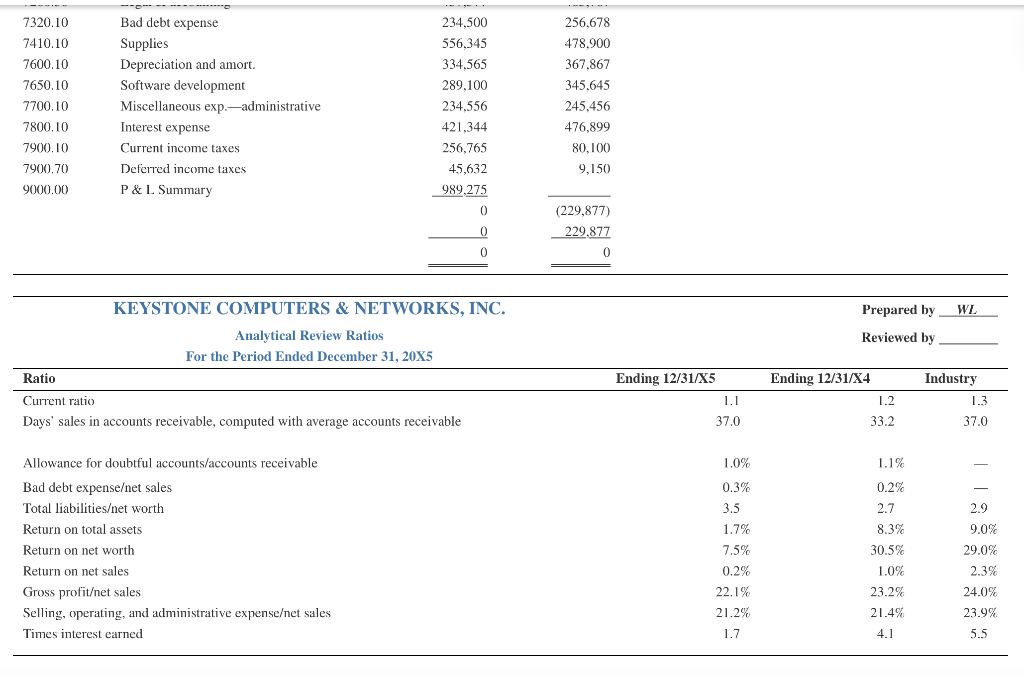

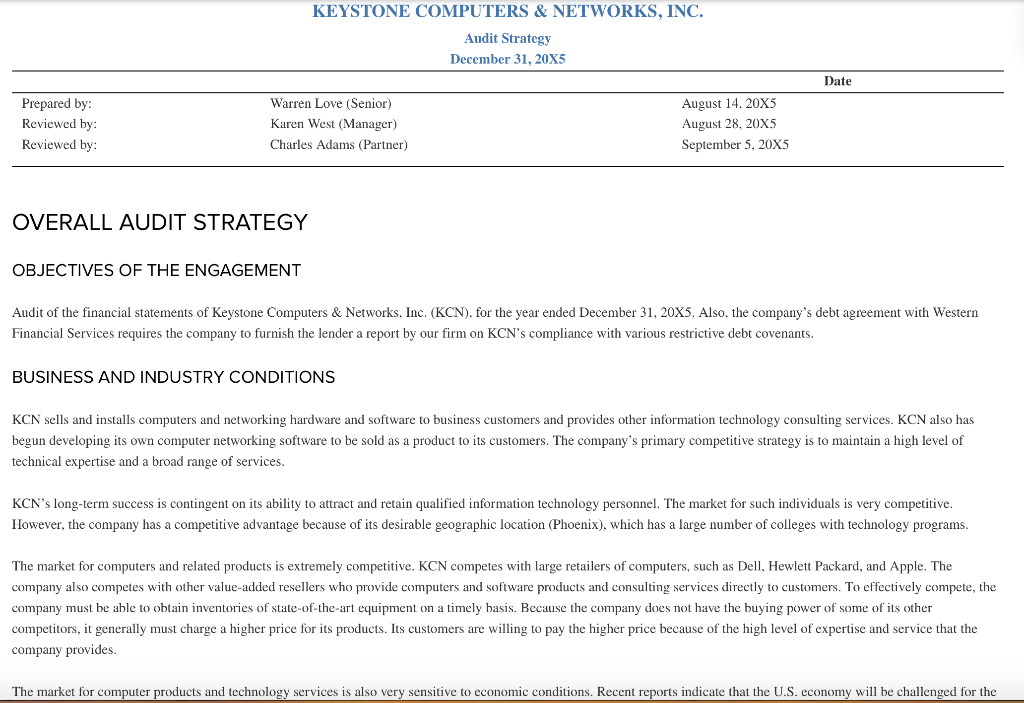

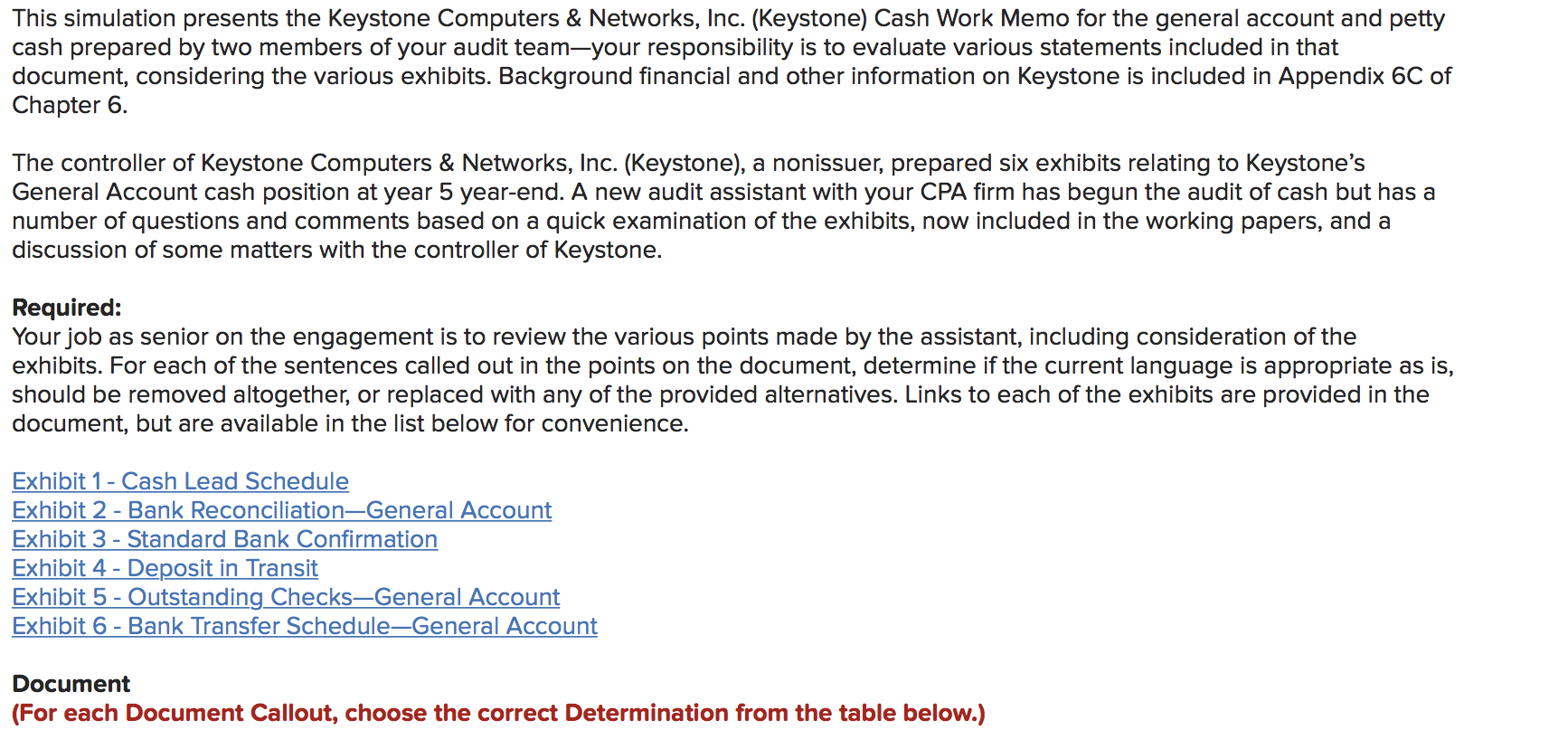

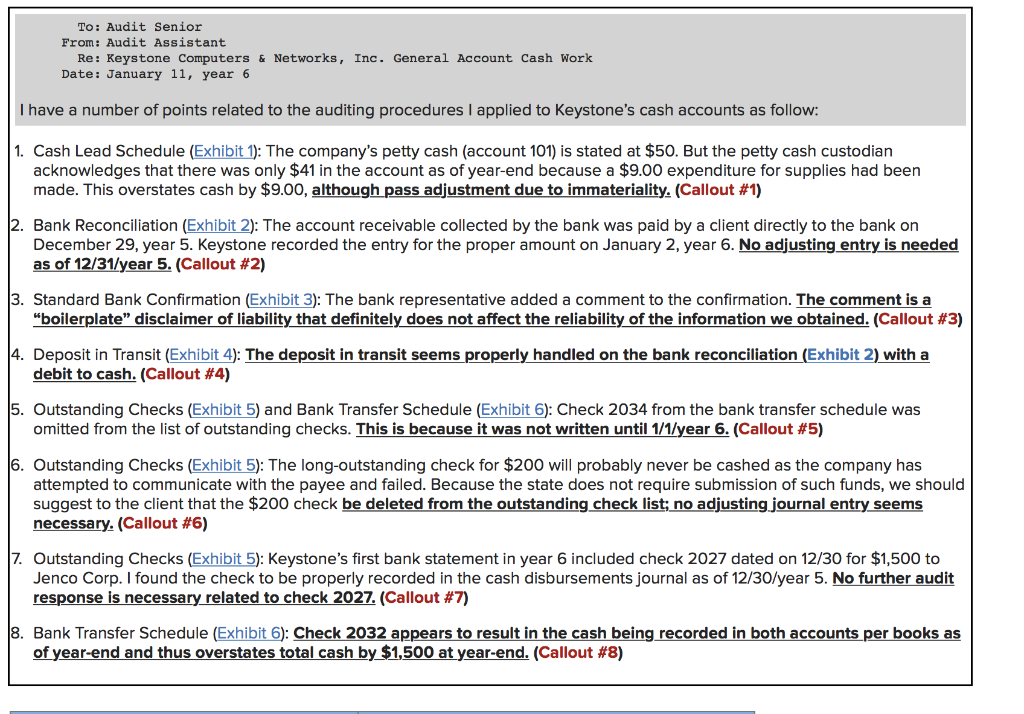

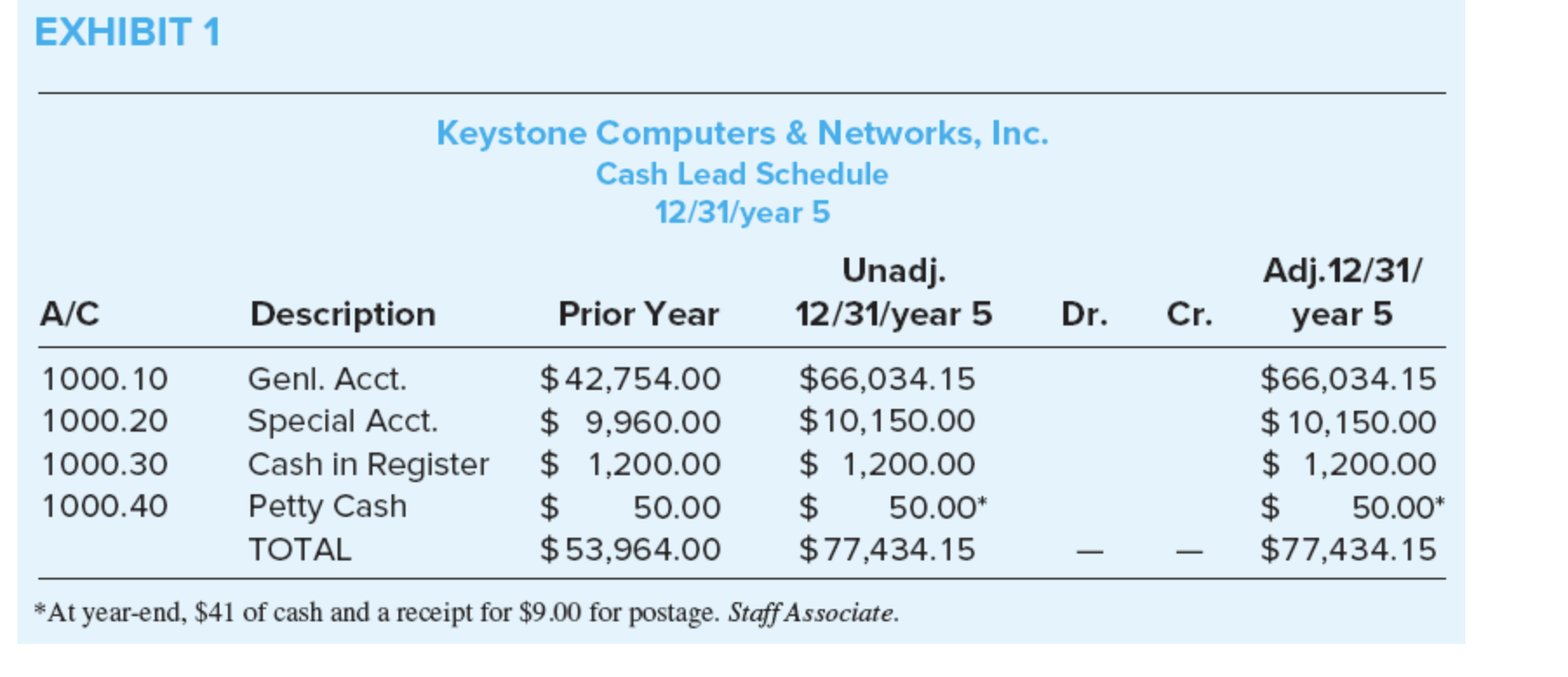

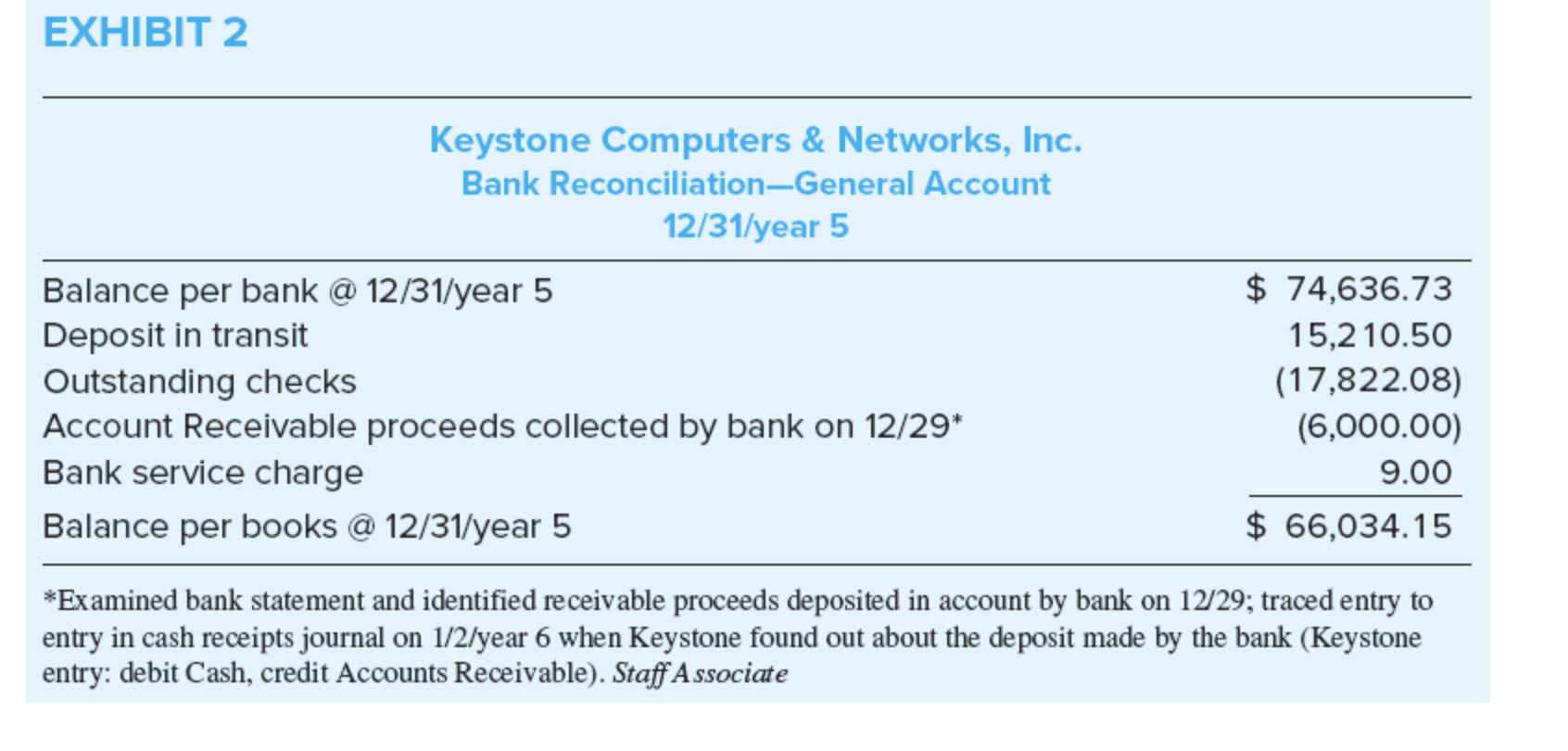

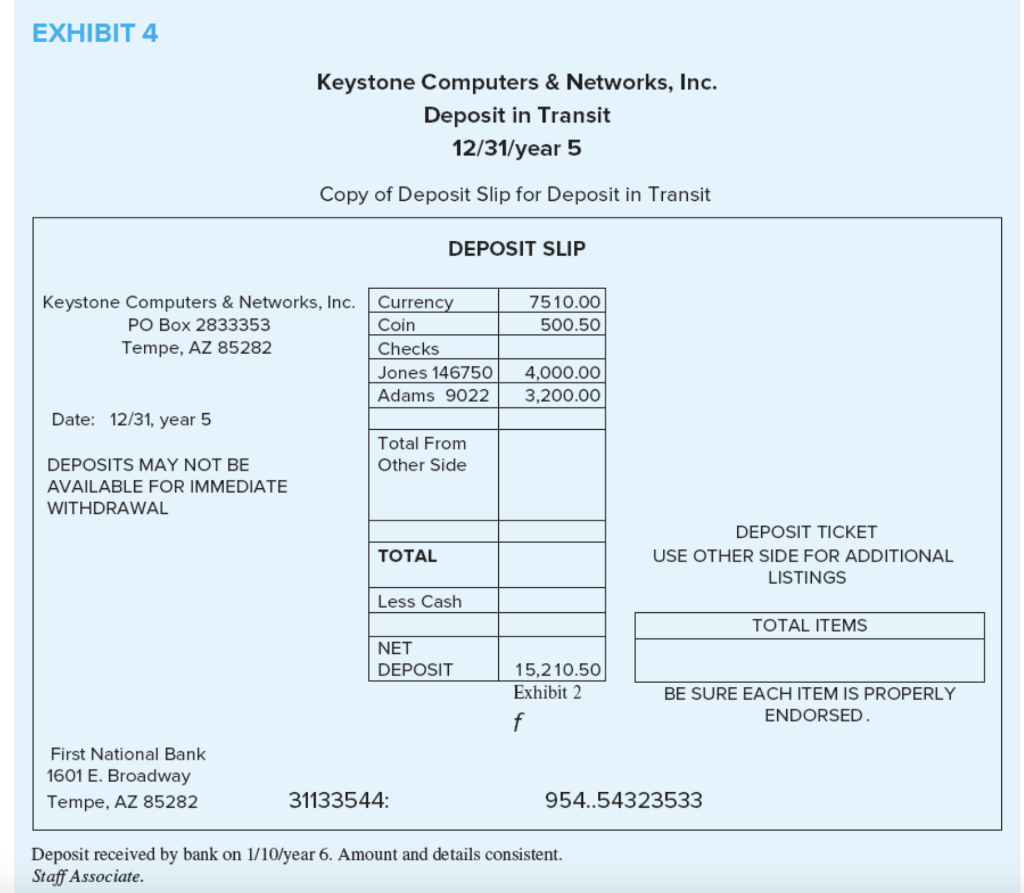

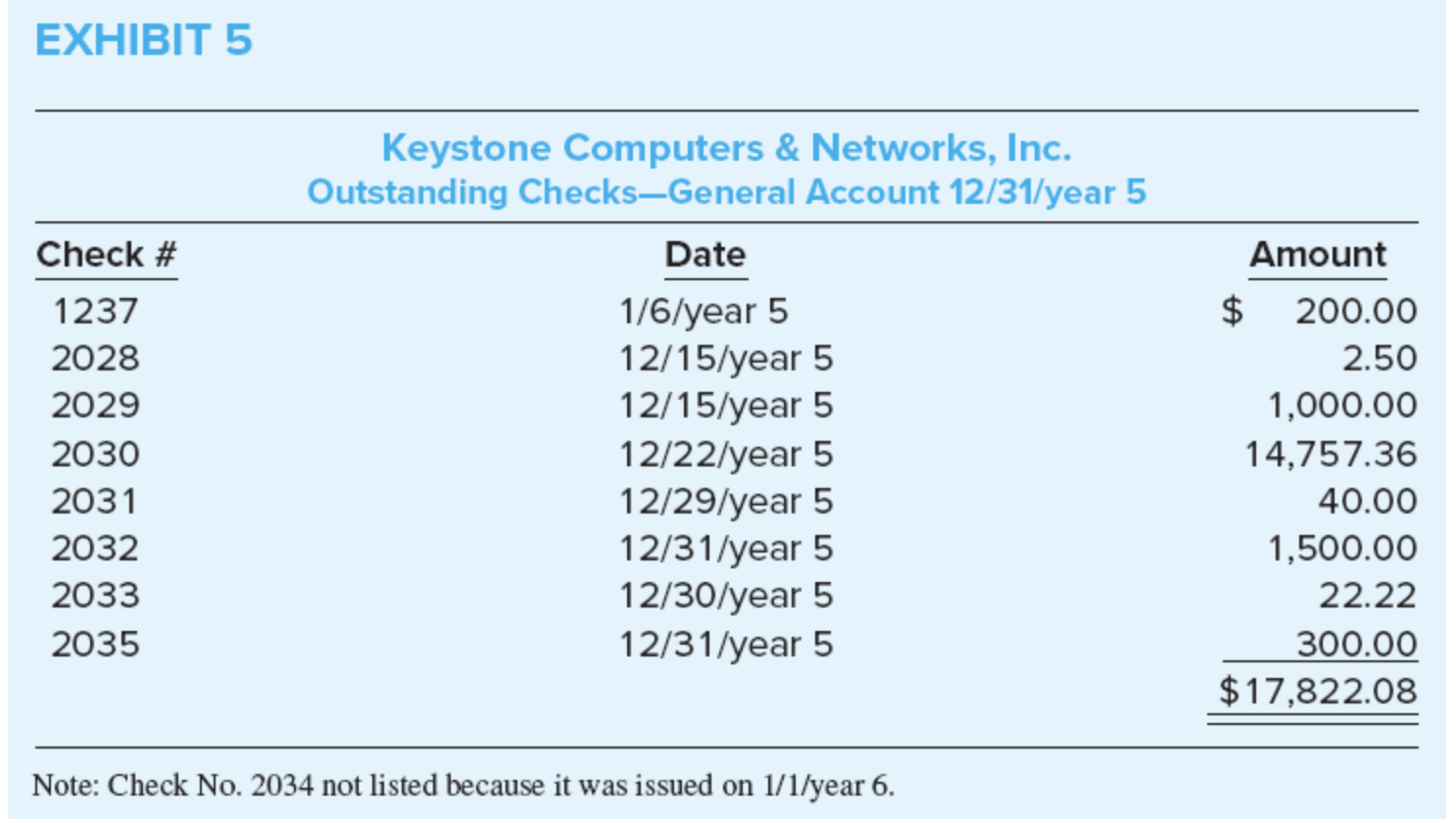

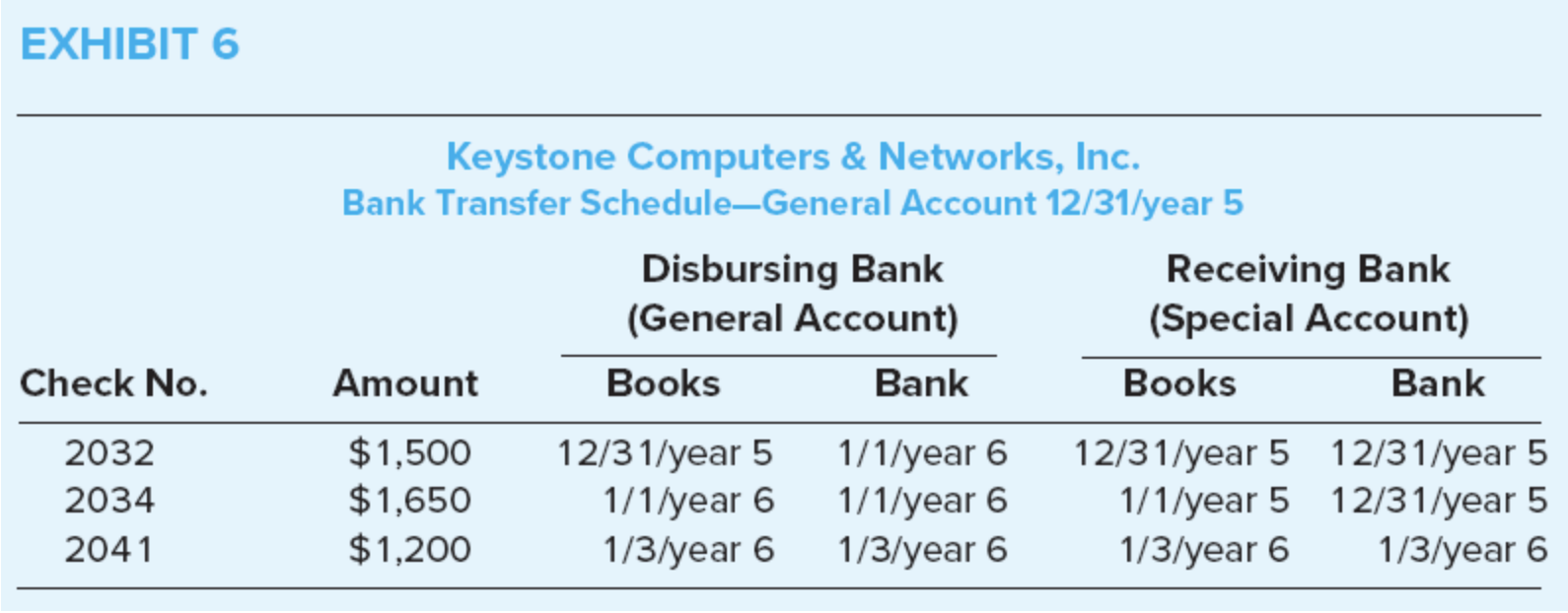

This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) 6. Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) EXHIBIT 1 Keystone Computers & Networks, Inc. Cash Lead Schedule 12/31/year 5 Adj. 12/31/ year 5 A/C Description Unadj. 12/31/year 5 Prior Year Dr. Cr. 1000.10 1000.20 1000.30 1000.40 Genl. Acct. Special Acct. Cash in Register Petty Cash TOTAL $ 42,754.00 $ 9,960.00 $ 1,200.00 $ 50.00 $53,964.00 $66,034.15 $10,150.00 $ 1,200.00 50.00* $ 77,434.15 $66,034.15 $ 10,150.00 $ 1,200.00 50.00* $77,434.15 - *At year-end, $41 of cash and a receipt for $9.00 for postage. Staff Associate. EXHIBIT 2 Keystone Computers & Networks, Inc. Bank Reconciliation-General Account 12/31/year 5 Balance per bank @ 12/31/year 5 Deposit in transit Outstanding checks Account Receivable proceeds collected by bank on 12/29* Bank service charge Balance per books @ 12/31/year 5 $ 74,636.73 15,2 10.50 (17,822.08) (6,000.00) 9.00 $ 66,034.15 *Examined bank statement and identified receivable proceeds deposited in account by bank on 12/29; traced entry to entry in cash receipts journal on 1/2/year 6 when Keystone found out about the deposit made by the bank (Keystone entry: debit Cash, credit Accounts Receivable). Staff Associate EXHIBIT 3 Keystone Computers & Networks, Inc. Standard Bank Confirmation 12/31/year 5 STANDARD FORM TO CONFIRM ACCOUNT BALANCE INFORMATION WITH FINANCIAL INSTITUTION ORIGINAL To be mailed to accountant 7 Financial Institution's Name and Address First National Bank 1601 E. Broadway Tempe, AZ 85282 Keystone Computers & Networks, Inc. CUSTOMER NAME We have provided to our accountants the following information as of the close of business on 12/31/ year5, regarding our deposit and loan balances. Please confirm the accuracy of the information, noting any exceptions to the information provided. If the balances have been left blank, please complete this form by furnishing the balance in the appropriate space below. Although we do not request nor expect you to conduct a comprehensive, detailed Search of your records, if during the process of completing this confirmation additional information about other deposit and loan accounts we may have with you comes to your attention, please Include such information below. Please use the enclosed envelope to return the form directly to our accountants L 1. At the close of business on the date listed above, our records indicated the following deposit balance(s): ACCOUNT NAME ACCOUNT NO. INTEREST RATE BALANCE GENERAL 4344-7834 -0- $74,636.73 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows: ACCOUNT NO DESCRIPTION BALANCE DATE THROUGH WHICH INTEREST IS PAID DATE DUE INTEREST RATE DESCRIPTION OF COLLATERAL Judith Hamilton 12/29/year (Customer's Authorized Signature) (Date) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive, detailed search of our records, no other deposit or loan accounts have come to our attention except as noted below. Will Jones 01/05/year (Financial Institution Authorized Signature) Date) Assistant Controller (Title) EXCEPTIONS AND/OR COMMENTS Information is not guaranteed to be accurate nor current and may be a matter of opinion. W.J. Please return this form directly to our accountants: T 7 Ordinarily, balances are intentionally left blank if they are not available at the time the form is prepared. Gill & Co, CPA's 2552 E. Camelback Road Phoenix, AZ 85002 L EXHIBIT 4 Keystone Computers & Networks, Inc. Deposit in Transit 12/31/year 5 Copy of Deposit Slip for Deposit in Transit DEPOSIT SLIP Keystone Computers & Networks, Inc. PO Box 2833353 Tempe, AZ 85282 75 10.00 500.50 Currency Coin Checks Jones 146750 Adams 9022 4,000.00 3,200.00 Date: 12/31, year 5 Total From Other Side DEPOSITS MAY NOT BE AVAILABLE FOR IMMEDIATE WITHDRAWAL TOTAL DEPOSIT TICKET USE OTHER SIDE FOR ADDITIONAL LISTINGS Less Cash TOTAL ITEMS NET DEPOSIT 15,2 10.50 Exhibit 2 f BE SURE EACH ITEM IS PROPERLY ENDORSED. First National Bank 1601 E. Broadway Tempe, AZ 85282 31133544: 954..54323533 Deposit received by bank on 1/10/year 6. Amount and details consistent. Staff Associate. EXHIBIT 5 Check # 1237 2028 2029 2030 2031 2032 2033 2035 Keystone Computers & Networks, Inc. Outstanding Checks-General Account 12/31/year 5 Date 1/6/year 5 12/15/year 5 12/15/year 5 12/22/year 5 12/29/year 5 12/31/year 5 12/30/year 5 12/31/year 5 Amount 200.00 2.50 1,000.00 14,757.36 40.00 1,500.00 22.22 300.00 $17,822.08 Note: Check No. 2034 not listed because it was issued on 1/1/year 6. EXHIBIT 6 Keystone Computers & Networks, Inc. Bank Transfer ScheduleGeneral Account 12/31/year 5 Disbursing Bank Receiving Bank (General Account) (Special Account) Amount Books Bank Books Bank $1,500 12/31/year 5 1/1/year 6 12/31/year 5 12/31/year 5 $1,650 1/1/year 6 1/1/year 6 1/1/year 5 12/31/year 5 $1,200 1/3/year 6 1/3/year 6 1/3/year 6 1/3/year 6 Check No. 2032 2034 2041 Callouts Determination 1. "...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6. "...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." Appendix 6C Illustrative Audit Case: Keystone Computers & Networks, Inc. Part I: Audit Planning The Keystone Computers & Networks, Inc. (KCN), case is used throughout the text to illustrate audit procedures and methodology. KCN is a company that sells and installs computer workstations and networking software to business customers. The CPA firm of Adams, Barnes & Co. has audited the financial statements of KCN for the past three years. This part of the case illustrates selective audit planning working papers prepared by the staff of Adams, Barnes & Co. for this year's audit. You should read through the information to obtain an understanding of the nature of the information that is important to planning an audit engagement. The working papers include The balance sheet and income statement for the company for the prior year, 20X4. A trial balance for 12/31/X5, with comparative amounts for 12/31/X4. The analytical ratios working paper, partially completed. The overall audit strategy for the audit of the financial statements for the year ended 12/31/X5. A fraud risk assessment. The engagement letter for the audit. presented in Figure 6.2 m of this chapter. KEYSTONE COMPUTERS & NETWORKS, INC. Balance Sheet December 31, 20X4 Assets Current Assets Cash Trade receivables, less allowance for doubtful accounts of $96,000 Accounts receivable-officers Inventory Prepaid expenses Total current assets $ 53,964 8,438,524 57,643 1.234,589 156.900 $ 9,941,620 Total current assets $ 9,941,620 Equipment and leasehold improvements, at cost Equipment and furniture Leasehold improvements Less accumulated depreciation $ 1,090,634 98,900 $ 1,189,534 _(250,987). $ 938,547 $ 1,000,000 $11,880,167 Intangible assets net of amortization Liabilities and Stockholders' Equity Current Liabilities Line of credit Accounts payable Current maturities of capital lease obligations Accrued expenses Total current liabilities Capital lease obligations, less current maturities Total liabilities Stockholders' equity Common stock, $1 par value; 1,000,000 shares authorized; 200,000 shares issued and outstanding Additional paid-in capital Retained earnings $ 6,612,550 1,349,839 43,200 178,900 $ 8,184,489 $ 456,700 $ 8,641,189 $ 200,000 423,500 2,615,478 $11,880,167 KEYSTONE COMPUTERS & NETWORKS, INC. Statements of Income and Retained Earnings Year Ended December 31, 20X4 $96,459,566 74.122,435 $22,337,131 Net sales Cost of goods sold Gross profit Selling expenses: Salaries Payroll benefits and taxes Advertising and promotion Travel and entertainment Miscellaneous $ 3.167,889 913,456 1,200,786 609,788 334.890 $6,226,809 Operating and administration expenses: Operating salaries Administrative salaries Payroll benefits and taxes Rent Utilities Insurance Legal and accounting Bad debt Supplies Depreciation and amortization Software development Miscellaneous $ 4.878.900 4.234.234 1,812,344 797,800 210,495 356.890 457,577 234,500 556.345 334,565 289,100 234.556 $14,397,306 Total selling, operating, and administrative expenses Operating income Interest expense Income before income taxes Income taxes: Current $20.624,115 $ 1,713,016 421,344 $ 1,291,672 $ 256.765 Current Deferred $ 256,765 45,632 Net income Retained earnings, January 1, 20X4 Retained earnings, December 31, 20X4 302.397 $ 989,275 $ 1.626.203 S 2.615,478 Prepared by WL Reviewed by Page 1 Adjusted Balance Dr (Cr) Adjustments Account # Ref # Dr (Cr) 1000.10 1000.20 1000.30 1000.40 1050.10 1050.40 1050.90 1100.10 1300.10 2050.10 2050.30 2050.80 2050.90 2100.00 2200.00 3050.10 3100.00 3200.10 3300.30 3400.50 KEYSTONE COMPUTERS & NETWORKS, INC. Working Trial Balance For the Period Ended December 31, 20X5 Prior Period Unadjusted Account Name Balance 12/31/X4 Trial Balance Dr (Cr) Cash-General Account 42.754 66,034 Cash-Special Account 9,960 10,150 Cash in Register 1,200 1.200 Petty Cash 50 50 Accounts receivable-trade 8,534,524 10,235,457 Accounts receivable officers 57,643 84.670 Allowance for bad debts (96,000) (104,000) Inventories 1,234,589 1,375,835 Prepaid expenses 156,900 176,456 Furniture & fixtures 300.980 344.900 Office equipment 974,676 Leasehold improvements 98.900 91.230 Accumulated depreciation (2,50.987) (404,560) Software development cost 178,000 Intangible assets 1,000,000 800.000 Accounts payable-trade (1,349,839) (1,429,033) Capital lease obligations current (43,200) (45,675) Accrued liabilities (178.900) (203,450) Unearned service revenue (42,300) Line of credit (6,612,550) (8,632,105) Capital lease obligations noncurrent (456.700) (423,680) 789,654 4400.10 4400.10 5050.10 5100.10 5700.10 5900.00 Capital lease obligations-noncurrent Capital stock Paid-in capital Retained earnings Dividends (456,700) (200,000) (423,500) (1,626,203) (423,680) (200,000) (423,500) (2,615,478) 415.000 229.877 (229,877) 0 989,275 (9.89.275) 0 WL Prepared by Reviewed by Page 2 Adjustments Dr (Cr) Adjusted Balance Dr (Cr) Ref # Account # 6000.10 6010.10 6020.10 6030.10 7020.10 7070.10 7070.50 7075.10 7080.10 7080.30 7090.10 7090.30 7090.50 7100.10 7140.10 7200.10 7260.30 7220 10 KEYSTONE COMPUTERS & NETWORKS, INC. Working Trial Balance For the Period Ended December 31, 20X5 Prior Period Unadjusted Balance Trial Balance Account Name 12/31/X4 Dr (Cr) Sales of computers (44,890,788) (42,345,675) Software licenses (248,900) (236,700) Service revenue (4,567,888) (4,325,777) Consulting revenue (46,751,990) (45,677,899) Cost of sales 74.122.435 72,134.566 Salaries-sales 3,167,889 2,765,677 Payroll benefits-sales 913.456 857,368 Advertising & promotion 1,200,786 1,567,889 Travel & entertainment 609.788 445,600 Miscellaneous exp. sales 334,890 278,656 Salaries-operations 4,878,900 4,544.860 Salaries administrative 4,234.234 3,945,670 Payroll benefits-admin. 1,812,344 1,734,565 Rent 797,800 721,345 Utilities 210,495 234.839 Insurance 356.890 378,677 Legal & accounting 457,577 485,767 pod doht oynance 224 500 756 678 7320.10 7410.10 7600.10 7650.10 7700.10 Bad debt expense Supplies Depreciation and amort. Software development Miscellaneous exp.-administrative Interest expense Current income taxes Deferred income taxes P & L Summary 234,500 556,345 334,565 289.100 234.556 421,344 256,765 45,632 989,275 256,678 478.900 367,867 345.645 245.456 476.899 80,100 9,150 7800.10 7900,10 7900.70 9000.00 0 0 0 (229,877) 229.877 0 WL Prepared by Reviewed by KEYSTONE COMPUTERS & NETWORKS, INC. Analytical Review Ratios For the Period Ended December 31, 20X5 Ratio Current ratio Days' sales in accounts receivable, computed with average accounts receivable Ending 12/31/X4 Industry Ending 12/31/X5 1.1 37.0 1.2 1.3 33.2 37.0 1.0% 1.1% Allowance for doubtful accounts/accounts receivable Bad debt expenseet sales Total liabilitieset worth Return on total assets Return on net worth Return on net sales Gross profitet sales Selling, operating, and administrative expenseet sales Times interest earned 0.3% 3.5 1.7% 7.5% 0.2% 22.1% 21.2% 1.7 0.2% 2.7 8.3% 30.5% 1.0% 23.2% 21.4% 4.1 2.9 9.0% 29.0% 2.3% 24.0% 23.9% 5.5 KEYSTONE COMPUTERS & NETWORKS, INC. Audit Strategy December 31, 20X5 Date Prepared by: Reviewed by: Reviewed by: Warren Love (Senior) Karen West (Manager) Charles Adams (Partner) August 14. 20X5 August 28, 20X5 September 5, 20X5 OVERALL AUDIT STRATEGY OBJECTIVES OF THE ENGAGEMENT Audit of the financial statements of Keystone Computers & Networks, Inc. (KCN), for the year ended December 31, 20X5. Also, the company's debt agreement with Western Financial Services requires the company to furnish the lender a report by our firm on KCN's compliance with various restrictive debt covenants. BUSINESS AND INDUSTRY CONDITIONS KCN sells and installs computers and networking hardware and software to business customers and provides other information technology consulting services. KCN also has begun developing its own computer networking software to be sold as a product to its customers. The company's primary competitive strategy is to maintain a high level of technical expertise and a broad range of services. KCN's long-term success is contingent on its ability to attract and retain qualified information technology personnel. The market for such individuals is very competitive. However, the company has a competitive advantage because of its desirable geographic location (Phoenix), which has a large number of colleges with technology programs. The market for computers and related products is extremely competitive. KCN competes with large retailers of computers, such as Dell, Hewlett Packard, and Apple. The company also competes with other value-added resellers who provide computers and software products and consulting services directly to customers. To effectively compete, the company must be able to obtain inventories of state-of-the-art equipment on a timely basis. Because the company does not have the buying power of some of its other competitors, it generally must charge a higher price for its products. Its customers are willing to pay the higher price because of the high level of expertise and service that the company provides The market for computer products and technology services is also very sensitive to economic conditions. Recent reports indicate that the U.S. economy will be challenged for the This simulation presents the Keystone Computers & Networks, Inc. (Keystone) Cash Work Memo for the general account and petty cash prepared by two members of your audit team-your responsibility is to evaluate various statements included in that document, considering the various exhibits. Background financial and other information on Keystone is included in Appendix 6C of Chapter 6. The controller of Keystone Computers & Networks, Inc. (Keystone), a nonissuer, prepared six exhibits relating to Keystone's General Account cash position at year 5 year-end. A new audit assistant with your CPA firm has begun the audit of cash but has a number of questions and comments based on a quick examination of the exhibits, now included in the working papers, and a discussion of some matters with the controller of Keystone. Required: Your job as senior on the engagement is to review the various points made by the assistant, including consideration of the exhibits. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Links to each of the exhibits are provided in the document, but are available in the list below for convenience. Exhibit 1 - Cash Lead Schedule Exhibit 2 - Bank Reconciliation General Account Exhibit 3 - Standard Bank Confirmation Exhibit 4 - Deposit in Transit Exhibit 5 - Outstanding Checks-General Account Exhibit 6 - Bank Transfer Schedule-General Account Document (For each Document Callout, choose the correct Determination from the table below.) To: Audit Senior From: Audit Assistant Re: Keystone Computers & Networks, Inc. General Account Cash Work Date: January 11, year 6 I have a number of points related to the auditing procedures I applied to Keystone's cash accounts as follow: 1. Cash Lead Schedule (Exhibit 1): The company's petty cash (account 101) is stated at $50. But the petty cash custodian acknowledges that there was only $41 in the account as of year-end because a $9.00 expenditure for supplies had been made. This overstates cash by $9.00, although pass adjustment due to immateriality. (Callout #1) 2. Bank Reconciliation (Exhibit 2): The account receivable collected by the bank was paid by a client directly to the bank on December 29, year 5. Keystone recorded the entry for the proper amount on January 2, year 6. No adjusting entry is needed as of 12/31/year 5. (Callout #2) 3. Standard Bank Confirmation (Exhibit 3): The bank representative added a comment to the confirmation. The comment is a "boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained. (Callout #3) 4. Deposit in Transit (Exhibit 4): The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash. (Callout #4) 5. Outstanding Checks (Exhibit 5) and Bank Transfer Schedule (Exhibit 6): Check 2034 from the bank transfer schedule was omitted from the list of outstanding checks. This is because it was not written until 1/1/year 6. (Callout #5) 6. Outstanding Checks (Exhibit 5): The long-outstanding check for $200 will probably never be cashed as the company has attempted to communicate with the payee and failed. Because the state does not require submission of such funds, we should suggest to the client that the $200 check be deleted from the outstanding check list; no adjusting journal entry seems necessary. (Callout #6) 7. Outstanding Checks (Exhibit 5): Keystone's first bank statement in year 6 included check 2027 dated on 12/30 for $1,500 to Jenco Corp. I found the check to be properly recorded in the cash disbursements journal as of 12/30/year 5. No further audit response is necessary related to check 2027. (Callout #7) 8. Bank Transfer Schedule (Exhibit 6): Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end. (Callout #8) EXHIBIT 1 Keystone Computers & Networks, Inc. Cash Lead Schedule 12/31/year 5 Adj. 12/31/ year 5 A/C Description Unadj. 12/31/year 5 Prior Year Dr. Cr. 1000.10 1000.20 1000.30 1000.40 Genl. Acct. Special Acct. Cash in Register Petty Cash TOTAL $ 42,754.00 $ 9,960.00 $ 1,200.00 $ 50.00 $53,964.00 $66,034.15 $10,150.00 $ 1,200.00 50.00* $ 77,434.15 $66,034.15 $ 10,150.00 $ 1,200.00 50.00* $77,434.15 - *At year-end, $41 of cash and a receipt for $9.00 for postage. Staff Associate. EXHIBIT 2 Keystone Computers & Networks, Inc. Bank Reconciliation-General Account 12/31/year 5 Balance per bank @ 12/31/year 5 Deposit in transit Outstanding checks Account Receivable proceeds collected by bank on 12/29* Bank service charge Balance per books @ 12/31/year 5 $ 74,636.73 15,2 10.50 (17,822.08) (6,000.00) 9.00 $ 66,034.15 *Examined bank statement and identified receivable proceeds deposited in account by bank on 12/29; traced entry to entry in cash receipts journal on 1/2/year 6 when Keystone found out about the deposit made by the bank (Keystone entry: debit Cash, credit Accounts Receivable). Staff Associate EXHIBIT 3 Keystone Computers & Networks, Inc. Standard Bank Confirmation 12/31/year 5 STANDARD FORM TO CONFIRM ACCOUNT BALANCE INFORMATION WITH FINANCIAL INSTITUTION ORIGINAL To be mailed to accountant 7 Financial Institution's Name and Address First National Bank 1601 E. Broadway Tempe, AZ 85282 Keystone Computers & Networks, Inc. CUSTOMER NAME We have provided to our accountants the following information as of the close of business on 12/31/ year5, regarding our deposit and loan balances. Please confirm the accuracy of the information, noting any exceptions to the information provided. If the balances have been left blank, please complete this form by furnishing the balance in the appropriate space below. Although we do not request nor expect you to conduct a comprehensive, detailed Search of your records, if during the process of completing this confirmation additional information about other deposit and loan accounts we may have with you comes to your attention, please Include such information below. Please use the enclosed envelope to return the form directly to our accountants L 1. At the close of business on the date listed above, our records indicated the following deposit balance(s): ACCOUNT NAME ACCOUNT NO. INTEREST RATE BALANCE GENERAL 4344-7834 -0- $74,636.73 2. We were directly liable to the financial institution for loans at the close of business on the date listed above as follows: ACCOUNT NO DESCRIPTION BALANCE DATE THROUGH WHICH INTEREST IS PAID DATE DUE INTEREST RATE DESCRIPTION OF COLLATERAL Judith Hamilton 12/29/year (Customer's Authorized Signature) (Date) The information presented above by the customer is in agreement with our records. Although we have not conducted a comprehensive, detailed search of our records, no other deposit or loan accounts have come to our attention except as noted below. Will Jones 01/05/year (Financial Institution Authorized Signature) Date) Assistant Controller (Title) EXCEPTIONS AND/OR COMMENTS Information is not guaranteed to be accurate nor current and may be a matter of opinion. W.J. Please return this form directly to our accountants: T 7 Ordinarily, balances are intentionally left blank if they are not available at the time the form is prepared. Gill & Co, CPA's 2552 E. Camelback Road Phoenix, AZ 85002 L EXHIBIT 4 Keystone Computers & Networks, Inc. Deposit in Transit 12/31/year 5 Copy of Deposit Slip for Deposit in Transit DEPOSIT SLIP Keystone Computers & Networks, Inc. PO Box 2833353 Tempe, AZ 85282 75 10.00 500.50 Currency Coin Checks Jones 146750 Adams 9022 4,000.00 3,200.00 Date: 12/31, year 5 Total From Other Side DEPOSITS MAY NOT BE AVAILABLE FOR IMMEDIATE WITHDRAWAL TOTAL DEPOSIT TICKET USE OTHER SIDE FOR ADDITIONAL LISTINGS Less Cash TOTAL ITEMS NET DEPOSIT 15,2 10.50 Exhibit 2 f BE SURE EACH ITEM IS PROPERLY ENDORSED. First National Bank 1601 E. Broadway Tempe, AZ 85282 31133544: 954..54323533 Deposit received by bank on 1/10/year 6. Amount and details consistent. Staff Associate. EXHIBIT 5 Check # 1237 2028 2029 2030 2031 2032 2033 2035 Keystone Computers & Networks, Inc. Outstanding Checks-General Account 12/31/year 5 Date 1/6/year 5 12/15/year 5 12/15/year 5 12/22/year 5 12/29/year 5 12/31/year 5 12/30/year 5 12/31/year 5 Amount 200.00 2.50 1,000.00 14,757.36 40.00 1,500.00 22.22 300.00 $17,822.08 Note: Check No. 2034 not listed because it was issued on 1/1/year 6. EXHIBIT 6 Keystone Computers & Networks, Inc. Bank Transfer ScheduleGeneral Account 12/31/year 5 Disbursing Bank Receiving Bank (General Account) (Special Account) Amount Books Bank Books Bank $1,500 12/31/year 5 1/1/year 6 12/31/year 5 12/31/year 5 $1,650 1/1/year 6 1/1/year 6 1/1/year 5 12/31/year 5 $1,200 1/3/year 6 1/3/year 6 1/3/year 6 1/3/year 6 Check No. 2032 2034 2041 Callouts Determination 1. "...although pass adjustment due to immateriality." 2. "No adjusting entry is needed as of 12/31/year 5." 3. "The comment is a boilerplate" disclaimer of liability that definitely does not affect the reliability of the information we obtained." 4. "The deposit in transit seems properly handled on the bank reconciliation (Exhibit 2) with a debit to cash." 5. "This is because it was not written until 1/1/year 6." 6. "...be deleted from the outstanding check list; no adjusting journal entry seems necessary." 7. "No further audit response is necessary related to check 2027." 8. "Check 2032 appears to result in the cash being recorded in both accounts per books as of year-end and thus overstates total cash by $1,500 at year-end." Appendix 6C Illustrative Audit Case: Keystone Computers & Networks, Inc. Part I: Audit Planning The Keystone Computers & Networks, Inc. (KCN), case is used throughout the text to illustrate audit procedures and methodology. KCN is a company that sells and installs computer workstations and networking software to business customers. The CPA firm of Adams, Barnes & Co. has audited the financial statements of KCN for the past three years. This part of the case illustrates selective audit planning working papers prepared by the staff of Adams, Barnes & Co. for this year's audit. You should read through the information to obtain an understanding of the nature of the information that is important to planning an audit engagement. The working papers include The balance sheet and income statement for the company for the prior year, 20X4. A trial balance for 12/31/X5, with comparative amounts for 12/31/X4. The analytical ratios working paper, partially completed. The overall audit strategy for the audit of the financial statements for the year ended 12/31/X5. A fraud risk assessment. The engagement letter for the audit. presented in Figure 6.2 m of this chapter. KEYSTONE COMPUTERS & NETWORKS, INC. Balance Sheet December 31, 20X4 Assets Current Assets Cash Trade receivables, less allowance for doubtful accounts of $96,000 Accounts receivable-officers Inventory Prepaid expenses Total current assets $ 53,964 8,438,524 57,643 1.234,589 156.900 $ 9,941,620 Total current assets $ 9,941,620 Equipment and leasehold improvements, at cost Equipment and furniture Leasehold improvements Less accumulated depreciation $ 1,090,634 98,900 $ 1,189,534 _(250,987). $ 938,547 $ 1,000,000 $11,880,167 Intangible assets net of amortization Liabilities and Stockholders' Equity Current Liabilities Line of credit Accounts payable Current maturities of capital lease obligations Accrued expenses Total current liabilities Capital lease obligations, less current maturities Total liabilities Stockholders' equity Common stock, $1 par value; 1,000,000 shares authorized; 200,000 shares issued and outstanding Additional paid-in capital Retained earnings $ 6,612,550 1,349,839 43,200 178,900 $ 8,184,489 $ 456,700 $ 8,641,189 $ 200,000 423,500 2,615,478 $11,880,167 KEYSTONE COMPUTERS & NETWORKS, INC. Statements of Income and Retained Earnings Year Ended December 31, 20X4 $96,459,566 74.122,435 $22,337,131 Net sales Cost of goods sold Gross profit Selling expenses: Salaries Payroll benefits and taxes Advertising and promotion Travel and entertainment Miscellaneous $ 3.167,889 913,456 1,200,786 609,788 334.890 $6,226,809 Operating and administration expenses: Operating salaries Administrative salaries Payroll benefits and taxes Rent Utilities Insurance Legal and accounting Bad debt Supplies Depreciation and amortization Software development Miscellaneous $ 4.878.900 4.234.234 1,812,344 797,800 210,495 356.890 457,577 234,500 556.345 334,565 289,100 234.556 $14,397,306 Total selling, operating, and administrative expenses Operating income Interest expense Income before income taxes Income taxes: Current $20.624,115 $ 1,713,016 421,344 $ 1,291,672 $ 256.765 Current Deferred $ 256,765 45,632 Net income Retained earnings, January 1, 20X4 Retained earnings, December 31, 20X4 302.397 $ 989,275 $ 1.626.203 S 2.615,478 Prepared by WL Reviewed by Page 1 Adjusted Balance Dr (Cr) Adjustments Account # Ref # Dr (Cr) 1000.10 1000.20 1000.30 1000.40 1050.10 1050.40 1050.90 1100.10 1300.10 2050.10 2050.30 2050.80 2050.90 2100.00 2200.00 3050.10 3100.00 3200.10 3300.30 3400.50 KEYSTONE COMPUTERS & NETWORKS, INC. Working Trial Balance For the Period Ended December 31, 20X5 Prior Period Unadjusted Account Name Balance 12/31/X4 Trial Balance Dr (Cr) Cash-General Account 42.754 66,034 Cash-Special Account 9,960 10,150 Cash in Register 1,200 1.200 Petty Cash 50 50 Accounts receivable-trade 8,534,524 10,235,457 Accounts receivable officers 57,643 84.670 Allowance for bad debts (96,000) (104,000) Inventories 1,234,589 1,375,835 Prepaid expenses 156,900 176,456 Furniture & fixtures 300.980 344.900 Office equipment 974,676 Leasehold improvements 98.900 91.230 Accumulated depreciation (2,50.987) (404,560) Software development cost 178,000 Intangible assets 1,000,000 800.000 Accounts payable-trade (1,349,839) (1,429,033) Capital lease obligations current (43,200) (45,675) Accrued liabilities (178.900) (203,450) Unearned service revenue (42,300) Line of credit (6,612,550) (8,632,105) Capital lease obligations noncurrent (456.700) (423,680) 789,654 4400.10 4400.10 5050.10 5100.10 5700.10 5900.00 Capital lease obligations-noncurrent Capital stock Paid-in capital Retained earnings Dividends (456,700) (200,000) (423,500) (1,626,203) (423,680) (200,000) (423,500) (2,615,478) 415.000 229.877 (229,877) 0 989,275 (9.89.275) 0 WL Prepared by Reviewed by Page 2 Adjustments Dr (Cr) Adjusted Balance Dr (Cr) Ref # Account # 6000.10 6010.10 6020.10 6030.10 7020.10 7070.10 7070.50 7075.10 7080.10 7080.30 7090.10 7090.30 7090.50 7100.10 7140.10 7200.10 7260.30 7220 10 KEYSTONE COMPUTERS & NETWORKS, INC. Working Trial Balance For the Period Ended December 31, 20X5 Prior Period Unadjusted Balance Trial Balance Account Name 12/31/X4 Dr (Cr) Sales of computers (44,890,788) (42,345,675) Software licenses (248,900) (236,700) Service revenue (4,567,888) (4,325,777) Consulting revenue (46,751,990) (45,677,899) Cost of sales 74.122.435 72,134.566 Salaries-sales 3,167,889 2,765,677 Payroll benefits-sales 913.456 857,368 Advertising & promotion 1,200,786 1,567,889 Travel & entertainment 609.788 445,600 Miscellaneous exp. sales 334,890 278,656 Salaries-operations 4,878,900 4,544.860 Salaries administrative 4,234.234 3,945,670 Payroll benefits-admin. 1,812,344 1,734,565 Rent 797,800 721,345 Utilities 210,495 234.839 Insurance 356.890 378,677 Legal & accounting 457,577 485,767 pod doht oynance 224 500 756 678 7320.10 7410.10 7600.10 7650.10 7700.10 Bad debt expense Supplies Depreciation and amort. Software development Miscellaneous exp.-administrative Interest expense Current income taxes Deferred income taxes P & L Summary 234,500 556,345 334,565 289.100 234.556 421,344 256,765 45,632 989,275 256,678 478.900 367,867 345.645 245.456 476.899 80,100 9,150 7800.10 7900,10 7900.70 9000.00 0 0 0 (229,877) 229.877 0 WL Prepared by Reviewed by KEYSTONE COMPUTERS & NETWORKS, INC. Analytical Review Ratios For the Period Ended December 31, 20X5 Ratio Current ratio Days' sales in accounts receivable, computed with average accounts receivable Ending 12/31/X4 Industry Ending 12/31/X5 1.1 37.0 1.2 1.3 33.2 37.0 1.0% 1.1% Allowance for doubtful accounts/accounts receivable Bad debt expenseet sales Total liabilitieset worth Return on total assets Return on net worth Return on net sales Gross profitet sales Selling, operating, and administrative expenseet sales Times interest earned 0.3% 3.5 1.7% 7.5% 0.2% 22.1% 21.2% 1.7 0.2% 2.7 8.3% 30.5% 1.0% 23.2% 21.4% 4.1 2.9 9.0% 29.0% 2.3% 24.0% 23.9% 5.5 KEYSTONE COMPUTERS & NETWORKS, INC. Audit Strategy December 31, 20X5 Date Prepared by: Reviewed by: Reviewed by: Warren Love (Senior) Karen West (Manager) Charles Adams (Partner) August 14. 20X5 August 28, 20X5 September 5, 20X5 OVERALL AUDIT STRATEGY OBJECTIVES OF THE ENGAGEMENT Audit of the financial statements of Keystone Computers & Networks, Inc. (KCN), for the year ended December 31, 20X5. Also, the company's debt agreement with Western Financial Services requires the company to furnish the lender a report by our firm on KCN's compliance with various restrictive debt covenants. BUSINESS AND INDUSTRY CONDITIONS KCN sells and installs computers and networking hardware and software to business customers and provides other information technology consulting services. KCN also has begun developing its own computer networking software to be sold as a product to its customers. The company's primary competitive strategy is to maintain a high level of technical expertise and a broad range of services. KCN's long-term success is contingent on its ability to attract and retain qualified information technology personnel. The market for such individuals is very competitive. However, the company has a competitive advantage because of its desirable geographic location (Phoenix), which has a large number of colleges with technology programs. The market for computers and related products is extremely competitive. KCN competes with large retailers of computers, such as Dell, Hewlett Packard, and Apple. The company also competes with other value-added resellers who provide computers and software products and consulting services directly to customers. To effectively compete, the company must be able to obtain inventories of state-of-the-art equipment on a timely basis. Because the company does not have the buying power of some of its other competitors, it generally must charge a higher price for its products. Its customers are willing to pay the higher price because of the high level of expertise and service that the company provides The market for computer products and technology services is also very sensitive to economic conditions. Recent reports indicate that the U.S. economy will be challenged for the

1. A. Retain the original text.

1. A. Retain the original text.