Answered step by step

Verified Expert Solution

Question

1 Approved Answer

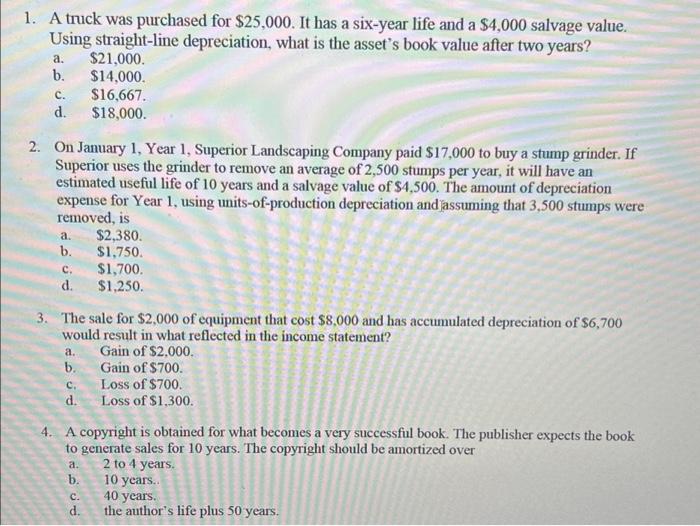

1. A truck was purchased for $25,000. It has a six-year life and a $4,000 salvage value. Using straight-line depreciation, what is the asset's book

1. A truck was purchased for $25,000. It has a six-year life and a $4,000 salvage value. Using straight-line depreciation, what is the asset's book value after two years? a. $21,000. b. $14,000. $16,667. $18,000. C. d. 2. On January 1, Year 1, Superior Landscaping Company paid $17,000 to buy a stump grinder. If Superior uses the grinder to remove an average of 2,500 stumps per year, it will have an estimated useful life of 10 years and a salvage value of $4,500. The amount of depreciation expense for Year 1, using units-of-production depreciation and Jassuming that 3,500 stumps were removed, is a. b. C. d. 3. The sale for $2,000 of equipment that cost $8,000 and has accumulated depreciation of $6,700 would result in what reflected in the income statement? Gain of $2,000. Gain of $700. Loss of $700. Loss of $1,300. a. b. C. d. $2,380. $1,750. $1,700. $1,250. 4. A copyright is obtained for what becomes a very successful book. The publisher expects the book to generate sales for 10 years. The copyright should be amortized over a. 2 to 4 years. b. C. d. 10 years.. 40 years. the author's life plus 50 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started