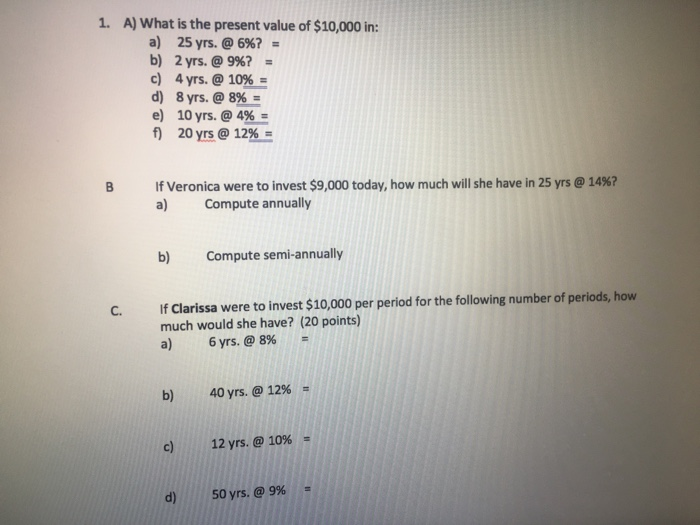

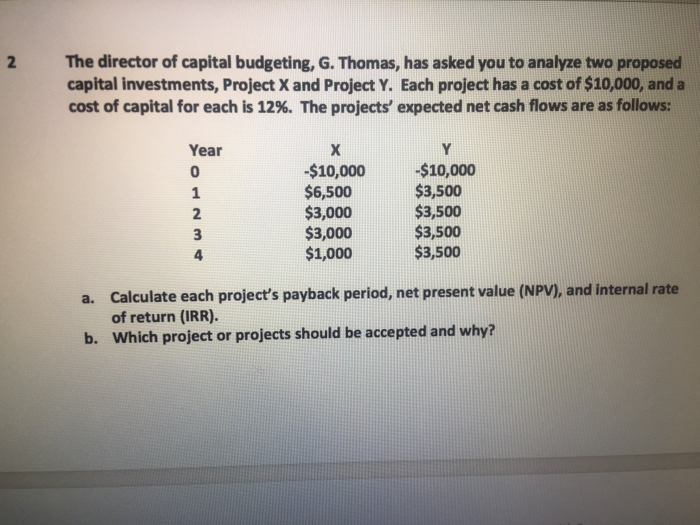

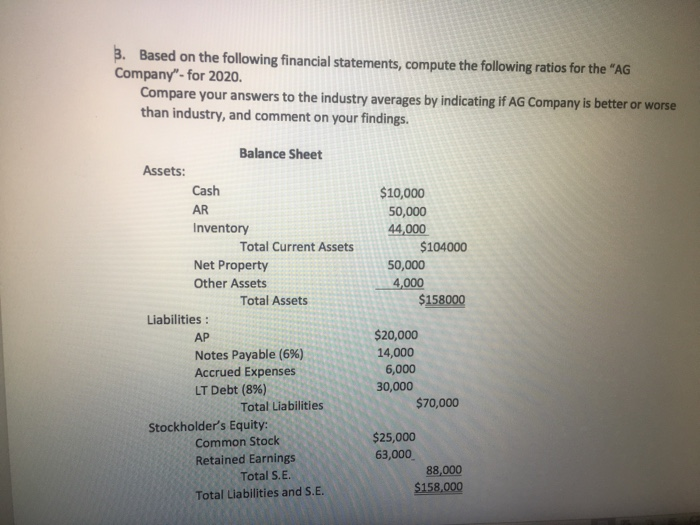

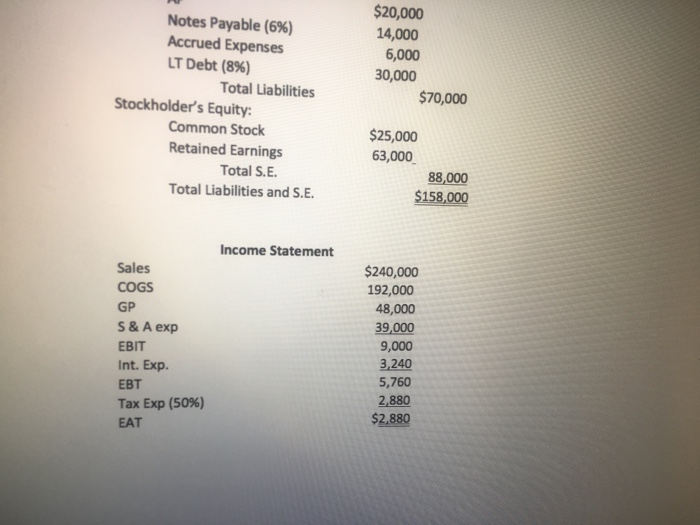

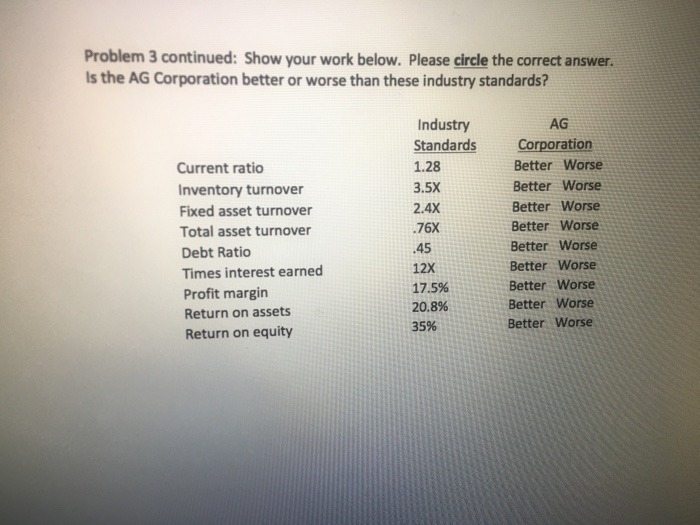

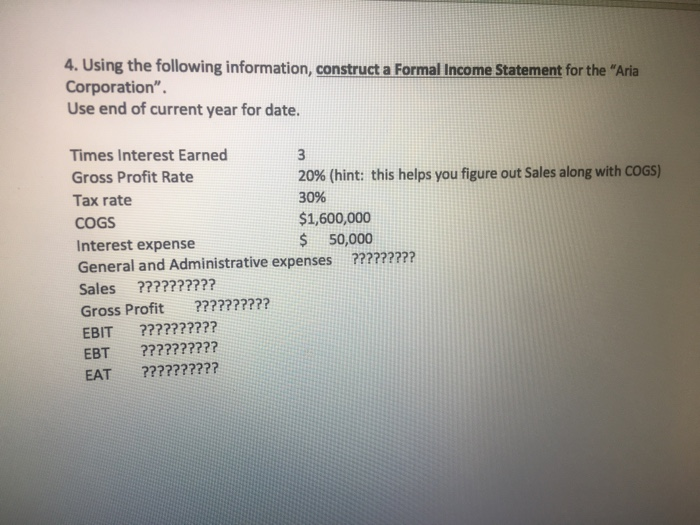

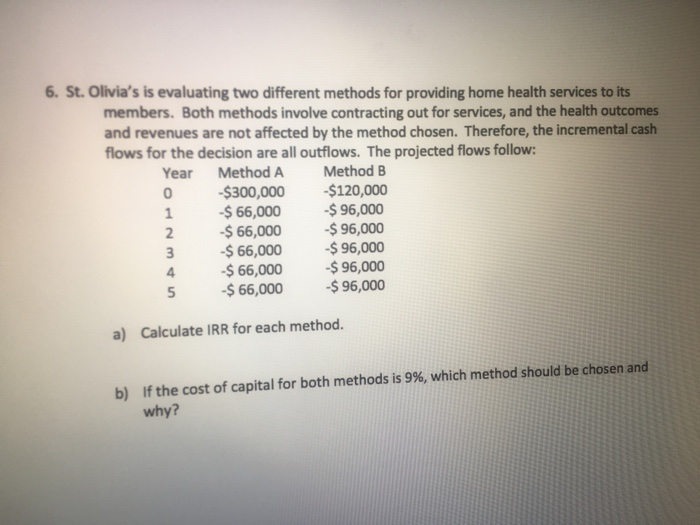

1. A) What is the present value of $10,000 in: a) 25 yrs. @ 6%? = b) 2 yrs. @ 9%? = c) 4 yrs. @ 10% = d) 8 yrs. @ 8% = e) 10 yrs. @ 4% = f) 20 yrs @ 12% = If Veronica were to invest $9,000 today, how much will she have in 25 yrs @ 14%? a) Compute annually b) Compute semi-annually If Clarissa were to invest $10,000 per period for the following number of periods, how much would she have? (20 points) a) 6 yrs. @ 8% b) 40 yrs. @ 12% c) 12 yrs. @ 10% = d) 50 yrs. @ 9% = 2 The director of capital budgeting, G. Thomas, has asked you to analyze two proposed capital investments, Project X and Project Y. Each project has a cost of $10,000, and a cost of capital for each is 12%. The projects' expected net cash flows are as follows: Year WNO -$10,000 $6,500 $3,000 $3,000 $1,000 -$10,000 $3,500 $3,500 $3,500 $3,500 a. Calculate each project's payback period, net present value (NPV), and internal rate of return (IRR). b. Which project or projects should be accepted and why? 3. Based on the following financial statements, compute the following ratios for the "AG Company"- for 2020. Compare your answers to the industry averages by indicating if AG Company is better or worse than industry, and comment on your findings. $10,000 50,000 44,000 $104000 50,000 4,000 $158000 Balance Sheet Assets: Cash AR Inventory Total Current Assets Net Property Other Assets Total Assets Liabilities: AP Notes Payable (6%) Accrued Expenses LT Debt (8%) Total Liabilities Stockholder's Equity: Common Stock Retained Earnings Total S.E. Total Liabilities and S.E. $20,000 14,000 6,000 30,000 $70,000 $25,000 63,000 88,000 $158,000 Notes Payable (6%) Accrued Expenses LT Debt (8%) Total Liabilities Stockholder's Equity: Common Stock Retained Earnings Total S.E. Total Liabilities and S.E. $20,000 14,000 6,000 30,000 $70,000 $25,000 63,000 88,000 $158,000 Income Statement Sales COGS GP S&A exp EBIT Int. Exp. EBT Tax Exp (50%) EAT $240,000 192,000 48,000 39,000 9,000 3,240 5,760 2,880 $2.880 Problem 3 continued: Show your work below. Please circle the correct answer. Is the AG Corporation better or worse than these industry standards? Industry Standards 1.28 3.5X 2.4x .76X Current ratio Inventory turnover Fixed asset turnover Total asset turnover Debt Ratio Times interest earned Profit margin Return on assets Return on equity AG Corporation Better Worse Better Worse Better Worse Better Worse Better Worse Better Worse Better Worse Better Worse Better Worse .45 12x 17.5% 20.8% 35% 4. Using the following information, construct a Formal Income Statement for the "Aria Corporation". Use end of current year for date. Times Interest Earned Gross Profit Rate 20% (hint: this helps you figure out Sales along with COGS) Tax rate 30% COGS $1,600,000 Interest expense $ 50,000 General and Administrative expenses ????????? Sales ?????????? Gross Profit ?????????? EBIT ?????????? EBT ?????????? EAT ?????????? 6. St. Olivia's is evaluating two different methods for providing home health services to its members. Both methods involve contracting out for services, and the health outcomes and revenues are not affected by the method chosen. Therefore, the incremental cash! flows for the decision are all outflows. The projected flows follow: Year Method A Method B -$300,000 $120,000 -$ 66,000 -$ 96,000 -$ 66,000 -$ 96,000 -$ 66,000 -$ 96,000 -$ 66,000 -$ 96,000 -$ 66,000 -$ 96,000 a) Calculate IRR for each method. b) If the cost of capital for both methods is 9%, which method should be chosen and why