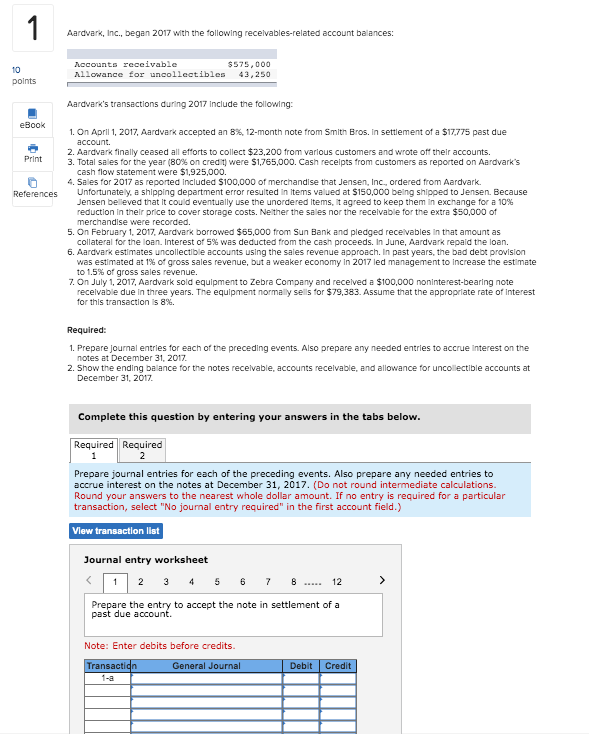

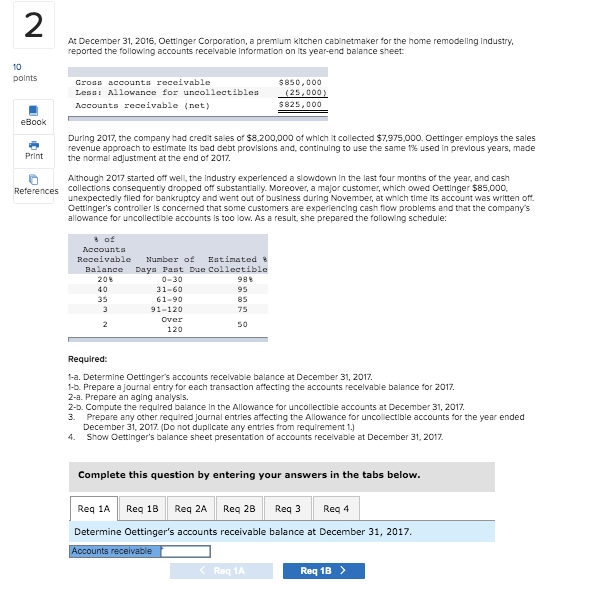

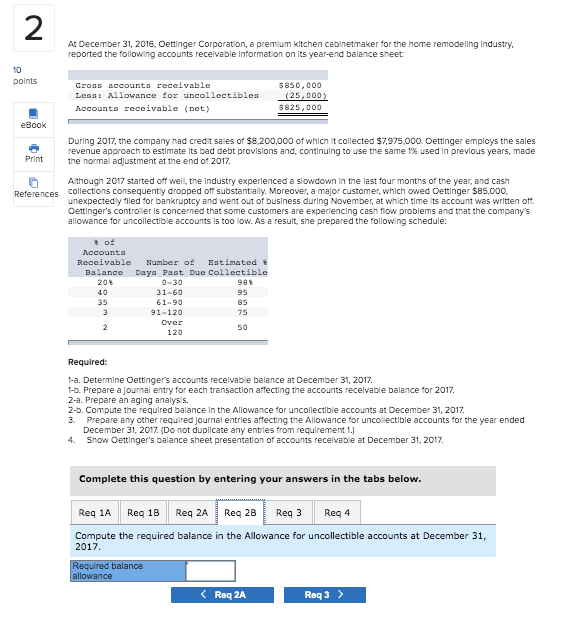

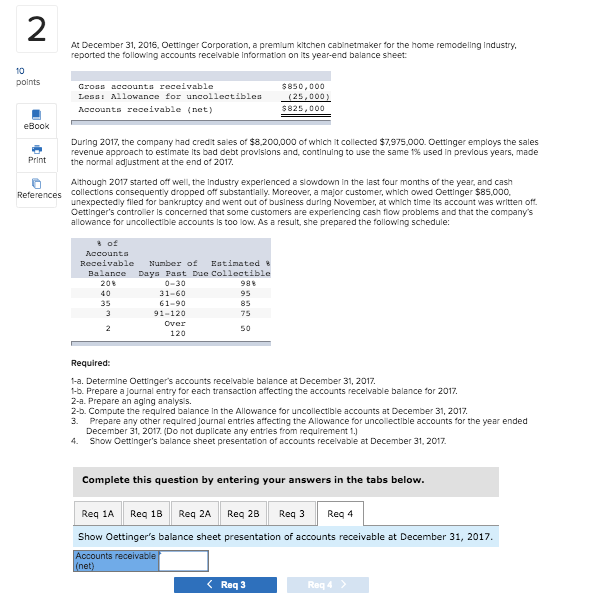

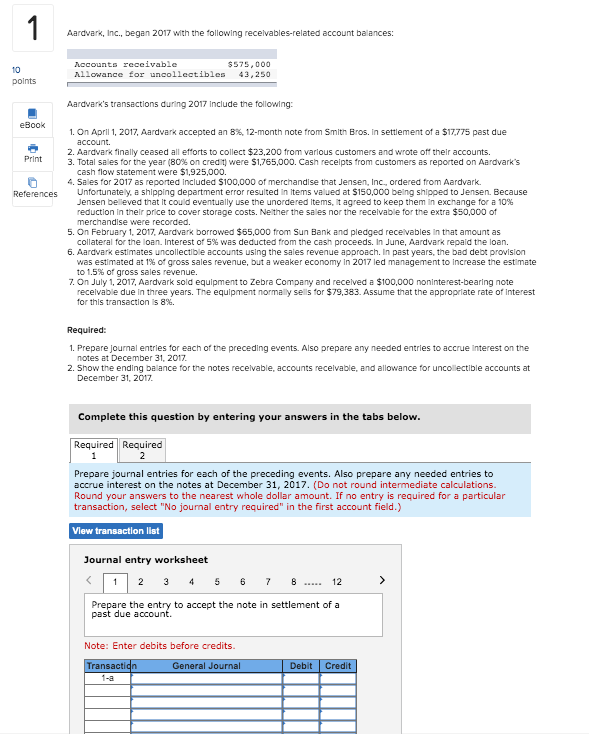

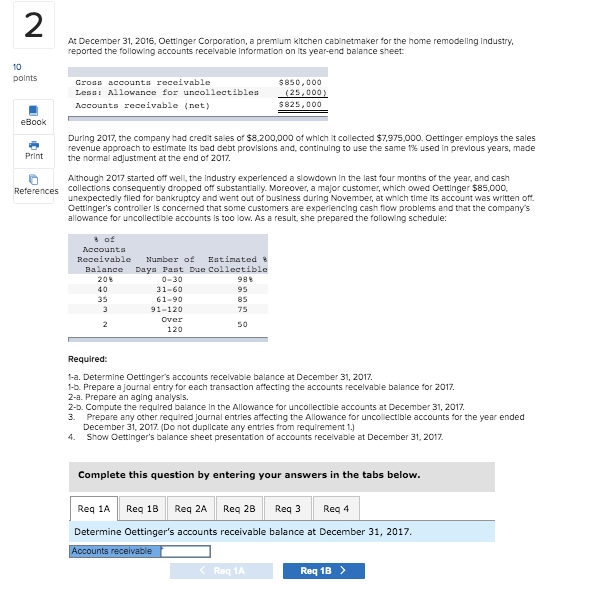

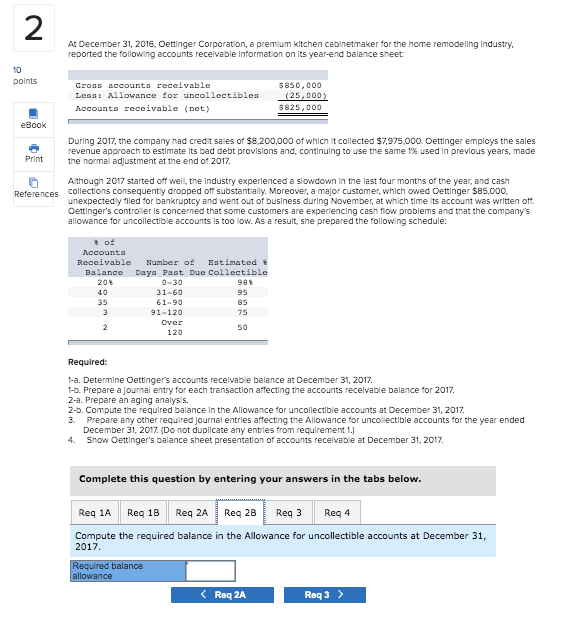

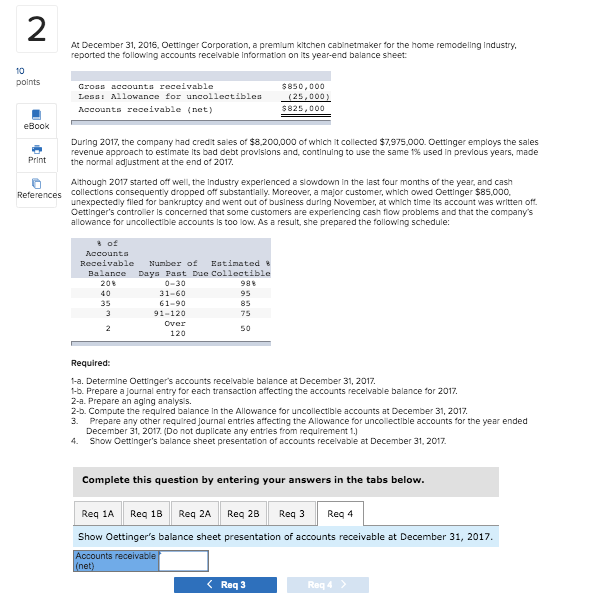

1 Aardvark, Inc., began 2017 with the following recelvables-related account balances: 10 points Accounts receivable $575,000 Allowance for uncollectibles 43,250 Aardvark's transactions during 2017 include the following: eBook Print References 1. On April 1, 2017, Aardvark accepted an 8%, 12-month note from Smith Bros. In settlement of a $17,775 past due account. 2. Aardvark finally ceased all efforts to collect $23,200 from various customers and wrote off their accounts. 3. Total sales for the year (80% on credit) were $1,765,000. Cash receipts from customers as reported on Aardvark's cash flow statement were $1,925,000. 4. Sales for 2017 as reported included $100,000 of merchandise that Jensen, Inc., ordered from Aardvark. Unfortunately, a shipping department error resulted in items valued at $150,000 being shipped to Jensen. Because Jensen believed that it could eventually use the unordered items, it agreed to keep them in exchange for a 10% reduction in their price to cover storage costs. Neither the sales nor the receivable for the extra $50,000 of merchandise were recorded. 5. On February 1, 2017, Aardvark borrowed $65,000 from Sun Bank and pledged receivables in that amount as collateral for the loan. Interest of 5% was deducted from the cash proceeds. In June, Aardvark repaid the loan. 6. Aardvark estimates uncollectible accounts using the sales revenue approach. In past years, the bad debt provision was estimated at 1% of gross sales revenue, but a weaker economy in 2017 led management to increase the estimate to 1.5% of gross sales revenue, 7. On July 1, 2017, Aardvark sold equipment to Zebra Company and received a $100,000 noninterest-bearing note receivable due in three years. The equipment normally sells for $79,383. Assume that the appropriate rate of interest for this transaction is 8%. Required: 1. Prepare journal entries for each of the preceding events. Also prepare any needed entries accrue Interest on the notes at December 31, 2017 2. Show the ending balance for the notes receivable accounts receivable, and allowance for uncollectible accounts at December 31, 2017 Complete this question by entering your answers in the tabs below. Required Required 1 2 Prepare journal entries for each of the preceding events. Also prepare any needed entries to accrue interest on the notes at December 31, 2017. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list > Journal entry worksheet 2 At December 31, 2016. Oettinger Corporation, a premium kitchen cabinetmaker for the home remodeling industry, reported the following accounts receivable information on its year-end balance sheet: 10 points Cross accounts receivable Less: Allowance for uncollectibles Accounts receivable (net) $850,000 (25,000 $825,000 eBook During 2017, the company had credit sales of $8,200,000 of which it collected $7,975.000. Oettinger employs the sales revenue approach to estimate its bad debt provisions and continuing to use the same 1% used in previous years, made Print the normal adjustment at the end of 2017, Although 2017 started off well, the industry experienced a slowdown in the last four months of the year, and cash References collections consequently dropped off substantially. Moreover, a major customer, which owed Oettinger $85.000 unexpectedly filed for bankruptcy and went out of business during November, at which time its account was written oft. Oettinger's controller is concerned that some customers are experiencing cash flow problems and that the company's allowance for uncollectible accounts is too low. As a result, she prepared the following schedule: Accounts Receivable Balance 208 40 35 Number of Estimated Days Past Due Collectible 0-30 988 31-60 61-90 85 91-120 75 Over 120 50 2 Required: 1-a. Determine Oettinger's accounts receivable balance at December 31, 2017. 1-6. Prepare a journal entry for each transaction affecting the accounts receivable balance for 2017. 2-a. Prepare an aging analysis. 2-b. Compute the required balance in the Allowance for uncollectible accounts at December 31, 2017 3. Prepare any other required journal entries affecting the Allowance for uncollectible accounts for the year ended December 31, 2017. (Do not duplicate any entries from requirement 1.) 4. Show Oettinger's balance sheet presentation of accounts receivable at December 31, 2017 Complete this question by entering your answers in the tabs below. Reg 4 Req 1A Reg 1B Req 2A Reg 2B Reg 3 Compute the required balance in the Allowance for uncollectible accounts at December 31, 2017. Required balance allowance Req 2A Reg 3 >