Question

1) According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Net sales? Amount can be entered with or without commas. DO

1)  According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Net sales? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Net sales? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

2) According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Gross Profit? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

3) According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Total Operating Expenses? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

4) According to Worker Products Company's Multi-Step Income Statement you prepared, what is Operating Income? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

5) According to Worker Products Company's Multi-Step Income Statement you prepared, what is the Net Income? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

6) According to Worker Products Company's Statement of Retained Earnings you prepared, what is the Ending Retained earnings? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

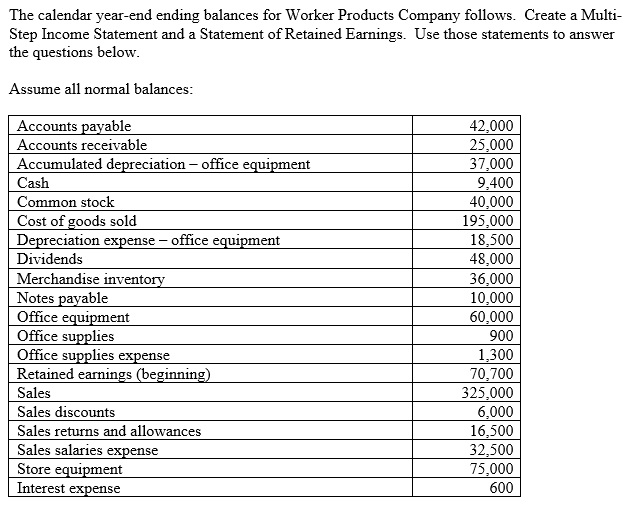

The calendar year-end ending balances for Worker Products Company follows. Create a Multi- Step Income Statement and a Statement of Retained Earnings. Use those statements to answer the questions below. Assume all normal balances: Accounts payable Accounts receivable Accumulated depreciation - office equipment Cash Common stock Cost of goods sold Depreciation expense - office equipment Dividends Merchandise inventory Notes payable Office equipment Office supplies Office supplies expense Retained earnings (beginning) Sales Sales discounts Sales returns and allowances Sales salaries expense Store equipment Interest expense 42,000 25,000 37,000 9,400 40,000 195,000 18,500 48,000 36,000 10,000 60,000 900 1,300 70,700 325,000 6,000 16,500 32,500 75,000 600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started