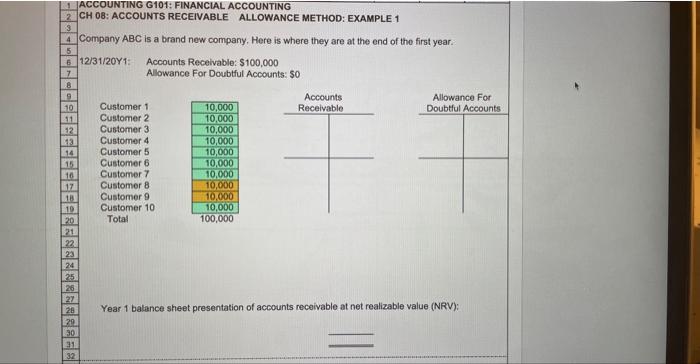

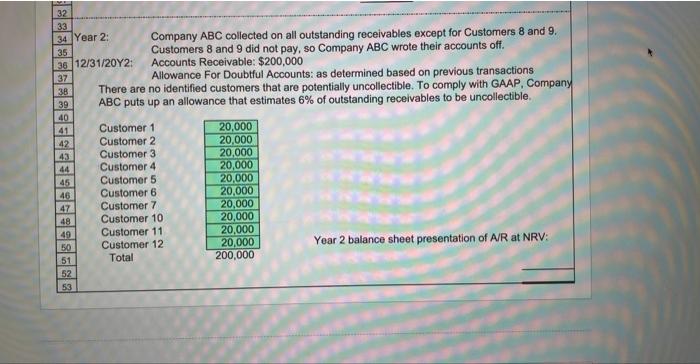

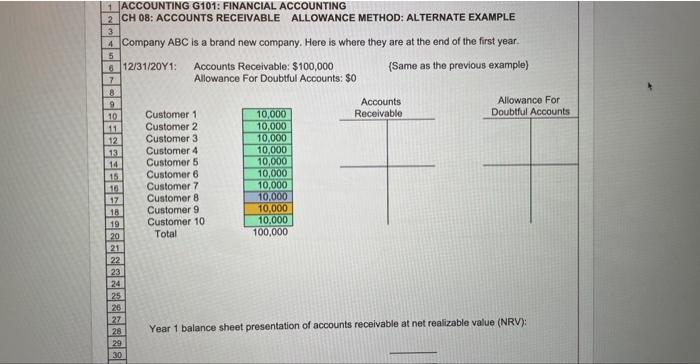

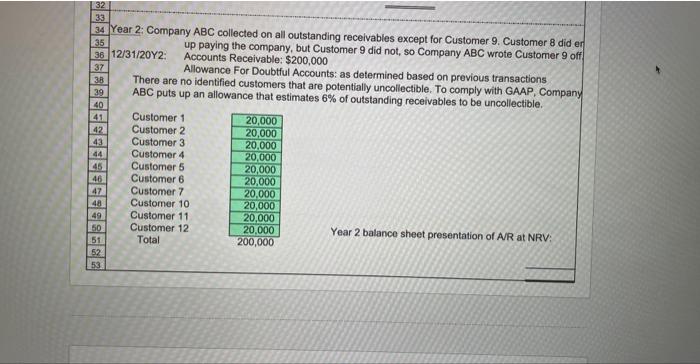

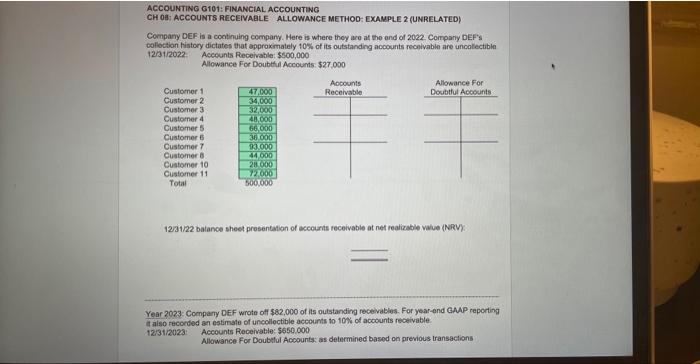

1 ACCOUNTING G101: FINANCIAL ACCOUNTING 2 CH 08: ACCOUNTS RECEIVABLE ALLOWANCE METHOD: EXAMPLE 1 4 Company ABC is a brand new company. Here is where they are at the end of the first year. 6 12/31/20Y1: Accounts Recelvable: $100,000 Alowance For Doubtful Accounts: $0 Year 1 batance sheet presentation of accounts receivable at net realizable value (NRV): Company ABC collected on all outstanding receivables except for Customers 8 and 9. Customers 8 and 9 did not pay, so Company ABC wrote their accounts off. 20Y2: Accounts Receivable: $200,000 Allowance For Doubtful Accounts: as determined based on previous transactions here are no identified customers that are potentially uncollectible. To comply with GAAP, Company BC puts up an allowance that estimates 6% of outstanding receivables to be uncollectible. \begin{tabular}{|l|} \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline 20,000 \\ \hline \end{tabular} Year 2 balance sheet presentation of A/R at NRV: 1 ACCOUNTING G101: FINANCIAL ACCOUNTING 2 CH 08: ACCOUNTS RECEIVABLE ALLOWANCE METHOD: ALTERNATE EXAMPLE 43 Company ABC is a brand new company. Here is where they are at the end of the first year. - 1 12/31/20Y1: Accounts Receivable: $100,000 (Same as the previous example) 7 Allowance For Doubtul Accounts: $0 1514 1615 1717 1918 20 \begin{tabular}{|l|} \hline2221 \\ \hline 23 \\ \hline 24 \\ \hline 25 \\ \hline 26 \\ \hline 27 \\ \hline 28 \\ \hline 29 \\ \hline 30 \\ \hline \end{tabular} Year 1 balance sheet presentation of accounts receivable at net realizable value (NRV): Year 2: Company ABC collected on all outstanding receivables except for Customer 9. Customer 8 did e Accounts Receivable: $200,000 Allowance For Doubtful Accounts: as determined based on previous transactions There are no identified customers that are potentially uncoliectible. To comply with GAAP, Company ABC puts up an allowance that estimates 6% of outstanding receivables to be uncollectible. Year 2 balance sheet presentation of A/R at NRV: ACCOUNTING G101: FINANCIAL ACCOUNTING CH O:: ACCOUNTS RECENAALE ALLOWANCE METHOD- EXAMPLE 2 (UNRELATED) Company DEF is a continuing company. Here is where they aro at the ond of 2022 . Compary DEF's colloction history dictates that approxmately 10% of its outstanding accounts recolvabie are uncotectibla 12/31/2022. Accounts Receivable: $500,000 Alowance For Doubthil Accounts: $27,000 12/31/22 batance sheet presentation of accourts receivable at net realizable value (NRV): Year 2023: Company DEF wrote off \$82,000 of its outstanding recelvables. For year-end GAMP reporting Year a also racorded an estimate of uncolloctible accounts to 10W of accounts receivable 121312028: Accounts Riecehable: 5650,000 Alowance For Doubtlul Accounts as determined basod on previous transactions