Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 ) After the end of four years, the firm expects to sell the store for RM 1 , 0 0 0 , 0 0

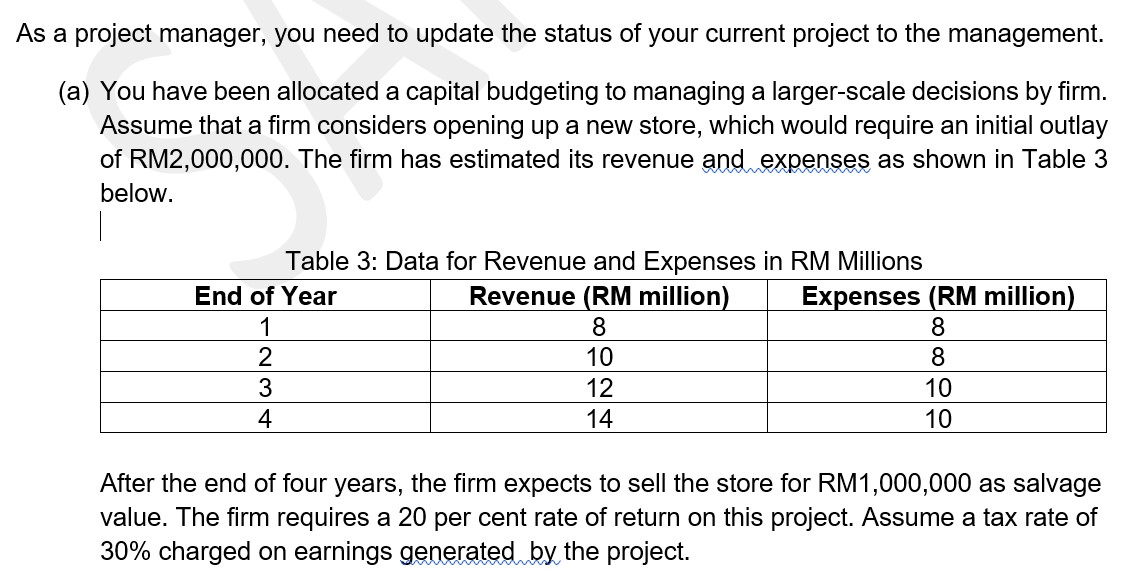

After the end of four years, the firm expects to sell the store for RM as salvage value. The firm requires a per cent rate of return on this project. Assume a tax rate of charged on earnings generated by the project. Determine the Net Present Value NPV for this project and proposed your recommendation to management regarding on this proposed project.

Calculate the Net Present Value NPV for this project and proposed your recommendation to management regarding on this Mekar Mega development project.

explain and calculate precisely.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started