Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors live at 12340 Cocoshell Road, Coral Gables,

1. Albert Gaytor and his wife Allison are married and file a joint return for 2018. The Gaytors live at 12340 Cocoshell Road, Coral Gables, FL 33134. Captain Gaytor is a charter fishing boat captain but took 6 months off from his job in 2018 to train and study for his Masters Captains License.

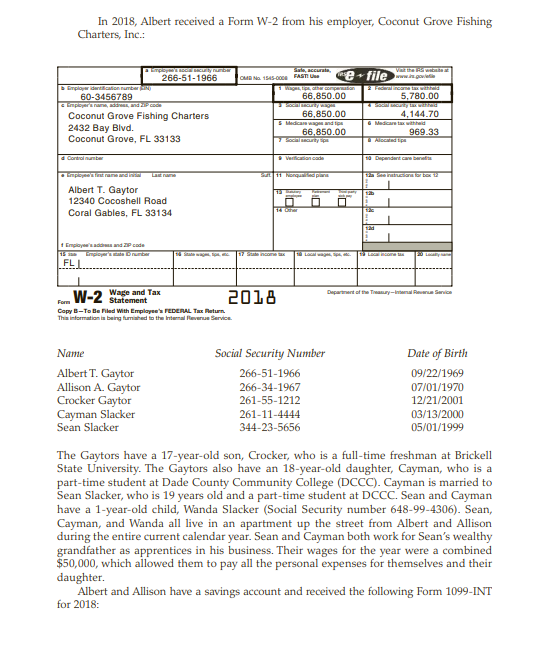

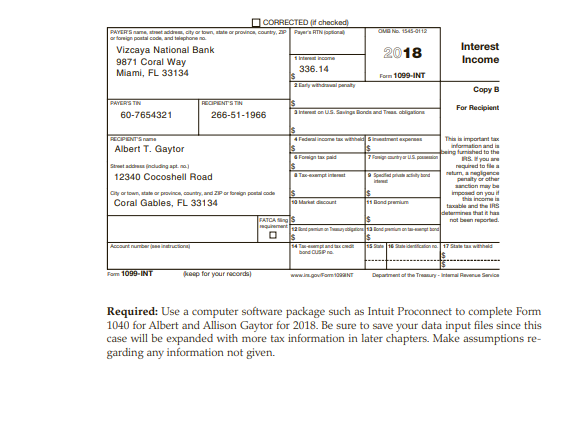

In 2018, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc.: 266-51-1966 . e. file 66.850.00 60-3456789 5.780.00 66.850.00 4.144 70 Coconut Grove Fishing Charters 2432 Bay Blvd. Coconut Grove, FL 33133 66.850.00 969.33 Albert T. Gaytor 12340 Cocoshell Road Coral Gables, FL 33134 FL W.2 Wage and Tax For W Z Statement 2018 Copy -Tete led With Em FEDERALT aturn The information is being used to the Internal Revenue Service Name Albert T. Gaytor Allison A. Gaytor Crocker Gaytor Cayman Slacker Sean Slacker Social Security Number 266-51-1966 266-34-1967 261-55-1212 261-11-4444 344-23-5656 Date of Birth 09/22/1969 07/01/1970 12/21/2001 03/13/2000 05/01/1999 The Gaytors have a 17-year-old son, Crocker, who is a full-time freshman at Brickell State University. The Gaytors also have an 18-year-old daughter, Cayman, who is a part-time student at Dade County Community College (DCCC). Cayman is married to Sean Slacker, who is 19 years old and a part-time student at DCCC. Sean and Cayman have a 1-year-old child, Wanda Slacker (Social Security number 648-99-4306). Sean, Cayman, and Wanda all live in an apartment up the street from Albert and Allison during the entire current calendar year. Sean and Cayman both work for Sean's wealthy grandfather as apprentices in his business. Their wages for the year were a combined $50,000, which allowed them to pay all the personal expenses for themselves and their daughter. Albert and Allison have a savings account and received the following Form 1099-INT for 2018: CORRECTED I checked or province, county, ZP Paris National address, city or town, 2018 Vizcaya National Bank 9871 Coral Way Miami, FL 33134 Interest Income 336.14 Form 1099-INT Copy B For Recipient 60-7654321 266-51-1966 This important Albert T. Gaytor readincluding apt. 12340 Cocoshell Road Gyor town, state or province, country, and ZIP or frin postal code Coral Gables, FL 33134 Form 1099-INT Moup for your records) www.igovom Required: Use a computer software package such as Intuit Proconnect to complete Form 1040 for Albert and Allison Gaytor for 2018. Be sure to save your data input files since this case will be expanded with more tax information in later chapters. Make assumptions re- garding any information not given. In 2018, Albert received a Form W-2 from his employer, Coconut Grove Fishing Charters, Inc.: 266-51-1966 . e. file 66.850.00 60-3456789 5.780.00 66.850.00 4.144 70 Coconut Grove Fishing Charters 2432 Bay Blvd. Coconut Grove, FL 33133 66.850.00 969.33 Albert T. Gaytor 12340 Cocoshell Road Coral Gables, FL 33134 FL W.2 Wage and Tax For W Z Statement 2018 Copy -Tete led With Em FEDERALT aturn The information is being used to the Internal Revenue Service Name Albert T. Gaytor Allison A. Gaytor Crocker Gaytor Cayman Slacker Sean Slacker Social Security Number 266-51-1966 266-34-1967 261-55-1212 261-11-4444 344-23-5656 Date of Birth 09/22/1969 07/01/1970 12/21/2001 03/13/2000 05/01/1999 The Gaytors have a 17-year-old son, Crocker, who is a full-time freshman at Brickell State University. The Gaytors also have an 18-year-old daughter, Cayman, who is a part-time student at Dade County Community College (DCCC). Cayman is married to Sean Slacker, who is 19 years old and a part-time student at DCCC. Sean and Cayman have a 1-year-old child, Wanda Slacker (Social Security number 648-99-4306). Sean, Cayman, and Wanda all live in an apartment up the street from Albert and Allison during the entire current calendar year. Sean and Cayman both work for Sean's wealthy grandfather as apprentices in his business. Their wages for the year were a combined $50,000, which allowed them to pay all the personal expenses for themselves and their daughter. Albert and Allison have a savings account and received the following Form 1099-INT for 2018: CORRECTED I checked or province, county, ZP Paris National address, city or town, 2018 Vizcaya National Bank 9871 Coral Way Miami, FL 33134 Interest Income 336.14 Form 1099-INT Copy B For Recipient 60-7654321 266-51-1966 This important Albert T. Gaytor readincluding apt. 12340 Cocoshell Road Gyor town, state or province, country, and ZIP or frin postal code Coral Gables, FL 33134 Form 1099-INT Moup for your records) www.igovom Required: Use a computer software package such as Intuit Proconnect to complete Form 1040 for Albert and Allison Gaytor for 2018. Be sure to save your data input files since this case will be expanded with more tax information in later chapters. Make assumptions re- garding any information not given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started