Question

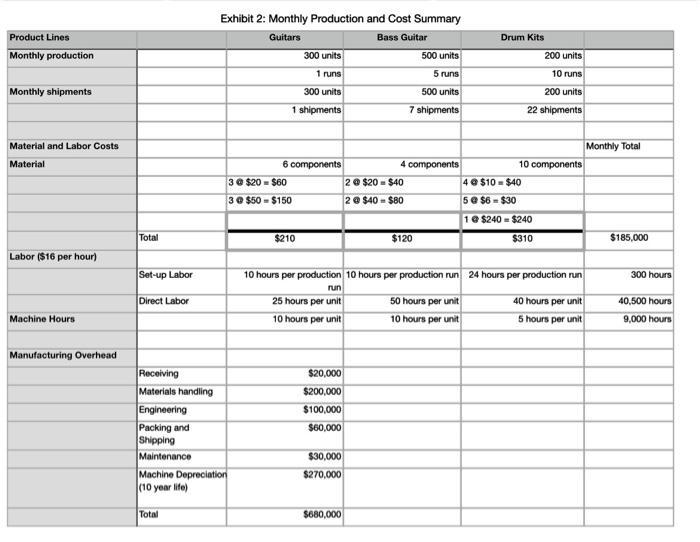

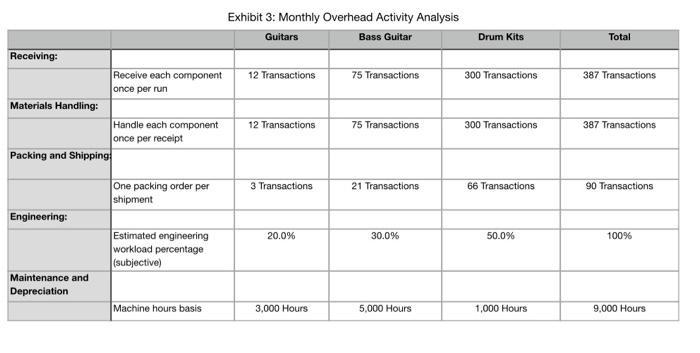

1: Alex, suggested an alternative method where they allocate overhead costs as a function of transactions. Based on the data provided in Exhibit 3, and

1: Alex, suggested an alternative method where they allocate overhead costs as a function of transactions. Based on the data provided in Exhibit 3, and the suggestion to "allocate overhead costs as a function of transactions related to each overhead

cost," what is the cost of Receiving per transaction?

Please only provide a number and round to the second decimal. e.g. $5.6836/Direct Labor Hour should just be 5.68

2: Alex, suggested an alternative method where they allocate overhead costs as a function of transactions. They could then allocate costs unrelated to transactions like Engineering based on the engineering workload, and maintenance and depreciation based on machine hours. Based on the data provided in Exhibit 3, what is the cost of Maintenance and Depreciation per machine hour?

Please only provide a number and round to the second decimal. e.g. $5.6836/Direct Labor Hour should just be 5.68

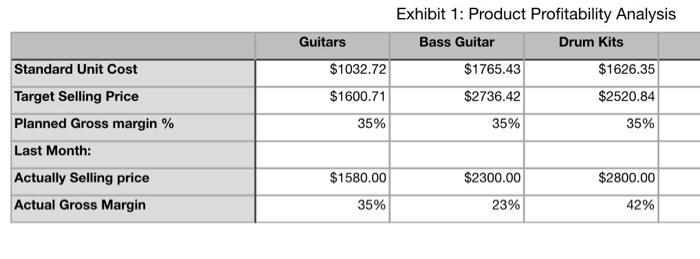

Standard Unit Cost Target Selling Price Planned Gross margin % Last Month: Actually Selling price Actual Gross Margin Guitars $1032.72 $1600.71 35% $1580.00 35% Exhibit 1: Product Profitability Analysis Bass Guitar Drum Kits $1765.43 $2736.42 35% $2300.00 23% $1626.35 $2520.84 35% $2800.00 42%

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Computation of Cost of Receiving per transaction Receiving overheads 20000 Total number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started