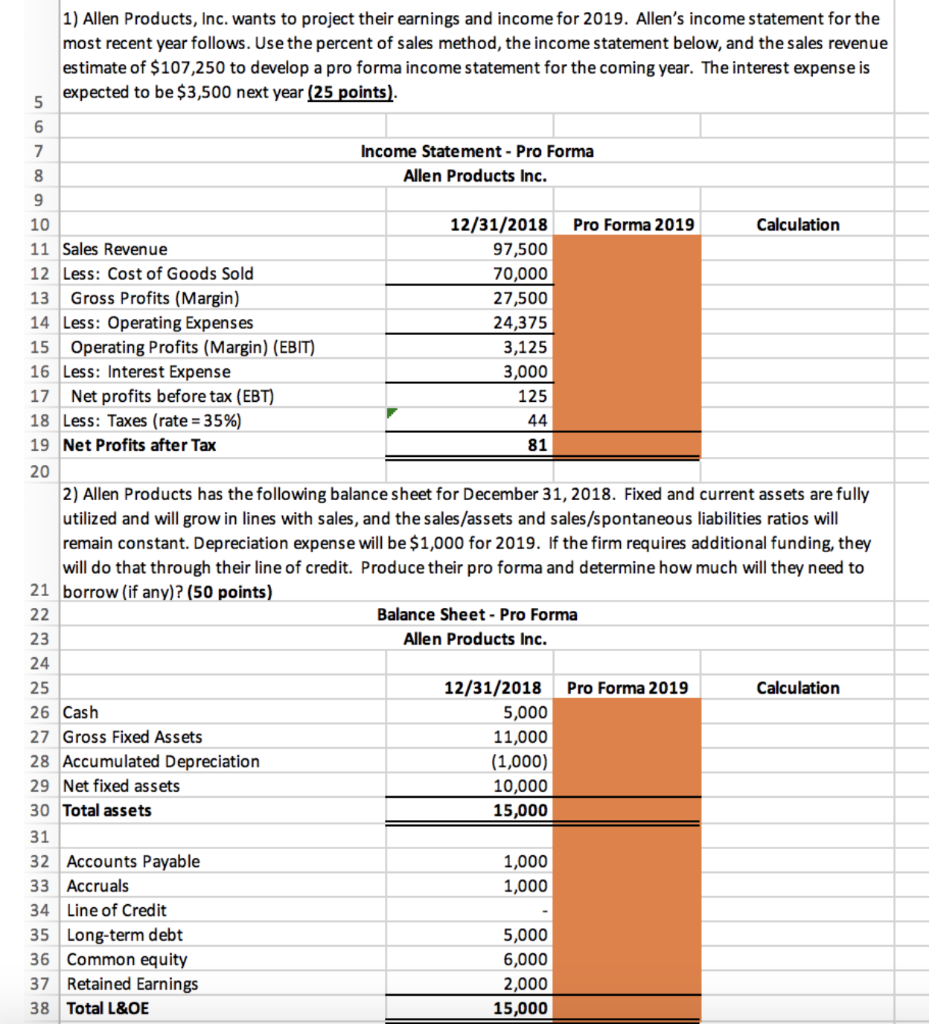

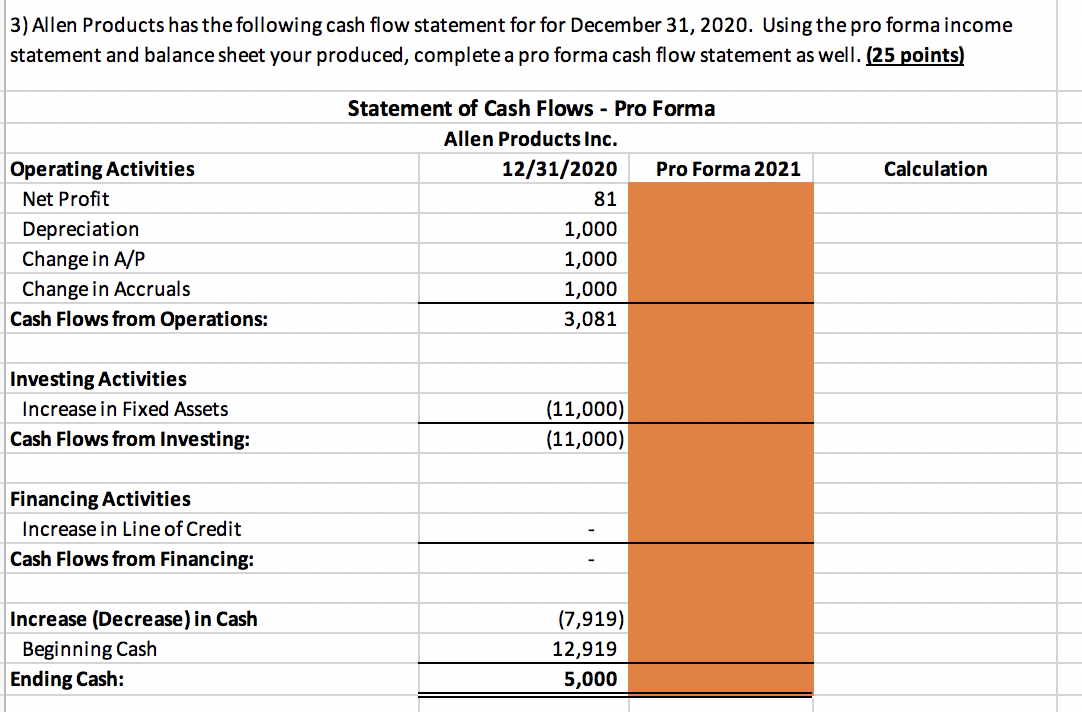

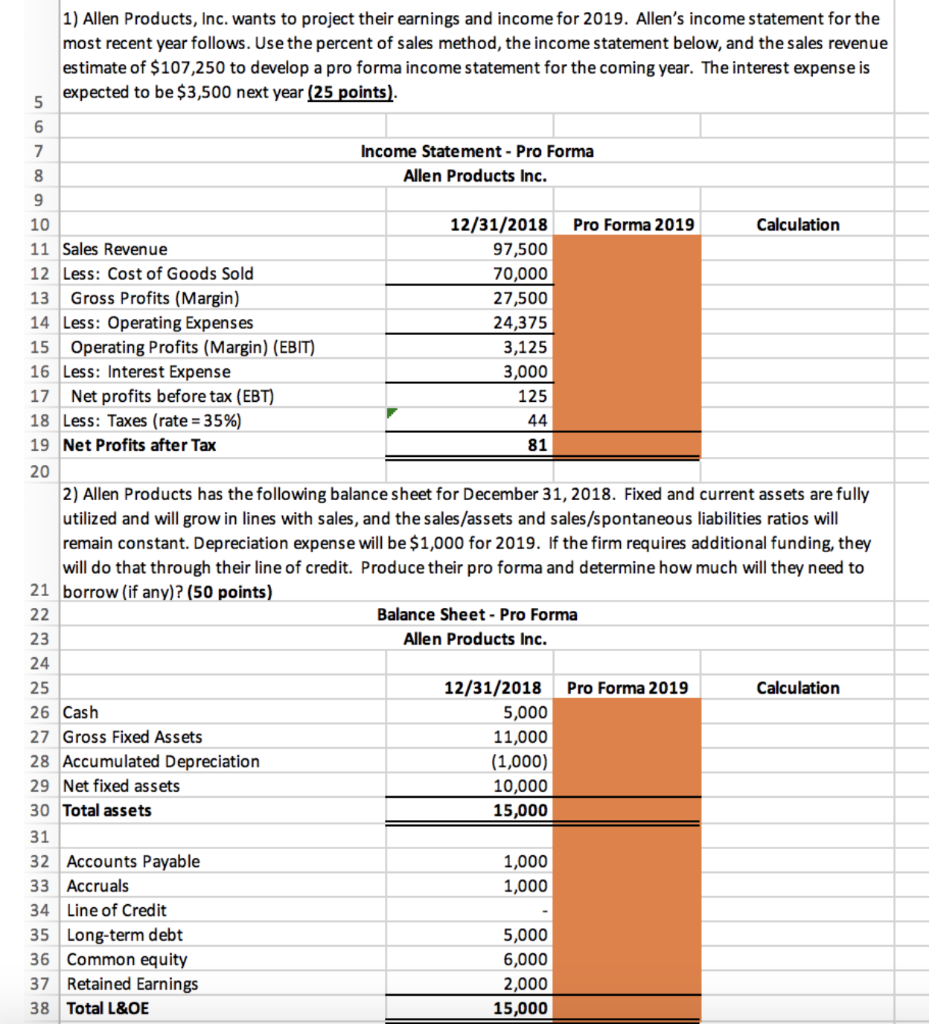

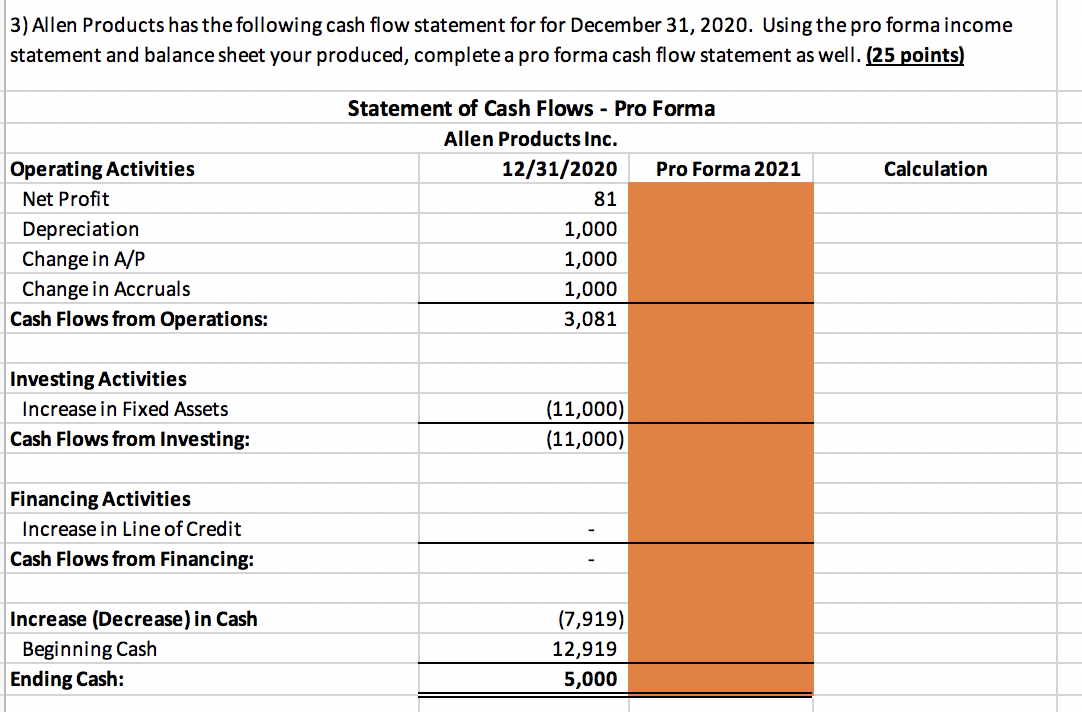

1) Allen Products, Inc. wants to project their earnings and income for 2019. Allen's income statement for the most recent year follows. Use the percent of sales method, the income statement below, and the sales revenue estimate of $107,250 to develop a pro forma income statement for the coming year. The interest expense is expected to be $3,500 next year (25 points). 5 6 7 Income Statement - Pro Forma 8 Allen Products Inc. 9 10 12/31/2018 Pro Forma 2019 Calculation 11 Sales Revenue 97,500 12 Less: Cost of Goods Sold 70,000 13 Gross Profits (Margin) 27,500 14 Less: Operating Expenses 24,375 15 Operating profits (Margin) (EBIT) 3,125 16 Less: Interest Expense 3,000 17 Net profits before tax (EBT) 125 18 Less: Taxes (rate = 35%) 44 19 Net Profits after Tax 81 20 2) Allen Products has the following balance sheet for December 31, 2018. Fixed and current assets are fully utilized and will grow in lines with sales, and the sales/assets and sales/spontaneous liabilities ratios will remain constant. Depreciation expense will be $1,000 for 2019. If the firm requires additional funding, they will do that through their line of credit. Produce their pro forma and determine how much will they need to 21 borrow (if any)? (50 points) 22 Balance Sheet - Pro Forma 23 Allen Products Inc. 24 25 12/31/2018 Pro Forma 2019 Calculation 26 Cash 5,000 27 Gross Fixed Assets 11,000 28 Accumulated Depreciation (1,000) 29 Net fixed assets 10,000 30 Total assets 15,000 31 32 Accounts Payable 1,000 33 Accruals 1,000 34 Line of Credit 35 Long-term debt 5,000 36 Common equity 6,000 37 Retained Earnings 2,000 38 Total L&OE 15,000 3) Allen Products has the following cash flow statement for for December 31, 2020. Using the pro forma income statement and balance sheet your produced, complete a pro forma cash flow statement as well. (25 points) Calculation Operating Activities Net Profit Depreciation Change in A/P Change in Accruals Cash Flows from Operations: Statement of Cash Flows - Pro Forma Allen Products Inc. 12/31/2020 Pro Forma 2021 81 1,000 1,000 1,000 3,081 Investing Activities Increase in Fixed Assets Cash Flows from Investing: (11,000) (11,000) Financing Activities Increase in Line of Credit Cash Flows from Financing: Increase (Decrease) in Cash Beginning Cash Ending Cash: (7,919) 12,919 5,000