Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 - An investor buys $8,000 worth of a stock priced at $40 per share using 50% initial margin. The broker charges 6% on the

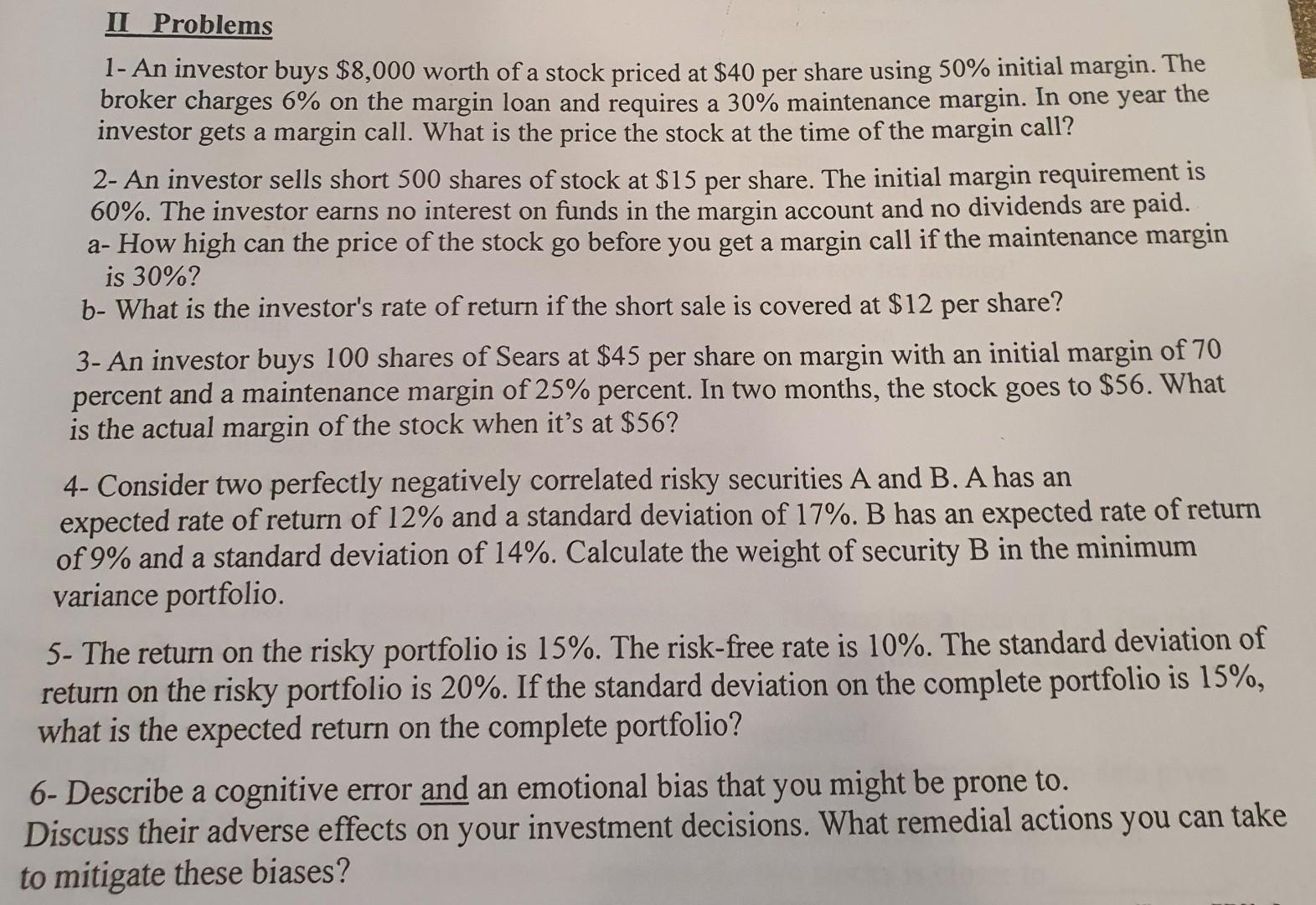

1 - An investor buys $8,000 worth of a stock priced at $40 per share using 50% initial margin. The broker charges 6% on the margin loan and requires a 30% maintenance margin. In one year the investor gets a margin call. What is the price the stock at the time of the margin call? 2- An investor sells short 500 shares of stock at $15 per share. The initial margin requirement is 60%. The investor earns no interest on funds in the margin account and no dividends are paid. a- How high can the price of the stock go before you get a margin call if the maintenance margin is 30% ? b- What is the investor's rate of return if the short sale is covered at $12 per share? 3- An investor buys 100 shares of Sears at $45 per share on margin with an initial margin of 70 percent and a maintenance margin of 25% percent. In two months, the stock goes to $56. What is the actual margin of the stock when it's at $56? 4- Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 12% and a standard deviation of 17%. B has an expected rate of return of 9% and a standard deviation of 14%. Calculate the weight of security B in the minimum variance portfolio. 5- The return on the risky portfolio is 15%. The risk-free rate is 10%. The standard deviation of return on the risky portfolio is 20%. If the standard deviation on the complete portfolio is 15%, what is the expected return on the complete portfolio? 6- Describe a cognitive error and an emotional bias that you might be prone to. Discuss their adverse effects on your investment decisions. What remedial actions you can take to mitigate these biases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started