Question

29) Highland Mining and Minerals Co. is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine will

29)

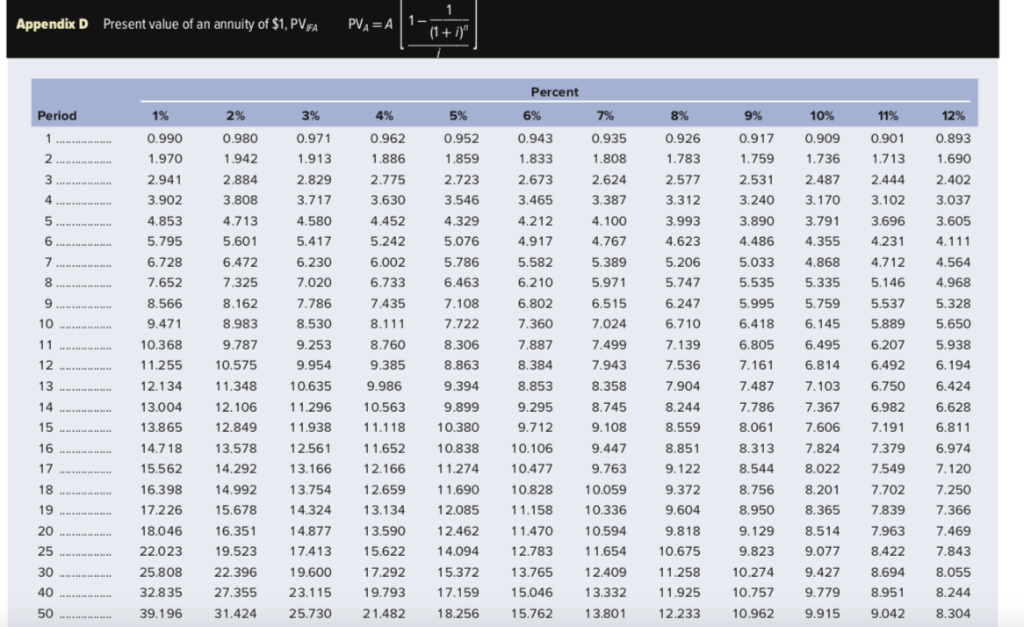

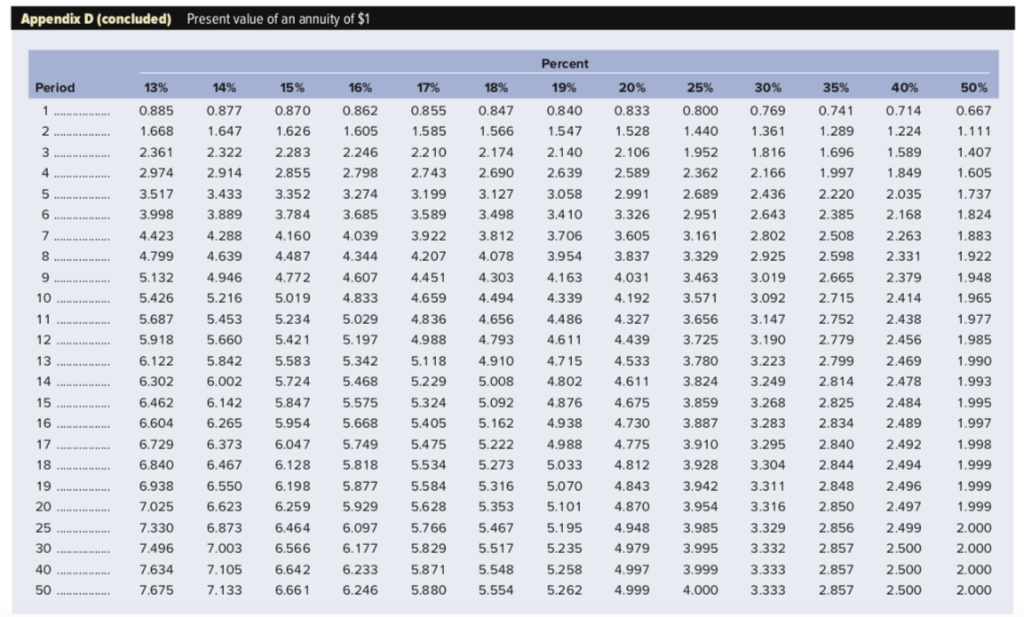

Highland Mining and Minerals Co. is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine will cost $1,630,000 and will produce $361,000 per year in years 5 through 15 and $555,000 per year in years 16 through 25. The U.S. gold mine will cost $2,020,000 and will produce $258,000 per year for the next 25 years. The cost of capital is 10 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this problem, you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years.) a-1. Calculate the net present value for each project. (Do not round intermediate calculations and round your answers to 2 decimal places.)

a-2. Which investment should be made?

-

Australian mine

-

U.S. mine

b-1. Assume the Australian mine justifies an extra 3 percent premium over the normal cost of capital because of its riskiness and relative uncertainty of cash flows. Calculate the new net present value given this assumption. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.)

b-2. Does the new assumption change the investment decision?

Appendix D Present value of an annuity of $1, PV154 PVA=A 1- (1 + i)" Period 3% 4% 8% 12% 0.926 1% 0.990 1.970 2.941 3.902 1.783 4.853 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 7.943 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 18.256 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 Percent 6% 7% 0.943 0.935 1.833 1.808 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5.389 6.210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 11.654 13.765 12.409 15.046 13.332 15.762 13.801 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 10% 11% 0.917 0.909 0.901 1.759 1.736 1.713 2.531 2.487 2.444 3.240 3.170 3.102 3.890 3.791 3.696 4.486 4.355 4.231 5.033 4.868 4.712 5.535 5.335 5.146 5.995 5.759 5.537 6.418 6.145 5.889 6.805 6.495 6.207 7.161 6.814 6.492 7.487 7.103 6.750 7.786 7.367 6.982 8.061 7.606 7.191 8.313 7.824 7.379 8.544 8.022 7.549 8.756 8.201 7.702 8.950 8.365 7.839 9.129 8.514 7.963 9.823 9.077 8.422 10.274 9.427 8.694 10.7579.7798.951 10.962 9.915 9.042 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.244 8.304 Appendix D (concluded) Present value of an annuity of $1 Period 1 . 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 7.330 7.496 7.634 7.675 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 6.873 7.003 7.105 7.133 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 6.464 6.566 6.642 6.661 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 17% 18% 0.855 0.847 1.585 1.566 2.210 2.174 2.743 2.690 3.199 3.127 3.589 3.498 3.922 3.812 4.207 4.078 4.451 4.303 4.659 4.494 4.836 4.656 4.988 4.793 5.1 18 4.910 5.229 5.008 5.324 5.092 5.405 5.162 5.475 5.222 5.534 5.273 5.584 5.316 5.628 5.353 5.766 5.467 5.829 5.517 5.8715.548 5.880 5.554 Percent 19% 0.840 1.547 2.140 2.639 3.058 3.410 3.706 3.954 4.163 4.339 4.486 4.611 4.715 4.802 4.876 4.938 4.988 5.033 5.070 5.101 5.195 5.235 5.258 5.262 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4.870 4.948 4.979 4.997 4.999 25% 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 30% 35% 0.769 0.741 1.361 1.289 1.816 1.696 2.166 1.997 2.436 2.220 2.643 2.385 2.802 2.508 2.925 2.598 3.019 2.665 3.092 2.715 3.147 2.752 3.190 2.779 3.223 2.799 3.249 2.814 3.268 2.825 3.283 2.834 3.295 2.840 3.304 2.844 3.311 2.848 3.316 2.850 3.329 2.856 3.332 2.857 3.3332.857 3.333 2 .857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 4.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started