Question

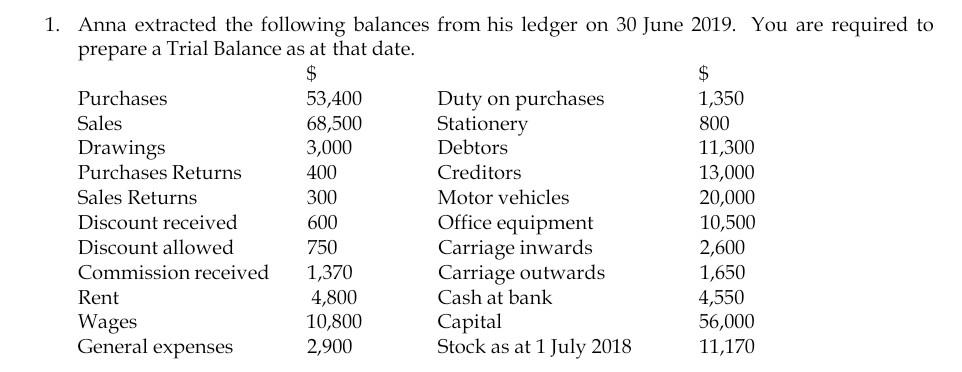

1. Anna extracted the following balances from his ledger on 30 June 2019. You are required to prepare a Trial Balance as at that

1. Anna extracted the following balances from his ledger on 30 June 2019. You are required to prepare a Trial Balance as at that date. $ $ Duty on purchases Stationery Debtors Purchases 53,400 68,500 3,000 1,350 Sales 800 Drawings Purchases Returns 11,300 400 Creditors 13,000 Sales Returns 20,000 10,500 2,600 300 Motor vehicles Office equipment Carriage inwards Carriage outwards Cash at bank Discount received 600 Discount allowed 750 Commission received 1,370 4,800 10,800 1,650 4,550 56,000 11,170 Rent Wages General expenses Capital Stock as at 1 July 2018 2,900

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

solution 7nou halane 30062019 as on NOme oF the gecount pebit crockt peunchases 53400 cales 68...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

IFRS 3rd edition

1118978080, 978-1119153726, 1119153727, 978-1119153702, 978-1118978085

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App