Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Annualizing Percentage Returns James Leddy and Austin Power compete with each other. Each one argued that he is the best investor. Please be a

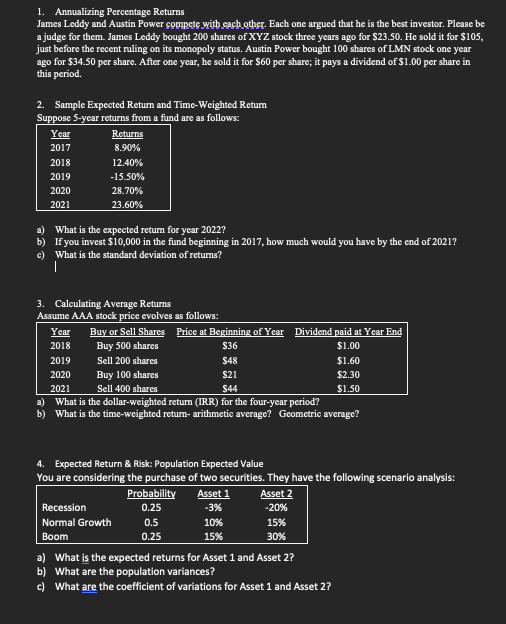

1. Annualizing Percentage Returns James Leddy and Austin Power compete with each other. Each one argued that he is the best investor. Please be a judge for them. James Leddy bought 200 shares of XYZ stock three years ago for $23.50. He sold it for $105, just before the recent ruling on its monopoly status. Austin Power bought 100 shares of LMN stock one year ago for $34.50 per share. After one year, he sold it for $60 per share; it pays a dividend of $1.00 per share in this period. 2. Sample Expected Return and Time-Weighted Return Suppose 5-year returns from a fund are as follows: a) What is the expected return for year 2022 ? b) If you invest $10,000 in the fund beginning in 2017 , how much would you have by the end of 2021 ? c) What is the standard deviation of returns? 3. Calculating Average Returns Assume AAA stock price evolves as follows: a) What is the dollar-weighted return (IRR) for the four-year period? b) What is the time-weighted return- arithmetic average? Geometric average? 4. Expected Return \& Risk: Population Expected Value You are considering the purchase of two securities. They have the following scenario analysis: a) What is the expected returns for Asset 1 and Asset 2? b) What are the population variances? c) What are the coefficient of variations for Asset 1 and Asset 2

1. Annualizing Percentage Returns James Leddy and Austin Power compete with each other. Each one argued that he is the best investor. Please be a judge for them. James Leddy bought 200 shares of XYZ stock three years ago for $23.50. He sold it for $105, just before the recent ruling on its monopoly status. Austin Power bought 100 shares of LMN stock one year ago for $34.50 per share. After one year, he sold it for $60 per share; it pays a dividend of $1.00 per share in this period. 2. Sample Expected Return and Time-Weighted Return Suppose 5-year returns from a fund are as follows: a) What is the expected return for year 2022 ? b) If you invest $10,000 in the fund beginning in 2017 , how much would you have by the end of 2021 ? c) What is the standard deviation of returns? 3. Calculating Average Returns Assume AAA stock price evolves as follows: a) What is the dollar-weighted return (IRR) for the four-year period? b) What is the time-weighted return- arithmetic average? Geometric average? 4. Expected Return \& Risk: Population Expected Value You are considering the purchase of two securities. They have the following scenario analysis: a) What is the expected returns for Asset 1 and Asset 2? b) What are the population variances? c) What are the coefficient of variations for Asset 1 and Asset 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started