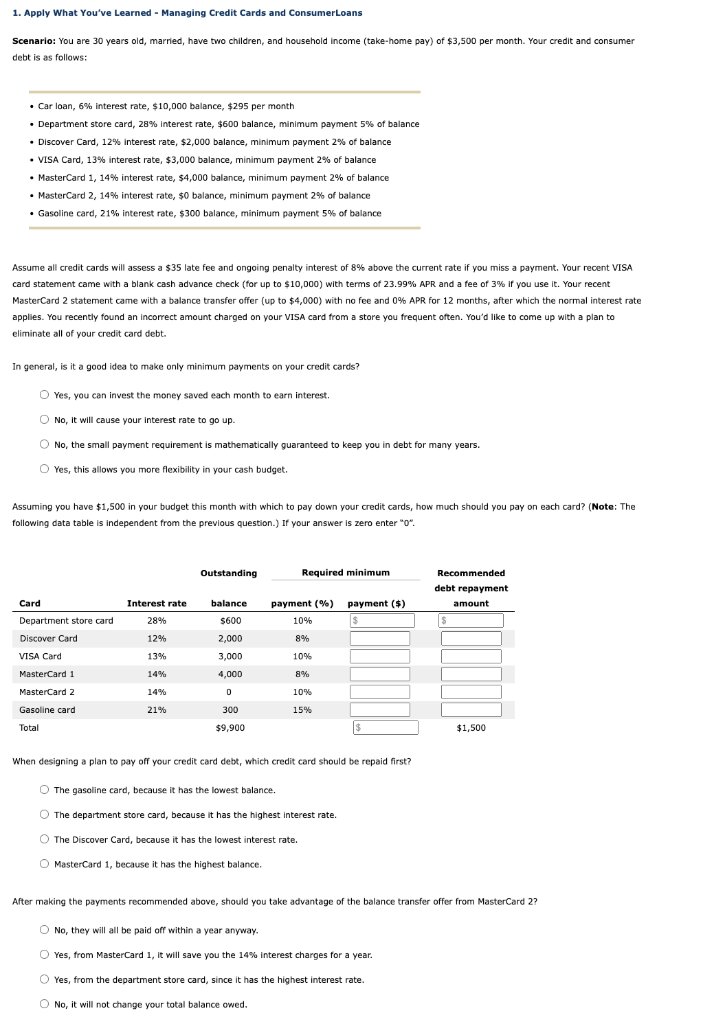

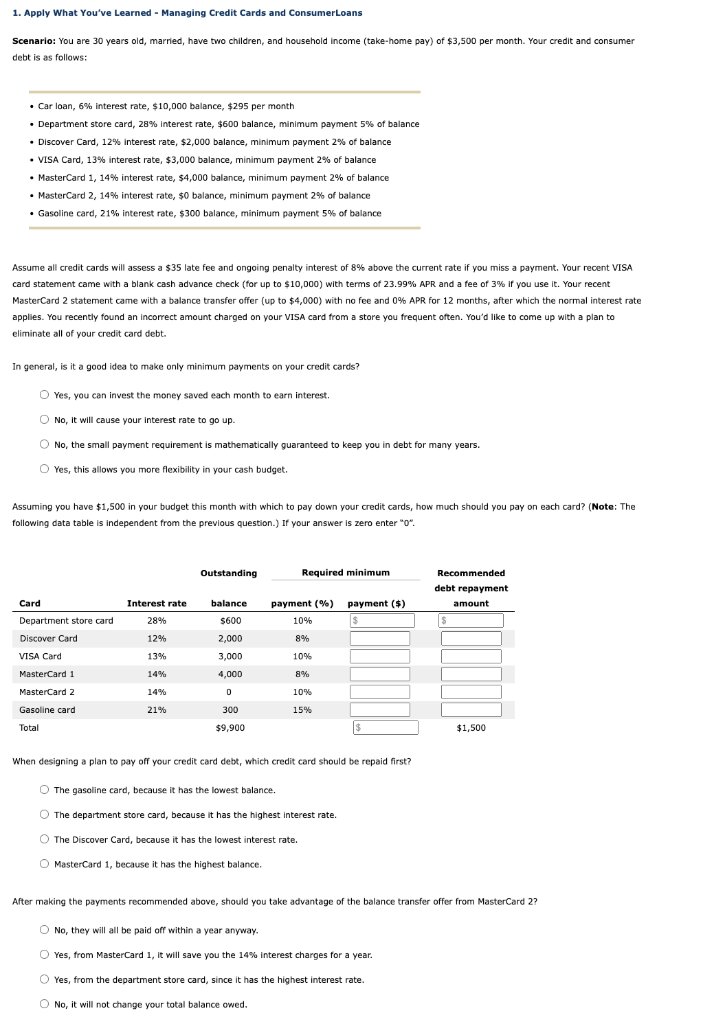

1. Apply What You've Learned - Managing Credit Cards and ConsumerLoans - Scenario: You are 30 years old, married, have two children, and household income (take-home pay) of $3,500 per month. Your credit and consumer , $. debt is as follows: . , 6 . Car loan, 6% interest rate, $10,000 balance, $295 per month . $, Department store card, 28% interest rate, $600 balance, minimum payment 5% of balance Discover Card, 12% Interest rate, $2,000 balance, minimum payment 2% of balance . VISA Card, 13% interest rate, $3,000 balance, minimum payment 2% of balance MasterCard 1, 14% interest rate, $4,000 balance, minimum payment 2% of balance 0 MasterCard 2, 14% interest rate, $0 balance, minimum payment 2% of balance Gasoline card, 21% interest rate, $300 balance, minimum payment 5% of balance , , Assume all credit cards will assess a $35 late fee and ongoing penalty interest of 8% above the current rate if you miss a payment. Your recent VISA card statement came with a blank cash advance check (for up to $10,000) with terms of 23.99% APR and a fee of 3% if you use it. Your recent MasterCard 2 statement came with a balance transfer offer (up to $4,000) with no fee and 0% APR for 12 months, after which the normal interest rate applies. You recently found an incorrect amount charged on your VISA card from a store you frequent often. You'd like to come up with a plan to a . a eliminate all of your credit card debt. In general, is it a good idea to make only minimum payments on your credit cards? Yes, you can invest the money saved each month to earn interest O No, it will cause your interest rate to go up O No, the small payment requirement is mathematically guaranteed to keep you in debt for many years. , Yes, this allows you more flexibility in your cash budget. Assuming you have $1,500 in your budget this month with which to pay down your credit cards, how much should you pay on each card? (Note: The following data table is independent from the previous question. If your answer is zero enter "o". Outstanding Required minimum Recommended debt repayment amount balance Card Department store card Interest rate 28% payment (%) payment ($) 10% $600 Discover Card 12% 2,000 8% 13% 10% VISA Card MasterCard 1 1 MasterCard 2 3,000 4,000 14% 8% 14% D 10% Gasoline card 21% 300 15% Total $9,900 $ $1,500 When designing a plan to pay off your credit card debt, which credit card should be repaid first? ? The gasoline card, because it has the lowest balance. The department store card, because it has the highest interest rate. The Discover Card, because it has the lowest interest rate. O MasterCard 1, because it has the highest balance. 1. After making the payments recommended above, should you take advantage of the balance transfer offer from MasterCard 2? , 2 No, they will all be paid off within a year anyway. , Yes, from MasterCard 1, it will save you the 14% interest charges for a year. Yes, from the department store card, since it has the highest interest rate. No, it will not change your total balance owed. 1. Apply What You've Learned - Managing Credit Cards and ConsumerLoans - Scenario: You are 30 years old, married, have two children, and household income (take-home pay) of $3,500 per month. Your credit and consumer , $. debt is as follows: . , 6 . Car loan, 6% interest rate, $10,000 balance, $295 per month . $, Department store card, 28% interest rate, $600 balance, minimum payment 5% of balance Discover Card, 12% Interest rate, $2,000 balance, minimum payment 2% of balance . VISA Card, 13% interest rate, $3,000 balance, minimum payment 2% of balance MasterCard 1, 14% interest rate, $4,000 balance, minimum payment 2% of balance 0 MasterCard 2, 14% interest rate, $0 balance, minimum payment 2% of balance Gasoline card, 21% interest rate, $300 balance, minimum payment 5% of balance , , Assume all credit cards will assess a $35 late fee and ongoing penalty interest of 8% above the current rate if you miss a payment. Your recent VISA card statement came with a blank cash advance check (for up to $10,000) with terms of 23.99% APR and a fee of 3% if you use it. Your recent MasterCard 2 statement came with a balance transfer offer (up to $4,000) with no fee and 0% APR for 12 months, after which the normal interest rate applies. You recently found an incorrect amount charged on your VISA card from a store you frequent often. You'd like to come up with a plan to a . a eliminate all of your credit card debt. In general, is it a good idea to make only minimum payments on your credit cards? Yes, you can invest the money saved each month to earn interest O No, it will cause your interest rate to go up O No, the small payment requirement is mathematically guaranteed to keep you in debt for many years. , Yes, this allows you more flexibility in your cash budget. Assuming you have $1,500 in your budget this month with which to pay down your credit cards, how much should you pay on each card? (Note: The following data table is independent from the previous question. If your answer is zero enter "o". Outstanding Required minimum Recommended debt repayment amount balance Card Department store card Interest rate 28% payment (%) payment ($) 10% $600 Discover Card 12% 2,000 8% 13% 10% VISA Card MasterCard 1 1 MasterCard 2 3,000 4,000 14% 8% 14% D 10% Gasoline card 21% 300 15% Total $9,900 $ $1,500 When designing a plan to pay off your credit card debt, which credit card should be repaid first? ? The gasoline card, because it has the lowest balance. The department store card, because it has the highest interest rate. The Discover Card, because it has the lowest interest rate. O MasterCard 1, because it has the highest balance. 1. After making the payments recommended above, should you take advantage of the balance transfer offer from MasterCard 2? , 2 No, they will all be paid off within a year anyway. , Yes, from MasterCard 1, it will save you the 14% interest charges for a year. Yes, from the department store card, since it has the highest interest rate. No, it will not change your total balance owed