Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AutoSave file Home X Cut 2 - Design - Layout - Insert 0 Comm References Mailings Review View Help Documenti - Word Ibekwe, Kem :

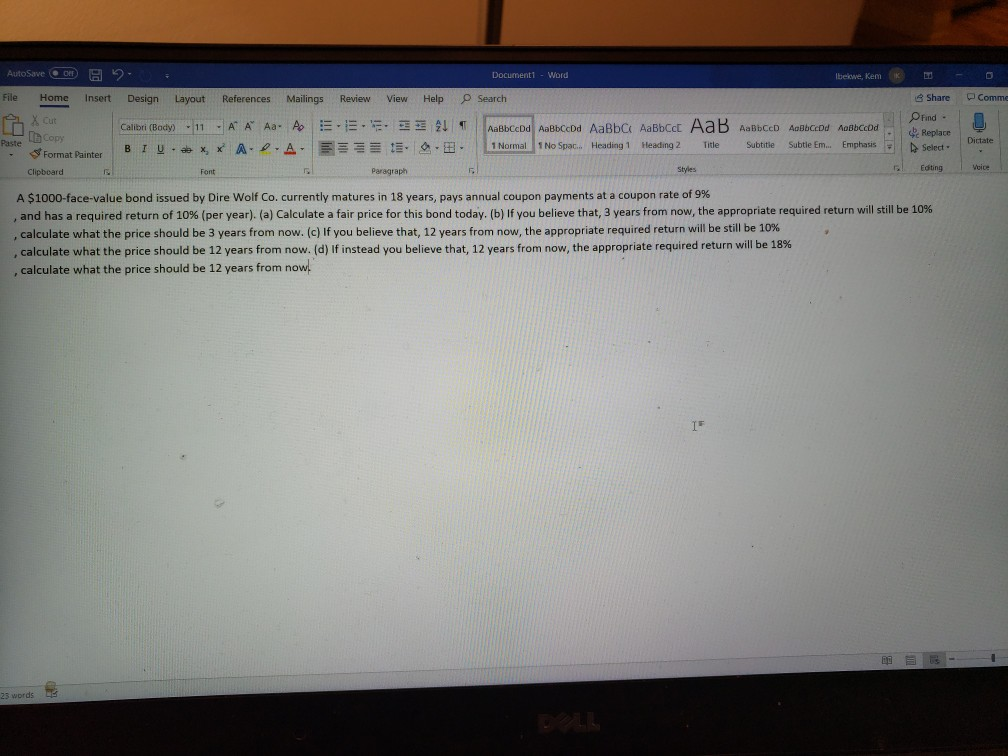

AutoSave file Home X Cut 2 - Design - Layout - Insert 0 Comm References Mailings Review View Help Documenti - Word Ibekwe, Kem : Search II AaBbcd AaBbceDd AaBbc Aabbcc AaB AabbCD Abod Abood 1 Normal 1 No Space Heading 1 Heading 2 Title Subtitle Subtle Em. Emphasis E 1 Calibr (Body) - 11 BIU. , * faste the Copy A A A A-D Share e Find 4 Replace Select A - - A E Dictate Format Painter Clipboard E . Paragraph Styles Editing A $1000-face-value bond issued by Dire Wolf Co. currently matures in 18 years, pays annual coupon payments at a coupon rate of 9% and has a required return of 10% (per year). (a) Calculate a fair price for this bond today. (b) If you believe that, 3 years from now, the appropriate required return will still be 10% calculate what the price should be 3 years from now. (c) If you believe that, 12 years from now, the appropriate required return will be still be 10% calculate what the price should be 12 years from now. (d) if instead you believe that, 12 years from now, the appropriate required return will be 18% calculate what the price should be 12 years from now

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started