Question

1/ As the assistant to the Chief Financial Oce for Volkswagen, you've been tasked with managing their international operations so as to facilitate the coordination

1/ As the assistant to the Chief Financial Oce for Volkswagen, you've been tasked with managing their

international operations so as to facilitate the coordination of their manufacturing networks. More speci-

cally, you've be presented with the following scenarios and asked to present a 'transnational solution' with

cash currently on hand. As such, you are considering exchanging Swiss Francs (CHF) for Japanese Yen

(JPY). At the bank you see the following.

CHF/USD 1.6933

USD/JPY: 115.44

_What is the JPY/CHF exchange rate?

_What is the CHF/JPY exchange rate?

_If the CHF appreciates by 10%; what would the new JPY/CHF rate be?

_If the JPY lost 25% of its quoted value against the CHF, what would the new JPY/CHF rate be?

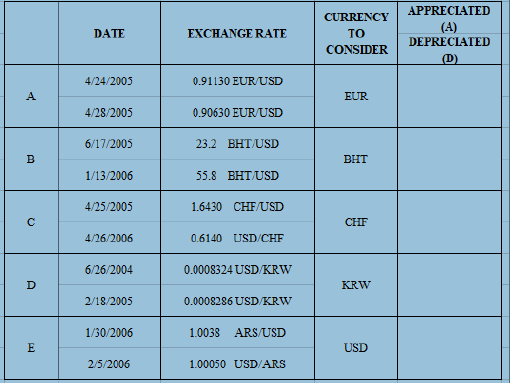

2/

On behalf of CFO Homan, complete the following table, indicating, which currency has appreciated

(denoted 'A") and which currency has depreciated (denoted 'B').

NOTE: You have been given a mixture of direct and indirect quotes

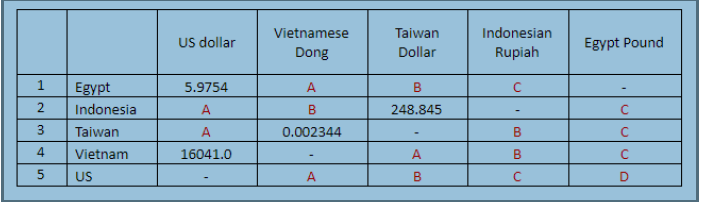

3/

Volkswagen is considering production diversication and thus considering the acquisition of an electrical

components plant. The potential plants are located in Egypt, Indonesia, Taiwan, Vietnam and the USA.

To better understand the acquisition cost, complete the following cross-rates. Label answers as follows:

1A, 1B, 2A, 2B etc.

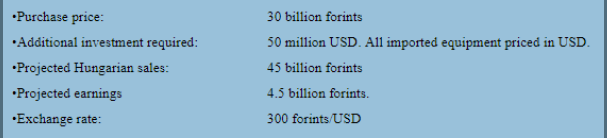

4/

Volkswagen may ultimately choose a plant outside of the ones listed in Question 6, opting for the country

Forinta - where the local currency is the forints. The projected investment and returns are as follows:

What would be their total total investment (in dollars)?

Once the plant is up and running, what would the annual percentage return on investment?

If the forint is devalued by 25 percent., what would the new exchange rate be?

DATE EXCHANGE RATE CURRENCY TO CONSIDER APPRECIATED (A) DEPRECIATED D) 4/24/2005 0.91130 EUR USD EUR 4/28/2005 0.90630 EUR/USD 6/17/2005 23.2 BHT USD BHT 1/13/2006 55.8 BHT USD 4/25/2005 1.6430 CHF/USD CHF 4/26/2006 0.6140 USD CHF 6/26/2004 0.0008324 USD/KRW KRW 2/18/2005 0.0008286 USD/KRW 1/30/2006 1.0038 ARS/USD USD 2/5/2006 1.00050 USD ARS US dollar Vietnamese Dong Taiwan Dollar Indonesian Rupiah Egypt Pound 5.9754 A 1 2 3 Egypt Indonesia Taiwan Vietnam US 0.002344 BC 248.845 - - B LA A A 16041.0 . C 5 1 Purchase price: Additional investment required: Projected Hungarian sales: Projected earnings Exchange rate: 30 billion forints 50 million USD. All imported equipment priced in USD. 45 billion forints 4.5 billion forints. 300 forints/USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started