Question

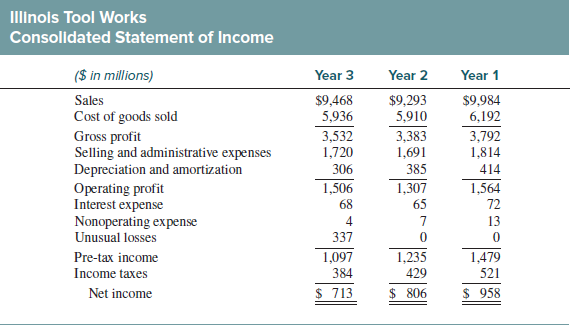

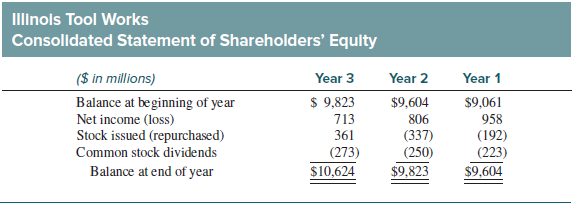

1. Assume a 10-year forecasting horizon. Note that ITWs Year 3 return on beginning stockholders equity (net income divided by beginning Year 3 stockholders equity),

1. Assume a 10-year forecasting horizon. Note that ITWs Year 3 return on beginning stockholders equity (net income divided by beginning Year 3 stockholders equity), adjusted to exclude unusual items and their tax effects, is 9.5%. (If we add $337 0.65 = $219 back to net income, we get $713 + $219 = $932 of adjusted net income. Dividing that amount by $9,823 gives 9.5%.) Assume return on beginning stockholders equity will persist at 9.5% throughout the forecasting horizon, with no additional unusual items. That is, expected net income is always equal to 0.095 multiplied by beginning-of-the-year stockholders equity. Also assume that no additional stock issuances or repurchases are made and that dividends equal 25% of net income in each year. (This is ITWs approximate historical dividend payout ratio.) Given these assumptions, the book value of stockholders equity at the end of Year 4 equals book value at the beginning of Year 4 plus (1 0.25) times Year 4 net income. Finally assume that the cost of equity capital is 9%. (This is ITWs approximate cost of equity capital.) With these relatively simple assumptions, use the abnormal earnings model to estimate the total value of Illinois Tool Works common shares as of the end of Year 3. Ignore terminal values at the end of the 10-year forecast horizon in your calculations.

2. As of the end of Year 3, 307 million common shares were outstanding. Convert your estimate in requirement 1 to a per share estimate. For purposes of comparison, the actual market value of ITWs common shares ranged from $56 to $64 during the first quarter of Year 4.

3. Now assume that ITW will maintain a 16% return on beginning stockholders equity over the 10-year forecast horizon. What would the companys shares then be worth?

Please answer Q3

Illinols Tool Works Consolidated Statement of Income (S in millions) Sales Cost of goods sold Gross profit Selling and administraive expenses Depreciation and amortization Operating profit Interest expense Nonoperating expense Unusual losses Pre-tax income Income taxes Year 3 Year 2 Year 1 $9,468 5,936 3,532 1,720 306 1,506 68 4 337 1,097 384 713 $9,293 5,910 3.383 1,691 385 1,307 65 $9,984 6,192 3.792 1,814 414 1,564 72 13 1,235 429 1,479 521 $ 958 Net income 806 Illinols Tool Works Consolidated Statement of Shareholders' Equity (S in millions) Year 3 Year 2 Balance at beginning of year Net income (loss) Stock issued (repurchased) Common stock dividends 9,823 713 361 (273) $10,624 $9,604 806 (337) (250) Year 1 $9,061 958 (192) (223) $9,604 Balance at end of year Illinols Tool Works Consolidated Statement of Income (S in millions) Sales Cost of goods sold Gross profit Selling and administraive expenses Depreciation and amortization Operating profit Interest expense Nonoperating expense Unusual losses Pre-tax income Income taxes Year 3 Year 2 Year 1 $9,468 5,936 3,532 1,720 306 1,506 68 4 337 1,097 384 713 $9,293 5,910 3.383 1,691 385 1,307 65 $9,984 6,192 3.792 1,814 414 1,564 72 13 1,235 429 1,479 521 $ 958 Net income 806 Illinols Tool Works Consolidated Statement of Shareholders' Equity (S in millions) Year 3 Year 2 Balance at beginning of year Net income (loss) Stock issued (repurchased) Common stock dividends 9,823 713 361 (273) $10,624 $9,604 806 (337) (250) Year 1 $9,061 958 (192) (223) $9,604 Balance at end of year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started