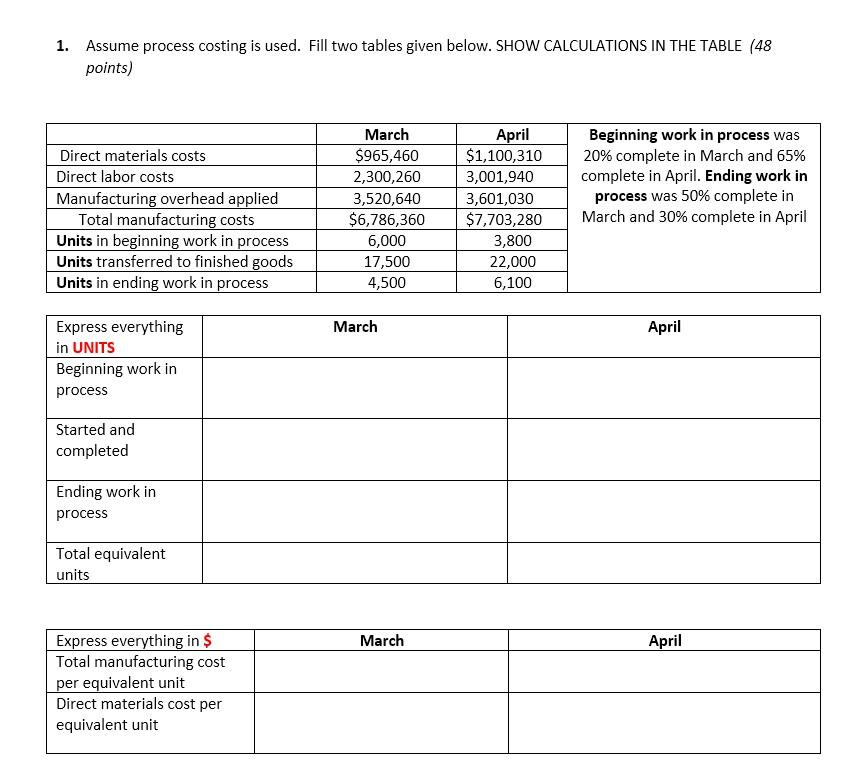

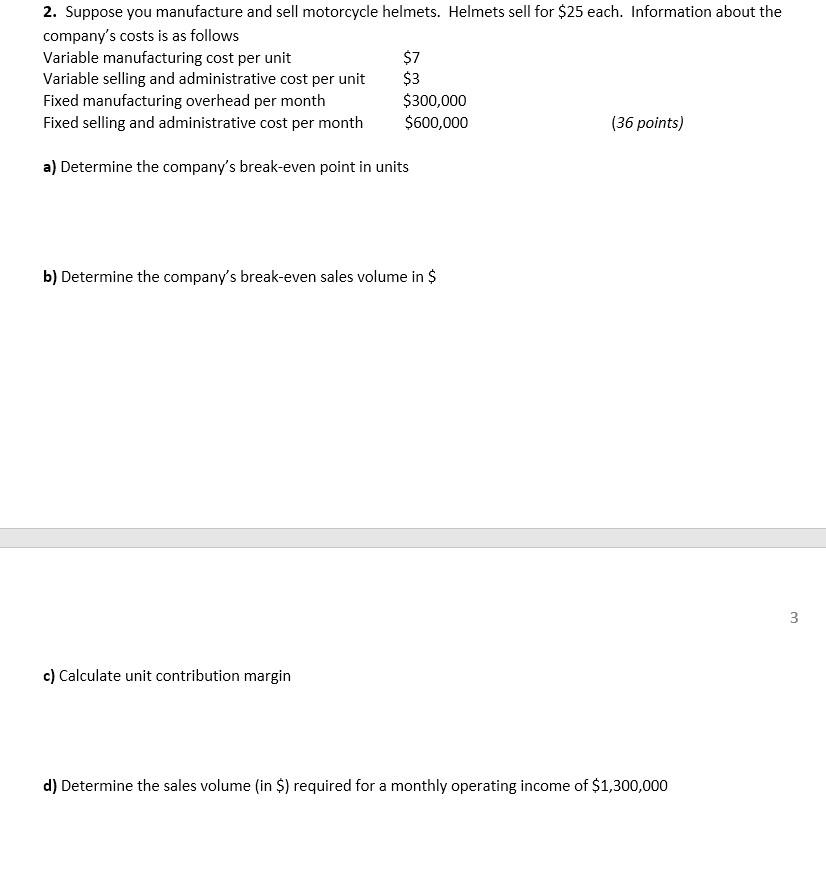

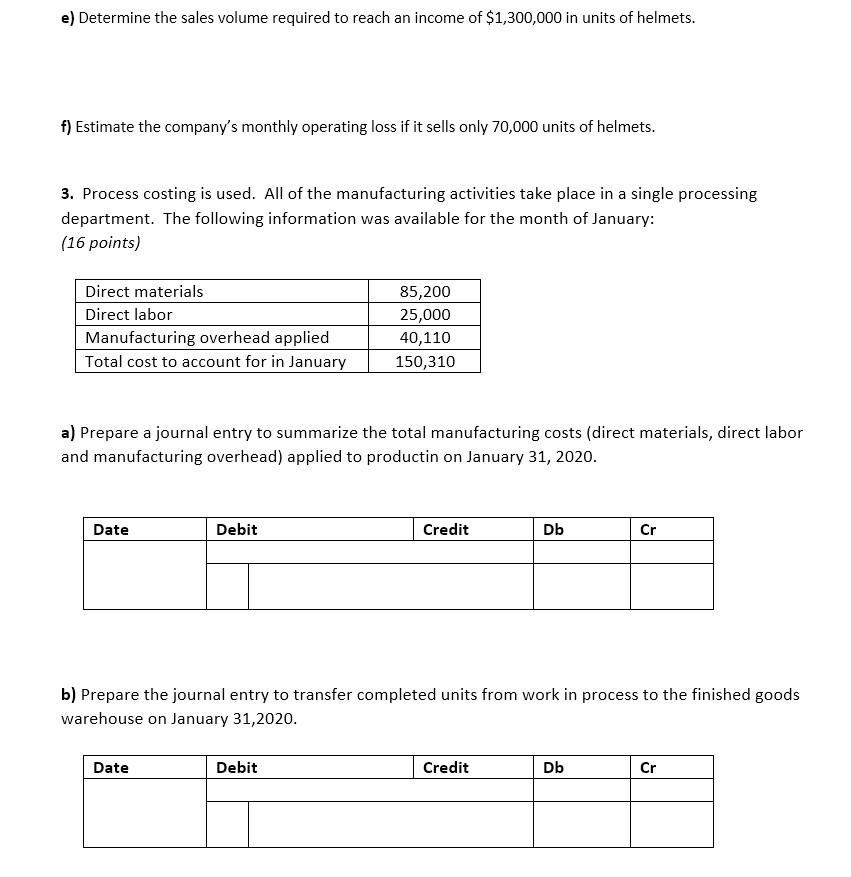

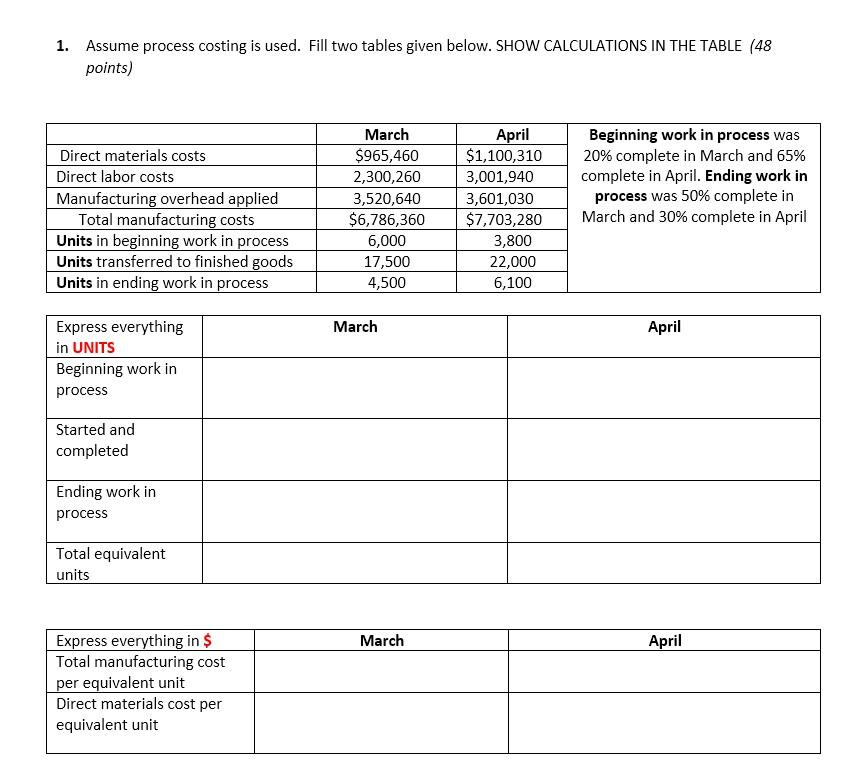

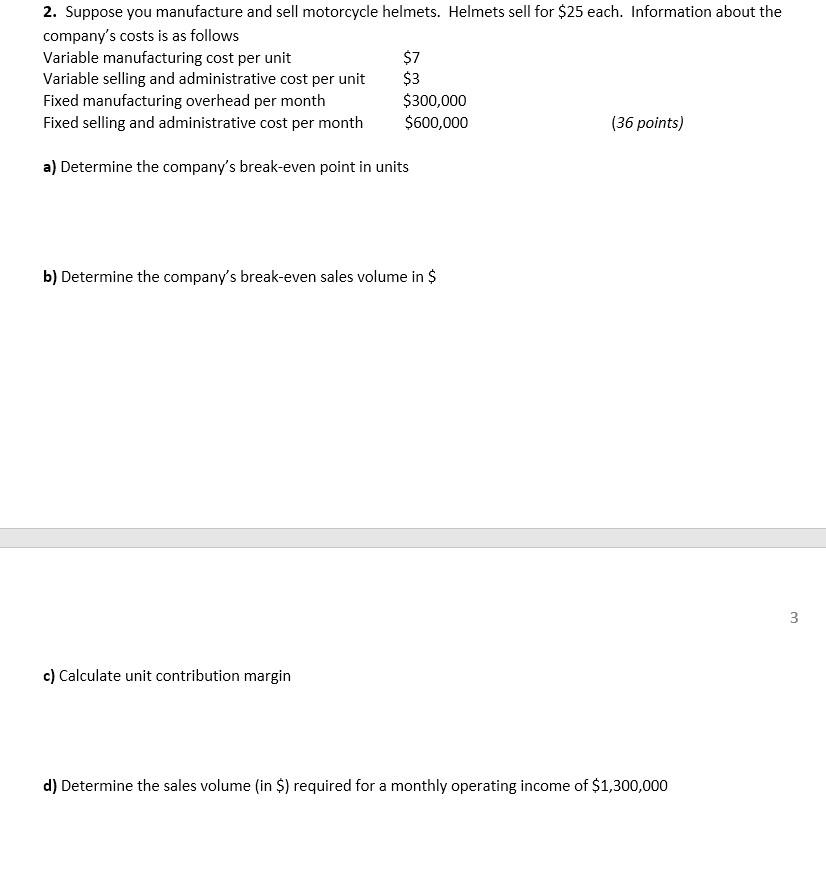

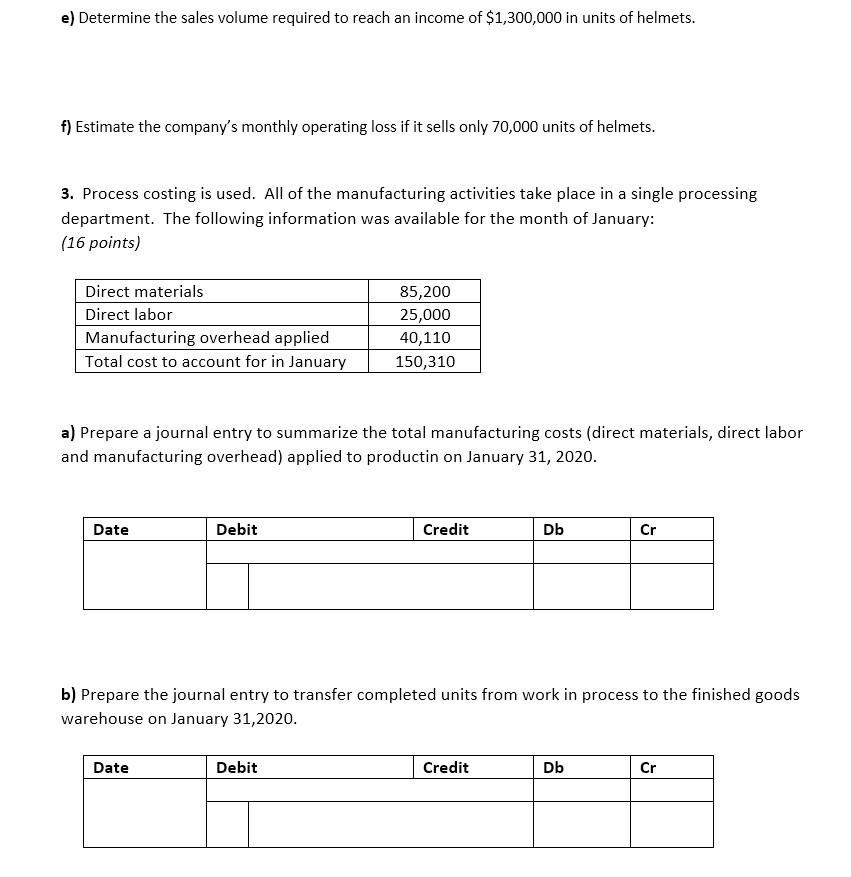

1. Assume process costing is used. Fill two tables given below. SHOW CALCULATIONS IN THE TABLE (48 points) Direct materials costs Direct labor costs March $965,460 2,300,260 3,520,640 $6,786,360 6,000 17,500 4,500 Manufacturing overhead applied Total manufacturing costs Units in beginning work in process Units transferred to finished goods Units in ending work in process April $1,100,310 3,001,940 3,601,030 $7,703,280 3,800 22,000 6,100 Beginning work in process was 20% complete in March and 65% complete in April. Ending work in process was 50% complete in March and 30% complete in April March April Express everything in UNITS Beginning work in process Started and completed Ending work in process Total equivalent units March April Express everything in $ Total manufacturing cost per equivalent unit Direct materials cost per equivalent unit 2. Suppose you manufacture and sell motorcycle helmets. Helmets sell for $25 each. Information about the company's costs is as follows Variable manufacturing cost per unit $7 Variable selling and administrative cost per unit $3 Fixed manufacturing overhead per month $300,000 Fixed selling and administrative cost per month $600,000 (36 points) a) Determine the company's break-even point in units b) Determine the company's break-even sales volume in $ 3 c) Calculate unit contribution margin d) Determine the sales volume (in $) required for a monthly operating income of $1,300,000 e) Determine the sales volume required to reach an income of $1,300,000 in units of helmets. f) Estimate the company's monthly operating loss if it sells only 70,000 units of helmets. 3. Process costing is used. All of the manufacturing activities take place in a single processing department. The following information was available for the month of January: (16 points) Direct materials Direct labor 85,200 25,000 40,110 Manufacturing overhead applied Total cost to account for in January 150,310 a) Prepare a journal entry to summarize the total manufacturing costs (direct materials, direct labor and manufacturing overhead) applied to productin on January 31, 2020. Date Debit Credit Db Cr b) Prepare the journal entry to transfer completed units from work in process to the finished goods warehouse on January 31,2020. Date Debit Credit Db Cr