Answered step by step

Verified Expert Solution

Question

1 Approved Answer

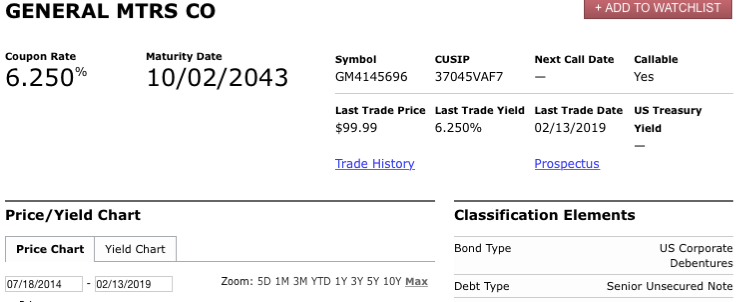

1. Assume that par value of the bond is $1,000. What were the last prices of the bonds in $$$? Show your work. 2. Assume

1. Assume that par value of the bond is $1,000. What were the last prices of the bonds in $$$? Show your work. 2. Assume that par value of the bond is $1,000. Calculate the annual coupon interest payments. Show your work. 3. Assume that par value of the bond is $1,000. Calculate the current yield of the bonds. Show your work. 4. How much is the YTM listed in quotations is for the bonds? Explain the meaning of YTM?

GENERAL MTRS CO +ADD TO WATCHLIST Coupon Rate Maturity Date Symbol CUSIP Next Call Date 6.250% 10/02/2043 GM4 145696 37045VAF7 Callable Yes Last Trade Price $99.99 Last Trade Yield 6.250% Last Trade Date 02/13/2019 US Treasury Yield Price/Yield Chart Classification Elements Bond Type Debt Type Price Chart Yield Chart US Corporate Debentures 07/18/2014-02/13/2019 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Senior UnsecuredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started