Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Assume that the following assets are correctly priced according to the security market line. Derive the security market line. What is the expected

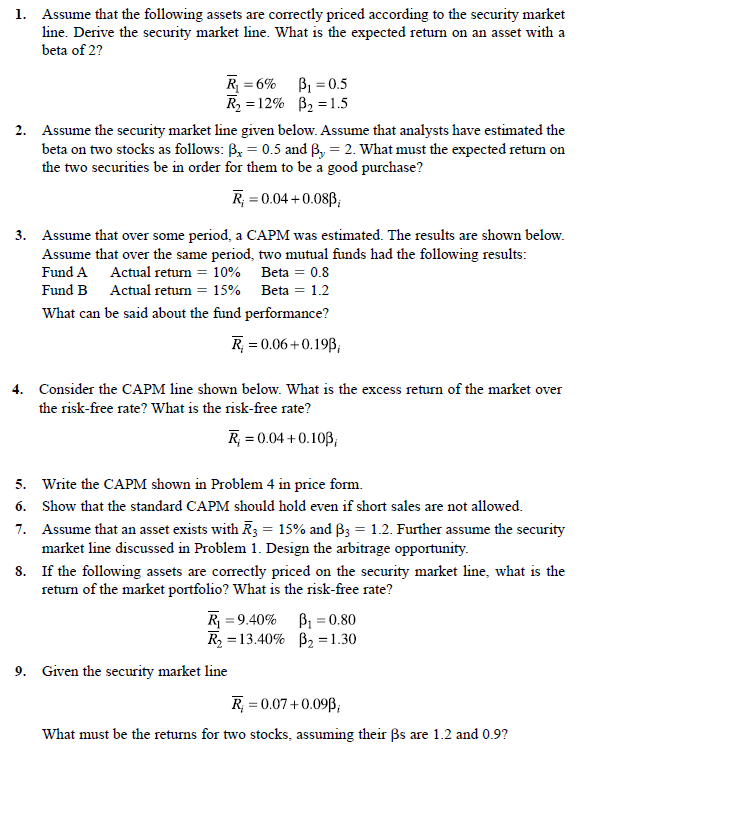

1. Assume that the following assets are correctly priced according to the security market line. Derive the security market line. What is the expected return on an asset with a beta of 2? R = 6% B=0.5 R = 12% B = 1.5 2. Assume the security market line given below. Assume that analysts have estimated the beta on two stocks as follows: B, = 0.5 and B, 2. What must the expected return on the two securities be in order for them to be a good purchase? R = 0.04 +0.083; 3. Assume that over some period, a CAPM was estimated. The results are shown below. Assume that over the same period, two mutual funds had the following results: Fund A Actual return = 10% Beta = 0.8 Fund B Actual return = 15% Beta = 1.2 What can be said about the fund performance? R = 0.06+0.193, 4. Consider the CAPM line shown below. What is the excess return of the market over the risk-free rate? What is the risk-free rate? R = 0.04 +0.103, 5. Write the CAPM shown in Problem 4 in price form. 6. Show that the standard CAPM should hold even if short sales are not allowed. 7. Assume that an asset exists with R3 = 15% and B3 = 1.2. Further assume the security market line discussed in Problem 1. Design the arbitrage opportunity. 8. If the following assets are correctly priced on the security market line, what is the return of the market portfolio? What is the risk-free rate? R = 9.40% B=0.80 R13.40% B = 1.30 9. Given the security market line R = 0.07 +0.09B, What must be the returns for two stocks, assuming their s are 1.2 and 0.9?

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started