Answered step by step

Verified Expert Solution

Question

1 Approved Answer

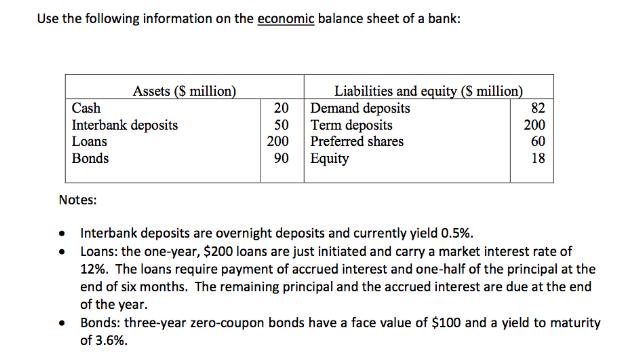

Use the following information on the economic balance sheet of a bank: Assets ($ million) Cash 20 Liabilities and equity (S million) Demand deposits

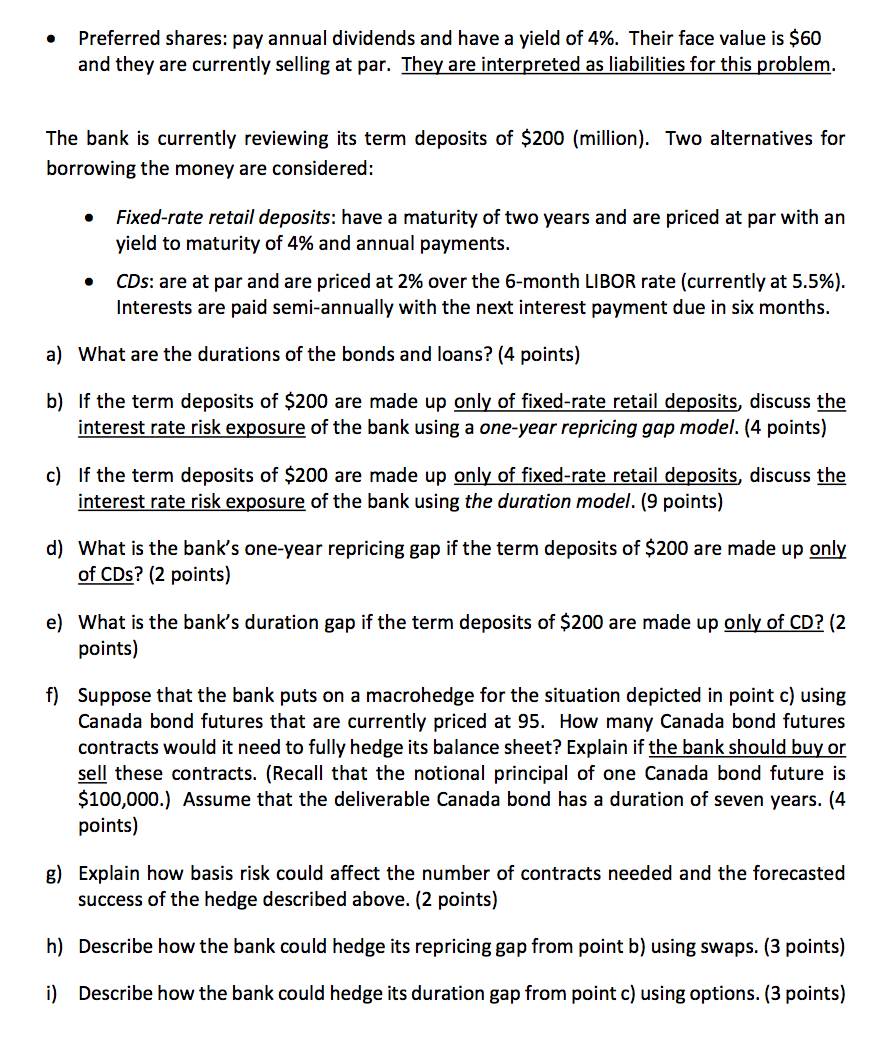

Use the following information on the economic balance sheet of a bank: Assets ($ million) Cash 20 Liabilities and equity (S million) Demand deposits Interbank deposits 50 Term deposits Loans 200 Preferred shares Bonds Notes: 90 Equity 82 200 60 18 Interbank deposits are overnight deposits and currently yield 0.5%. Loans: the one-year, $200 loans are just initiated and carry a market interest rate of 12%. The loans require payment of accrued interest and one-half of the principal at the end of six months. The remaining principal and the accrued interest are due at the end of the year. Bonds: three-year zero-coupon bonds have a face value of $100 and a yield to maturity of 3.6%. Preferred shares: pay annual dividends and have a yield of 4%. Their face value is $60 and they are currently selling at par. They are interpreted as liabilities for this problem. The bank is currently reviewing its term deposits of $200 (million). Two alternatives for borrowing the money are considered: Fixed-rate retail deposits: have a maturity of two years and are priced at par with an yield to maturity of 4% and annual payments. CDs: are at par and are priced at 2% over the 6-month LIBOR rate (currently at 5.5%). Interests are paid semi-annually with the next interest payment due in six months. a) What are the durations of the bonds and loans? (4 points) b) If the term deposits of $200 are made up only of fixed-rate retail deposits, discuss the interest rate risk exposure of the bank using a one-year repricing gap model. (4 points) c) If the term deposits of $200 are made up only of fixed-rate retail deposits, discuss the interest rate risk exposure of the bank using the duration model. (9 points) d) What is the bank's one-year repricing gap if the term deposits of $200 are made up only of CDs? (2 points) e) What is the bank's duration gap if the term deposits of $200 are made up only of CD? (2 points) f) Suppose that the bank puts on a macrohedge for the situation depicted in point c) using Canada bond futures that are currently priced at 95. How many Canada bond futures contracts would it need to fully hedge its balance sheet? Explain if the bank should buy or sell these contracts. (Recall that the notional principal of one Canada bond future is $100,000.) Assume that the deliverable Canada bond has a duration of seven years. (4 points) g) Explain how basis risk could affect the number of contracts needed and the forecasted success of the hedge described above. (2 points) h) Describe how the bank could hedge its repricing gap from point b) using swaps. (3 points) i) Describe how the bank could hedge its duration gap from point c) using options. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the durations of the bonds and loans we can use the formula Duration PVTPriceDelta y 1 Bonds Duration of the bonds 1003900036 833 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started