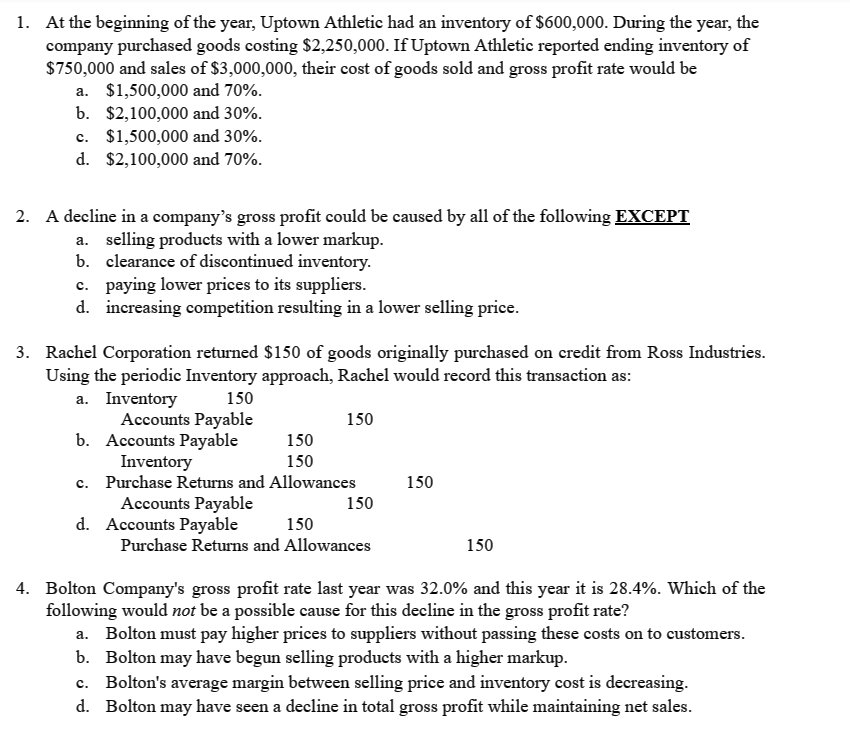

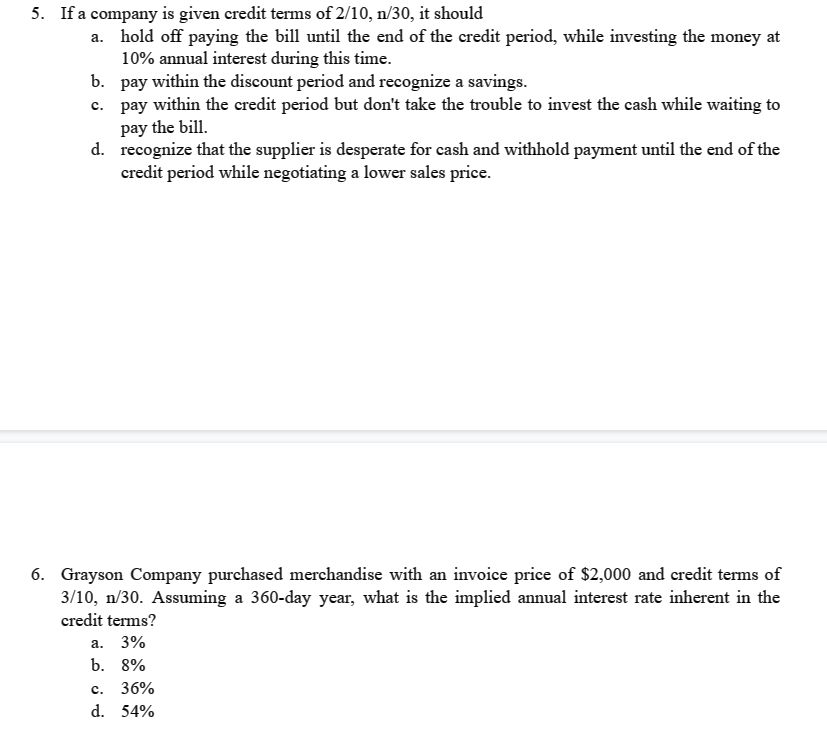

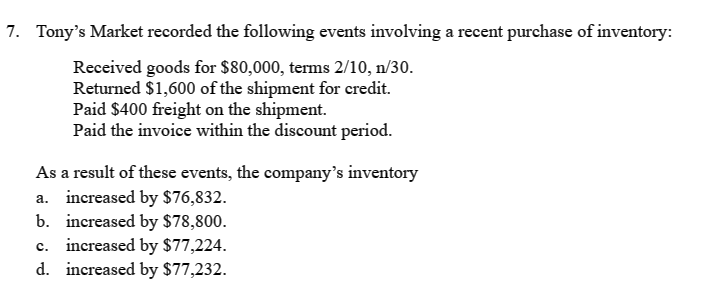

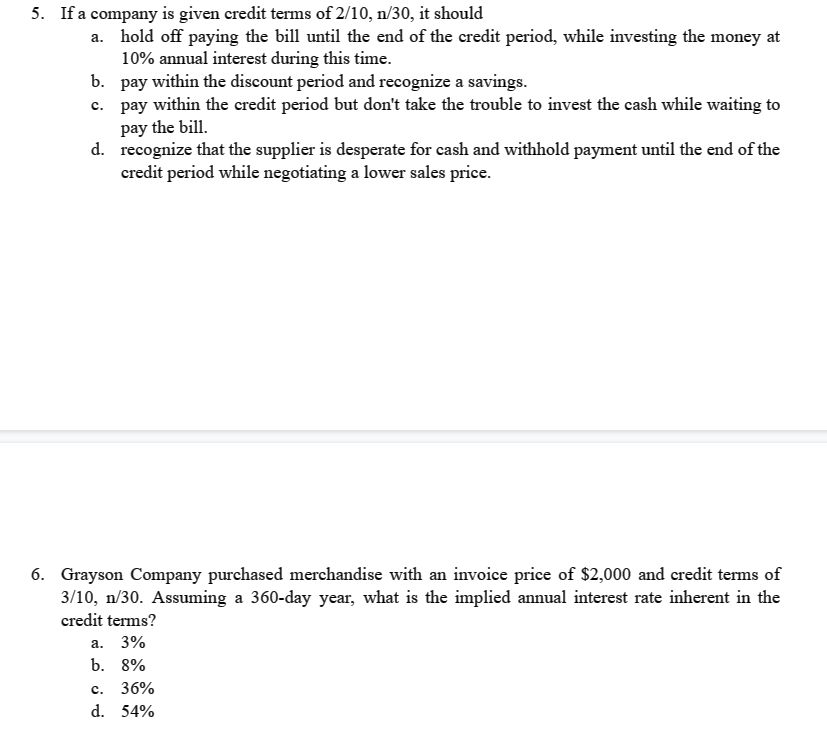

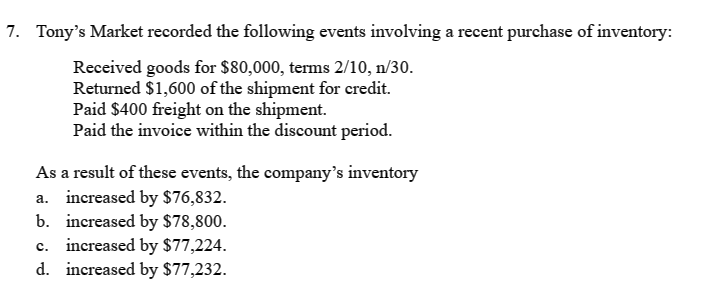

1. At the beginning of the year, Uptown Athletic had an inventory of $600,000. During the year, the company purchased goods costing $2,250,000. If Uptown Athletic reported ending inventory of $750,000 and sales of $3,000,000, their cost of goods sold and gross profit rate would be a. $1,500,000 and 70%. b. $2,100,000 and 30%. c. $1,500,000 and 30%. d. $2,100,000 and 70%. 2. A decline in a company's gross profit could be caused by all of the following EXCEPT a. selling products with a lower markup. b. clearance of discontinued inventory. c. paying lower prices to its suppliers. d. increasing competition resulting in a lower selling price. 3. Rachel Corporation returned $150 of goods originally purchased on credit from Ross Industries. Using the periodic Inventory approach, Rachel would record this transaction as: a. Inventory 150 4. Bolton Company's gross profit rate last year was 32.0% and this year it is 28.4%. Which of the following would not be a possible cause for this decline in the gross profit rate? a. Bolton must pay higher prices to suppliers without passing these costs on to customers. b. Bolton may have begun selling products with a higher markup. c. Bolton's average margin between selling price and inventory cost is decreasing. d. Bolton may have seen a decline in total gross profit while maintaining net sales. 5. If a company is given credit terms of 2/10,n/30, it should a. hold off paying the bill until the end of the credit period, while investing the money at 10% annual interest during this time. b. pay within the discount period and recognize a savings. c. pay within the credit period but don't take the trouble to invest the cash while waiting to pay the bill. d. recognize that the supplier is desperate for cash and withhold payment until the end of the credit period while negotiating a lower sales price. 6. Grayson Company purchased merchandise with an invoice price of $2,000 and credit terms of 3/10,n/30. Assuming a 360 -day year, what is the implied annual interest rate inherent in the credit terms? a. 3% b. 8% c. 36% d. 54% Tony's Market recorded the following events involving a recent purchase of inventory: Received goods for $80,000, terms 2/10,n/30. Returned $1,600 of the shipment for credit. Paid $400 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company's inventory a. increased by $76,832. b. increased by $78,800. c. increased by $77,224. d. increased by $77,232