Answered step by step

Verified Expert Solution

Question

1 Approved Answer

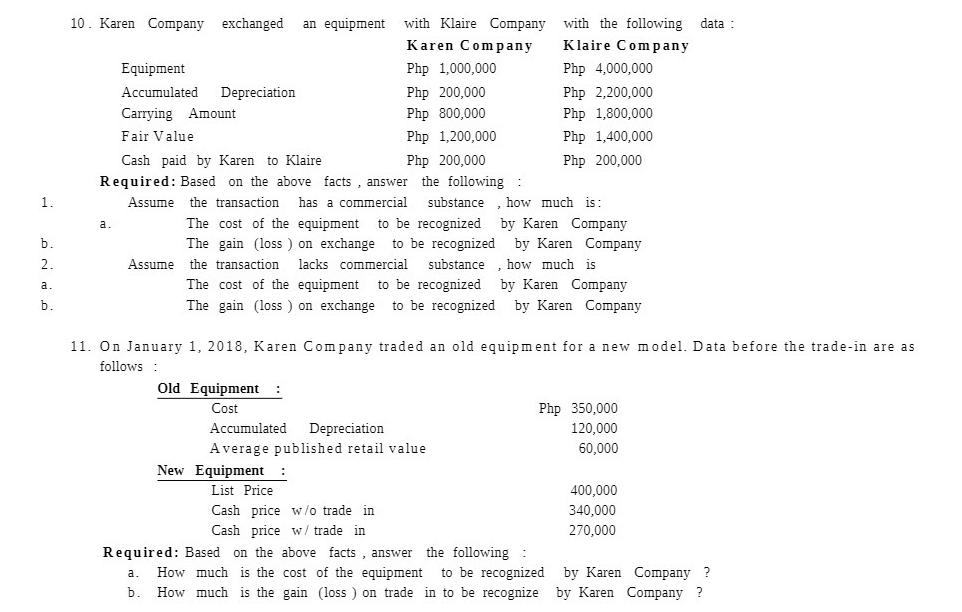

1. b. 2. a b 10. Karen Company exchanged a. Equipment Accumulated Depreciation Carrying Amount Fair Value Cash paid by Karen to Klaire Required:

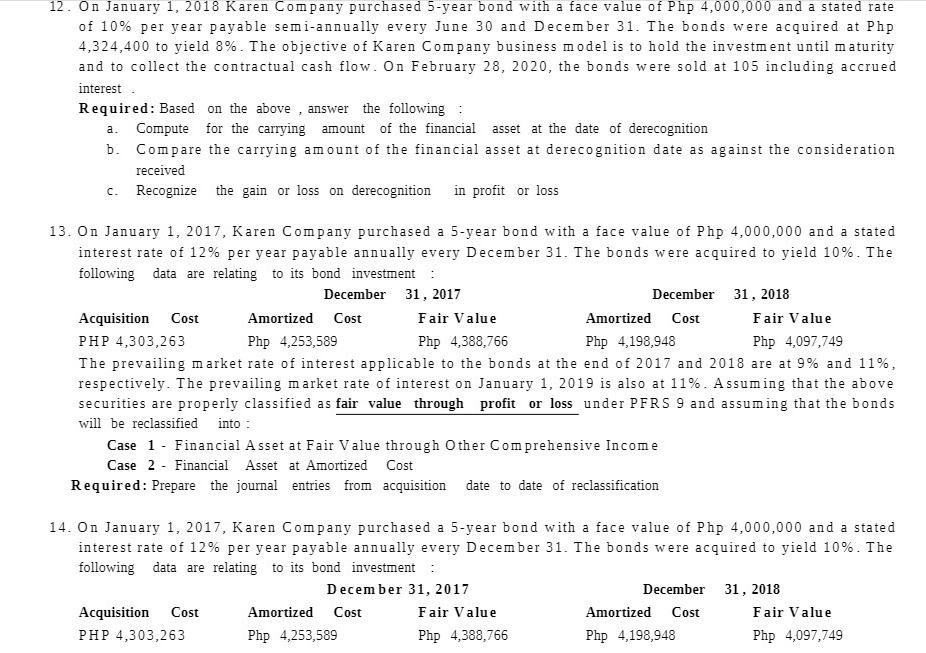

1. b. 2. a b 10. Karen Company exchanged a. Equipment Accumulated Depreciation Carrying Amount Fair Value Cash paid by Karen to Klaire Required: Based on the above facts, answer Assume the transaction has a commercial The cost of the equipment to be recognized The gain (loss) on exchange to be recognized Assume the transaction lacks commercial substance an equipment a. b. Old Equipment : Cost with Klaire Company Karen Company Php 1,000,000 Php 200,000 Php 800,000 Php 1,200,000 Php 200,000 New Equipment : List Price the following: Accumulated Depreciation Average published retail value Cash price w/o trade in Cash price w/ trade in by Karen Company how much is The cost of the equipment to be recognized by Karen Company The gain (loss) on exchange to be recognized by Karen Company 11. On January 1, 2018, Karen Company traded an old equipment for a new model. Data before the trade-in are as follows: with the following data : Klaire Company Php 4,000,000 Php 2,200,000 Php 1,800,000 Php 1,400,000 Php 200,000 substance how much is: by Karen Company Required: Based on the above facts, answer the following: How much is the cost of the equipment to be recognized How much is the gain (loss) on trade in to be recognize Php 350,000 120,000 60,000 400,000 340,000 270,000 by Karen Company ? by Karen Company ? 12. On January 1, 2018 Karen Company purchased 5-year bond with a face value of Php 4,000,000 and a stated rate of 10% per year payable semi-annually every June 30 and December 31. The bonds were acquired at Php 4,324,400 to yield 8%. The objective of Karen Company business model is to hold the investment until maturity and to collect the contractual cash flow. On February 28, 2020, the bonds were sold at 105 including accrued interest. Required: Based on the above, answer the following: a. Compute for the carrying amount of the financial asset at the date of derecognition b. Compare the carrying amount of the financial asset at derecognition date as against the consideration received c. Recognize the gain or loss on derecognition in profit or loss 13. On January 1, 2017, Karen Company purchased a 5-year bond with a face value of Php 4,000,000 and a stated interest rate of 12% per year payable annually every December 31. The bonds were acquired to yield 10%. The following data are relating to its bond investment : December 31, 2017 Amortized Cost Php 4,253,589 Acquisition Cost PHP 4,303,263 Fair Value Amortized Cost Php 4,198,948 Fair Value Php 4,097,749 Php 4,388,766 The prevailing market rate of interest applicable to the bonds at the end of 2017 and 2018 are at 9% and 11%, respectively. The prevailing market rate of interest on January 1, 2019 is also at 11%. Assuming that the above securities are properly classified as fair value through profit or loss under PFRS 9 and assuming that the bonds will be reclassified into: Case 1- Financial Asset at Fair Value through Other Comprehensive Income Case 2 Financial Asset at Amortized Cost Required: Prepare the journal entries from acquisition date to date of reclassification December Acquisition Cost PHP 4,303,263 14. On January 1, 2017, Karen Company purchased a 5-year bond with a face value of Php 4,000,000 and a stated interest rate of 12% per year payable annually every December 31. The bonds were acquired to yield 10%. The following data are relating to its bond investment : December 31, 2017 Amortized Cost Php 4,253,589 Fair Value Php 4,388,766 31, 2018 December 31, 2018 Amortized Cost Php 4,198,948 Fair Value Php 4,097,749

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The image contains questions 10 11 12 13 and 14 each concerning different accounting scenarios involving equipment exchanges bond purchases and the reclassification of financial assets Ill address the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started