Answered step by step

Verified Expert Solution

Question

1 Approved Answer

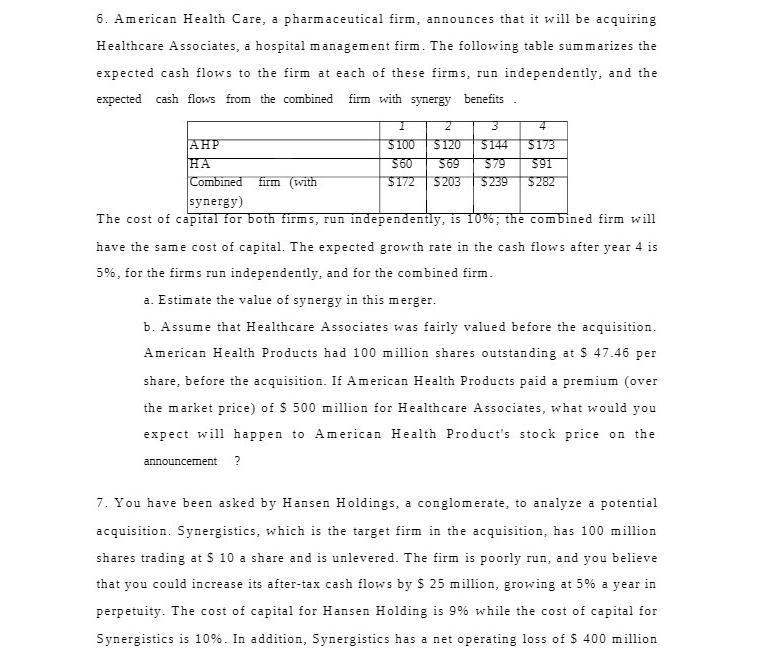

6. American Health Care, a pharmaceutical firm, announces that it will be acquiring Healthcare Associates, a hospital management firm. The following table summarizes the

6. American Health Care, a pharmaceutical firm, announces that it will be acquiring Healthcare Associates, a hospital management firm. The following table summarizes the expected cash flows to the firm at each of these firms, run independently, and the expected cash flows from the combined firm with synergy benefits AHP HA firm (with 2 $120 3 4 $144 $173 $91 $282 $100 $69 $79 $60 $172 $203 $239 Combined synergy) The cost of capital for both firms, run independently, is 10%; the combined firm will have the same cost of capital. The expected growth rate in the cash flows after year 4 is 5%, for the firms run independently, and for the combined firm. a. Estimate the value of synergy in this merger. b. Assume that Healthcare Associates was fairly valued before the acquisition. American Health Products had 100 million shares outstanding at $ 47.46 per share, before the acquisition. If American Health Products paid a premium (over the market price) of $ 500 million for Healthcare Associates, what would you expect will happen to American Health Product's stock price on the announcement ? 7. You have been asked by Hansen Holdings, a conglomerate, to analyze a potential acquisition. Synergistics, which is the target firm in the acquisition, has 100 million shares trading at $ 10 a share and is unlevered. The firm is poorly run, and you believe that you could increase its after-tax cash flows by $ 25 million, growing at 5% a year in perpetuity. The cost of capital for Hansen Holding is 9% while the cost of capital for Synergistics is 10%. In addition, Synergistics has a net operating loss of $ 400 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The part of the image with the question youre focused on reads 6 American Health Care a pharmaceutical firm announces that it will be acquiring Healthcare Associates a hospital management firm The fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started