Answered step by step

Verified Expert Solution

Question

1 Approved Answer

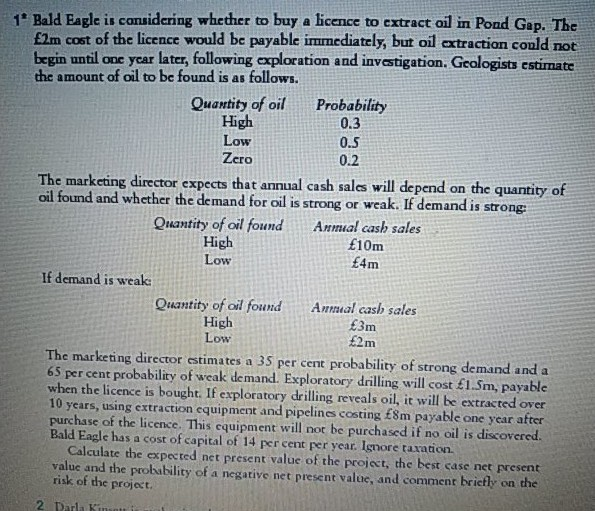

1 Bald Eagle is considering whether to buy a licence to cxtract oil in Pond Gap. The 2m cost of the licence would be payable

1" Bald Eagle is considering whether to buy a licence to cxtract oil in Pond Gap. The 2m cost of the licence would be payable immediately, but oil extraction could not begin until one ycar later, following exploration and investigation. Geologists estirnate the amount of oil to be found is as follows. Probability 0.3 0.5 0.2 Quantity of oil High Low Zero The markeing director expects that annual cash sales will depend on the quantity of oil found and whether the demand for oil is strong or weak. If demand is strong Quantity of oil found Anmual cash sales 610m 4m High Low If demand is weak Quantity of oil found High Low Anmial cash sales 3m 2m The marketing director estimates a 35 per cent probability of strong demand and a 65 per cent probability of weak demand. Exploratory drilling will cost 1.5m, payable when the licence is bought. If exploratory drilling reveals oil, it will be extracted over 10 years, using extraction equipment and pipelines costing 8m payable one year after rchase of the licence. This cquipment will not be purchased if no oil is discovered. Bald Eagle has a cost of capital of 14 per cent per year. Ignore taxation. Calculate the expected net present value of the project, the best case net present value and the probability of a negative net present value, and comment briefly on the risk of the project 2 Darla Kin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started