Answered step by step

Verified Expert Solution

Question

1 Approved Answer

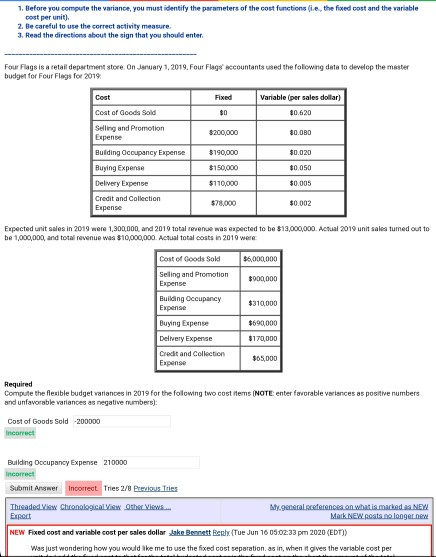

1. Before you compute the variance, you must identify the parameters of the cost functions (ie the fixed cost and the variable cost per unit).

1. Before you compute the variance, you must identify the parameters of the cost functions (ie the fixed cost and the variable cost per unit). 2. Be careful to use the correct netivity measure 3. Read the directions about the sign that you should enter Four Flags is a retail department store. On January 1, 2019. Four Flags accountants used the following data to develop the master budget for Four Flags for 2019, Fixed $0 Variable (per sales dollar) 80.620 $200,000 80.000 Cost Cost of Goods Sold Selling and Promotion Expense Buliding Occupancy Expense Buying Expense Delivery Expense Credit and Collection Expense $0.020 $190,000 $150,000 $110,000 $0.050 $0.005 $78,000 $0.002 Expected unit sales in 2019 were 1,300,000 and 2010 total revenue was expected to be $13,000,000. Actual 2019 unit sales tumed out to be 1,000,000, and total revenue was $10,000,000. Actual total costs in 2010 were $6,000,000 $900,000 $310,000 Cost of Goods Sold Selling and Promotion Expense Building Occupancy Expense Buying Expense Delivery Expense Credit and Collection Expense $690,000 $170,000 $05,000 Required Compute the flexible budget variances in 2019 for the following two cost items (NOTE enter favorable variances as positive numbers and unfavorable variances as negative numbers): Cost of Goods Sold -200000 Incorrect Building Docupancy Expense 210000 Incorrect Submit Answer Incorrect Tries 2/8 Previous Tres Threaded view. Chronological View Other Views.. Mygalernod on what is marked NEW Expect Mark New.Rosts no longer new NEW Fixed cost and variable cost per sales dollar lake Bennett Berly (Tue Jun 16 05:02:33 pm 2020 (EDT)) Was just wondering how you would like me to use the fixed cost separation, as in, when it gives the variable cost per

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started