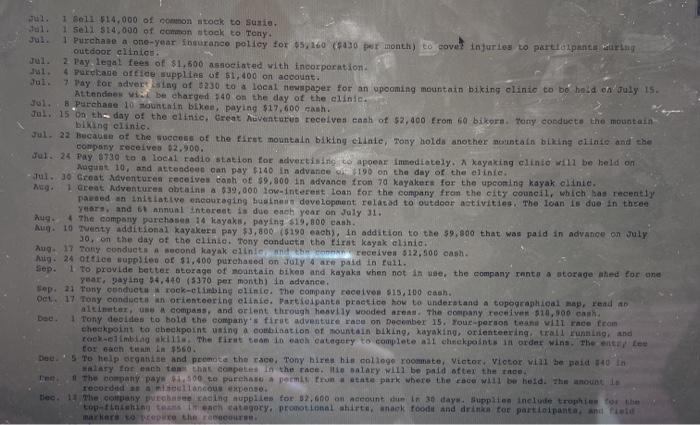

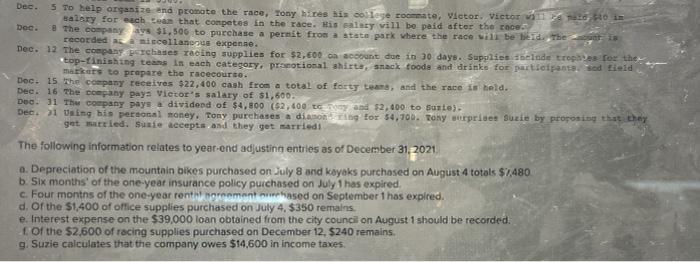

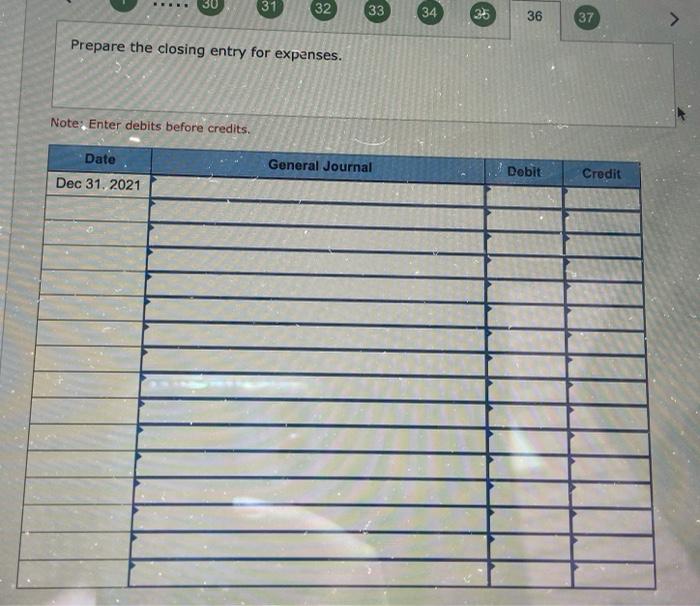

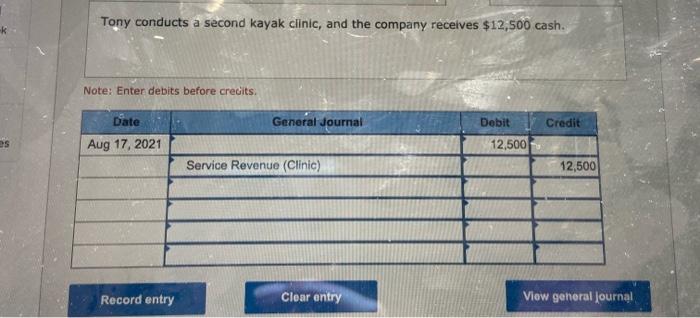

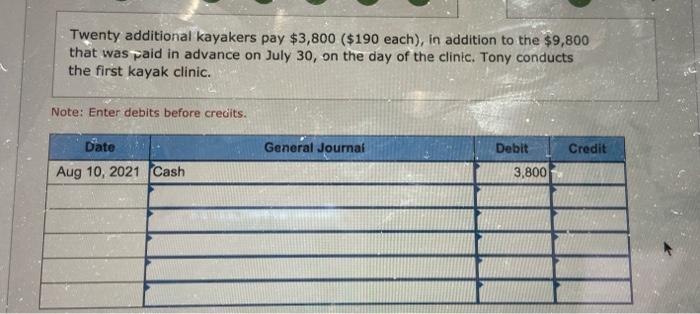

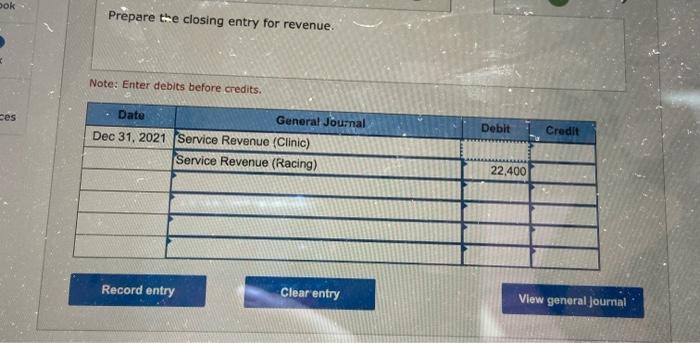

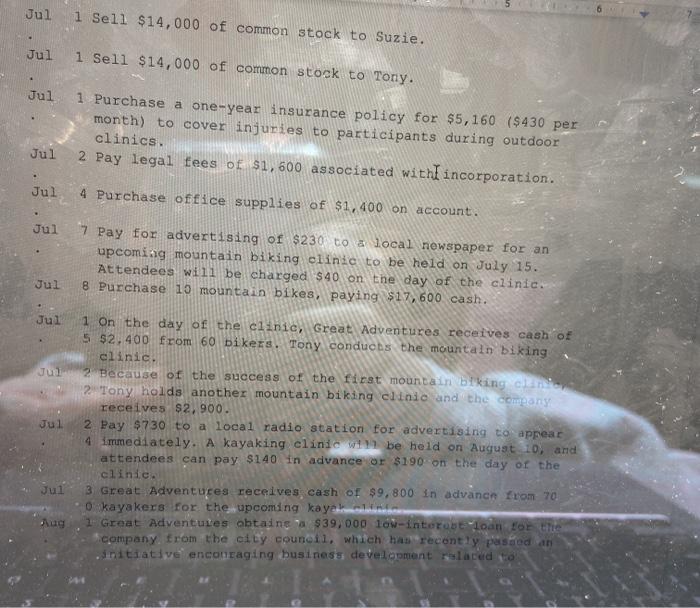

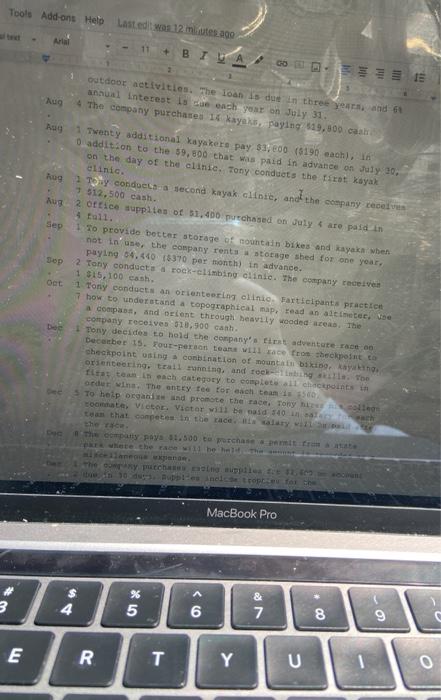

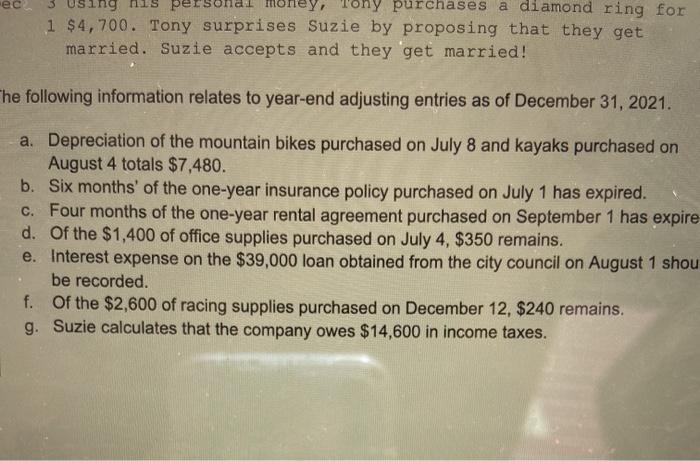

1 Bell $14.000 of common stock to Susio. 1 Sell 314,000 of common stock to Tony 1 Purchase a one-year fhuurance policy for $5,160 ($830 per month) to cove! injuries to participantering outdoor clinic Jul 2. Pay legal fees of $1.500 associated with incorporation Jul 4 Purchase office supplies of $1,400 on account. Jul 7 Pay for advertising of 230 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees vi be charged 340 on the day of the clinica Jul. Purchase 10 mountain bike, paying $17,600 cash. Jul 15 on the day of the clinic, Great Nuventures receives cash of $2,400 from 60 bikora. Tony conducte the mountain biking clinic Jul. 22 Because of the succes of the first mountain biking clinie, Tony holds another mountain biking alinie and the company received 02.900. Jul. 24 pay $730 to a local radio station for advertising to appear immediately. kayaking clinto will be held on August 10, and attendees can pay $140 in advance $190 on the day of the elite. Jul. 30 Great Adventures receives canh ot $9,800 in advance tron 70 kayakers for the upcoming kayak elinie. 1 Great Adventures obtain a $39,000 low-interest Loan for the company from the city council, which has recently paded an initiative encouraging business development relatad to outdoor activities. The loan is due in three Years, and 61 Annual Interest is due each year on July 31. Aug The company parehase 14 kayaks, paying $19.800 cash. Aug. 10 Twenty additional kayakers pay $3,800 ($190 each), in addition to the 59.000 that was paid in advance on July 30, on the day of the clinic. Tony conduct the first kayak clinic Aug 17 Tony conducts second layak elinio receives $12,500 cash. Aug. 24 ottice supplies of $1,400 purchased on July 4 are paid in full. to provide better storage of mountain bikes and kayaks when not in use, the company ronto a storage shed for one year, paying 34.440 (5370 per month) in advance. Sep 21 Tony conducta rock-climbing blinie. The company receives 515,100 cach. Oct 17 Tony conducts orienteering blinie. Participants practice how to understand a topographical map rendan altimeter, compass, and orient through heavily wooded areas. The company receiver $10,00 cash. 1 Tony decides to hold the company's first adventure ran on December 15. Your person tean will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering trail running and relimbing The first team in each category to complete all checkpoints in order wins the entry Lee torente 3560. 5 To help organise and promote the cace, Tony hires his college roommate, Victor Victor will be paid 140 in alary for each to the compete in the race. i salary will be paid after the race The company pays 100 se pare permis from state park where the race will be held. The amount recorded at allancous expense. Dec. 1 The Company pega cacing supplies for 32.600 on Account in 30 day. Supplies include trophies to the top-tinteling tech category, promotional shirtex anak food and drink toe partioipants and Piet markers to prepare the rol Dee Dec. DOG 5 To help organize and promote the race, Tony hares is college roommate, Victor. Victor 20540 in Balary for each team that competes in the race. His lacy will be paid after the race The company as $1.506 to purchase a pernit from a state park where the race will be held. The is recorded as a miscellaneous expense. Dec. 12 The company purchases racing supplies for $2,600 on account due in 30 days. Supplies helnde tropas for the top-finishing teams in each category. pramotional shirta, snack foods and drinks for participantsSed field makers to prepare the racecourse. Dec. 15 The company receives $22,400 cash from a total of forty team, and the race is held. Dee. 16 The company pays Victor's salary of $1,600. Dec. 31 The company pays dividend of $4,800 (52,400 and $2,000 to Bunte Dec. 1 Using his personal money. Tony purchases a diamong for 54,700. Tony surprise Suzie by proposing that they get married. Sunie accepts and they get marriedi The following information relates to year-end adjusting entries as of December 31, 2021 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August A totals $7480 b. Six months of the one-year insurance policy purchased on July 1 has expired, c. Four months of the one-year rental gronment whased on September 1 has expired. d. Of the $1,400 of office supplies purchased on July 4, $350 remains. e. Interest expense on the $39,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,600 of racing supplies purchased on December 12. $240 remains. g. Suzie calculates that the company owes $14,600 in income taxes. 30 31 32 33 34 35 36 37 Prepare the closing entry for expenses. Note: Enter debits before credits. Date Dec 31, 2021 General Journal Dobit Credit Tony conducts a second kayak clinic, and the company receives $12,500 cash. Note: Enter debits before credits General Journal Debit Credit Date Aug 17, 2021 es 12,500 Service Revenue (Clinic) 12,500 Record entry Clear entry View general Journal Twenty additional kayakers pay $3,800 ($190 each), in addition to the $9,800 that was paid in advance on July 30, on the day of the clinic. Tony conducts the first kayak clinic. Note: Enter debits before credits. General Journal Credit Date Aug 10, 2021 Cash Debit 3,800 ok Prepare the closing entry for revenue Note: Enter debits before credits. ces Debit Credit Date General Journal Dec 31, 2021 Service Revenue (Clinic) Service Revenue (Racing) 22,400 Record entry Clear entry View general Journal Jul 1 Sell $14,000 of common stock to Suzie. Jul 1 Sell $14,000 of common stock to Tony. Jul 1 Purchase a one-year insurance policy for $5,160 ($430 per month) to cover injuries to participants during outdoor clinics. 2 Pay legal fees of $1,600 associated with incorporation. Jul Jul 4 Purchase office supplies of $1,400 on account. Jul 7 Pay for advertising of $230 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $40 on the day of the clinic. 8 Purchase 15 mountain bikes, paying $17,600 cash. Jul Jul Jul Jul 1 On the day of the clinic, Great Adventures receives cash of 5 $2.400 from 60 bikers. Tony conducts the mountain biking clinic. 2 Because of the success of the first mountain biking CENA 2 Tony holds another mountain biking clinic and the company receives $2.900. 2 Pay $730 to a local radio station for advertising to appear 4 immediately. A kayaking clinic will be held on August 10, and attendees can pay $140 in advance or $190 on the day of the clinic. 3 Great Adventuces receives cash of $9,800 in advance from 70 o kayakers for the upcoming kaya 1 Great Adventures obtain a $39,000 low-interest Loan for the company from the city council, which has recently passed an initiative encouraging business development ruled to Jul Tools Add-ons Help Last edit was 12 minutes ago 11 BILA outdoor activities. The loan is due in three years and 67 annual interest is each year on July 31. The company purchases 16 kayaks, paying 19.800 cash Aug Aug Twenty additional kayakers pay $3.000 (8190 each, in 0 addition to the 59,800 that was paid in advance on July 20, on the day of the clinic. Tony conducts the first kayak clinic 2 Toy conductor second kayak clinit, and the company receives 1512,500 cash. 2 office supplies of $1.400 purchased on July are paid in Rug Aug Sep oot 1. To provide better storage of mountain bikes and kayaks when not in use, the company renta storage shed for one year, paying 54.0 15370 per month) in advance. 2 Tony conducts a rock-climbing clinic. The company receives 1 315,100 cash. 1 Tony conduct an orienteering clinic Farticipants practice 7 how to understand a topographical map, read an altimeter. Ve coepass, and scient through heavily wooded D. The company receives 310.900 canh Tony decides to hold the company's fint adventure de December 15. Four-person teams will ace from the point to checkpoint using combination of mountain biking orientering, trail running and rocking in the fitt team in each category to complete all checkpoints in order wine. The entry fee for each team is 1500 To help organised promote the race. Tony Rolle cata, Vietot. Victor will be nad 140 Duc MacBook Pro 4 % 5 6 & 7 8 9 ER Y U o Anal B Dec o company purchase acing supply for 1200 sunt den 30 days. Sutelude trophies for t tes-tinning team nach categy promotion hack toods and see participating field mo prepare the accurs. Dec 1. The conpany received 322.400 cash ftonta total of forty 5 teams, and the race held. Die The company pays vietos salary of $1,500) Dec 3. The company pays a dividend of 54,800 (52.400 tony 1 $2.400 to Susta Dec 3 Going his personal money. Tony purchases a diamond ring for 194,700. Tony surprises Suze by proponing that they get married. Suzie accepts and they get mare cod The following information relates to year-end adjusting entries as of December 31, 2021 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $7.480. b. Six months of the one-year insurance policy purchased on July 1 has c Four months of the one-year rental agreement purchased on September 1 has expired di Of the $1,400 of office supplies purchased on July 4, $850 remains Interest expense on the $39,000 loan obtained from the city council on August 1 should be recorded Of the $2,600 of racing supplies purchased on December 12.3240 Suzin calculates that the.com.sy. 14 MacBook Pro $ 4 % 5 & 7 6 00 3 Using persone money, Tony purchases a diamond ring for 1 $4,700. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2021. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $7.480. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expire d. Of the $1,400 of office supplies purchased on July 4, $350 remains. e. Interest expense on the $39,000 loan obtained from the city council on August 1 shou be recorded. f. Of the $2,600 of racing supplies purchased on December 12, $240 remains. g. Suzie calculates that the company owes $14,600 in income taxes. 1 Bell $14.000 of common stock to Susio. 1 Sell 314,000 of common stock to Tony 1 Purchase a one-year fhuurance policy for $5,160 ($830 per month) to cove! injuries to participantering outdoor clinic Jul 2. Pay legal fees of $1.500 associated with incorporation Jul 4 Purchase office supplies of $1,400 on account. Jul 7 Pay for advertising of 230 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees vi be charged 340 on the day of the clinica Jul. Purchase 10 mountain bike, paying $17,600 cash. Jul 15 on the day of the clinic, Great Nuventures receives cash of $2,400 from 60 bikora. Tony conducte the mountain biking clinic Jul. 22 Because of the succes of the first mountain biking clinie, Tony holds another mountain biking alinie and the company received 02.900. Jul. 24 pay $730 to a local radio station for advertising to appear immediately. kayaking clinto will be held on August 10, and attendees can pay $140 in advance $190 on the day of the elite. Jul. 30 Great Adventures receives canh ot $9,800 in advance tron 70 kayakers for the upcoming kayak elinie. 1 Great Adventures obtain a $39,000 low-interest Loan for the company from the city council, which has recently paded an initiative encouraging business development relatad to outdoor activities. The loan is due in three Years, and 61 Annual Interest is due each year on July 31. Aug The company parehase 14 kayaks, paying $19.800 cash. Aug. 10 Twenty additional kayakers pay $3,800 ($190 each), in addition to the 59.000 that was paid in advance on July 30, on the day of the clinic. Tony conduct the first kayak clinic Aug 17 Tony conducts second layak elinio receives $12,500 cash. Aug. 24 ottice supplies of $1,400 purchased on July 4 are paid in full. to provide better storage of mountain bikes and kayaks when not in use, the company ronto a storage shed for one year, paying 34.440 (5370 per month) in advance. Sep 21 Tony conducta rock-climbing blinie. The company receives 515,100 cach. Oct 17 Tony conducts orienteering blinie. Participants practice how to understand a topographical map rendan altimeter, compass, and orient through heavily wooded areas. The company receiver $10,00 cash. 1 Tony decides to hold the company's first adventure ran on December 15. Your person tean will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering trail running and relimbing The first team in each category to complete all checkpoints in order wins the entry Lee torente 3560. 5 To help organise and promote the cace, Tony hires his college roommate, Victor Victor will be paid 140 in alary for each to the compete in the race. i salary will be paid after the race The company pays 100 se pare permis from state park where the race will be held. The amount recorded at allancous expense. Dec. 1 The Company pega cacing supplies for 32.600 on Account in 30 day. Supplies include trophies to the top-tinteling tech category, promotional shirtex anak food and drink toe partioipants and Piet markers to prepare the rol Dee Dec. DOG 5 To help organize and promote the race, Tony hares is college roommate, Victor. Victor 20540 in Balary for each team that competes in the race. His lacy will be paid after the race The company as $1.506 to purchase a pernit from a state park where the race will be held. The is recorded as a miscellaneous expense. Dec. 12 The company purchases racing supplies for $2,600 on account due in 30 days. Supplies helnde tropas for the top-finishing teams in each category. pramotional shirta, snack foods and drinks for participantsSed field makers to prepare the racecourse. Dec. 15 The company receives $22,400 cash from a total of forty team, and the race is held. Dee. 16 The company pays Victor's salary of $1,600. Dec. 31 The company pays dividend of $4,800 (52,400 and $2,000 to Bunte Dec. 1 Using his personal money. Tony purchases a diamong for 54,700. Tony surprise Suzie by proposing that they get married. Sunie accepts and they get marriedi The following information relates to year-end adjusting entries as of December 31, 2021 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August A totals $7480 b. Six months of the one-year insurance policy purchased on July 1 has expired, c. Four months of the one-year rental gronment whased on September 1 has expired. d. Of the $1,400 of office supplies purchased on July 4, $350 remains. e. Interest expense on the $39,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,600 of racing supplies purchased on December 12. $240 remains. g. Suzie calculates that the company owes $14,600 in income taxes. 30 31 32 33 34 35 36 37 Prepare the closing entry for expenses. Note: Enter debits before credits. Date Dec 31, 2021 General Journal Dobit Credit Tony conducts a second kayak clinic, and the company receives $12,500 cash. Note: Enter debits before credits General Journal Debit Credit Date Aug 17, 2021 es 12,500 Service Revenue (Clinic) 12,500 Record entry Clear entry View general Journal Twenty additional kayakers pay $3,800 ($190 each), in addition to the $9,800 that was paid in advance on July 30, on the day of the clinic. Tony conducts the first kayak clinic. Note: Enter debits before credits. General Journal Credit Date Aug 10, 2021 Cash Debit 3,800 ok Prepare the closing entry for revenue Note: Enter debits before credits. ces Debit Credit Date General Journal Dec 31, 2021 Service Revenue (Clinic) Service Revenue (Racing) 22,400 Record entry Clear entry View general Journal Jul 1 Sell $14,000 of common stock to Suzie. Jul 1 Sell $14,000 of common stock to Tony. Jul 1 Purchase a one-year insurance policy for $5,160 ($430 per month) to cover injuries to participants during outdoor clinics. 2 Pay legal fees of $1,600 associated with incorporation. Jul Jul 4 Purchase office supplies of $1,400 on account. Jul 7 Pay for advertising of $230 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $40 on the day of the clinic. 8 Purchase 15 mountain bikes, paying $17,600 cash. Jul Jul Jul Jul 1 On the day of the clinic, Great Adventures receives cash of 5 $2.400 from 60 bikers. Tony conducts the mountain biking clinic. 2 Because of the success of the first mountain biking CENA 2 Tony holds another mountain biking clinic and the company receives $2.900. 2 Pay $730 to a local radio station for advertising to appear 4 immediately. A kayaking clinic will be held on August 10, and attendees can pay $140 in advance or $190 on the day of the clinic. 3 Great Adventuces receives cash of $9,800 in advance from 70 o kayakers for the upcoming kaya 1 Great Adventures obtain a $39,000 low-interest Loan for the company from the city council, which has recently passed an initiative encouraging business development ruled to Jul Tools Add-ons Help Last edit was 12 minutes ago 11 BILA outdoor activities. The loan is due in three years and 67 annual interest is each year on July 31. The company purchases 16 kayaks, paying 19.800 cash Aug Aug Twenty additional kayakers pay $3.000 (8190 each, in 0 addition to the 59,800 that was paid in advance on July 20, on the day of the clinic. Tony conducts the first kayak clinic 2 Toy conductor second kayak clinit, and the company receives 1512,500 cash. 2 office supplies of $1.400 purchased on July are paid in Rug Aug Sep oot 1. To provide better storage of mountain bikes and kayaks when not in use, the company renta storage shed for one year, paying 54.0 15370 per month) in advance. 2 Tony conducts a rock-climbing clinic. The company receives 1 315,100 cash. 1 Tony conduct an orienteering clinic Farticipants practice 7 how to understand a topographical map, read an altimeter. Ve coepass, and scient through heavily wooded D. The company receives 310.900 canh Tony decides to hold the company's fint adventure de December 15. Four-person teams will ace from the point to checkpoint using combination of mountain biking orientering, trail running and rocking in the fitt team in each category to complete all checkpoints in order wine. The entry fee for each team is 1500 To help organised promote the race. Tony Rolle cata, Vietot. Victor will be nad 140 Duc MacBook Pro 4 % 5 6 & 7 8 9 ER Y U o Anal B Dec o company purchase acing supply for 1200 sunt den 30 days. Sutelude trophies for t tes-tinning team nach categy promotion hack toods and see participating field mo prepare the accurs. Dec 1. The conpany received 322.400 cash ftonta total of forty 5 teams, and the race held. Die The company pays vietos salary of $1,500) Dec 3. The company pays a dividend of 54,800 (52.400 tony 1 $2.400 to Susta Dec 3 Going his personal money. Tony purchases a diamond ring for 194,700. Tony surprises Suze by proponing that they get married. Suzie accepts and they get mare cod The following information relates to year-end adjusting entries as of December 31, 2021 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $7.480. b. Six months of the one-year insurance policy purchased on July 1 has c Four months of the one-year rental agreement purchased on September 1 has expired di Of the $1,400 of office supplies purchased on July 4, $850 remains Interest expense on the $39,000 loan obtained from the city council on August 1 should be recorded Of the $2,600 of racing supplies purchased on December 12.3240 Suzin calculates that the.com.sy. 14 MacBook Pro $ 4 % 5 & 7 6 00 3 Using persone money, Tony purchases a diamond ring for 1 $4,700. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2021. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $7.480. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expire d. Of the $1,400 of office supplies purchased on July 4, $350 remains. e. Interest expense on the $39,000 loan obtained from the city council on August 1 shou be recorded. f. Of the $2,600 of racing supplies purchased on December 12, $240 remains. g. Suzie calculates that the company owes $14,600 in income taxes