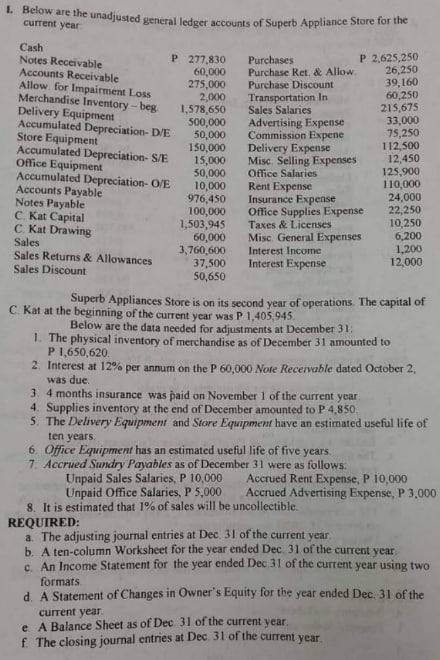

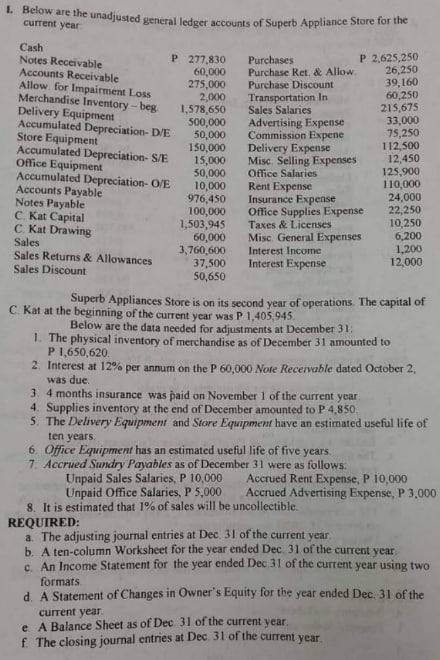

1. Below are the unadjusted general ledger accounts of Superb Appliance Store for the current year Superb Appliances Store is on its second year of operations. The capital of C. Kat at the beginning of the current year was P1,405,945 Below are the data needed for adjustments at December 31 : 1. The physical inventory of merchandise as of December 31 amounted to P 1,650,620 2. Interest at 12% per annum on the P 60,000 Note Recenvable dated October 2, was due. 3. 4 months insurance was paid on November 1 of the current year. 4. Supplies inventory at the end of December amounted to P 4,850 . 5. The Delivery Equipmemt and Store Equipment have an estimated useful life of ten years. 6. Office Equipment has an estimated useful life of five years. 7. Accrued Sundry Payables as of December 31 were as follows. Unpaid Sales Salaries, P 10,000 Accrued Rent Expense, P 10,000 Unpaid Office Salaries, P 5,000 Accrued Advertising Expense, P 3,000 8. It is estimated that 1% of sales will be uncollectible. REQUIRED: a. The adjusting journal entries at Dec. 31 of the current year. b. A ten-column Worksheet for the year ended Dec. 31 of the current year c. An Income Statement for the year ended Dec.31 of the current year using two formats. d. A Statement of Changes in Owner's Equity for the year ended Dec. 31 of the current year. e. A Balance Sheet as of Dec 31 of the current year. f. The closing journal entries at Dec 31 of the current year. 1. Below are the unadjusted general ledger accounts of Superb Appliance Store for the current year Superb Appliances Store is on its second year of operations. The capital of C. Kat at the beginning of the current year was P1,405,945 Below are the data needed for adjustments at December 31 : 1. The physical inventory of merchandise as of December 31 amounted to P 1,650,620 2. Interest at 12% per annum on the P 60,000 Note Recenvable dated October 2, was due. 3. 4 months insurance was paid on November 1 of the current year. 4. Supplies inventory at the end of December amounted to P 4,850 . 5. The Delivery Equipmemt and Store Equipment have an estimated useful life of ten years. 6. Office Equipment has an estimated useful life of five years. 7. Accrued Sundry Payables as of December 31 were as follows. Unpaid Sales Salaries, P 10,000 Accrued Rent Expense, P 10,000 Unpaid Office Salaries, P 5,000 Accrued Advertising Expense, P 3,000 8. It is estimated that 1% of sales will be uncollectible. REQUIRED: a. The adjusting journal entries at Dec. 31 of the current year. b. A ten-column Worksheet for the year ended Dec. 31 of the current year c. An Income Statement for the year ended Dec.31 of the current year using two formats. d. A Statement of Changes in Owner's Equity for the year ended Dec. 31 of the current year. e. A Balance Sheet as of Dec 31 of the current year. f. The closing journal entries at Dec 31 of the current year