Answered step by step

Verified Expert Solution

Question

1 Approved Answer

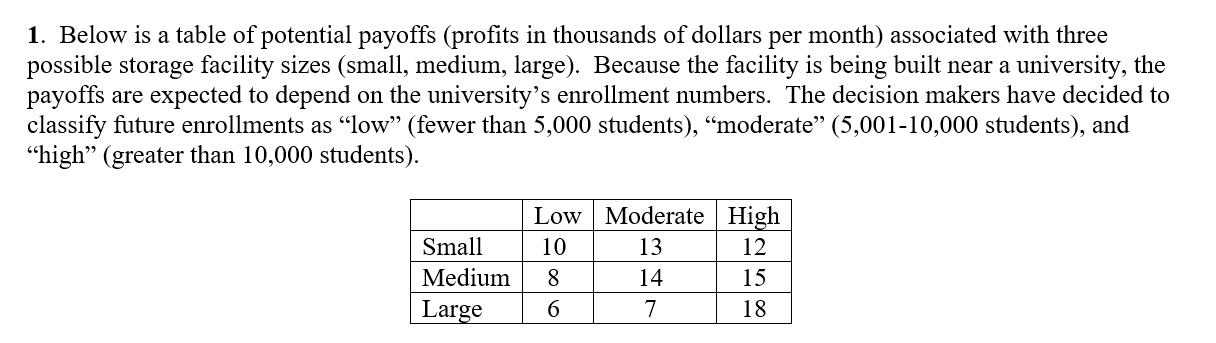

1. Below is a table of potential payoffs (profits in thousands of dollars per month) associated with three possible storage facility sizes (small, medium,

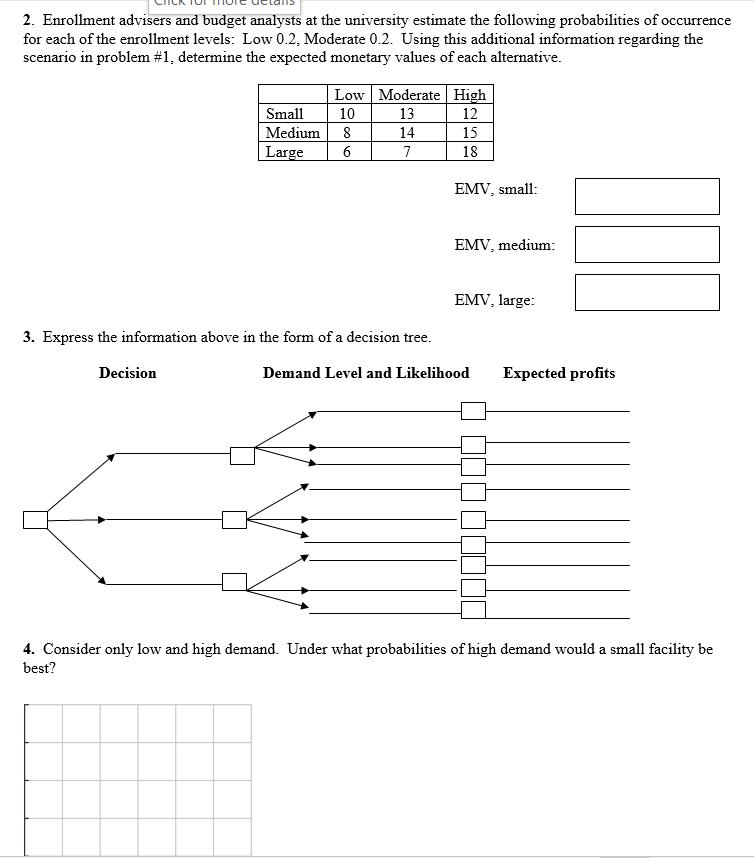

1. Below is a table of potential payoffs (profits in thousands of dollars per month) associated with three possible storage facility sizes (small, medium, large). Because the facility is being built near a university, the payoffs are expected to depend on the university's enrollment numbers. The decision makers have decided to classify future enrollments as "low" (fewer than 5,000 students), "moderate (5,001-10,000 students), and "high" (greater than 10,000 students). Small Medium Large Low Moderate High 10 13 12 8 14 15 6 7 18 2. Enrollment advisers and budget analysts at the university estimate the following probabilities of occurrence for each of the enrollment levels: Low 0.2, Moderate 0.2. Using this additional information regarding the scenario in problem #1, determine the expected monetary values of each alternative. Low Moderate High Small 10 13 12 Medium 8 14 15 Large 6 7 18 3. Express the information above in the form of a decision tree. Decision EMV, small: EMV, medium: EMV, large: 000 Demand Level and Likelihood Expected profits 4. Consider only low and high demand. Under what probabilities of high demand would a small facility be best?

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 1 Expected Monetary Values EMVs Sma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started