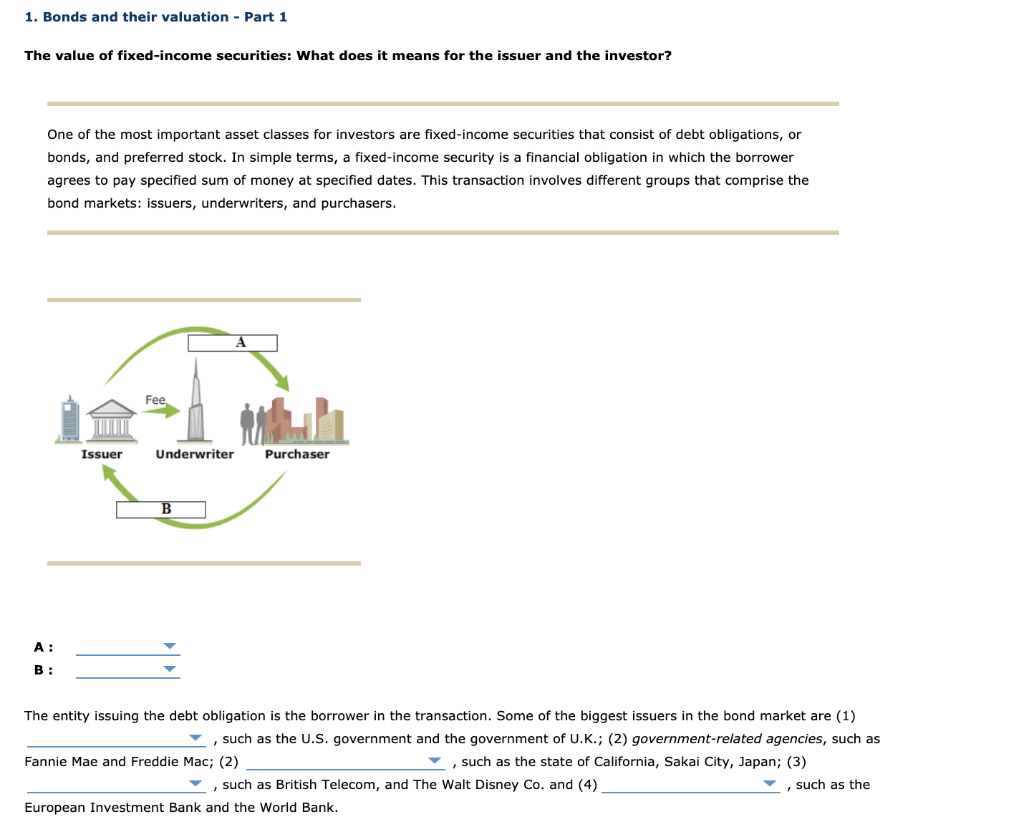

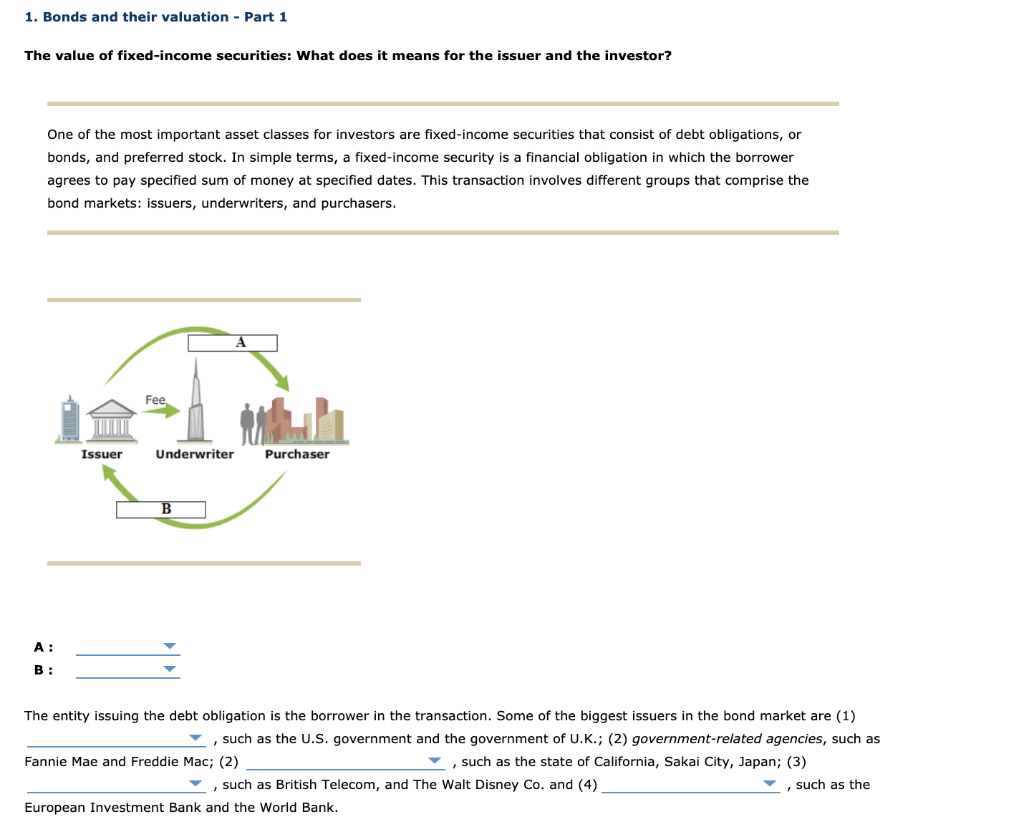

1. Bonds and their valuation - Part 1 The value of fixed-income securities: What does it means for the issuer and the investor? One of the most important asset classes for investors are fixed-income securities that consist of debt obligations, or bonds, and preferred stock. In simple terms, a fixed-income security is a financial obligation in which the borrower agrees to pay specified sum of money at specified dates. This transaction involves different groups that comprise the bond markets: issuers, underwriters, and purchasers. Issuer Underwriter Purchaser B A: B: The entity issuing the debt obligation is the borrower in the transaction. Some of the biggest issuers in the bond market are (1) , such as the U.S. government and the government of U.K.; (2) government-related agencies, such as Fannie Mae and Freddie Mac; (2) , such as the state of California, Sakai City, Japan; (3) , such as British Telecom, and The Walt Disney Co. and (4) such as the European Investment Bank and the World Bank. Why do entities borrow in the form of debt obligations? Economies around the world were still recovering during 2012 after the 2008-2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. Federal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds. In the context of the reasons why entities borrow in the form of bond issues, which statement is correct? Check all that apply. Bond coupon payments are borrowing costs for issuers. When interest rates are low, borrowing cost is low, thus more conducive for issuers to lock in low costs. When investors look for instruments that help generate income and have lower risk levels-as compared to equity offerings-they are eager to invest in debt obligations. When equity markets are turbulent and investors prefer relatively safer fixed-income securities, bond markets become a safe place to invest. This leads to increased demand, thus encouraging corporations to supply fixed-income securities. Investors looking for tax-exempt income are likely to invest in companies that pay high dividends. Corporate-Bond Issuers Race to the Market as U.S. Yields Approach Record Low On April 25, 2011, the Fed announced that short-term interest rates would be kept near zero through late 2014. Because corporate bonds are indexed to Treasury yields and the Treasury yield hit nearly all-time lows, issuing conditions became conducive for investment-grade borrowers. Europe's debt crisis fueled the demand for relatively safer U.S. securities, and the market became more confident that Europe's crisis would not significantly disrupt recovery of the world's largest economy. This triggered issuers to announce investment-grade supply benefiting from the low borrowing costs. Companies such as IBM, Procter & Gamble, Petroleo Brasileiro SA, and Berkshire Hathaway announced more than $15.5 billion debt offerings The relationship between corporate bond yields and Treasury yields The article highlights an important relationship between the corporate bond yields and the U.S. Treasury yields. When demand for Treasuries increases, prices rise and yields All else being equal, this leads to the of corporate bond yields because they are riskier and their yields are than U.S. Treasury yields. However, this does not necessarily imply that particular changes in the Treasury yield will lead to similar changes in the corporate bond yields. A corporate bond with a narrow yield spread and high credit rating will offer a relatively return when the bond is purchased. However, if the yield spread widens, the price of the bond will , thus the value of the fixed-income asset class in the investor's portfolio. Why do entities borrow in the form of debt obligations? Economies around the world were still recovering during 2012 after the 2008-2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. Federal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds. In the context of the reasons why entities borrow in the form of bond issues, which statement is correct? Check all that apply. Bond coupon payments are borrowing costs for issuers. When interest rates are low, borrowing cost is low, thus more conducive for issuers to lock in low costs. When investors look for instruments that help generate income and have lower risk levels-as compared to equity offerings,they are eager to invest in debt obligations. When equity markets are turbulent and investors prefer relatively safer fixed-income securities, bond markets become a safe place to invest. This leads to increased demand, thus encouraging corporations to supply fixed-income securities. Investors looking for tax-exempt income are likely to invest in companies that pay high dividends. as yields approached record lows. The spread between the Treasury bonds and investment-grade bonds was hovering at narrow levels, making it attractive for issuers to tap into low borrowing costs. According to a Business Week story, "Yields have fallen to 3.55 percent, the lowest level since touching 3.53 percent on Aug. 10, and within 10 basis points of a record low 3.45 on Aug. 4, according to the Bank of America Merrill Lynch U.S. Corporate Master Index." Another factor contributing to the rising issues of investment-grade bonds was purchasers' eagerness to invest in high- quality securities. Sales of debt offerings had fallen 19% from the year before, and that made investors eager to spend cash on offerings. The relationship between corporate bond yields and Treasury yields The article highlights an important relationship between the corporate bond yields and the U.S. Treasury yields. When demand for Treasuries increases, prices rise and yields. All else being equal, this leads to the of corporate bond yields because they are riskier and their yields are than U.S. Treasury yields. However, this does not necessarily imply that particular changes in the Treasury yield will lead to similar changes in the corporate bond yields. A corporate bond with a narrow yield spread and high credit rating will offer a relatively return when the bond is purchased. However, if the yield spread widens, the price of the bond will , thus the value of the fixed-income asset class in the investor's portfolio. 1. Bonds and their valuation - Part 1 The value of fixed-income securities: What does it means for the issuer and the investor? One of the most important asset classes for investors are fixed-income securities that consist of debt obligations, or bonds, and preferred stock. In simple terms, a fixed-income security is a financial obligation in which the borrower agrees to pay specified sum of money at specified dates. This transaction involves different groups that comprise the bond markets: issuers, underwriters, and purchasers. Issuer Underwriter Purchaser B A: B: The entity issuing the debt obligation is the borrower in the transaction. Some of the biggest issuers in the bond market are (1) , such as the U.S. government and the government of U.K.; (2) government-related agencies, such as Fannie Mae and Freddie Mac; (2) , such as the state of California, Sakai City, Japan; (3) , such as British Telecom, and The Walt Disney Co. and (4) such as the European Investment Bank and the World Bank. Why do entities borrow in the form of debt obligations? Economies around the world were still recovering during 2012 after the 2008-2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. Federal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds. In the context of the reasons why entities borrow in the form of bond issues, which statement is correct? Check all that apply. Bond coupon payments are borrowing costs for issuers. When interest rates are low, borrowing cost is low, thus more conducive for issuers to lock in low costs. When investors look for instruments that help generate income and have lower risk levels-as compared to equity offerings-they are eager to invest in debt obligations. When equity markets are turbulent and investors prefer relatively safer fixed-income securities, bond markets become a safe place to invest. This leads to increased demand, thus encouraging corporations to supply fixed-income securities. Investors looking for tax-exempt income are likely to invest in companies that pay high dividends. Corporate-Bond Issuers Race to the Market as U.S. Yields Approach Record Low On April 25, 2011, the Fed announced that short-term interest rates would be kept near zero through late 2014. Because corporate bonds are indexed to Treasury yields and the Treasury yield hit nearly all-time lows, issuing conditions became conducive for investment-grade borrowers. Europe's debt crisis fueled the demand for relatively safer U.S. securities, and the market became more confident that Europe's crisis would not significantly disrupt recovery of the world's largest economy. This triggered issuers to announce investment-grade supply benefiting from the low borrowing costs. Companies such as IBM, Procter & Gamble, Petroleo Brasileiro SA, and Berkshire Hathaway announced more than $15.5 billion debt offerings The relationship between corporate bond yields and Treasury yields The article highlights an important relationship between the corporate bond yields and the U.S. Treasury yields. When demand for Treasuries increases, prices rise and yields All else being equal, this leads to the of corporate bond yields because they are riskier and their yields are than U.S. Treasury yields. However, this does not necessarily imply that particular changes in the Treasury yield will lead to similar changes in the corporate bond yields. A corporate bond with a narrow yield spread and high credit rating will offer a relatively return when the bond is purchased. However, if the yield spread widens, the price of the bond will , thus the value of the fixed-income asset class in the investor's portfolio. Why do entities borrow in the form of debt obligations? Economies around the world were still recovering during 2012 after the 2008-2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. Federal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds. In the context of the reasons why entities borrow in the form of bond issues, which statement is correct? Check all that apply. Bond coupon payments are borrowing costs for issuers. When interest rates are low, borrowing cost is low, thus more conducive for issuers to lock in low costs. When investors look for instruments that help generate income and have lower risk levels-as compared to equity offerings,they are eager to invest in debt obligations. When equity markets are turbulent and investors prefer relatively safer fixed-income securities, bond markets become a safe place to invest. This leads to increased demand, thus encouraging corporations to supply fixed-income securities. Investors looking for tax-exempt income are likely to invest in companies that pay high dividends. as yields approached record lows. The spread between the Treasury bonds and investment-grade bonds was hovering at narrow levels, making it attractive for issuers to tap into low borrowing costs. According to a Business Week story, "Yields have fallen to 3.55 percent, the lowest level since touching 3.53 percent on Aug. 10, and within 10 basis points of a record low 3.45 on Aug. 4, according to the Bank of America Merrill Lynch U.S. Corporate Master Index." Another factor contributing to the rising issues of investment-grade bonds was purchasers' eagerness to invest in high- quality securities. Sales of debt offerings had fallen 19% from the year before, and that made investors eager to spend cash on offerings. The relationship between corporate bond yields and Treasury yields The article highlights an important relationship between the corporate bond yields and the U.S. Treasury yields. When demand for Treasuries increases, prices rise and yields. All else being equal, this leads to the of corporate bond yields because they are riskier and their yields are than U.S. Treasury yields. However, this does not necessarily imply that particular changes in the Treasury yield will lead to similar changes in the corporate bond yields. A corporate bond with a narrow yield spread and high credit rating will offer a relatively return when the bond is purchased. However, if the yield spread widens, the price of the bond will , thus the value of the fixed-income asset class in the investor's portfolio