Answered step by step

Verified Expert Solution

Question

1 Approved Answer

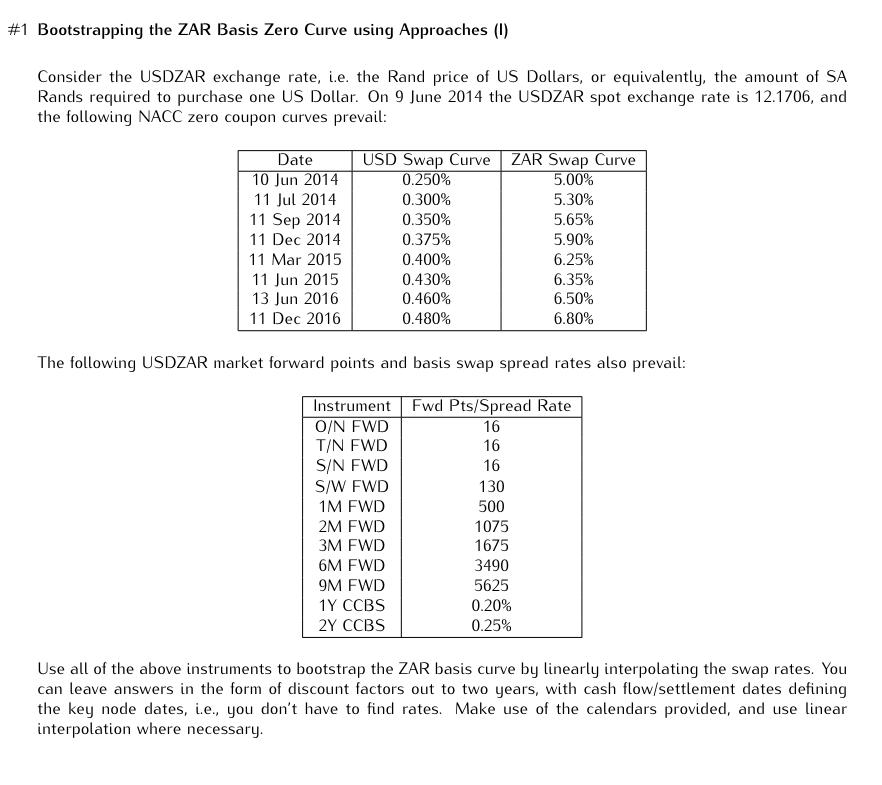

# 1 Bootstrapping the ZAR Basis Zero Curve using Approaches ( I ) Consider the USDZAR exchange rate, i . e . the Rand price

# Bootstrapping the ZAR Basis Zero Curve using Approaches I

Consider the USDZAR exchange rate, ie the Rand price of US Dollars, or equivalently, the amount of SA

Rands required to purchase one US Dollar. On June the USDZAR spot exchange rate is and

the following NACC zero coupon curves prevail:

The following USDZAR market forward points and basis swap spread rates also prevail:

Use all of the above instruments to bootstrap the ZAR basis curve by linearly interpolating the swap rates. You

can leave answers in the form of discount factors out to two years, with cash flowsettlement dates defining

the key node dates, ie you don't have to find rates. Make use of the calendars provided, and use linear

interpolation where necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started