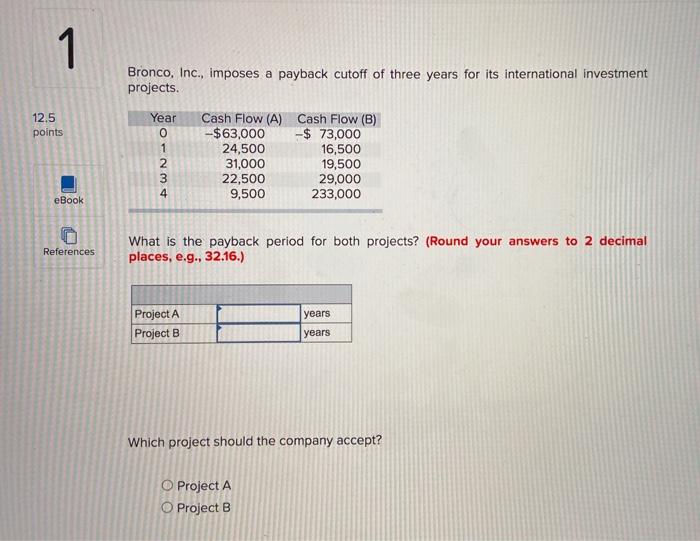

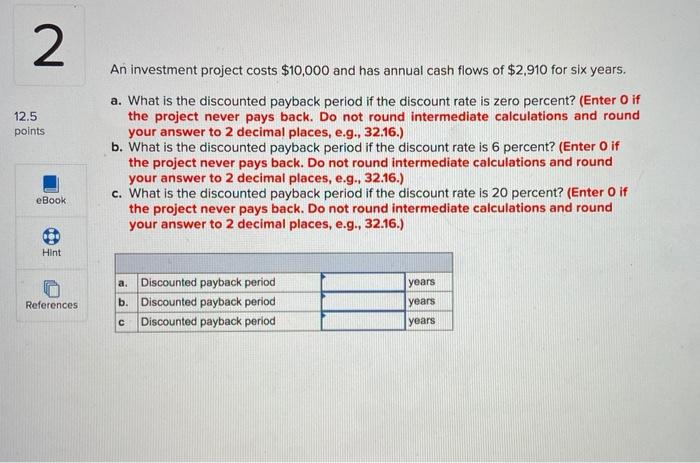

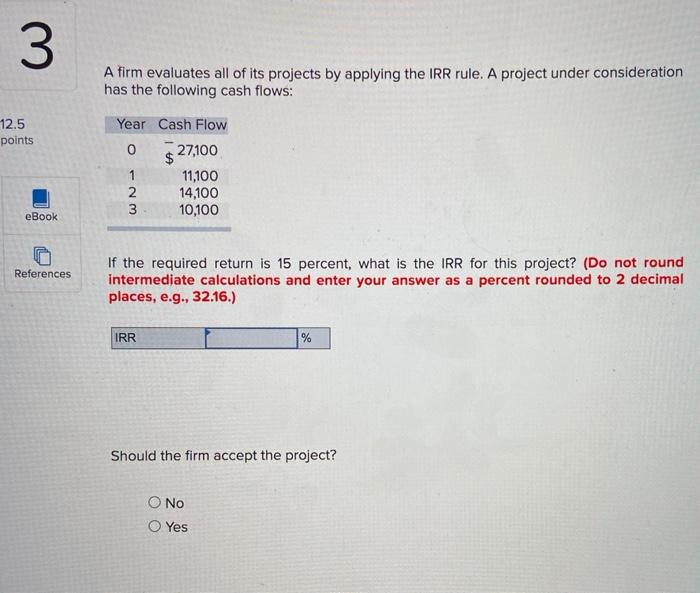

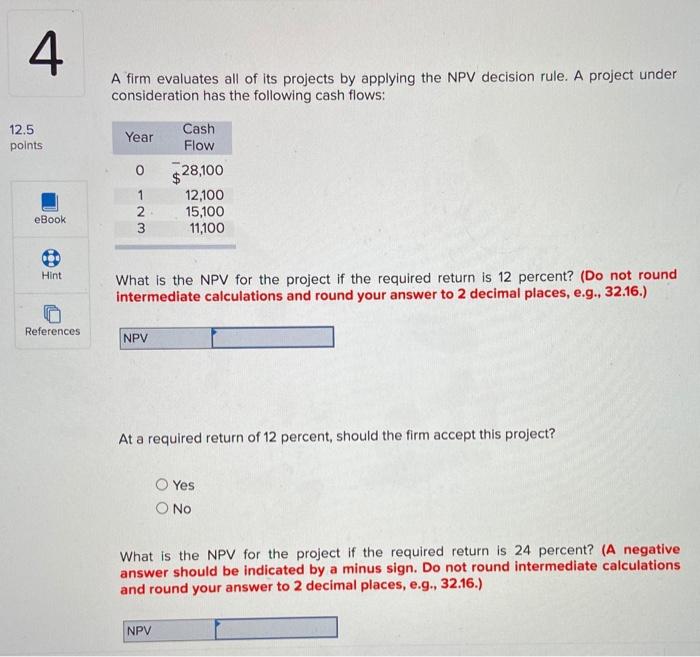

1 Bronco, Inc., imposes a payback cutoff of three years for its international investment projects. Year 12.5 points ONM Cash Flow (A) Cash Flow (B) $63,000 -$ 73,000 24,500 16,500 31,000 19,500 22,500 29,000 9,500 233,000 4 eBook References What is the payback period for both projects? (Round your answers to 2 decimal places, e.g., 32.16.) Project A Project B years years Which project should the company accept? O Project A O Project B 2 12.5 points An investment project costs $10,000 and has annual cash flows of $2,910 for six years. a. What is the discounted payback period if the discount rate is zero percent? (Enter O if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the discounted payback period if the discount rate is 6 percent? (Enter O if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the discounted payback period if the discount rate is 20 percent? (Enter O if the project never pays back. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook Hint a. years References Discounted payback period b. Discounted payback period Discounted payback period years years 3 A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: 12.5 points Year Cash Flow 0 $ 27,100 1 11,100 2. 14,100 3 10,100 eBook References If the required return is 15 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR % Should the firm accept the project? O Yes 4 A firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: 12.5 points Year O Cash Flow 28,100 12,100 15,100 11,100 N eBook Hint What is the NPV for the project if the required return is 12 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) References NPV At a required return of 12 percent, should the firm accept this project? Yes No What is the NPV for the project if the required return is 24 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV