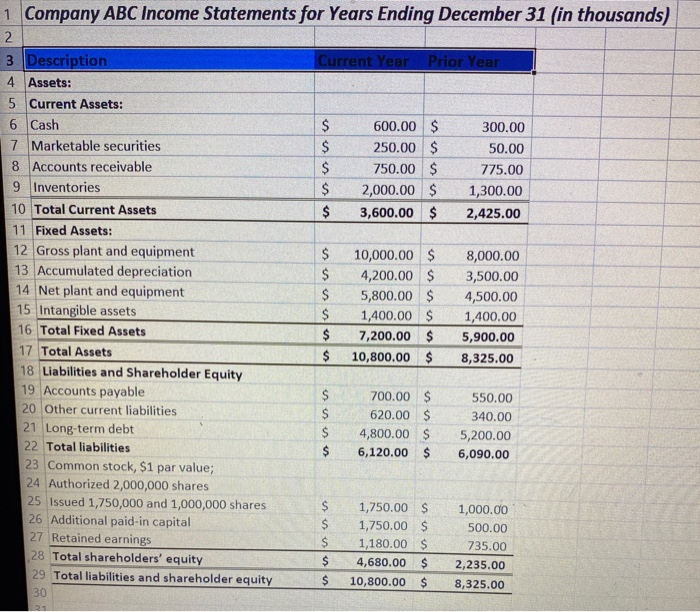

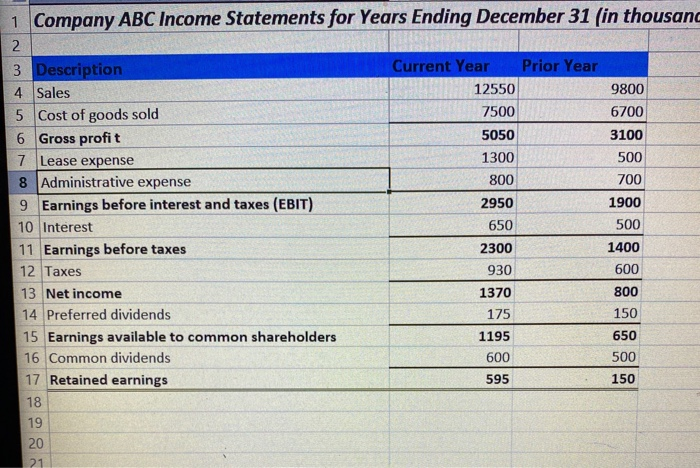

1. Calculate and analyze Return on Investment Ratios, i.e. Basic Earning Power Ratio, ROA, and ROE of Company ABC financial statements attached. 2. Calculate and analyze the Cash Conversion Cycle of Company ABC. 3. Calculate and analyze the Current and Quick Ratios of Company ABC. 4. Calculate and analyze how much times per annum does Company ABC turns over its inventory. 5. Calculate and analyze the financial leverage of Company ABC (debt-to-assets & debt-to- equity ratios). $ 1 Company ABC Income Statements for Years Ending December 31 (in thousands) 2 3 Description Current Year Prior Year 4 Assets: 5 Current Assets: 6 Cash $ 600.00 $ 300.00 7 Marketable securities $ 250.00 $ 50.00 8 Accounts receivable $ 750.00 $ 775.00 9 Inventories $ 2,000.00 $ 1,300.00 10 Total Current Assets $ 3,600.00 $ 2,425.00 11 Fixed Assets: 12 Gross plant and equipment $ 10,000.00 $ 8,000.00 13 Accumulated depreciation $ 4,200.00 $ 3,500.00 14 Net plant and equipment $ 5,800.00 $ 4,500.00 15 Intangible assets $ 1,400.00 $ 1,400.00 16 Total Fixed Assets $ 7,200.00 $ 5,900.00 17 Total Assets $ 10,800.00 $ 8,325.00 18 Liabilities and Shareholder Equity 19 Accounts payable $ 700.00 $ 550.00 20 Other current liabilities $ 620.00 $ 340.00 21 Long-term debt $ 4,800.00 $ 5,200.00 22 Total liabilities $ 6,120.00 $ 6,090.00 23 Common stock, $1 par value; 24 Authorized 2,000,000 shares 25 Issued 1,750,000 and 1,000,000 shares S 1,750.00 $ 1,000.00 26 Additional paid-in capital $ 1,750.00 $ 500.00 27 Retained earnings S 1,180.00 $ 735.00 28 Total shareholders' equity $ 4,680.00 $ 2,235.00 29 Total liabilities and shareholder equity $ 10,800.00 $ 8,325.00 30 21 1 Company ABC Income Statements for Years Ending December 31 (in thousand 2 3 Description Current Year Prior Year 4 Sales 12550 9800 5 Cost of goods sold 7500 6700 6 Gross profit 5050 3100 7 Lease expense 1300 500 8 Administrative expense 800 700 9 Earnings before interest and taxes (EBIT) 2950 1900 10 Interest 650 500 11 Earnings before taxes 2300 1400 12 Taxes 930 600 13 Net income 1370 800 14 Preferred dividends 175 150 15 Earnings available to common shareholders 1195 650 16 Common dividends 600 500 17 Retained earnings 595 150 18 19 20 21