Answered step by step

Verified Expert Solution

Question

1 Approved Answer

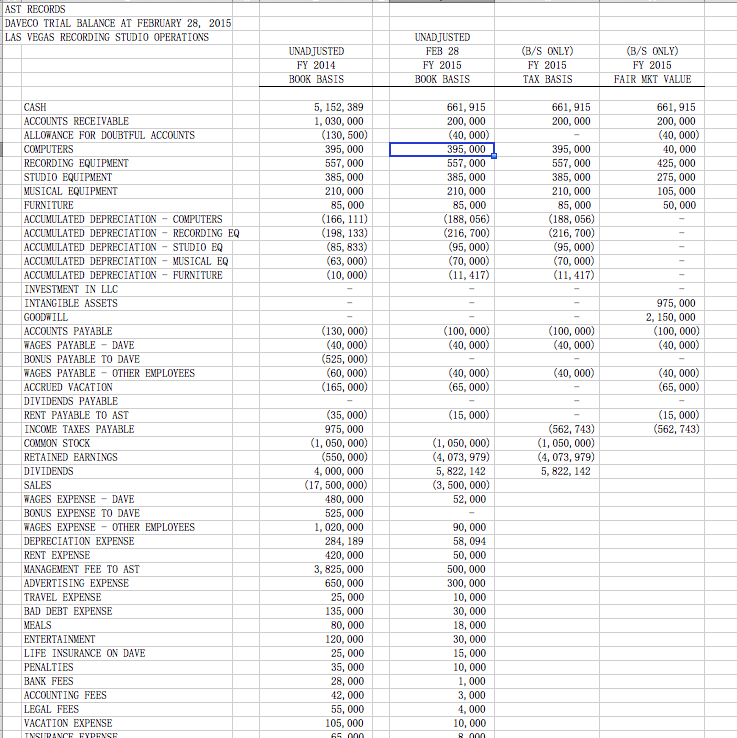

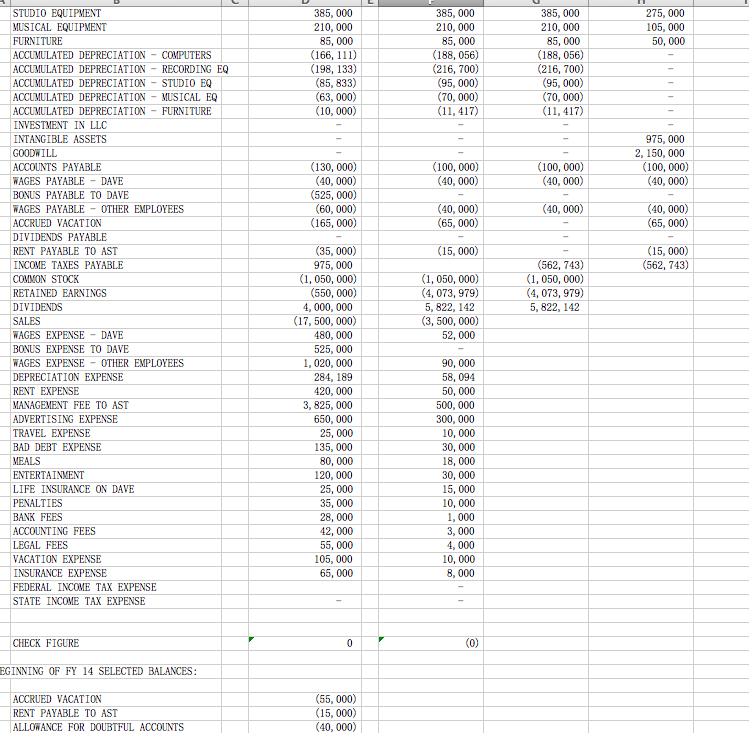

1. Calculate book income. 2. Calculate book income differences. 3. Calculate taxable income. AST RECORDS DAVECO TRIAL BALANCE AT FEBRUARY 28, 2015 LAS VEGAS RECORDING

1. Calculate book income.

2. Calculate book income differences.

3. Calculate taxable income.

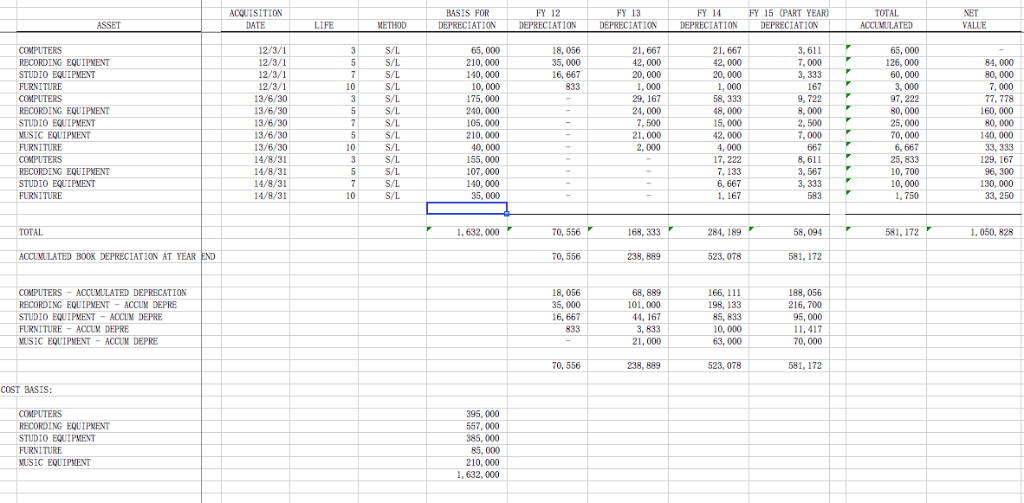

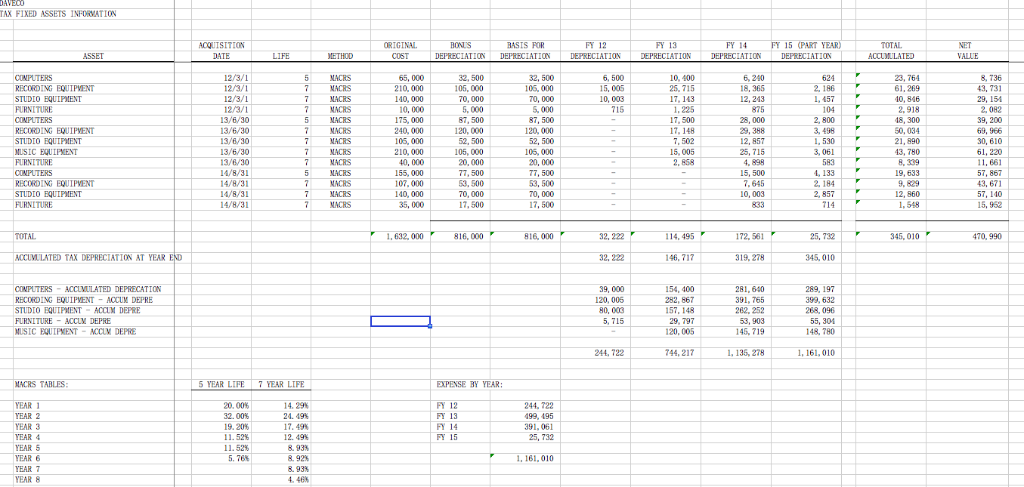

AST RECORDS DAVECO TRIAL BALANCE AT FEBRUARY 28, 2015 LAS VEGAS RECORDING STUDIO OPERATIONS UNADJUSTED FY 2014 BOOK BASIS UNADJUSTED FEB 28 FY 2015 BOOK BASIS FY 2015 TAX BASIS FY 2015 FAIR MKT VALUE CASH AOCOUNTS RECEIVABLE ALLOWANCE FOR DOUBTFUL ACCOUNTS 661,915 200, 000 661,915 200, 000 661, 915 200, 000 1, 030, 000 (130, 500) 395, 000 557, 000 385, 000 210, 000 85, 000 (166, 111) (198, 133) (85, 833) (63, 000) 395, 000 557, 000 385, 000 40, 000 425, 000 275, 000 105, 000 395, 000 557, 000 385, 000 210, 000 85, 000 (188, 056) (216, 700) (95, 000) RECORDING EQUIPMENT STUDIO EQUIPMENT MUSICAL EQUIPMENT FURNITURE AOCUMULATED DEPRECIATION - COMPUTERS ACCUMULATED DEPRECIATION RECORDING EQ ACCUMULATED DEPRECIATION STUDIO EQ ACCUMULATED DEPRECIATION MUSICAL EQ AOCUMULATED DEPRECIATION FURNITURE INVESTMENT IN LLC INTANGIBLE ASSETS GOODWILL AOCOUNTS PAYABLE MAGES PAYABLE DAVE BONUS PAYABLE TO DAVE MAGES PAYABLE OTHER EMPLOYEES AOCRUED VACATION DIVIDENDS PAYABLE RENT PAYABLE TO AST INCOME TAXES PAYABLE COMMON STOCK RETAINED EARNINGS DIVIDENDS SALES MAGES EXPENSE DAVE BONUS EXPENSE TO DAVE MAGES EXPENSE OTHER EMPLOYEES DEPRECIATION EXPENSE RENT EXPENSE MANAGEMENT FEE TO AST ADVERTISING EXPENSE TRAVEL EXPENSE BAD DEBT EXPENSE MEALS ENTERTAINMENT LIFE INSURANCE ON DAVE PENALTIES BANK FEES AOCOUNTING FEES LEGAL FEES VACATION EXPENSE 85, 000 (188, 056) (216, 700) 975, 000 2, 150, 000 (100, 000) (130, 000) (525, 000) (165, 000) (100, 000) (100, 000) 40, 000) 40, 000) (65, 000) (15, 000) (1,050, 000) (65, 000) 35, 000) 975, 000 (1,050, 000) (550, 000) 4, 000, 000 (17, 500, 000) 480, 000 525, 000 1, 020, 000 (15, 000) (562, 743) (562, 743) (1,050, 000) (4, 073, 979) 5, 822, 142 (4, 073, 979) (3, 500, 000) 90, 000 420, 000 3, 825, 000 650, 000 25, 000 135, 000 500, 000 300, 000 30, 000 120, 000 25, 000 35, 000 42, 105, 000 STUDIO EQUIPMENT MUSICAL EQUIPMENT FURNITURE AOCUMULATED DEPRECIATION - COMPUTERS ACCUMULATED DEPRECIATION RECORDING EQ ACCUMULATED DEPRECIATION STUDIO EQ ACCUMULATED DEPRECIATION MUSICAL EQ AOCUMULATED DEPRECIATION FURNITURE INVESTMENT IN LLC INTANGIBLE ASSETS GOODWILL AOCOUNTS PAYABLE MAGES PAYABLE DAVE BONUS PAYABLE TO DAVE MAGES PAYABLE OTHER EMPLOYEES AOCRUED VACATION DIVIDENDS PAYABLE RENT PAYABLE TO AST INCOME TAXES PAYABLE COMMON STOCK RETAINED EARNINGS DIVIDENDS SALES MAGES EXPENSE DAVE BONUS EXPENSE TO DAVE MAGES EXPENSE OTHER EMPLOYEES DEPRECIATION EXPENSE RENT EXPENSE MANAGEMENT FEE TO AST ADVERTISING EXPENSE TRAVEL EXPENSE BAD DEBT EXPENSE MEALS ENTERTAINMENT LIFE INSURANCE ON DAVE PENALTIES BANK FEES AOCOUNTING FEES LEGAL FEES VACATION EXPENSE INSURANCE EXPENSE FEDERAL INCOME TAX EXPENSE STATE INCOME TAX EXPENSE 385, 000 385, 000 210, 000 85, 000 (188, 056) (216, 700) (95, 000) 385, 000 210, 000 85, 000 (188, 056) (216, 700) (95, 000) 275, 000 105, 000 50, 000 85, 000 (166, 111) (198, 133) (85, 833) (63, 000) (10, 000) 975, 000 2, 150, 000 (100, 000) (130, 000) (525, 000) (165, 000) (100, 000) (100, 000) 40, 000) (65, 000) 40, 000) (65, 000) 40, 000) (15, 000) (562, 743) (1,050, 000) (4, 073, 979) 5, 822, 142 (562, 743) 975, 000 (1,050, 000) (550, 000) 4, 000, 000 (17, 500, 000) 480, 000 525, 000 1, 020, 000 284, 189 420, 000 3, 825, 000 650, 000 25, 000 135, 000 80, 000 120, 000 25, 000 35, 000 28, 000 42, 000 55, 000 105, 000 65, 000 (1,050, 000) (4, 073, 979) 5, 822, 142 (3, 500, 000) 50, 000 500, 000 300, 000 30, 000 18, 000 30, 000 15, 000 3, 000 CHECK FIGURE EGINNING OF FY 14 SELECTED BALANCES: AOCRUED VACATION RENT PAYABLE TO AST ALLOWANCE FOR DOUBTFUL ACCOUNTS (15, 000) TOTAL ACCUVULATED DEPRECIATION DEPRECIATION DEPRECIATION DEPRECIATION DEPRECIATION RECORDING EQUIPMENT RECORDING EQUIPMENT STUDIO EQUIPMENT 10 RECORDING EQUIPNENT STUDIO EQUIPMENT 1,632,000 ACCUVULATED BOOK DEPRECIATION AT YEAR COMPUTERS ACCUMULATED DEPRECATION RECORDING EQUIPNENT ACCUM DEPRE STUDIO EQUIPMENT-ACCUM DEPRE URNITURE-ACCUM DEPRE MUSIC EQUIPMENT-ACCM DEPRE 70, 556 RECORDING EQUIPMENT AX FIXED ASSETS INFORMATION TOTAL ACCUULATED DEPRECIATION VALLE 114, 495 CCUVU LATED TAX DEPRECIATION AT YEAR CONPUTERS -ACCUVULATED DEPRECATION RECORDING EQUIPMENT ACCUM DEPRE STUDIO EQUIPMENT ACCLM DEPRE FURNITURE ACCLY DEPRE MUSIC EQUIPMENT- ACCLY DEPf EAR LIFE 7 YEAR LIFE EXPENSE BY YEAR: YEAR 4 1, 161.010Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started