Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate EFN (reconciled with Income Statement) 2. Prepare a projected income statement and balance sheet for 2019 (reconciled) Cash Marketable securities Accounts receivable Inventory

1. Calculate EFN (reconciled with Income Statement)

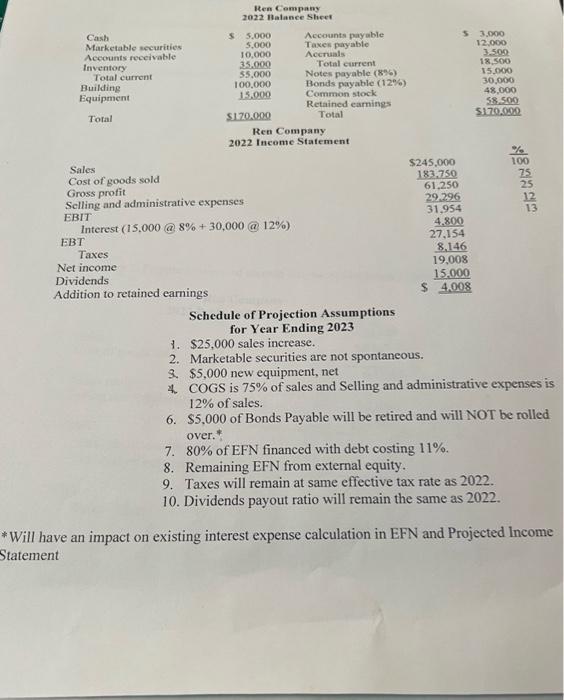

Cash Marketable securities Accounts receivable Inventory Total current Building Equipment. Total Taxes Net income Dividends Addition to retained earnings Sales Cost of goods sold Gross profit Selling and administrative expenses EBIT Interest (15,000 @ 8% + 30,000 @ 12%) EBT 1. 2. Ren Company 2022 Balance Sheet S. $5,000 5,000 10,000 35.000 55,000 100,000 15.000 4 $170.000 Accounts payable Taxes payable Accruals Total current Notes payable (8%) Bonds payable (12%) Common stock Retained earnings Total Ren Company 2022 Income Statement Schedule of Projection Assumptions for Year Ending 2023 $245,000 183.750 61,250 29.296 31,954 $ 3,000 12,000 3.500 18,500 15,000 30,000 48,000 58.500 $170,000 4.800 27,154 8,146 19,008 15.000 $ 4,008 $25,000 sales increase. Marketable securities are not spontaneous. $5,000 new equipment, net COGS is 75% of sales and Selling and administrative expenses is 12% of sales. 6. $5,000 of Bonds Payable will be retired and will NOT be rolled over.* 7. 80% of EFN financed with debt costing 11%. 8. Remaining EFN from external equity. 9. Taxes will remain at same effective tax rate as 2022. 10. Dividends payout ratio will remain the same as 2022. % 100 25 12 13 *Will have an impact on existing interest expense calculation in EFN and Projected Income Statement

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets start by calculating the External Financing Needed EFN for Ren Company for the year ending 2023 reconciled with the provided income statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started