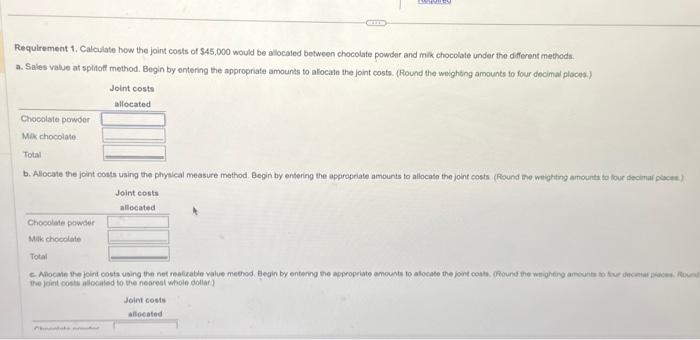

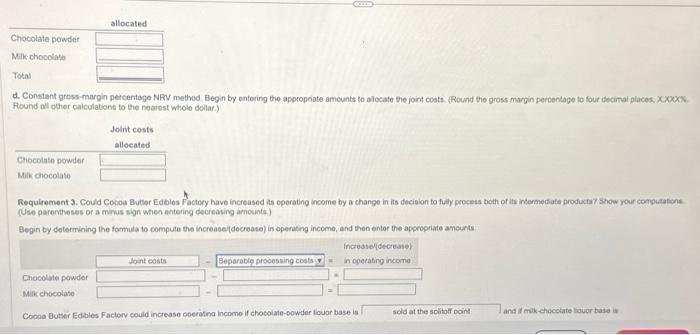

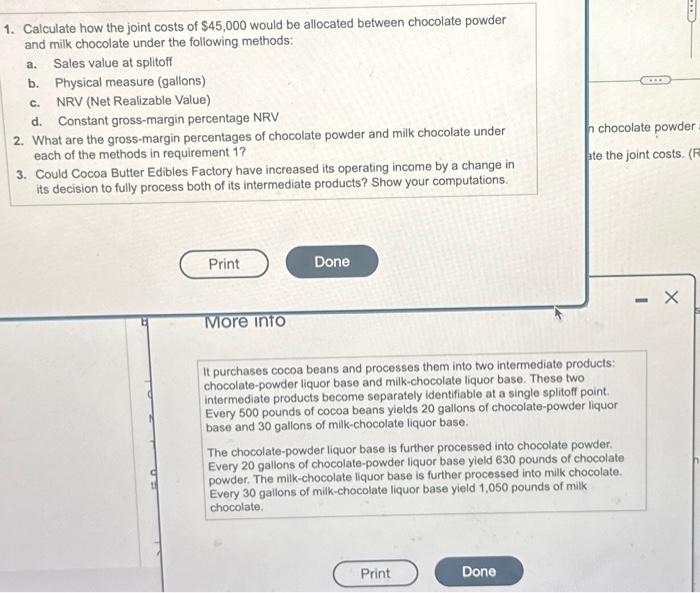

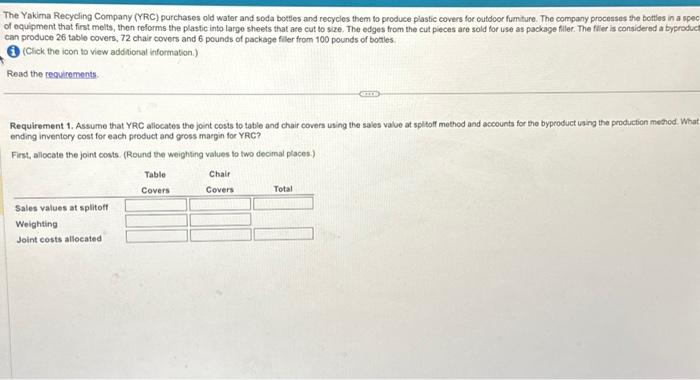

1. Calculate how the joint costs of $45,000 would be allocated between chocolate powder and milk chocolate under the following methods: a. Sales value at splitoff b. Physical measure (gallons) c. NRV (Net Realizable Value) d. Constant gross-margin percentage NRV 2. What are the gross-margin percentages of chocolate powder and milk chocolate under each of the methods in requirement 1? 3. Could Cocoa Butter Edibles Factory have increased its operating income by a change in its decision to fully process both of its intermediate products? Show your computations. More into It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 500 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 30 gallons of milk-chocolate liquor base. The chocolate-powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yield 630 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 30 gallons of milk-chocolate liquor base yield 1,050 pounds of milk chocolate. Found oil other calculations to the nearest wholo dellar.) (Use parenthoses or a minus sign when entering decreasing arnocunts) Begin by determining the formula to compute the increase/(decrease) in openating income, and then enter the appropriate ameunts Requirement 1. Calculate how the joint costs of $45,000 would be allocaled between chocolate powder and mik chocolate under the different methods. a. Sales value at splitoff method. Begin by entering the appropriate amounts to alocate the joint costs. (Round the woighting amounts fo four docimal ploces.) b. Allocate the joint costs using the physcal measure method Begin by entering the appropriate amounts to allocate the joint costs (Round the wrighting arnourtt to lour decimai plocen) The Yakima Recycling Company (YRC) purchases old water and soda bottles and recycles them to produce plastic covers for cutdoor fumiture. The company processes the bottles in a spec of equipment that first meits, then reforms the plastic into largo sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filer is considered a byproduct can produce 26 tablo covers, 72 chair covers and 6 pounds of package filer from 100 pounds of botiles. (Chick the icon to view addifional information.) Read the requirements. Requirement 1. Assume that YRC allocates the joint costs to table and chair covers using the sales value at spltoff method and accounts for the byproduct using the production mechod. What ending inventory cost for each product and gross margin for YRC? First, allocate the joint costs. (Round the weighting values to two decimal places.) 1. Calculate how the joint costs of $45,000 would be allocated between chocolate powder and milk chocolate under the following methods: a. Sales value at splitoff b. Physical measure (gallons) c. NRV (Net Realizable Value) d. Constant gross-margin percentage NRV 2. What are the gross-margin percentages of chocolate powder and milk chocolate under each of the methods in requirement 1? 3. Could Cocoa Butter Edibles Factory have increased its operating income by a change in its decision to fully process both of its intermediate products? Show your computations. More into It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 500 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 30 gallons of milk-chocolate liquor base. The chocolate-powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yield 630 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 30 gallons of milk-chocolate liquor base yield 1,050 pounds of milk chocolate. Found oil other calculations to the nearest wholo dellar.) (Use parenthoses or a minus sign when entering decreasing arnocunts) Begin by determining the formula to compute the increase/(decrease) in openating income, and then enter the appropriate ameunts Requirement 1. Calculate how the joint costs of $45,000 would be allocaled between chocolate powder and mik chocolate under the different methods. a. Sales value at splitoff method. Begin by entering the appropriate amounts to alocate the joint costs. (Round the woighting amounts fo four docimal ploces.) b. Allocate the joint costs using the physcal measure method Begin by entering the appropriate amounts to allocate the joint costs (Round the wrighting arnourtt to lour decimai plocen) The Yakima Recycling Company (YRC) purchases old water and soda bottles and recycles them to produce plastic covers for cutdoor fumiture. The company processes the bottles in a spec of equipment that first meits, then reforms the plastic into largo sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filer is considered a byproduct can produce 26 tablo covers, 72 chair covers and 6 pounds of package filer from 100 pounds of botiles. (Chick the icon to view addifional information.) Read the requirements. Requirement 1. Assume that YRC allocates the joint costs to table and chair covers using the sales value at spltoff method and accounts for the byproduct using the production mechod. What ending inventory cost for each product and gross margin for YRC? First, allocate the joint costs. (Round the weighting values to two decimal places.)