1) Calculate market size

2) calculate potential market size

3) calculate segment sizes

4) which segment would you target?

5) Calculate BEP

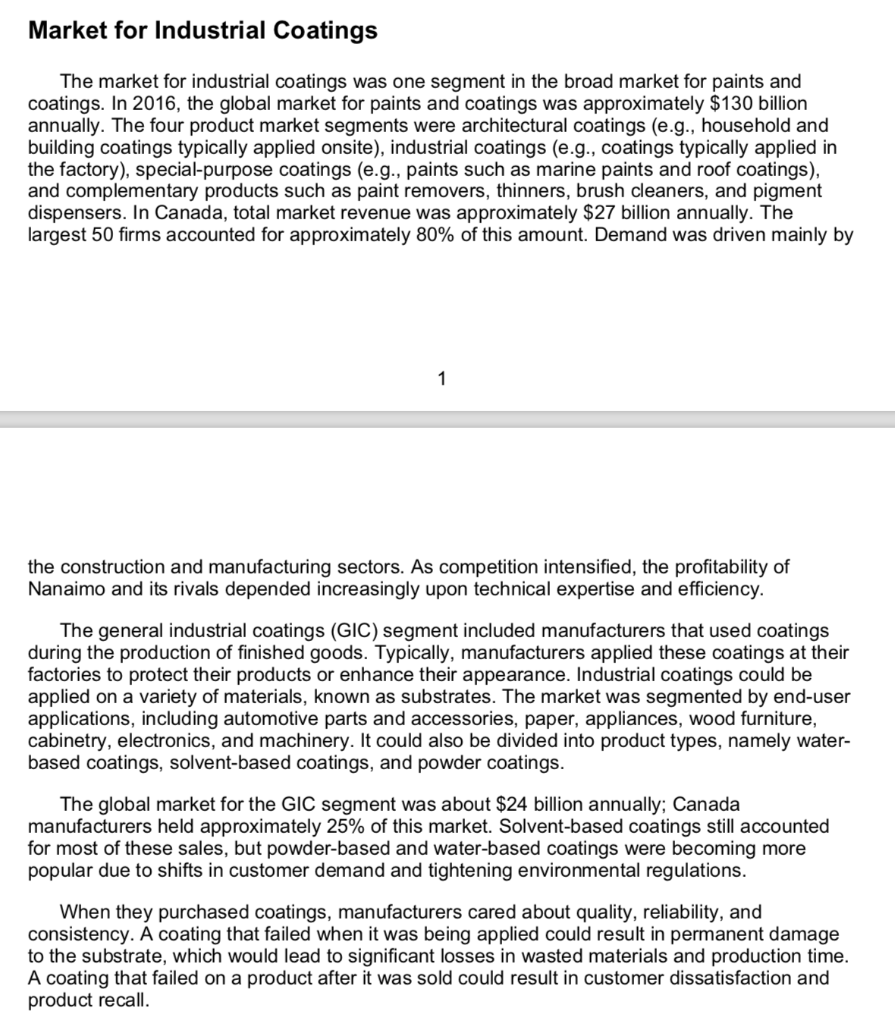

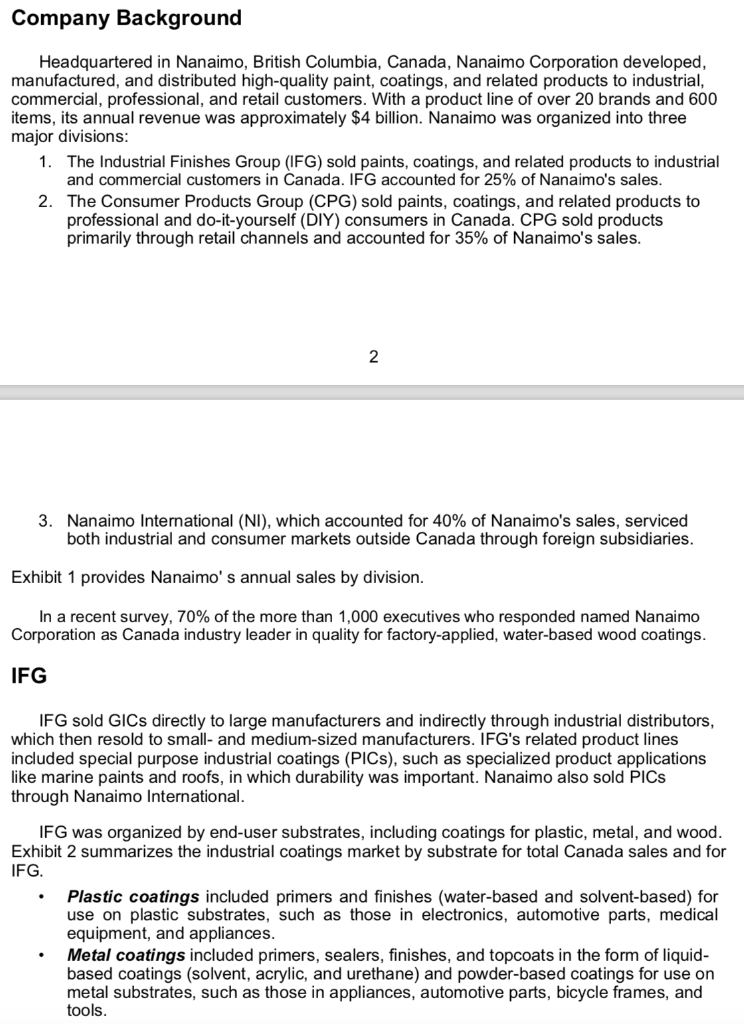

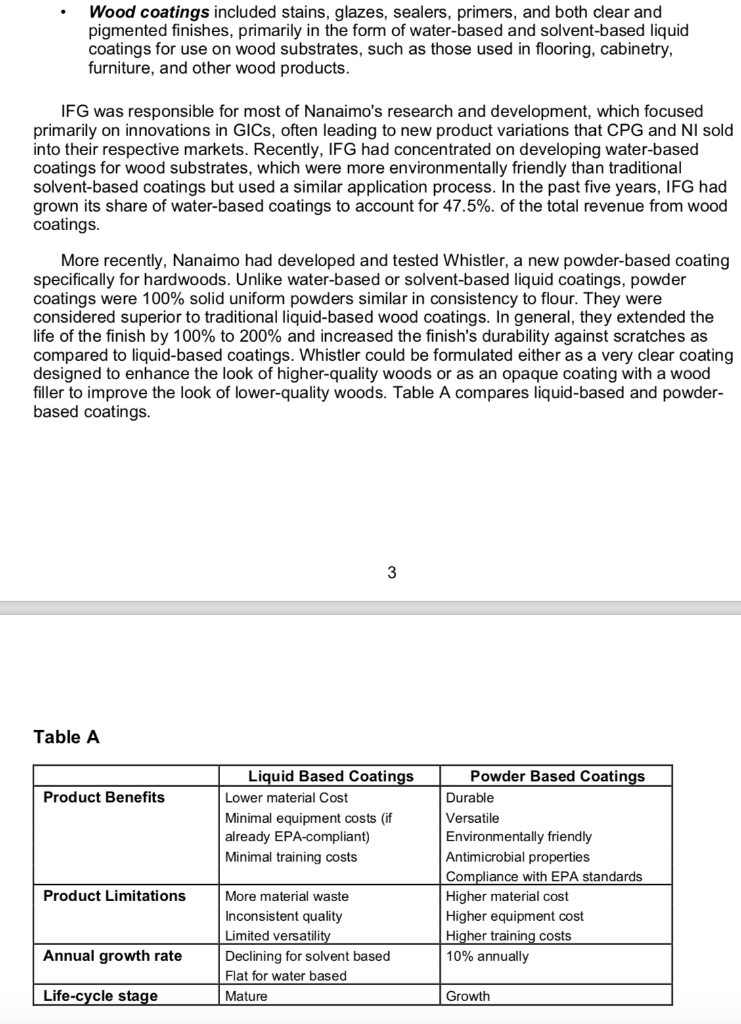

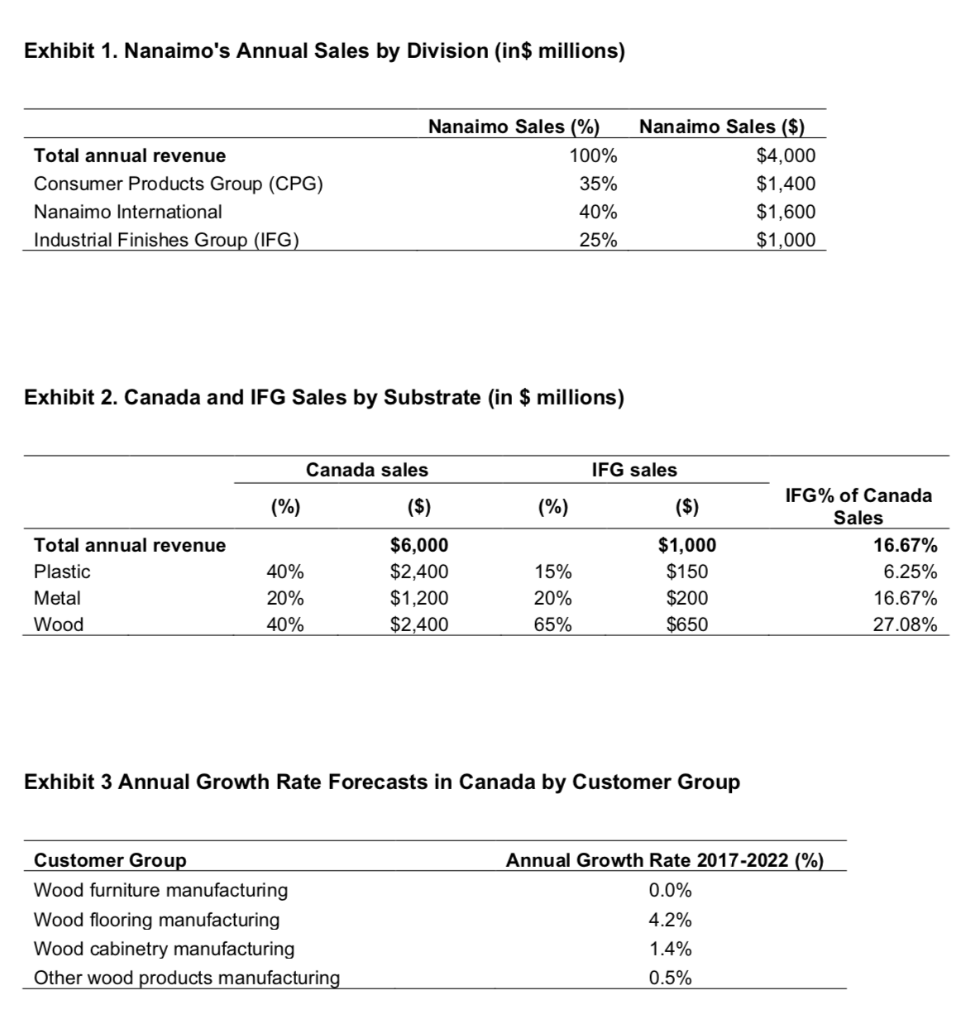

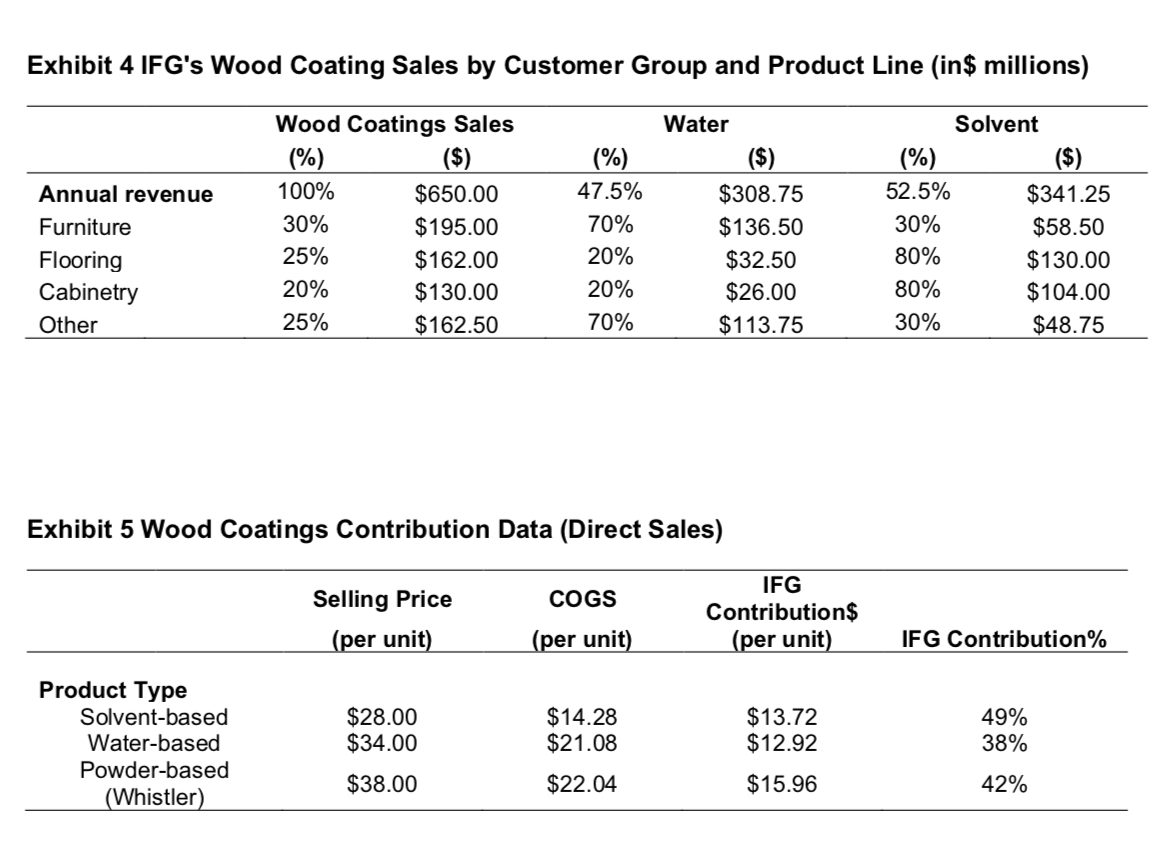

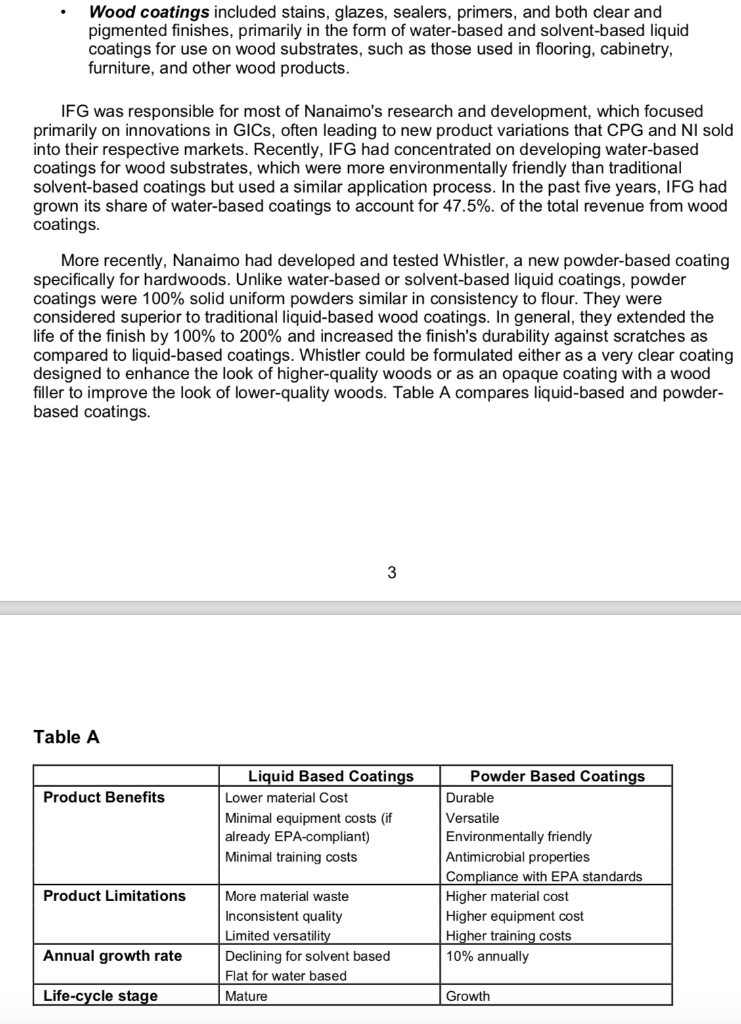

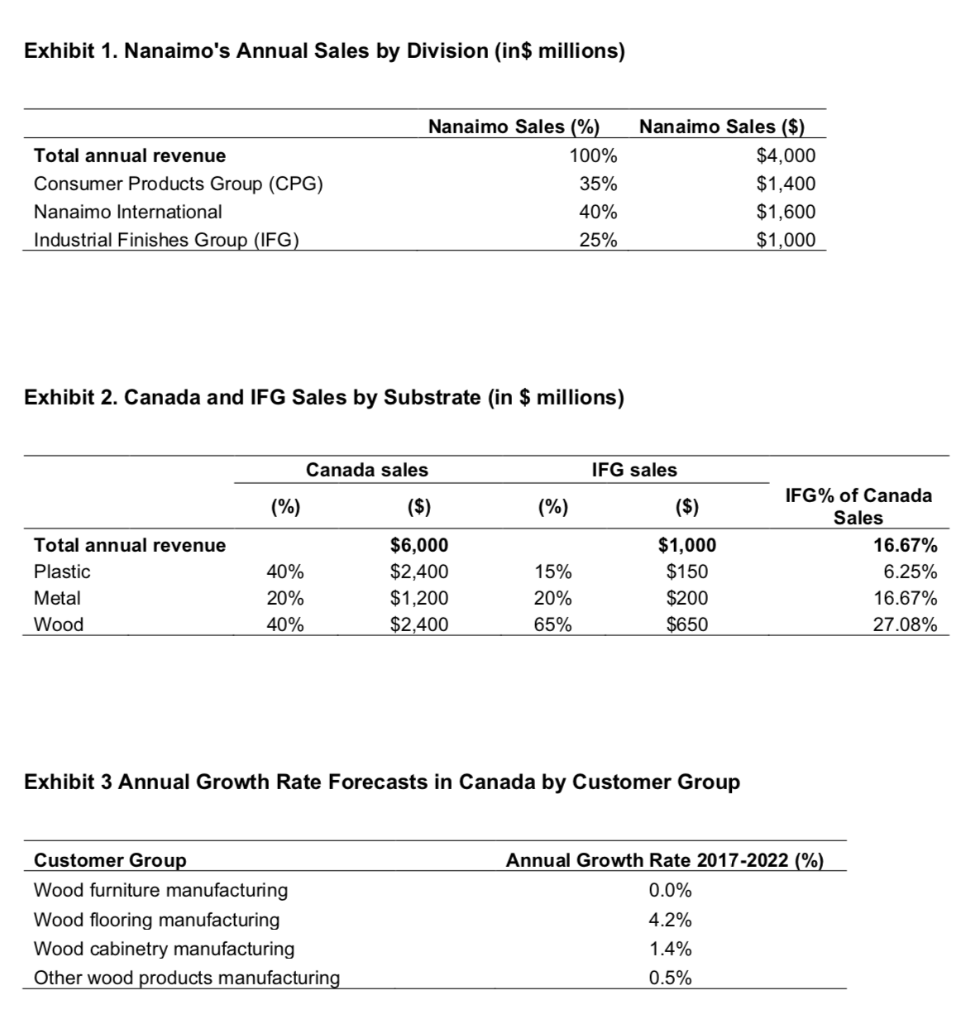

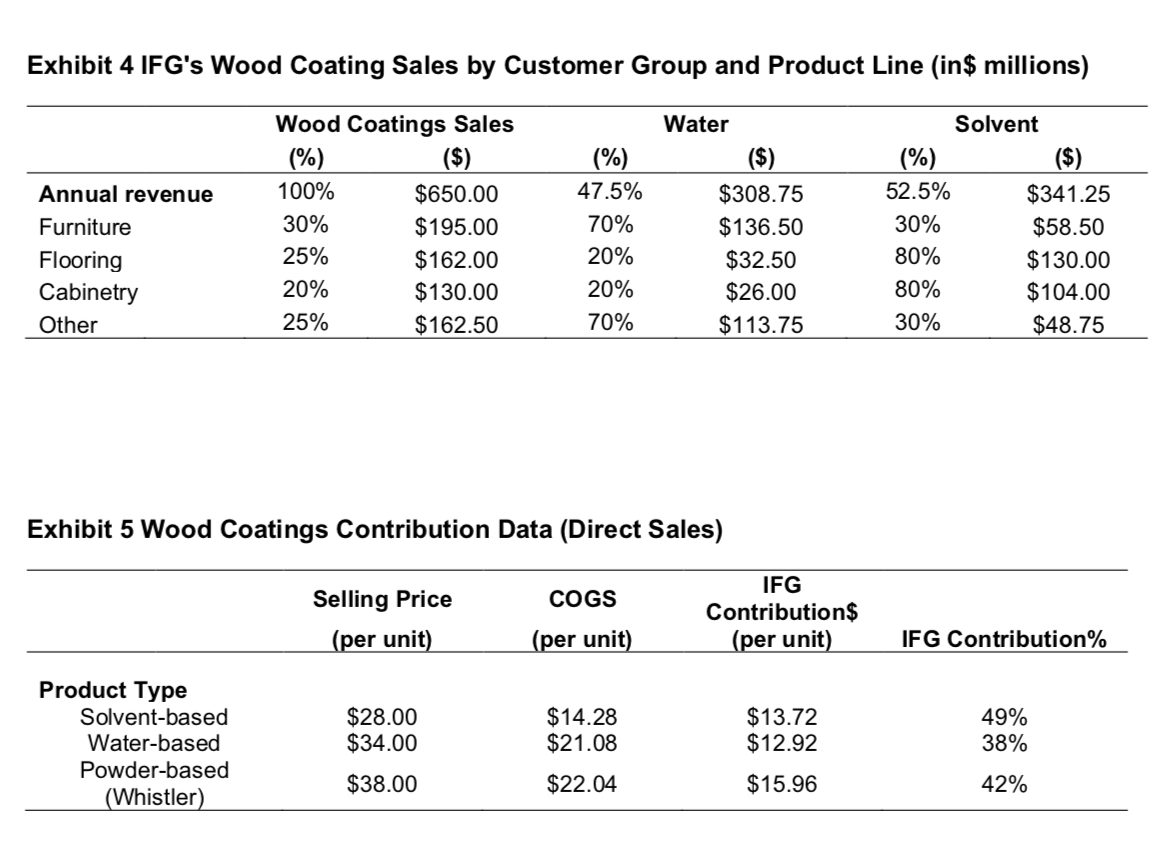

Market for Industrial Coatings The market for industrial coatings was one segment in the broad market for paints and coatings. In 2016, the global market for paints and coatings was approximately $130 billion annually. The four product market segments were architectural coatings (e.g., household and building coatings typically applied onsite), industrial coatings (e.g., coatings typically applied in the factory), special-purpose coatings (e.g., paints such as marine paints and roof coatings), and complementary products such as paint removers, thinners, brush cleaners, and pigment dispensers. In Canada, total market revenue was approximately $27 billion annually. The largest 50 firms accounted for approximately 80% of this amount. Demand was driven mainly by 1 the construction and manufacturing sectors. As competition intensified, the profitability of Nanaimo and its rivals depended increasingly upon technical expertise and efficiency. The general industrial coatings (GIC) segment included manufacturers that used coatings during the production of finished goods. Typically, manufacturers applied these coatings at their factories to protect their products or enhance their appearance. Industrial coatings could be applied on a variety of materials, known as substrates. The market was segmented by end-user applications, including automotive parts and accessories, paper, appliances, wood furniture, cabinetry, electronics, and machinery. It could also be divided into product types, namely water- based coatings, solvent-based coatings, and powder coatings. The global market for the GIC segment was about $24 billion annually; Canada manufacturers held approximately 25% of this market. Solvent-based coatings still accounted for most of these sales, but powder-based and water-based coatings were becoming more popular due to shifts in customer demand and tightening environmental regulations. When they purchased coatings, manufacturers cared about quality, reliability, and consistency. A coating that failed when it was being applied could result in permanent damage to the substrate, which would lead to significant losses in wasted materials and production time. A coating that failed on a product after it was sold could result in customer dissatisfaction and product recall. Company Background Headquartered in Nanaimo, British Columbia, Canada, Nanaimo Corporation developed, manufactured, and distributed high-quality paint, coatings, and related products to industrial, commercial, professional, and retail customers. With a product line of over 20 brands and 600 items, its annual revenue was approximately $4 billion. Nanaimo was organized into three major divisions: 1. The Industrial Finishes Group (IFG) sold paints, coatings, and related products to industrial and commercial customers in Canada. IFG accounted for 25% of Nanaimo's sales. 2. The Consumer Products Group (CPG) sold paints, coatings, and related products to professional and do-it-yourself (DIY) consumers in Canada. CPG sold products primarily through retail channels and accounted for 35% of Nanaimo's sales. 2 3. Nanaimo International (NI), which accounted for 40% of Nanaimo's sales, serviced both industrial and consumer markets outside Canada through foreign subsidiaries. Exhibit 1 provides Nanaimo's annual sales by division. In a recent survey, 70% of the more than 1,000 executives who responded named Nanaimo 1 Corporation as Canada industry leader in quality for factory-applied, water-based wood coatings. IFG IFG sold GICs directly to large manufacturers and indirectly through industrial distributors, which then resold to small- and medium-sized manufacturers. IFG's related product lines included special purpose industrial coatings (PICs), such as specialized product applications like marine paints and roofs, in which durability was important. Nanaimo also sold PICS through Nanaimo International. IFG was organized by end-user substrates, including coatings for plastic, metal, and wood. Exhibit 2 summarizes the industrial coatings market by substrate for total Canada sales and for IFG. Plastic coatings included primers and finishes (water-based and solvent-based) for use on plastic substrates, such as those in electronics, automotive parts, medical equipment, and appliances. Metal coatings included primers, sealers, finishes, and topcoats in the form of liquid- based coatings (solvent, acrylic, and urethane) and powder-based coatings for use on metal substrates, such as those in appliances, automotive parts, bicycle frames, and tools. Wood coatings included stains, glazes, sealers, primers, and both clear and pigmented finishes, primarily in the form of water-based and solvent-based liquid coatings for use on wood substrates, such as those used in flooring, cabinetry, furniture, and other wood products. IFG was responsible for most of Nanaimo's research and development, which focused primarily on innovations in GICs, often leading to new product variations that CPG and NI sold into their respective markets. Recently, IFG had concentrated on developing water-based coatings for wood substrates, which were more environmentally friendly than traditional solvent-based coatings but used a similar application process. In the past five years, IFG had grown its share of water-based coatings to account for 47.5%. of the total revenue from wood coatings. More recently, Nanaimo had developed and tested Whistler, a new powder-based coating specifically for hardwoods. Unlike water-based or solvent-based liquid coatings, powder coatings were 100% solid uniform powders similar in consistency to flour. They were considered superior to traditional liquid-based wood coatings. In general, they extended the life of the finish by 100% to 200% and increased the finish's durability against scratches as compared to liquid-based coatings. Whistler could be formulated either as a very clear coating designed to enhance the look of higher-quality woods or as an opaque coating with a wood filler to improve the look of lower-quality woods. Table A compares liquid-based and powder- based coatings. 3 Table A Product Benefits Liquid Based Coatings Lower material Cost Minimal equipment costs (if already EPA-compliant) Minimal training costs Powder Based Coatings Durable Versatile Environmentally friendly Antimicrobial properties Compliance with EPA standards Higher material cost Higher equipment cost Higher training costs 10% annually Product Limitations More material waste Inconsistent quality Limited versatility Declining for solvent based Flat for water based Mature Annual growth rate Life-cycle stage Growth Exhibit 1. Nanaimo's Annual Sales by Division (in$ millions) Total annual revenue Consumer Products Group (CPG) Nanaimo International Industrial Finishes Group (IFG) Nanaimo Sales (%) 100% 35% 40% 25% Nanaimo Sales ($). $4,000 $1,400 $1,600 $1,000 Exhibit 2. Canada and IFG Sales by Substrate (in $ millions) Canada sales IFG sales (%) ($) (%) ($) Total annual revenue Plastic Metal Wood $6,000 $2,400 $1,200 $2,400 40% 20% 40% IFG% of Canada Sales 16.67% 6.25% 16.67% 27.08% $1,000 $150 $200 $650 15% 20% 65% Exhibit 3 Annual Growth Rate Forecasts in Canada by Customer Group Customer Group Wood furniture manufacturing Wood flooring manufacturing Wood cabinetry manufacturing Other wood products manufacturing Annual Growth Rate 2017-2022 %) 0.0% 4.2% 1.4% 0.5% Exhibit 4 IFG's Wood Coating Sales by Customer Group and Product Line (in$ millions) Annual revenue Furniture Flooring Cabinetry Other Wood Coatings Sales (%) ($) 100% $650.00 30% $195.00 25% $162.00 20% $130.00 25% $162.50 (%) 47.5% 70% 20% 20% 70% Water ($) $308.75 $136.50 $32.50 $26.00 $113.75 Solvent (%) ($) 52.5% $341.25 30% $58.50 80% $130.00 80% $104.00 30% $48.75 Exhibit 5 Wood Coatings Contribution Data (Direct Sales) COGS Selling Price (per unit) IFG Contributions (per unit) (per unit) IFG Contribution% Product Type Solvent-based Water-based Powder-based (Whistler) $28.00 $34.00 $14.28 $21.08 $13.72 $12.92 49% 38% $38.00 $22.04 $15.96 42% Market for Industrial Coatings The market for industrial coatings was one segment in the broad market for paints and coatings. In 2016, the global market for paints and coatings was approximately $130 billion annually. The four product market segments were architectural coatings (e.g., household and building coatings typically applied onsite), industrial coatings (e.g., coatings typically applied in the factory), special-purpose coatings (e.g., paints such as marine paints and roof coatings), and complementary products such as paint removers, thinners, brush cleaners, and pigment dispensers. In Canada, total market revenue was approximately $27 billion annually. The largest 50 firms accounted for approximately 80% of this amount. Demand was driven mainly by 1 the construction and manufacturing sectors. As competition intensified, the profitability of Nanaimo and its rivals depended increasingly upon technical expertise and efficiency. The general industrial coatings (GIC) segment included manufacturers that used coatings during the production of finished goods. Typically, manufacturers applied these coatings at their factories to protect their products or enhance their appearance. Industrial coatings could be applied on a variety of materials, known as substrates. The market was segmented by end-user applications, including automotive parts and accessories, paper, appliances, wood furniture, cabinetry, electronics, and machinery. It could also be divided into product types, namely water- based coatings, solvent-based coatings, and powder coatings. The global market for the GIC segment was about $24 billion annually; Canada manufacturers held approximately 25% of this market. Solvent-based coatings still accounted for most of these sales, but powder-based and water-based coatings were becoming more popular due to shifts in customer demand and tightening environmental regulations. When they purchased coatings, manufacturers cared about quality, reliability, and consistency. A coating that failed when it was being applied could result in permanent damage to the substrate, which would lead to significant losses in wasted materials and production time. A coating that failed on a product after it was sold could result in customer dissatisfaction and product recall. Company Background Headquartered in Nanaimo, British Columbia, Canada, Nanaimo Corporation developed, manufactured, and distributed high-quality paint, coatings, and related products to industrial, commercial, professional, and retail customers. With a product line of over 20 brands and 600 items, its annual revenue was approximately $4 billion. Nanaimo was organized into three major divisions: 1. The Industrial Finishes Group (IFG) sold paints, coatings, and related products to industrial and commercial customers in Canada. IFG accounted for 25% of Nanaimo's sales. 2. The Consumer Products Group (CPG) sold paints, coatings, and related products to professional and do-it-yourself (DIY) consumers in Canada. CPG sold products primarily through retail channels and accounted for 35% of Nanaimo's sales. 2 3. Nanaimo International (NI), which accounted for 40% of Nanaimo's sales, serviced both industrial and consumer markets outside Canada through foreign subsidiaries. Exhibit 1 provides Nanaimo's annual sales by division. In a recent survey, 70% of the more than 1,000 executives who responded named Nanaimo 1 Corporation as Canada industry leader in quality for factory-applied, water-based wood coatings. IFG IFG sold GICs directly to large manufacturers and indirectly through industrial distributors, which then resold to small- and medium-sized manufacturers. IFG's related product lines included special purpose industrial coatings (PICs), such as specialized product applications like marine paints and roofs, in which durability was important. Nanaimo also sold PICS through Nanaimo International. IFG was organized by end-user substrates, including coatings for plastic, metal, and wood. Exhibit 2 summarizes the industrial coatings market by substrate for total Canada sales and for IFG. Plastic coatings included primers and finishes (water-based and solvent-based) for use on plastic substrates, such as those in electronics, automotive parts, medical equipment, and appliances. Metal coatings included primers, sealers, finishes, and topcoats in the form of liquid- based coatings (solvent, acrylic, and urethane) and powder-based coatings for use on metal substrates, such as those in appliances, automotive parts, bicycle frames, and tools. Wood coatings included stains, glazes, sealers, primers, and both clear and pigmented finishes, primarily in the form of water-based and solvent-based liquid coatings for use on wood substrates, such as those used in flooring, cabinetry, furniture, and other wood products. IFG was responsible for most of Nanaimo's research and development, which focused primarily on innovations in GICs, often leading to new product variations that CPG and NI sold into their respective markets. Recently, IFG had concentrated on developing water-based coatings for wood substrates, which were more environmentally friendly than traditional solvent-based coatings but used a similar application process. In the past five years, IFG had grown its share of water-based coatings to account for 47.5%. of the total revenue from wood coatings. More recently, Nanaimo had developed and tested Whistler, a new powder-based coating specifically for hardwoods. Unlike water-based or solvent-based liquid coatings, powder coatings were 100% solid uniform powders similar in consistency to flour. They were considered superior to traditional liquid-based wood coatings. In general, they extended the life of the finish by 100% to 200% and increased the finish's durability against scratches as compared to liquid-based coatings. Whistler could be formulated either as a very clear coating designed to enhance the look of higher-quality woods or as an opaque coating with a wood filler to improve the look of lower-quality woods. Table A compares liquid-based and powder- based coatings. 3 Table A Product Benefits Liquid Based Coatings Lower material Cost Minimal equipment costs (if already EPA-compliant) Minimal training costs Powder Based Coatings Durable Versatile Environmentally friendly Antimicrobial properties Compliance with EPA standards Higher material cost Higher equipment cost Higher training costs 10% annually Product Limitations More material waste Inconsistent quality Limited versatility Declining for solvent based Flat for water based Mature Annual growth rate Life-cycle stage Growth Exhibit 1. Nanaimo's Annual Sales by Division (in$ millions) Total annual revenue Consumer Products Group (CPG) Nanaimo International Industrial Finishes Group (IFG) Nanaimo Sales (%) 100% 35% 40% 25% Nanaimo Sales ($). $4,000 $1,400 $1,600 $1,000 Exhibit 2. Canada and IFG Sales by Substrate (in $ millions) Canada sales IFG sales (%) ($) (%) ($) Total annual revenue Plastic Metal Wood $6,000 $2,400 $1,200 $2,400 40% 20% 40% IFG% of Canada Sales 16.67% 6.25% 16.67% 27.08% $1,000 $150 $200 $650 15% 20% 65% Exhibit 3 Annual Growth Rate Forecasts in Canada by Customer Group Customer Group Wood furniture manufacturing Wood flooring manufacturing Wood cabinetry manufacturing Other wood products manufacturing Annual Growth Rate 2017-2022 %) 0.0% 4.2% 1.4% 0.5% Exhibit 4 IFG's Wood Coating Sales by Customer Group and Product Line (in$ millions) Annual revenue Furniture Flooring Cabinetry Other Wood Coatings Sales (%) ($) 100% $650.00 30% $195.00 25% $162.00 20% $130.00 25% $162.50 (%) 47.5% 70% 20% 20% 70% Water ($) $308.75 $136.50 $32.50 $26.00 $113.75 Solvent (%) ($) 52.5% $341.25 30% $58.50 80% $130.00 80% $104.00 30% $48.75 Exhibit 5 Wood Coatings Contribution Data (Direct Sales) COGS Selling Price (per unit) IFG Contributions (per unit) (per unit) IFG Contribution% Product Type Solvent-based Water-based Powder-based (Whistler) $28.00 $34.00 $14.28 $21.08 $13.72 $12.92 49% 38% $38.00 $22.04 $15.96 42%